Following the expiration of New York States COVID-19 State of Emergency the Unemployment Insurance unpaid waiting period rule is once again in effect. For wages you should receive a W-2 from your employer or employers.

Nys Department Of Labor On Twitter While Fpuc Benefits Have Expired Ui And Pua Benefits Have Been Extended For New Yorkers When Your Effective Days Reaches 0 During Your Benefit Year You

Call the IRS at 1-800-829-1040 after February 23.

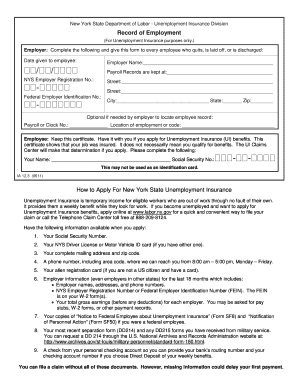

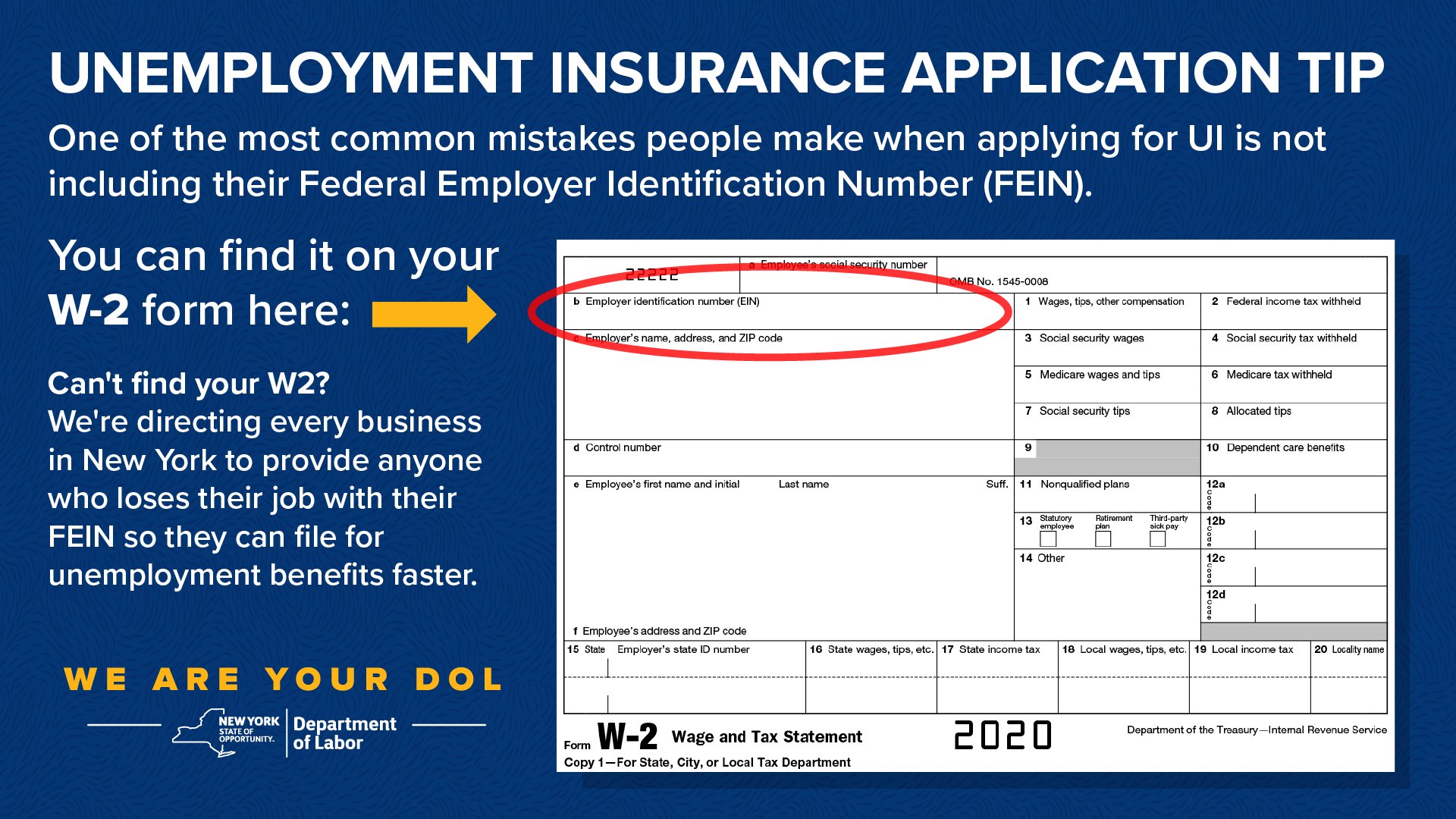

Unemployment ny w2. If you do not receive your Form 1099-G by February 1 and you received unemployment benefits during the prior calendar year you may request a duplicate 1099-G form by phone. What to do if your w2 is lost or missing. 14 of the W-2 Statement to provide its employees with information regarding items that may or may not impact the calculation of.

