The Unemployment Compensation UC program provides temporary income support if you lose your job through no fault of your own or if you are working less than your full-time hours. Vaccinesgov makes it easy to find COVID-19 vaccination.

Manage PUA Claim Telephone Self-Service.

Pa unemployment gov. If you accidentally select the incorrect answer the only way to fix it and move forward on your claim is to call the UC Service center at 888-313-7284 or uchelppagov Unemployment Compensation The Unemployment Compensation UC. 1099Gs will be mailed to all claimants by the January 31st deadline. An extension for people already receiving unemployment benefits.

UC Unemployment Benefits. Find information and services from Pennsylvania state government agencies. If you are employed in Pennsylvania and are unable to work because of COVID-19 you may be eligible for regular unemployment compensation benefits.

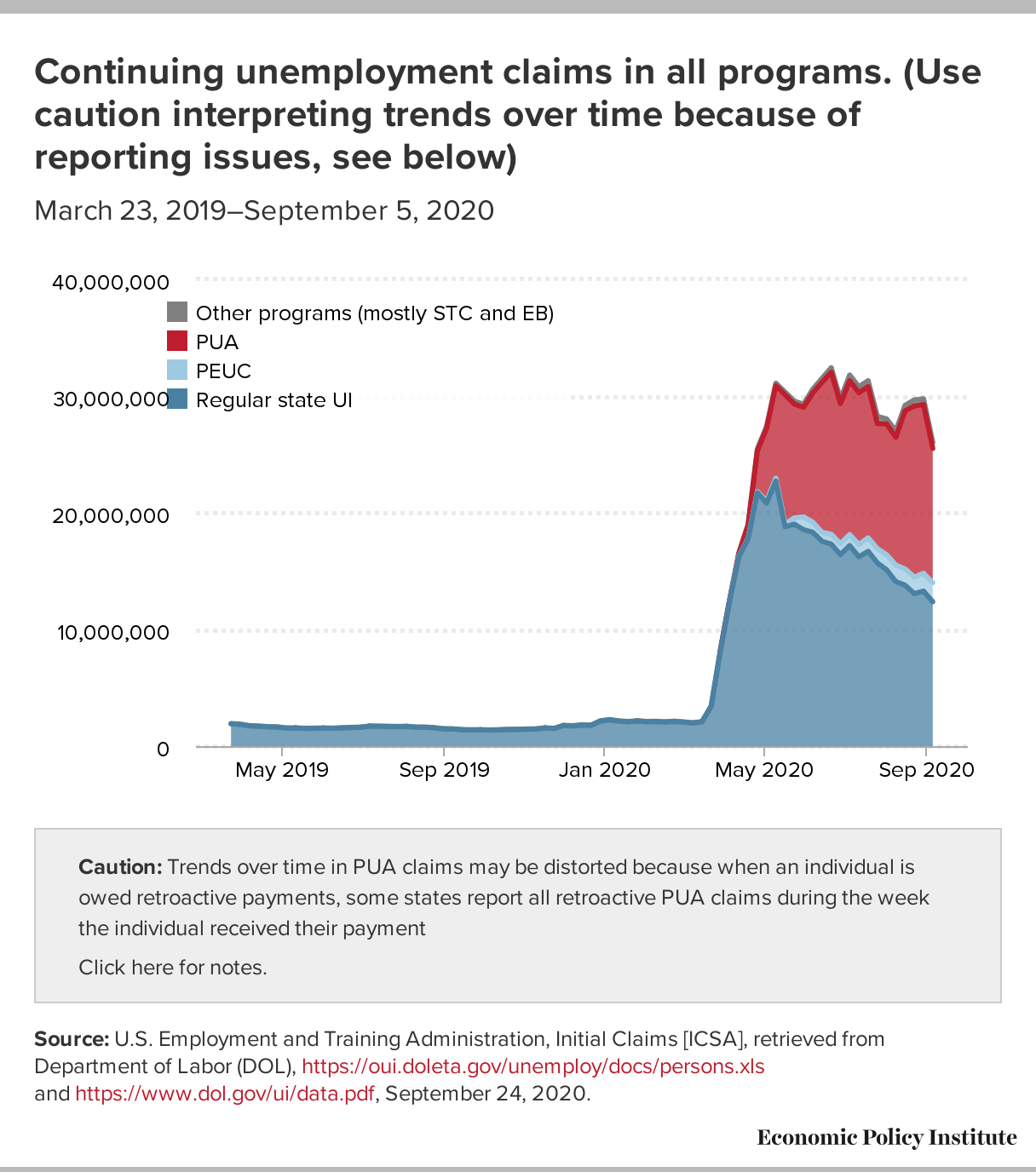

Find COVID-19 Vaccine Locations With Vaccinesgov. Pennsylvanias Pandemic Unemployment Assistance Portal by Looking for a job in Pennsylvania. There has been a historic surge in people seeking unemployment compensation in Pennsylvania because of fallout from the coronavirus pandemic.

New York State Department of Labor - Unemployment. COVID-19 extended unemployment benefits from the federal government have ended. How to file an initial claim according to your state.

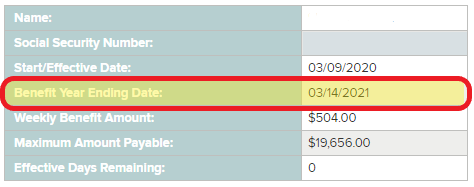

The amount of unemployment compensation you can receive is known as your Weekly Benefit Rate WBR. In the Subject line of the email indicate BACK DATE REQUEST and in the body please indicate exactly when and how COVID affected your employment or self. Contact your states unemployment insurance program for the most up-to-date information.

