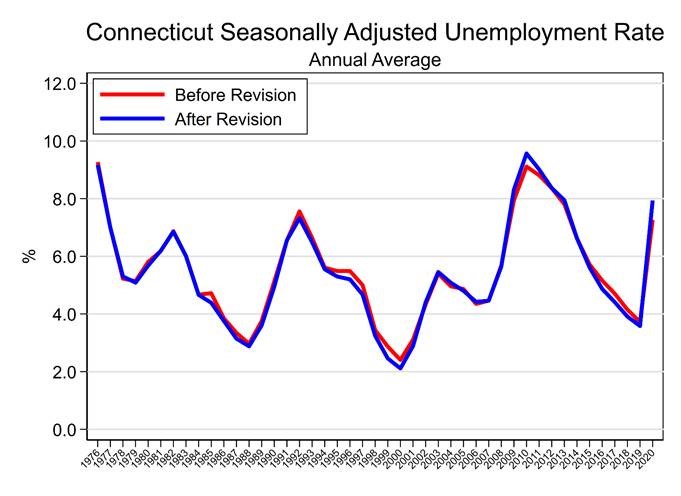

The states CT Direct Benefits is the system that is used to administer and process benefit requests. The latest figures for Connecticut show an unemployment rate of 81.

In most cases the maximum number of weeks you can receive unemployment benefits is 26 weeks unless you are given an unemployment benefits extension during a time of high statewide unemployment.

Ct unemployment benefits amount. For example if you earned an average of 17000 in the two highest quarters your weekly benefit amount would be 594 17000 26 65385 subject to the maximum cap of 698. Unemployment insurance is taxable income and must be reported on your IRS federal income tax return. The weekly unemployment benefit for new filers in Connecticut increased by 18 on Oct.

6 2019 Connecticut Department of Labor Commissioner Kurt Westby said today. It is vital that. Connecticut will raise its maximum weekly unemployment benefit by 18the highest amount allowed under lawfrom 613 to 631 effective Oct.

You have to earn at least 40 times the weekly benefit amount in your base period one year before being eligible to collect. In 2008 when the banks fucked over the economy greed the unemployed got a minimum of 99 weeks of benefits. Wisconsin has a Weekly Benefit Rate Calculator that helps you figure out the amount of your unemployment.

This calculator uses the average weekly state benefit amount reported by the Department of Labor from January 2020 to November 2020 to calculate total. What is the maximum unemployment benefit in CT. State Benefits Calculators.

Unemployment Benefits In Florida Questions Connecticut Delaware DC. Unemployment Insurance is temporary income for workers who are unemployed through no fault of their own and who are either looking for new jobs in approved training or are awaiting recall to employment. The Great Recession was mostly a banking crisis that was eased by giving them a.

The amount of state unemployment compensation taxes that an employer pays is a function of the 1 amount of wages paid by the employer that are subject to the state s taxable wage base. For the 12 months ending August 31 2019 unemployment insurance benefits averaged 39394 per week and claimants received an average of 163 weeks of compensation. The weekly unemployment benefit for new filers in Connecticut increased by 18 on Oct.

Your weekly benefit amount and the number of weeks of entitlement are based on the wages you were paid and the amount of time you worked during your base period. This base period will also determine how much you will earn in part. Get tax info 1099G form File your application for Extended Benefits EB Received an extended benefits letter.

The maximum weekly benefit for individuals is now 649 a week or about 16 per hour. A workers UI benefit in Connecticut is calculated by using the wages in the two calendar quarters of their base year in which they earned the most money. State in which you earned wages.

The unemployment compensation examiner will make a calculation based on the wages you earned during your base period and whether you have any dependents. Your local state unemployment agency will send you form 1099-G to file with your tax. Unemployment Online Assistance Center.

Claiming benefits for unemployment is a straightforward process that can either be completed online or over the phone. Archived Connecticut Unemployment benefit amount Connecticut Question. The Connecticut Department of Labor administers unemployment insurance benefits for workers in the state who are either partially or fully unemployed and who are either looking for new jobs in training or waiting to be recalled back to their jobs.

529 Connecticut unemployment extended benefits unemployment claim issues and what to do. The DOL averages these amounts and divides the resulting sum by 26. Connecticut Unemployment benefit amount Connecticut Question.

Will I have to pay taxes on my Unemployment Benefits. For 12 Month Period Ending June 30 2021 520 - 621 Taxable. How much unemployment benefit can I get in Connecticut.

The offset is reduced to the extent that the employee contributed to the pension approximately 50 in. The change does not apply to claimants currently receiving unemployment benefits or those who filed before Oct. Connecticut Statewide.

The weekly benefit amount is calculated by dividing the sum of the wages earned during the highest quarter of the base period by 26 rounded down to the next lower whole dollar. The maximum unemployment benefit available to individuals in Connecticut was 949 a week or about 24 per hour through September 6 2021. Florida Georgia Hawaii Here is a list of the maximum weekly unemployment compensation benefits for each US.

The result is the workers weekly benefit as long as it is under the maximum benefit amount of 698. 2 the amount of unemployment benefits paid to the employer s workers over a specified period of time ie the amount that is charged to the. 4 to a maximum of 667 state labor Commissioner Kurt Westby said.

Average Weekly Initial Claims Not Seasonally Adjusted Average Insured Unemployed. Benefits are typically available for up to 26 weeks although this may increase in. Select a benefits payment option.