Call your local unemployment office to request a copy of your 1099-G by mail or fax. Disaster Unemployment Assistance. Those who received unemployment benefits for some or all of the year will need a 1099-G form.

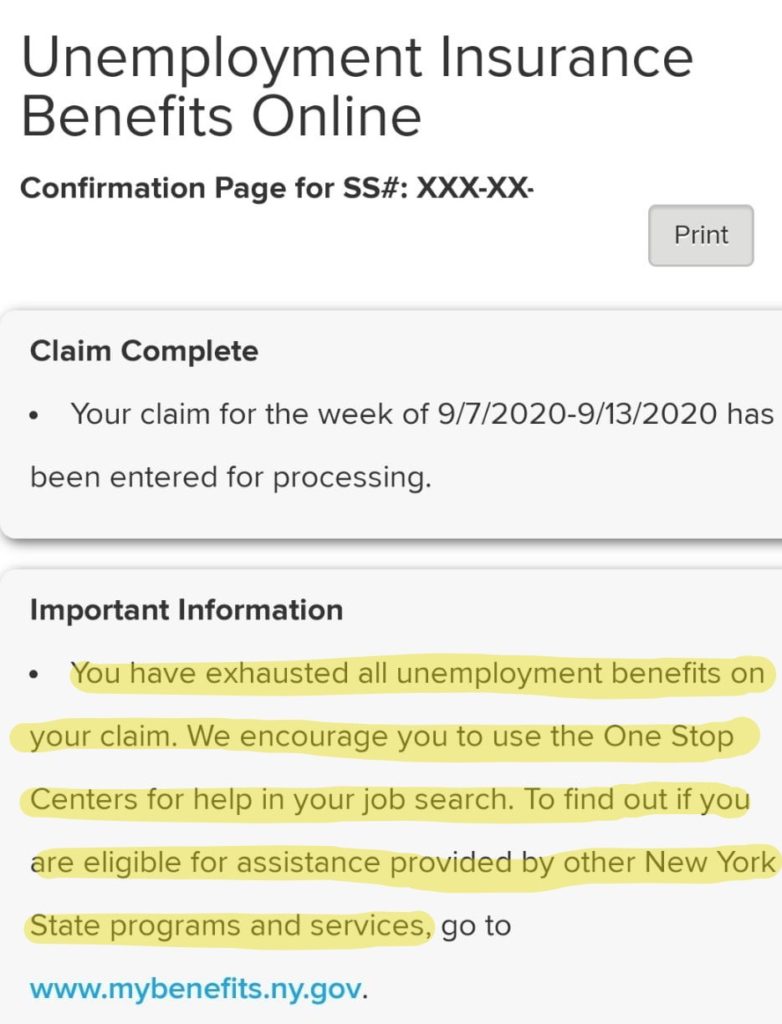

Select Unemployment Services and ViewPrint 1099-G. In New York the easiest way to find your 1099-G is by logging in to the state Department of Labors web portal. If you are eligible for unemployment from before June 2021 you may need to fight for your claim to be backdated further.

Certify for Weekly Unemployment Insurance Benefits. Yes unemployment compensation is reported on your tax return differently than and separately from W-2 wage income. Regular pre-covid-type Unemployment still exists.

There are three ways you can certify your missing back weeks. You dont enter information for unemployment in the W-2 section. Friday from 730 am.

Pacific time except on state holidays. Log into the Unemployment website labornygovsignin. Claimants will not receive payment for the first full week of a claim but must still claim weekly benefits and fulfill eligibility requirements.

If you were out of work for some or all of the previous year you arent off the hook with the IRS. That means if you lost your regular W2 job sometime. You can find.

If you are on unemployment you do not get a W2 you would get a 1099-G form from your State. The tax department will review the information and if appropriate revise the proposed amount due. Select option 2 and follow the prompts.

