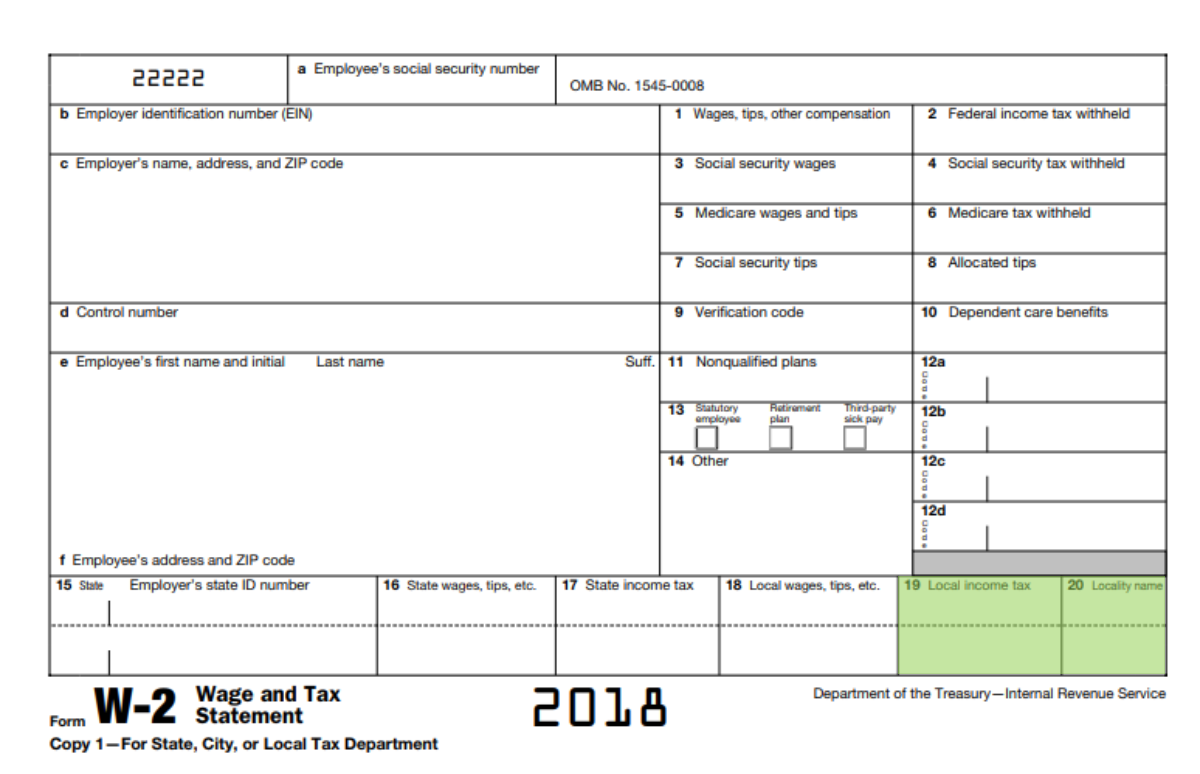

Box 182830 Columbus Ohio 43218-2830. Files must contain W-2 information for each employee from whom you withheld Ohio individual income tax or Ohio school district income tax during the reported year including both Medicare- qualified and non -Medicare-qualified employees.

Covid 19 Unemployment Benefits Hamilton Ryker

The 10200 exclusion are also applicable under Ohio law.

Ohio unemployment w-2. For a full list of changes to Ohio unemployment tax rates see the Department of Jobs and Family Services website. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19. Partial unemployment is defined as earning less income than what the worker would be eligible to receive in unemployment benefits.

The worker must be totally or partially unemployed. Unemployment Taxes ERIC Unemployment Benefits OJI Recruit and Hire Workers. Ive never filed for unemployment before but it says I already have an account.

Employers with questions can call 614 466-2319. W-21099 Forms Filer Pricing. Ohio law is in conformity with federal law therefore the provisions applicable under federal law eg.

For unemployment compensation benefits you should probably receive a Form 1099-G from your state government. Welcome to Ohio Pandemic Unemployment Assistance Online Application. To see if you are eligible apply at unemploymentohiogov or call 877 644-6562.

Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on. But you dont have to wait for your copy of the form to arrive in the mail. If you were out of work for some or all of the previous year you arent off the hook with the IRS.

While the official cause of death for the Grammy-winning musician real name Marvin Lee Aday has. Appeal requests may be submitted online at unemploymentohiogov by email to UITaxAppealsjfsohiogov by fax to 614 752-4952 or by mail to Unemployment Tax Appeals P O. Individuals who receive a 1099-G form and did not file for unemployment benefits should visit unemploymentohiogov and click on the red Report Identity Theft button or call 1-833-658-0394 if they have not already done so.

Used by employers to apply for an unemployment tax account. Unemployment benefits are taxable pursuant to federal and Ohio law. If you have an online account in the Ohio PUA system enter your Social Security Number and Password below.

Those who issue fewer than 250 W-2 forms ODT encourages you to use the W-21099 Upload feature on the Ohio Business Gateway. Each year brings changes to Ohio unemployment tax rates. The appeal must be in writing and it must state the reasons the employer believes the determination was incorrect.

How To Get My W2 From Unemployment Nj. The Department has created a new electronic W-2 filing method called the Simplified W-2 Upload format which utilizes a CSV comma-separated values file format to create a W-2 file to electronically submit to the Department using the W-21099 Upload feature on the Ohio Business Gateway Gateway. While the Lowest Experience Rate and New Employer Rate have held constant since 2017 the Highest Experience Rate has gone up by 02 each year.

ODJFS also has posted extensive guidance and frequently asked questions at unemploymenthelpohiogovIdentityTheft. Where Can I Get Free Stna Training In Dayton Ohio. Those who received unemployment benefits for some or all of the year will need a 1099-G form.

To qualify for traditional unemployment benefits Ohio workers filing for unemployment benefits must meet the following criteria. Youll also need this form if you received payments as part of a governmental paid family leave program. Apply for Unemployment Now Employee 1099 Employee Employer.

Unemployment benefits provide short-term income to unemployed workers who lose their jobs through no fault of their own and who are actively seeking work. Generally you should not include unemployment benefits you did not apply for as income on your federal and state income tax returns. Yes unemployment compensation is reported on your tax return differently than and separately from W-2 wage income.

Rock star Meat Loaf who died Thursday night at the age of 74 was reportedly sick with COVID-19. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. Those who issue 250 or more W-2 forms must submit this information to ODT using the approved format through the W-21099 Upload feature on the Ohio Business Gateway.