When applying for unemployment and the state is considering the benefit amount are wages from a prior job considered even if you quit voluntarily. File your weekly claim Sun - Fri only Check status of weekly claim or manage your account. 4 to a maximum of 667 state labor Commissioner Kurt Westby said.

This includes the federally funded enhanced extended benefits PUA PEUC and 300 FPUC provided in 2020 and 2021. Connecticut requires an offset against unemployment compensation benefits for Social Security pensions and in certain cases other public and private pensions. Applying for Benefits in Connecticut.

Find more information about the benefits offered. New York for example has a UI Benefits Calculator on which you can enter the starting date of your original claim to determine how many weeks of UI Regular Unemployment Insurance Benefits you will receive. The decision by the state Department of Labor is designed to bring the benefit in line with wage increases said CBIA vice president for government affairs Eric Gjede.

Calculate your estimated benefit by answering a few questions below. File for Pandemic Unemployment Assistance PUA File your weekly PUA certification. Total Weekly Benefit.

Now facing a crisis the world hasnt seen in 100 years were being provided fewer weeks despite the challenges being much much worst than in 2008.

Federal Pandemic Unemployment Compensation Fpuc

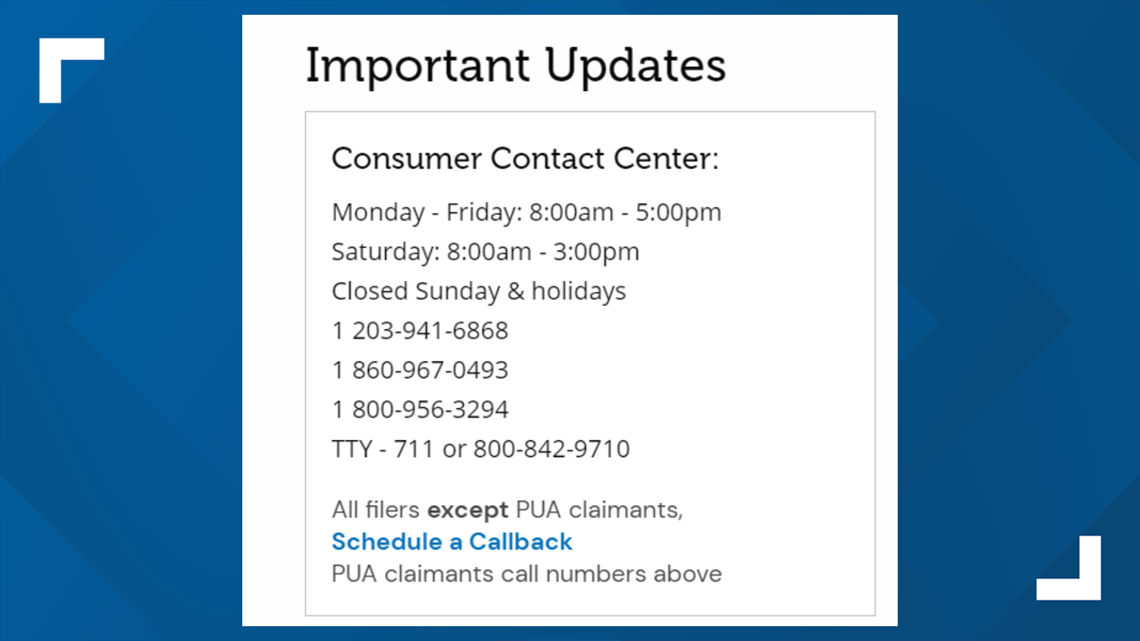

Connecticut Unemployment Helpline Phone Number Fox61 Com

State Of Connecticut Labor Market Information Initial Claims Profile

World S Largest Professional Network Employment Service American Jobs Job Center

Autodial Helps People Claim Benefits Through Call And Text Automation And Innovation Helping People Computer Programming Solving

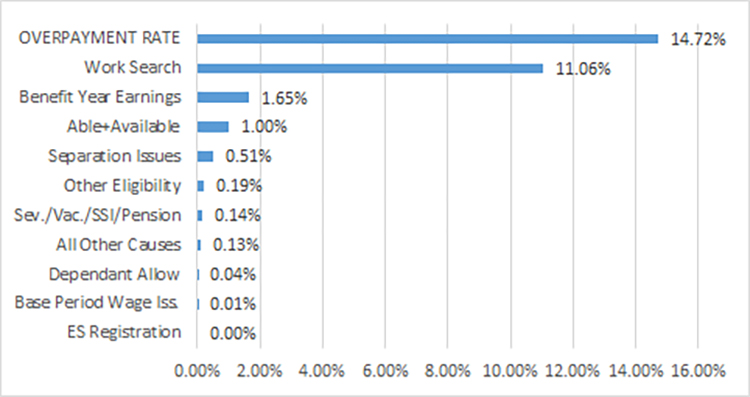

Ct Lawmakers Call On State To Forgive Unemployment Overpayments

Ct Dept Of Labor Unemployment Rate Private Sector Employment Up

Unemployment Benefits Comparison By State Fileunemployment Org

State Of Connecticut Labor Market Information Initial Claims Profile

Ct Dept Of Labor Unemployment Rate Private Sector Employment Up

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

Connecticut U S Department Of Labor

No comments:

Post a Comment