This requires you to call. Under the program the state could have increased the weekly supplement to 400 by paying 100 a week in state funds.

Michigan Paid 8 5 Billion In Fraudulent Pandemic Jobless Claims State Abc12 Com

You worked a couple days and made 400.

Michigan unemployment 400 dollars. Michigan pays up to 362 a week in traditional unemployment benefits. If Michigan does take part the 400 per week payments would be retroactive to Aug. Michigan like most other states are not in a position to provide the additional 100 weekly sum which would cost the State roughly 1 billion monthly so Michigan applied.

MMA fought hard in 2011 and 2013 for fundamental reforms of Michigans. 1 meaning residents could get a few weeks worth of payments in one to start. If you do end up receiving 300 or 400 a week again on top of your state unemployment benefits the federal governments portion of 300 a week will be pulled from a 44 billion disaster.

The extra FEMA payments will bring the total to 662 a week. The federal deductible as of 2021 is 12400. And for your taxes you dont have to file it wont even do anything for your unemployment because they dont care.

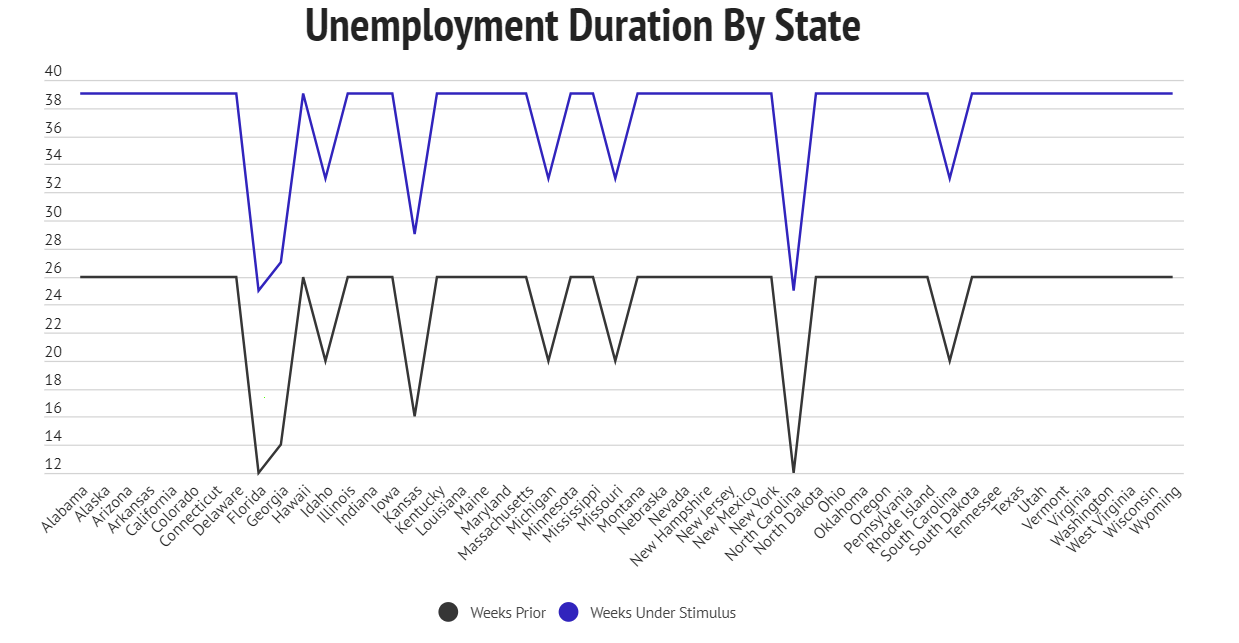

If you meet Michigan unemployment benefits eligibility you will be approved for up to 20 weeks of unemployment compensation. A day after President Donald Trump took executive action to offer 400 per week in supplemental unemployment benefits including 25 he said should be. Unemployment compensation benefits are administered by the Michigan Department of Labor and Economic Opportunitys Unemployment Insurance Agency the state government agency that helps Michigan job seekers and workers.

You were on a PUA you certified for week X but then the week went to Not Paid. Employers pay billions of dollars into Michigans unemployment insurance system each year but unfortunately the system has been plagued with inefficiency errors and scandal. Under the Executive Order while states could provide eligible unemployed persons up to 400 supplemental dollars weekly 100 would have to come from the state itself.

The Michigan Unemployment Insurance Agency did not apply for a larger 400 per week benefit because it would have required the cash-strapped state to cover a quarter of the cost up to 100 million per Whitmer administration estimates. The new response team was created under Executive Order 2021-16. Find out what key documents and information youll need to file your unemployment claim for benefits.

It was initially announced as 400 but that included an additional 100 from state funds that almost no states are providing. Michigan opts in on an extra 300 a week in federal unemployment money Dont bank on the 400 extra unemployment pay yet from Trump executive order Michigan cut off unemployment for thousands of. When the State of Michigan finds fraud in obtaining unemployment benefits they asses a 400 penalty on top of the alleged overpayment.

The release is silent on whether Michigan plans to chip in an extra 100 per week in benefits to increase the total additional benefits to 400. Some were penalized at a rate of 400 by automatic. Michigans Unemployment System Has History of Being a Mess.

So you dont even owe taxes on that 400 you made. State auditors have since reported that the agency improperly paid 39 billion to claimants who were later deemed ineligible. And the state spent countless more dollars litigating the false fraud claims.

AP Michigan likely paid about 85 billion in fraudulent jobless benefits over a 19-month period during the coronavirus pandemic far more than previously estimated according. Or you certified on an extension that had no balance and your week went to Not Paid. House Bill 4434 introduced by Lori Stone D-Warren was originally intended to ensure the Unemployment Insurance Agency uses plain language for correspondence and documents related to the taxes of employers and.

These problems cost manufacturers dearly in terms of time and money. States are eligible to receive up to 400 a week in federal funds. The Michigan unemployment department requires all benefits recipients to file a weekly claim with MARVIN the online reporting system.

The minimum amount you will receive is 81 with a maximum of 362. AP Michigan has applied for federal funding to provide an additional 300 a week in unemployment benefits amid the coronavirus pandemic less than the 600 boost that expired last month but still more than the maximum 362 weekly payment the state dispenses. This happens if you certify on an extension that has no balance or has been suspended to switch you to a new extension.

Big benefits claims a perfect storm for unemployment fraud in Michigan Whitmer blasted the president at the time because his order fell short of the 600 residents had qualified for and appeared to require cash-strapped states like Michigan to cover 100 of what could be a 400 weekly benefit. Trump announced an executive order Saturday that extends additional unemployment payments of 400 a week to help cushion the economic fallout of the pandemic. The system failed miserably and even accused some individuals who had never even received unemployment in their lives of fraud.

The Michigan House passed a bill Thursday that would eliminate the extra 300 in federal unemployment benefits for Michigan residents.