New Unemployment Insurance claims filed on and after June 28 2021 will include an unpaid waiting week. New York State City of New York and City of Yonkers Certificate of Nonresidence and Allocation of Withholding Tax. Youll also need this form if you received payments as part of a governmental paid family leave program.

By calling the NYS Department of Taxation and Finance at 518 485-5909. Call send a message and Docusign. You should have received a 1099-G with the amount paid to you reported in box 1 IF the state of NY was the entity that actually paid the compensation.

Unemployment Ins Never Sent Me A W2. Reports are that the NY DOL is backdating new claims to June 2021 and not earlier. Monday through Thursday 730 am.

How to find form 1099-G on the New York Department of Labors website. I was currently working for one W2 when our work was cancelled because of COVID-19 and the HR department let us know that since we were. If you need a copy of your 1099G you can view and print your 1099G for calendar year 2013 on the NYS Department of Labor website.

When Do I Get My Nj Unemployment W2. Unemployment as a W2 and 1099 freelancer in NY. To view and print your current or.

Can I Get My Kentucky Unemployment W2 Online. To date the New York State Department of Labor has paid out 12 billion in benefits from the fund and nearly 120000 applications have been approved. But you dont have to wait for your copy of the form to arrive in the mail.

How do I apply for unemployment for previous weeks in NY. Mail the completed form to. Call the Department of Labor 1-888-209-8124.

Call Tele-Serv at 800-558-8321. Click here for the Request for Change in Withholding Status form. What You Need to Know About Filing for Unemployment Insurance Benefits During the Pandemic.

Governor Kathy Hochul announced that New York States first-in-the-nation Excluded Workers Fund is close to being exhausted. With an online account you can. If you received unemployment compensation in 2021 including any income taxes withheld visit the New York State Department of Labors website for Form 1099-G.

Claim ID also referred to as Claimant ID in letters. They arrive at the end of the month. Visit the Department of Labors website.

Over 2 billion will be paid by the end of October. Should I have received a w2 from NYS unemployment. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on.

How to get my w2 from unemployment online. The employee will allocate the part of the employees federal wages that are attributable to services performed in New York State when the employee files his or her New York State nonresident income tax return. New Unemployment Insurance claims filed on and after June 28 2021 will include an unpaid waiting week.

Certify for benefits for each week you remain unemployed as soon as you receive notification to do so. Ok so I have two W2s and probably five or six 1099s. The W-2 form will show your annual earnings taxable fringe benefits income taxes withheld 401 contributions and other vital tax information.

Will unemployment Send me a w2. How do I certify for previous weeks in NY. Log in to your NYGov ID account.

Those who received unemployment benefits for some or all of the year will need a 1099-G form. Beginning October 20 2021 through November 18 2021 DUA is available to New Yorkers in the following New York Counties Bronx Dutchess Kings Nassau Queens Richmond Rockland Suffolk and Westchester who 1 lost employment as a direct result of Hurricane Ida and 2 live or work in an impacted county. How To Get My W2 From Unemployment Nj.

How to get a W-2 IRS form W2. Or by mailing or faxing the protest following the instructions in the letter to NYS Assessment Receivables PO Box 4128 Binghamton NY 13902-4128 or Fax. If you do not receive Form W-2 by early February or misplace it before filing your tax return the first thing to.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. Apply for Unemployment Insurance benefits file a claim -- your claim is processed faster when you file online and access other online services. Following the expiration of New York States COVID-19 State of Emergency the Unemployment Insurance unpaid waiting period rule is once again in effect.

For more information visit onnygovwwfaqs. New Unemployment Insurance claims filed on and after June 28 2021 will include an unpaid waiting week. Most States have an option to download your 1099-G on their unemployment site.

Nys Department Of Labor On Twitter If You Have Submitted An Application For Unemployment Without Your Fein A Representative Will Call You To Finish Your Claim If You Have Not Yet Filed

My Income Was Earned In Ny However I Was A Part Ti

Why Am I Getting Only 182 A Week Homeunemployed Com

Ia 12 3 Record Of Employment Fill Out And Sign Printable Pdf Template Signnow

How Do I Find My Employer S Ein Or Tax Id

New York State Unemployment Form 1099 G Jobs Ecityworks

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Nys Unemployment 1099 Fill Online Printable Fillable Blank Pdffiller

No comments:

Post a Comment