DUA oversees the unemployment insurance UI program which provides temporary income assistance to eligible workers in Massachusetts. The statewide unemployment rate rose from 5 to 52 in September while employers reported adding 11900 jobs across Massachusetts last month labor officials announced on Friday.

Mincer Jacob 1991 Education And Unemployment Nber Working Paper 3838 National Bureau Of Economic Research Cambridge Ma Lettura

Go to the UI Online login screen.

Unemployment ma. The rate was still slightly above pre-crisis levels amid reports of severe labor shortages but should decline further in the coming months as companies fill widespread vacancies. To report fraud or get help with your claim call Unemployment Customer Assistance at 877 626-6800. To request weekly benefits daily 6.

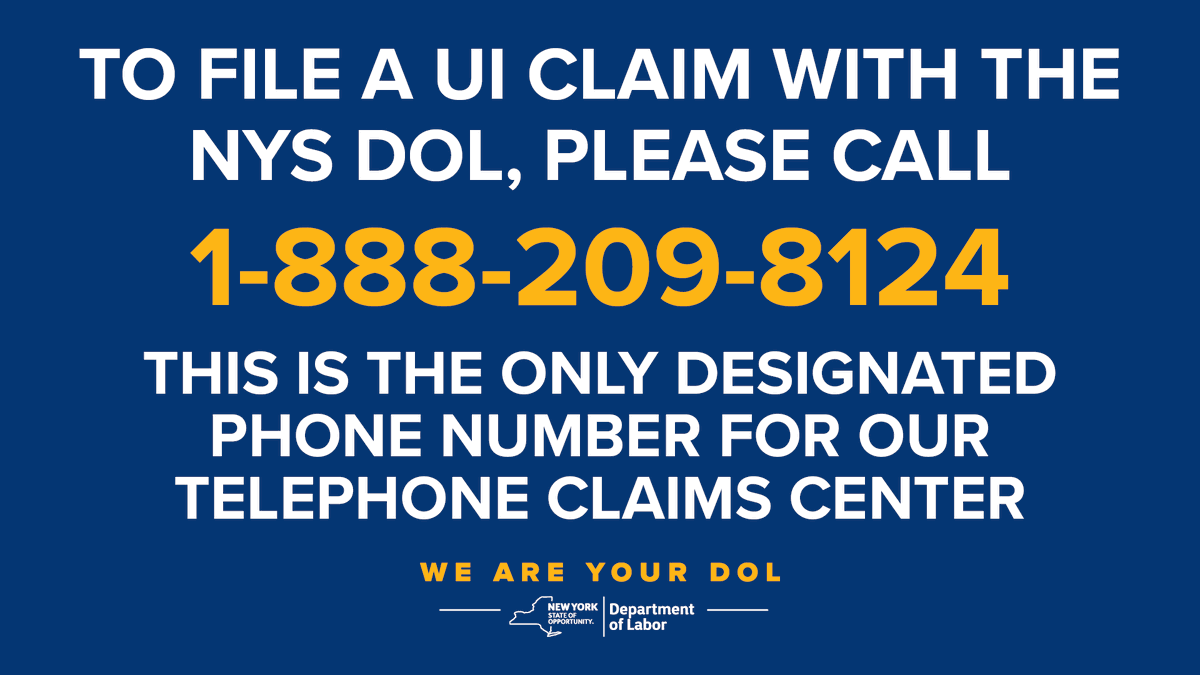

TeleCert Line Automated system is operational Call Department of Unemployment Assistance TeleCert Line Automated system is operational at 617 626-6338. Boston MA 02114 or by calling 877-626-6800. Beginning October 20 2021 through.

186 Alewife Brook Parkway Cambridge MA 02138. 1099-G Tax Form. Can you collect unemployment if you are fired Massachusetts.

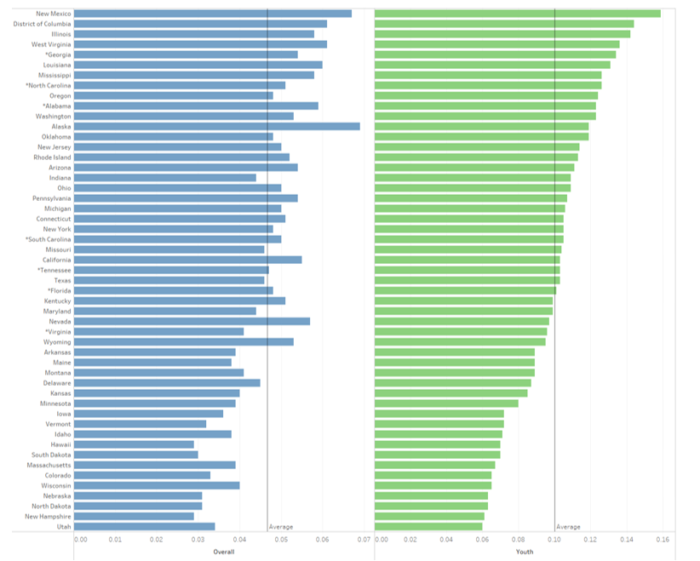

The US unemployment rate dropped to 39 percent the lowest since February 2020 pointing to a sustained recovery in the job market helped by a fast-recovering economy and strong demand for labor. You can apply for benefits during your first week or partial week of unemployment. See the 1099-G web page for more information.

