The federal government will reimburse each state in full for the additional benefits being paid. NY unemployment claims can pay its full weekly benefit for up to a maximum of 26 weeks or a maximum of 104 264104 days benefits.

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

For January 1 2020 March 31 2020 the minimum benefit rate is 172.

Ny unemployment benefits length. Unemployment benefits typically last for 26 weeks. Workers will receive some unemployment benefits as long as they work fewer than 30 hours. The CARES Act provides certain eligible workers with an additional 13 weeks of benefits for a total of 39 weeks.

Though New York State residents may receive standard benefits for a maximum of 52 weeks Unemployment Insurance recipients may only receive their full benefits payments for 26 weeks or a period of six months. This also includes if you were laid off earlier in the pandemic returned to work for a time lost work again and have filed a new claim within the past six months. Know how and when you will be paid.

New York State like many others provides for 26 weeks of UI benefits. For example states such as New York California Texas Pennsylvania Minnesota and Ohio each offer 26 weeks of unemployment benefits through the traditional state-funded unemployment insurance system. The number of available weeks of EB was dependent upon New York States unemployment rate.

Extended Benefits EB are triggered on in three states. Determine the number of weeks you can draw benefits. The minimum PUA benefit rate is 50 of the average weekly benefit amount in New York.

Normally you can draw 26 weeks of benefits in any given Benefit Year. Unemployment benefits typically last for 26 weeks. Thus residents of New York may receive a total of 93 weeks of benefits.

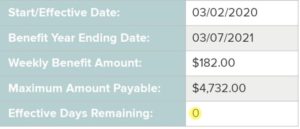

However if youÂre still unemployed at the end of this time period you may be able to apply for Emergency Unemployment Compensation. In the state of New York unemployment benefits are available for up to 26 weeks. For April 1 2020 June 30 2020 the minimum benefit rate is 182.

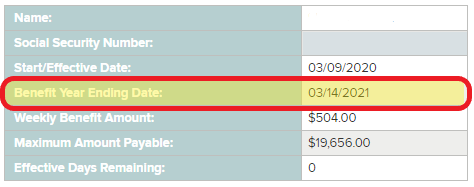

The maximum benefit rate is 504 the same as the maximum benefit rate for regular unemployment insurance benefits. Extending Shared Work Benefits - 91721. Your local state unemployment agency will send you form 1099-G to file with your tax.

The Shared Work program allows employers to keep employees and avoid layoffs by allowing staff members to receive partial Unemployment Insurance. That program can offer either 13 or 20 additional weeks depending on whether the federal government believes New York has high unemployment or extremely high unemployment. The proposal would require the state Department of Labor to provide initial determinations for unemployment benefits to the person seeking them within 30 days of the necessary documentation being furnished.

However each state dictates the length of unemployment benefits. For up-to-date information on New Yorks rules on unemployment eligibility and amounts during the COVID-19 pandemic visit the. New legislation S4049A5678 changes the cap on Shared Work benefits from a maximum of 26 weeks to a maximum of 26 times an individuals weekly benefit rate.

Workers in most states are eligible for up to 26 weeks of benefits from the regular state-funded unemployment compensation program although nine states provide fewer weeks and two provide more. The maximum length of extended benefits in New York State is 67 weeks. However if youre still unemployed at the end of this time period you may be able to apply for Emergency Unemployment Compensation EUC.

Unemployment insurance is taxable income and must be reported on your IRS federal income tax return. However each state dictates the length of unemployment benefits. From August 9 2021 through September 5 2021 this program was available for a maximum of 13 weeks.

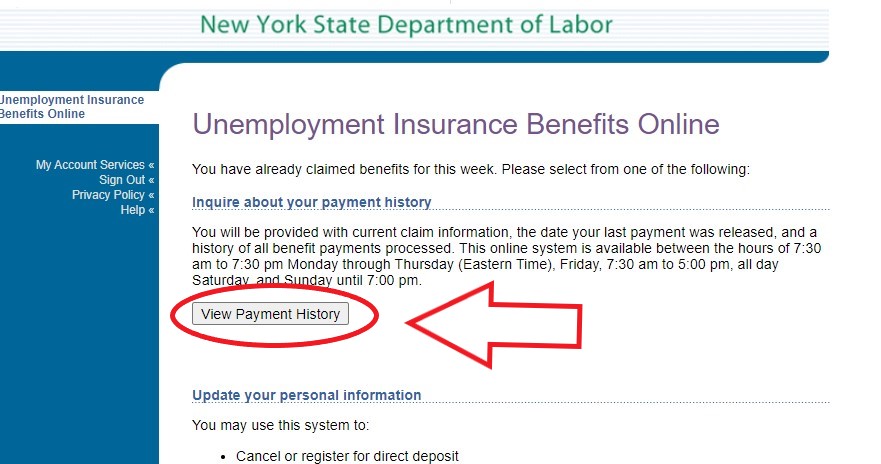

Workers receiving regular unemployment insurance or UI within the first 26 weeks will keep getting benefits until they hit 26 weeks. You can calculate your unemployment benefits at the NYS Department of Labors Benefit Rate Calculator. Based on your particular circumstances the New York Department of Labor will send you a notice of how many weeks of eligibility you have.