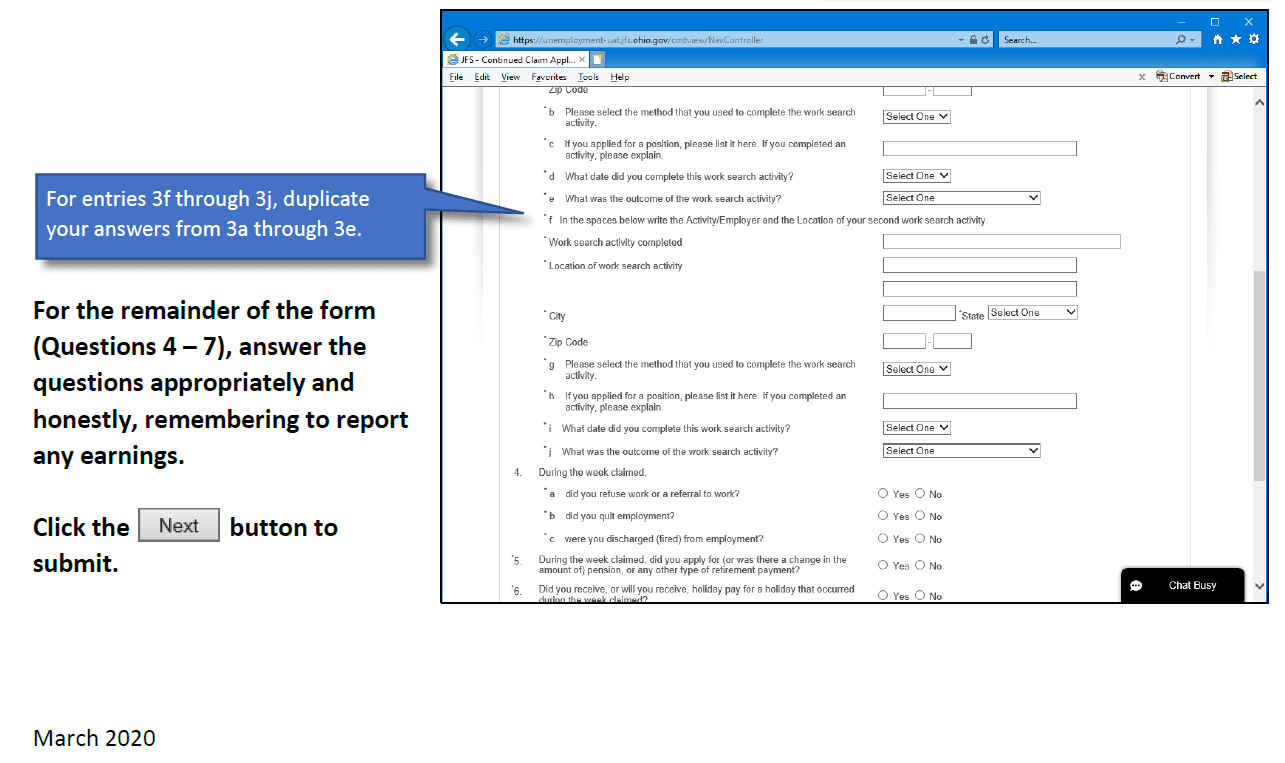

New PUA applications will continue to be accepted through Wednesday October 6 2021 but only for weeks of unemployment prior to September 4. The unemployment must be involuntary. Filing Your Weekly Claims.

To see if you are eligible apply at unemploymentohiogov or call 877 644-6562. JFS-20101 Transfer of Business. If you have additional questions with filing your Ohio return please call the Department of Taxation at 1.

Visit the IRS website here for specific information about the IRS adjustment for tax year 2020. Unemployment benefits provide short-term income to unemployed workers who lose their jobs through no fault of their own and who are actively seeking work. To be submitted if an employer has acquired any portion of a trade or business.

Payments for the first quarter of 2020 will be due April 30. For wages you should receive a W-2 from your employer or employers. To obtain your Employer ID immediately please visit httpsthesourcejfsohiogov to register your unemployment account.

W2 Forms No for reasons of confidentiality you can only get this form through the mail or over the phone. The Ohio Department of Taxation follows the EFW2 layout required by the Social Security Administration with certain modifications outlined below for the federal W-2 and the specifications outlined in IRS Publication 1220 for the federal 1099-R. Those who received unemployment benefits for some or all of the year will need a 1099-G form.

The states Back to Work Program is offering a one-off 1000 dollar payment for unemployed persons who accept part-time work and 2000 dollars to any unemployed person who takes on a full-time post. JFS-20100 Report to Determine Liability. Employers that issue 250 or more W-2 forms andor 1099-R forms must send this information to us on.

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Ohio Unemployment Phone Number Ohio Unemployment Customer Service Number Pua Ohio Unemployment Login

