A weekly supplemental payment of 300 beginning after December 26 2020 and ending on or before September 6 2021. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax.

States Will Be Ending Federal Unemployment Benefits This Week

Your local state unemployment agency will send you form 1099-G to file with your tax.

Unemployment benefits by state 2021. But the state did not increase its overall unemployment tax rate for 2021 and plans to limit the future impact on businesses through measures that. If you received unemployment benefits in 2021 you should receive Form 1099-G by the end of January. The maximum unemployment benefit available to individuals was Massachusetts is 1123 a week or about 31 per hour through September 6 2021The maximum weekly benefit for individuals is now 823 a week or about 21 per hour.

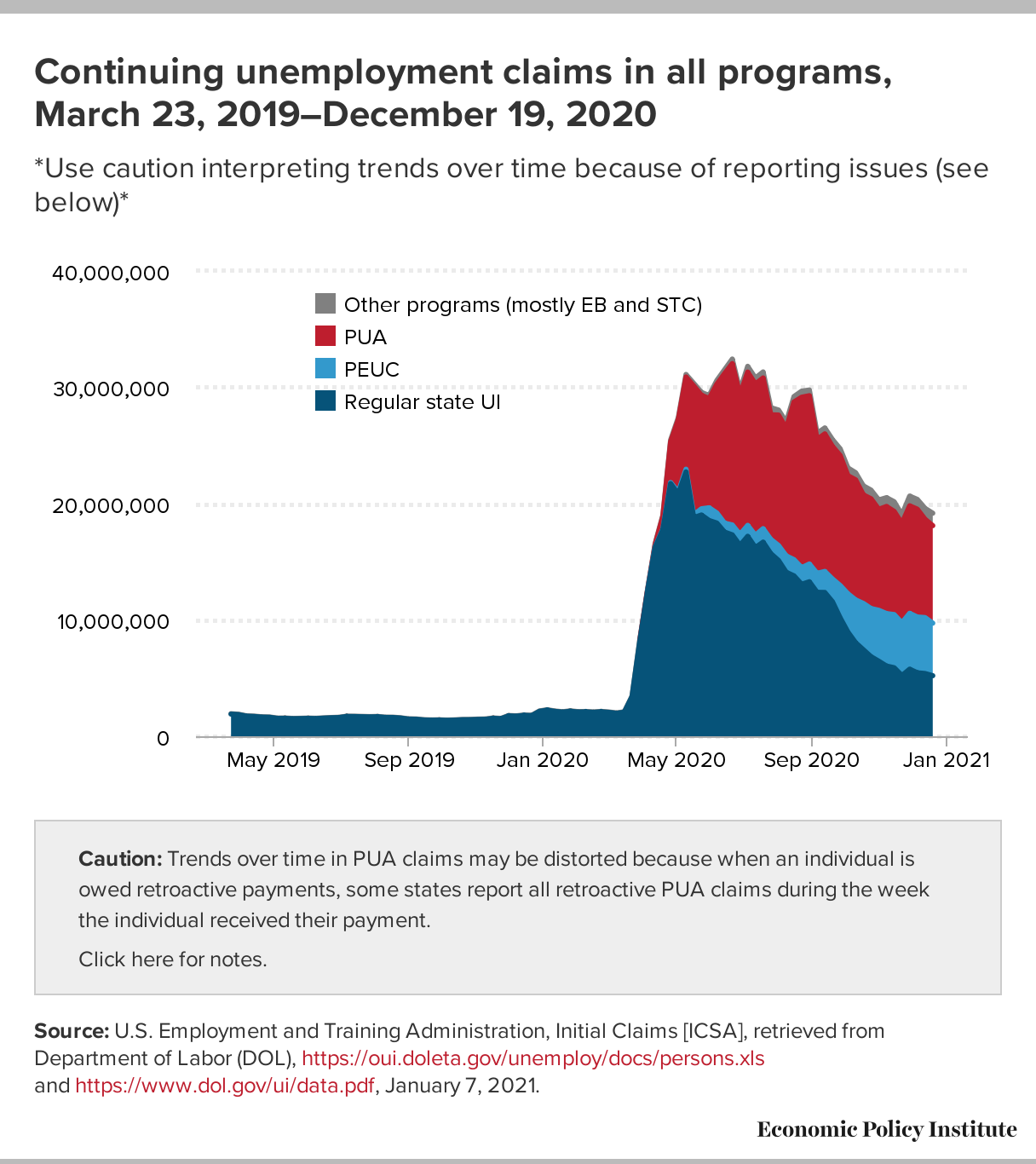

States offer unemployment benefits for up to 26 weeks. This includes the federally funded enhanced extended benefits PUA PEUC and 300 FPUC provided in 2020 and 2021. No a tax break on 2021 unemployment benefits isnt available.

It shows gross unemployment income you earned and how much if any was withheld for taxes. According to the Center on Budget and Policy Priorities the average weekly pre-pandemic unemployment benefit was about 387 ranging from 215 in. Here is a list of every state in the state regards to unemployment benefits.