Extended Benefits EB are triggered on in three states. The maximum amount of weekly traditional unemployment benefits in New York is 50400 per week for 39 weeks. Using the example above the minimum amount for traditional unemployment benefits in New York is 104 per week for 39 weeks.

If a determination cannot be issued within that time state officials must notify the claimant of the new time frame for when a determination can be. Additional weeks of pandemic federal benefits ended in all states on September 6 2021. Those additional benefits are triggered on when a states 13-week average insured unemployment rate is above 5 percent and climbing when the 13-week average insured unemployment rate is above 6.

The Length of Time to Receive Benefits has Increased. Workers in most states are eligible for up to 26 weeks of benefits from the regular state-funded unemployment compensation program although nine states provide fewer weeks and two provide more. How Long Can You Stay On Unemployment Benefits.

If you were awarded the maximum of 430week your award letter should have so said. Three options exist for receiving benefits. ARP increases the maximum duration of PEUC benefits from 24 to 53 weeks with an expiry date of September 4 2021.

Will I have to pay taxes on my Unemployment Benefits. This includes the federally funded enhanced extended benefits PUA PEUC and 300 FPUC provided in 2020 and 2021. Under the new system that person could work up to four hours at any time and receive their full benefits.

The EB program fully ended on September 5 2021. When you exhaust your standard unemployment benefits you receive EUC benefits for a maximum of 47 weeks after which point qualified applicants may continue to receive EB for a maximum of 20 weeks. In the state of New York unemployment benefits are available for up to 26 weeks.

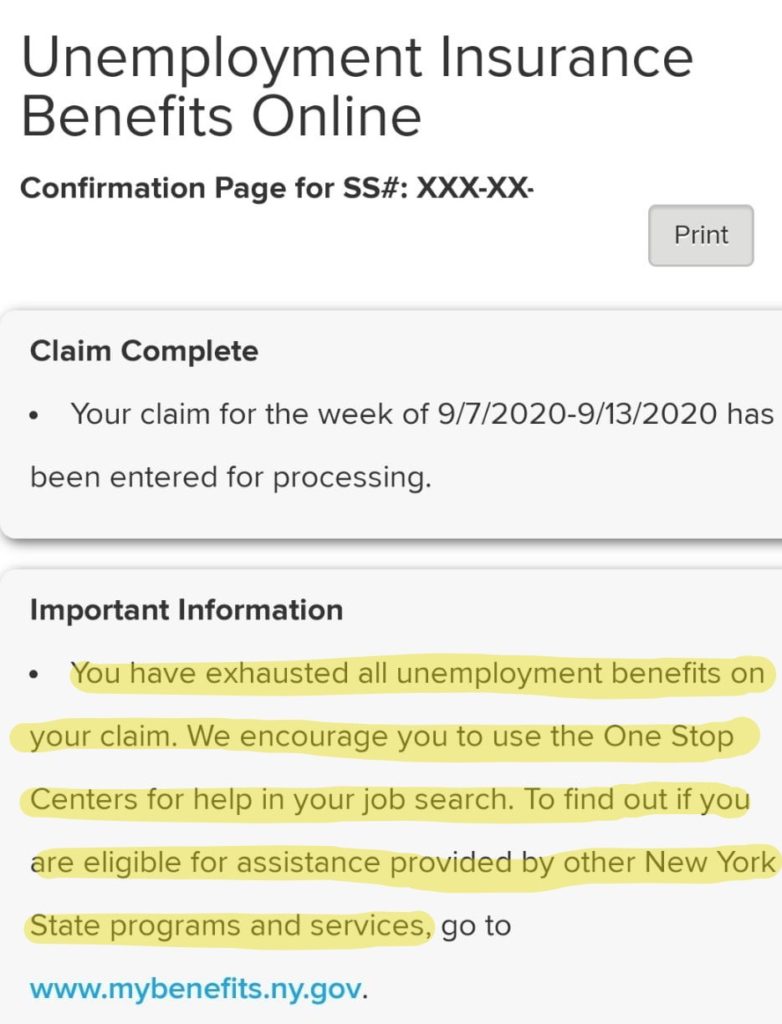

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

600 Extra Unemployment And 13 Week Unemployment Extension Status And Payment Schedule Aving To Invest

Nys Department Of Labor On Twitter While Fpuc Benefits Have Expired Ui And Pua Benefits Have Been Extended For New Yorkers When Your Effective Days Remaining Reaches 0 During Your Benefit Year

New York Ny Dol Unemployment Insurance Compensation After End Of Pandemic Programs What You Can Get In 2022 And Claiming Retroactive Payments News And Updates Aving To Invest

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Here S How Long Unemployment Benefits Now Last In Each State

New York State Department Of Labor Update The Extended Benefits Eb Program Is Now In Effect In Nys Thanks To The Pandemic Emergency Unemployment Compensation Peuc Eb Programs New Yorkers

Benefit Extension Information Department Of Labor

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22363790/EwH7osaWgAA9Ft8.jpeg)

It S Been One Year Since You Filed For Unemployment Now What The City

Pandemic Emergency Unemployment Compensation Peuc 2021 Extension Ending And Move To State Eb And Regular Ui Programs Aving To Invest

Pandemic Unemployment Assistance Pua 2021 Extension Delays And Zero Weeks Claim Balance Aving To Invest

No comments:

Post a Comment