How Much In Unemployment Benefits You will Receive in Pennsylvania. Pa Unemployment Phone Number Always Busy. PAULA virtual assistant general questions.

Under the Pennsylvania Unemployment Compensation Law. File or Reopen a Claim. Ucpagov Regular UC and related claim types.

In the state of Pennsylvania the minimum weekly unemployment benefit amount you could receive is 68 and the maximum is 572. Telephone An application can be filed on the statewide unemployment compensation toll-free number at 1-888-313-7284. Download and use the Pennsylvanias Pandemic.

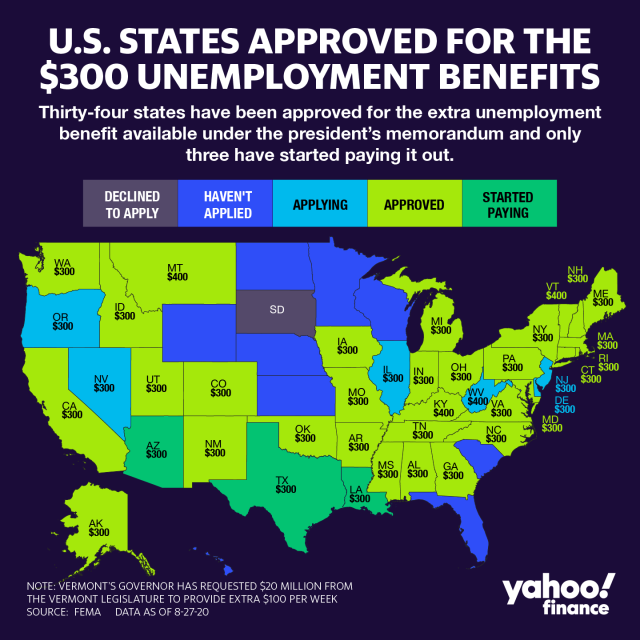

Pa unemployment ticket number tracker. PAGOV The Official Website for the Commonwealth of Pennsylvania. Automatic additional payments of 300 per week to everyone qualified for unemployment benefits.

Wwwucpagov unemployment-benefits Unemployment Benefits. Welcome to Pennsylvanias Unemployment Compensation UC system. Unemployment Benefits Claims Claimants.

The official website of the Commonwealth of Pennsylvania. In addition because many of the procedural rules for individuals filing for regular unemployment compensation also apply to DUA applicants you may find additional information in the Pennsylvania Unemployment Compensation Handbook. File a Benefit Appeal.

If you would like to become a fully registered user with Pennsylvanias Unemployment Compensation UC Benefits System and have access to all of our online services select one of the following account types. If you are looking to have the effective date of your claim earlier than the week in which you opened your claim you can call the PUA Call Center at 855-284-8545 OR you can send an email request to UCpuapagov. Manage Personal.