State State Spending Federal Spending Total Spending. Of 235 per week while Massachusetts has. The maximum unemployment benefit you can get in Virginia is 1090 a week through September 6 2021.

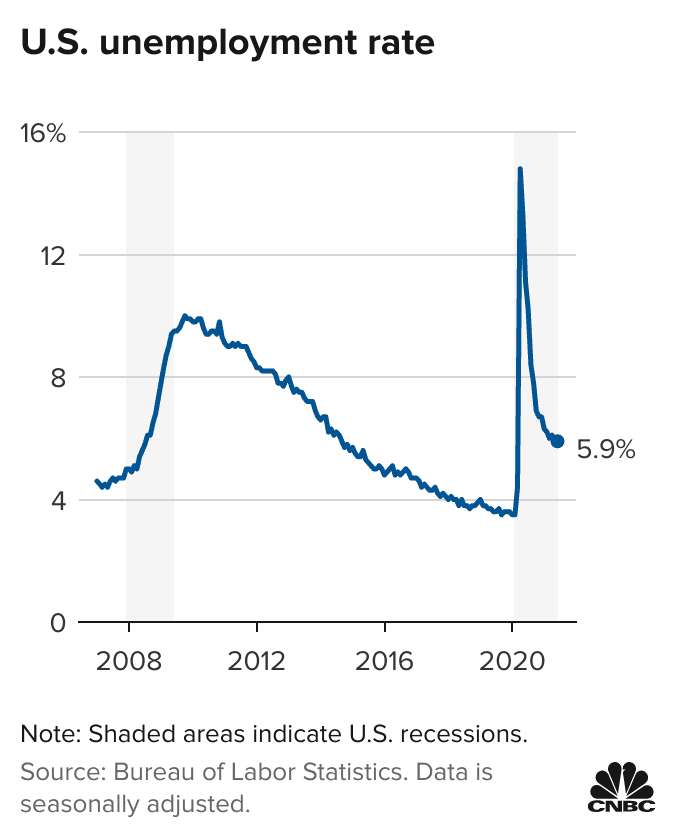

Maintained the highest Blackwhite unemployment ratio at 40 though that ratio has continued to fall as the recovery continues. Unemployment Rate as of April 2021. 52 rows If you collect wages while on UI benefits the state will disregard an amount equal to.

United States unemployment rates and the duration of unemployment assistance benefits vary between states. Policies and benefits vary by state. The average weekly state unemployment benefit is 428 more than.

Ordinarily workers in most states are eligible for 26 weeks of unemployment benefits although some states provide less coverage. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per. Unemployment insurance is taxable income and must be reported on your IRS federal income tax return.

54 rows Unemployment Rates for States Seasonally Adjusted. Mississippi has the lowest maximum unemployment benefits in the US. As you can see from the examples above the unemployment benefits by state vary.

Montana is the only state that provides more with 28 weeks of unemployment benefits. Qualifying Americans will receive 300 per week on top of state unemployment benefits through Sept. Benefits range from 235 a week to 823.