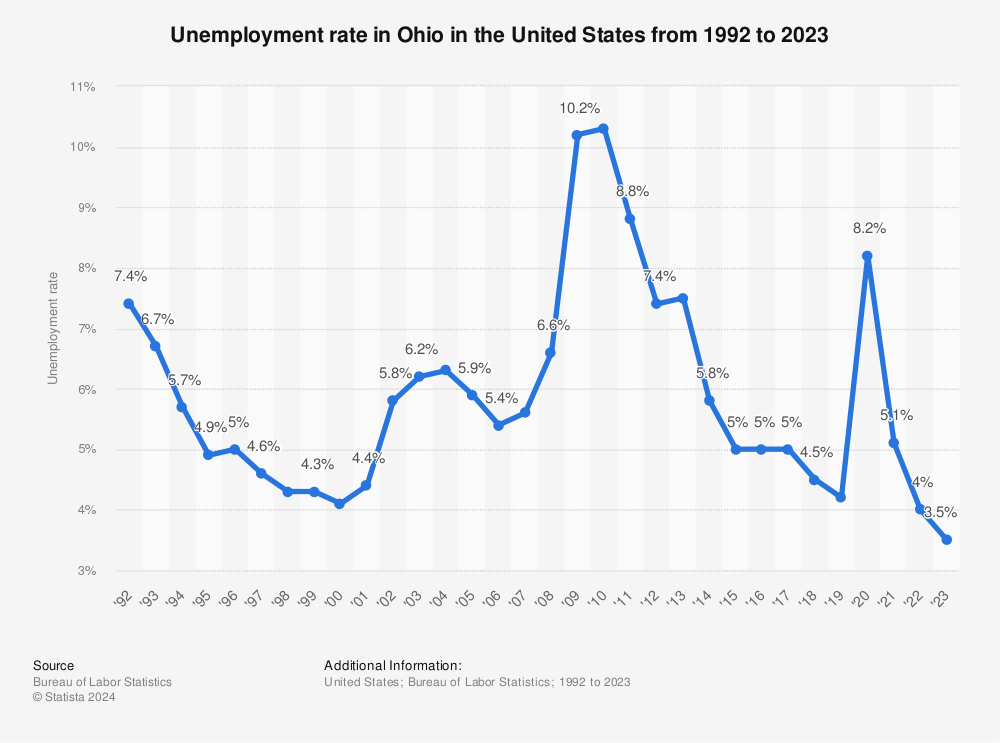

Ohio Unemployment Rate 2020 Statista

How Do I Report Ohio School District Income Taxes On A W 2 Help Center Workful

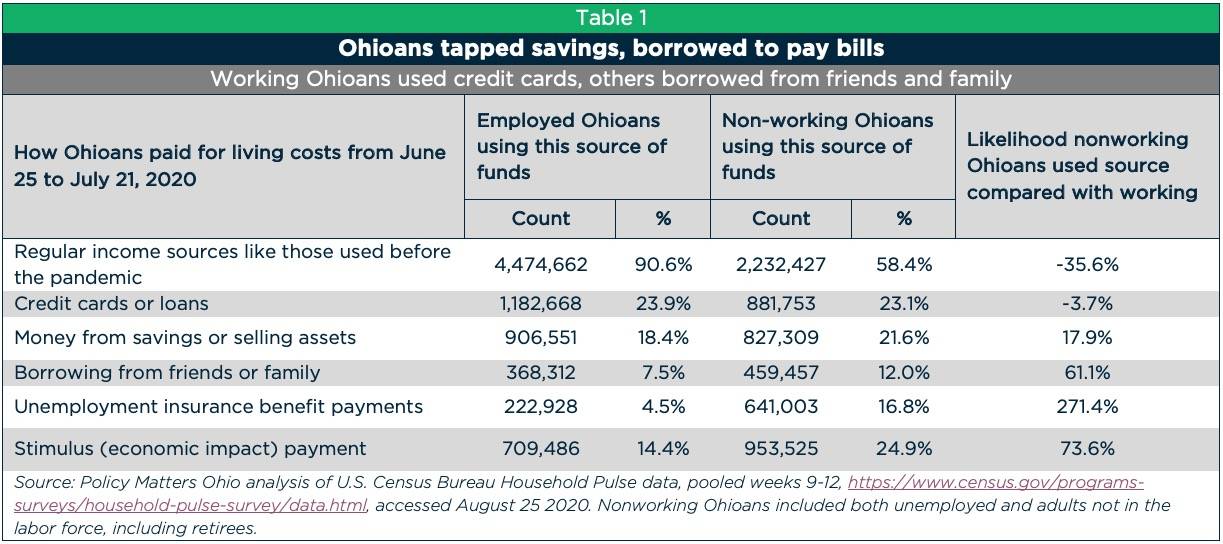

State Of Working Ohio 2020 Reset And Unrig

Income School District Tax Department Of Taxation

/cloudfront-us-east-1.images.arcpublishing.com/gray/VYN6IEBZFJDK5C6PF6QW3UZJLM.png)

Odjfs Addresses New Issue Opening Messages From Unemployment Office State Creates New Website For People Now Looking For Jobs

Covid 19 Unemployment Benefits Hamilton Ryker

Ohio Waivers Now Available For Pandemic Unemployment Overpayments Cleveland Com

No comments:

Post a Comment