Contact your states unemployment insurance program for the most up-to-date information. We are not an official source of unemployment we only provide information and do tutorials for those who do not know how to do the following. On this website you will find everything you need for people who are unemployed.

If you qualify you will receive money for a limited time to help you. The new unemployment compensation system replaces a 40-year-old mainframe that made filing for unemployment benefits complicated for users and. Unemployment Benefits - Unemployment Compensation - PAgov.

Obtain Federal Tax Documents. 1099Gs are not available online at this time. Welcome to The Unemployment website.

File for Weekly UC Benefits. What ticket number is pa unemployment on. The American Rescue Plan Act of 2021 temporarily authorized.

In case you have filed an application for unemployment compensation benefits within the last year and have a particular question about your claim or your eligibility call the PA Unemployment Phone Number. Important Information page for alerts and other details which may affect your PA UC Claim. Apply and manage your UC benefits anytime anywhere.

Pennsylvania Department of Labor Industry Acting Secretary Jennifer Berrier said Tuesday the new unemployment benefits system is now online and accepting claims at benefitsucpagov. Please check back soon. But you may still qualify for unemployment benefits from your state.

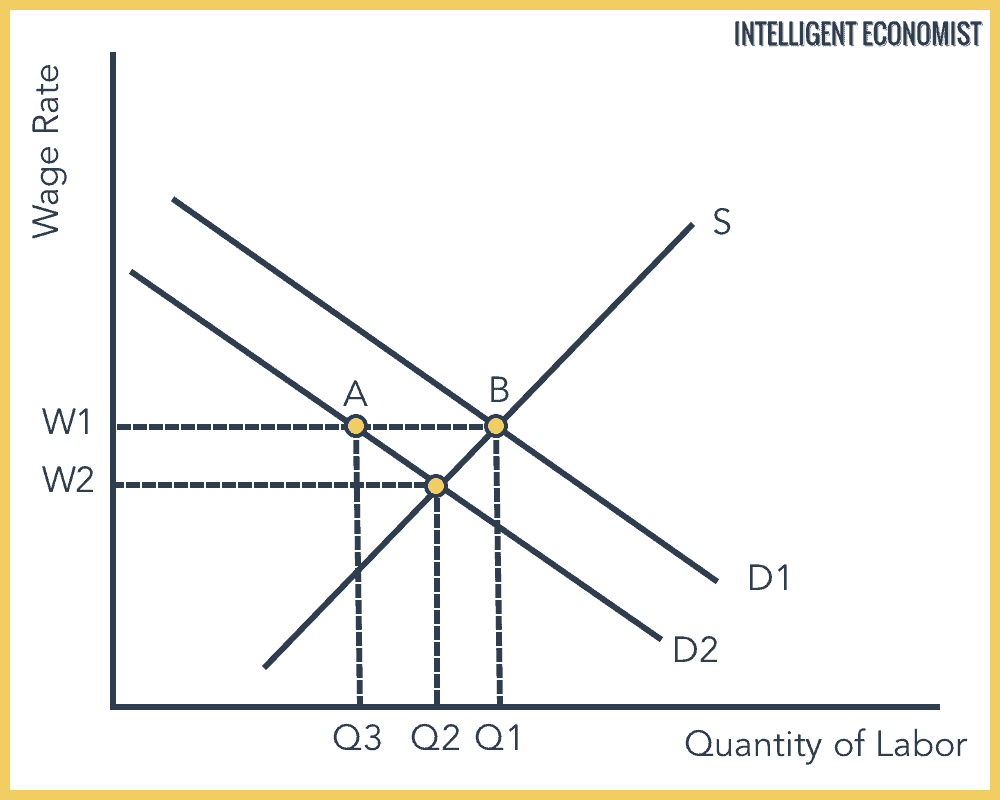

Option 2 - Create a User Account. Want to find jobs that match your skill set or training through the convenience of your mobile device. In addition to regular unemployment compensation benefits which provide roughly half of an individuals full-time weekly income up to 572 per week the federal CARES Act expanded UC benefits through several new programs.