617 626-6800 from any other area code. DUA also determines and collects employer contributions to the UI program. Massachusetts Unemployment Insurance UI Online Application for Benefits.

210 South Street Boston MA 02111. Can a company terminate an employee in Massachusetts. Due to scheduled system maintenance UI.

These are the steps you need to take. Multilingual call agents are available. If you are eligible to receive unemployment your weekly benefit in Massachusetts will be half of your average weekly wage during the two highest paid quarters of the base period or the highest paid quarter only if you worked during only two quarters of the base period.

Regular UI Online Hours are. If the employer does not respond within 10 days DUA may contact the applicant or the employer again for any missing. 600 am - 1000 pm daily.

Massachusetts Department of Unemployment Assistances Best Toll-Free800 Customer Phone Number. Maximum Length of Time. Check off the acknowledgement box that says I have read and understand the information above When prompted enter your Social Security number twice.

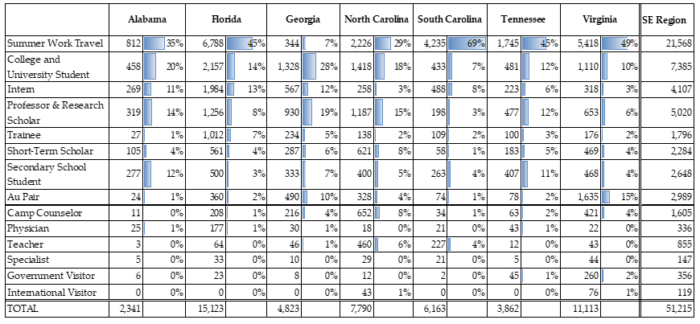

To apply for Unemployment Insurance UI benefits you need to provide personal information including your Social Security number birth date home address email address optional and phone number. This amount does not include the dependency allowance for children. As of 2011 Massachusetts offers unemployment benefits for a maximum of 26 weeks.

Since the maximum benefit amount you can get is 625 per week you cannot get more than 16250 total in unemployment benefits. This document has step-by-step instructions to reset your password. High rates of unemployment are a signal of economic distress while extremely low rates of.

How do you file unemployment in Ma. If you were fired you will be eligible for unemployment benefits unless you were fired for willful misconduct. The number you call depends on your area code.

UI benefits are overseen by. You can apply for unemployment benefits online via the Massachusetts Department of Unemployment Assistance. Open 830 am430 pm MondayFriday.

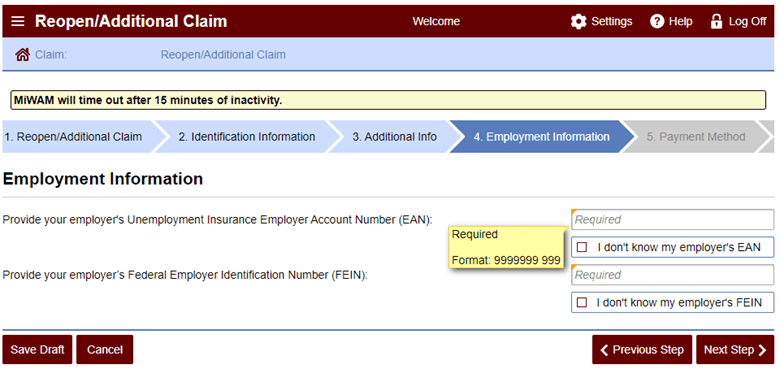

Unemployment occurs when workers who want to work are unable to find jobs which lowers economic output. You also need information about your employment history from the last 15 months including. Please try back again later.

To apply for unemployment benefits check your eligibility prepare your documents submit your claim and understand your allotted benefits. Filing an unemployment claim requires applicants to furnish their personal information and information about their former employers. Under Massachusetts law the first issue that needs to be addresses is whether you quit or were fired.

What you needfor Apply for unemployment benefits. 877 626-6800 from area codes 351 413 508 774 and 978. Department of Unemployment Assistance DUA.

Boston Unemployment Office. The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment benefits in calendar year 2021. This is Massachusetts Department of Unemployment Assistances best phone number the real-time current wait on hold and tools for skipping right through those phone lines to get right to a Massachusetts Department of Unemployment Assistance agent.

In the state of Massachusetts you can file for unemployment online through the UI Online portal in person at 19 Staniford St. 617-338-0809 Cambridge Unemployment Office. Welcome to Massachusetts Unemployment Insurance UI Online Application.

The most you can receive per week is currently 823. After petitioners apply for unemployment benefits in Massachusetts DUA sends a request to all employers listed on the claim for information regarding past wages and reasons for employment terminationEach employer has 10 days to respond. You can also file for unemployment benefits or get help with your application by calling the TeleClaim Center.

The Massachusetts unemployment application process necessitates that workers apply within a timely fashion of losing their job as initial eligibility considers the most recent months of earnings. Unemployment insurance or UI is a state-federal program designed to provide temporary income support for individuals who lose their job through no fault of their own. UI Online is currently unavailable for scheduled maintenance.