Across the unemployed in Vermont 1345 percent receive state unemployment benefits. After that the maximum weekly benefit is 790. Both North Carolina and Florida offer the shortest unemployment compensation for 12 weeks.

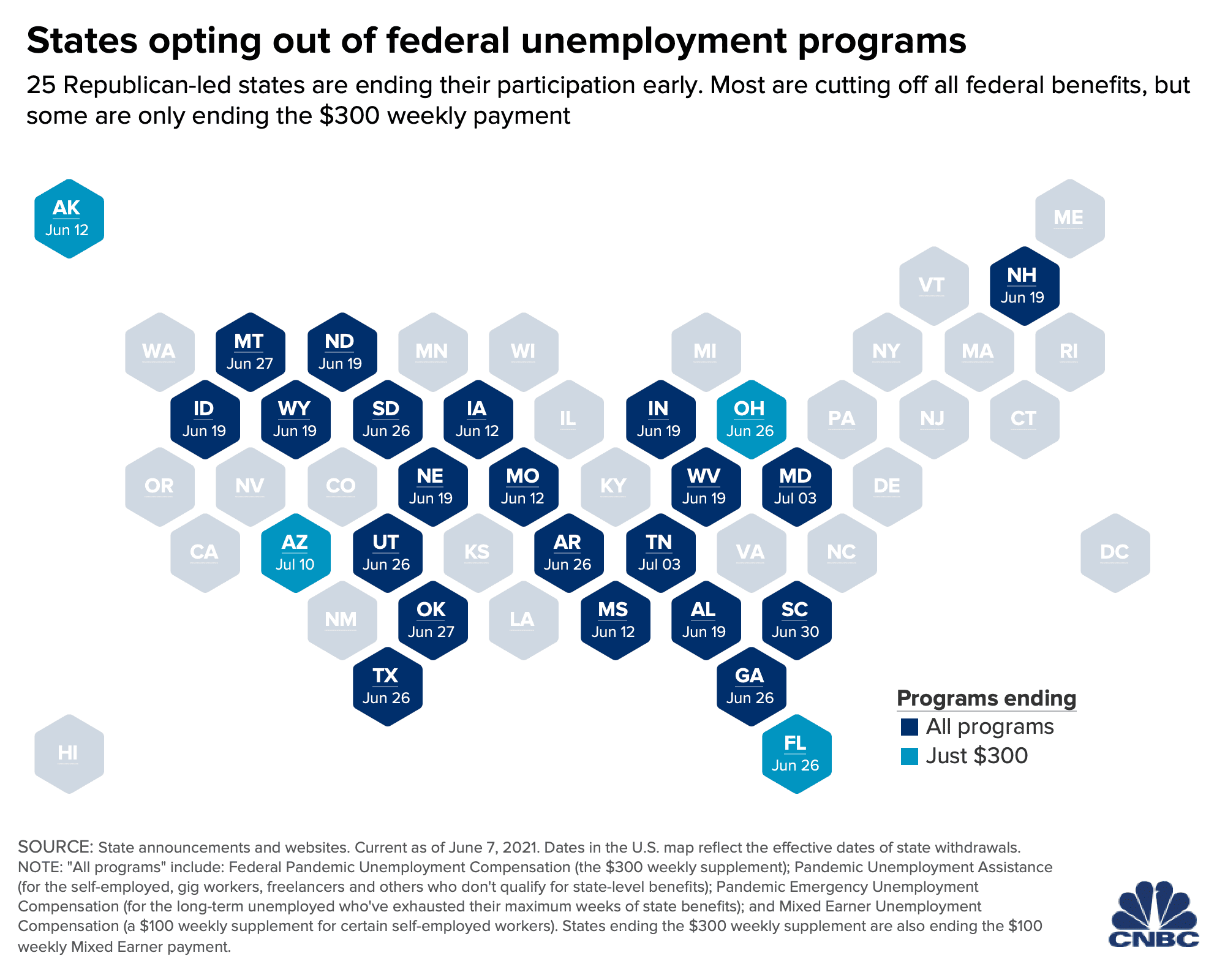

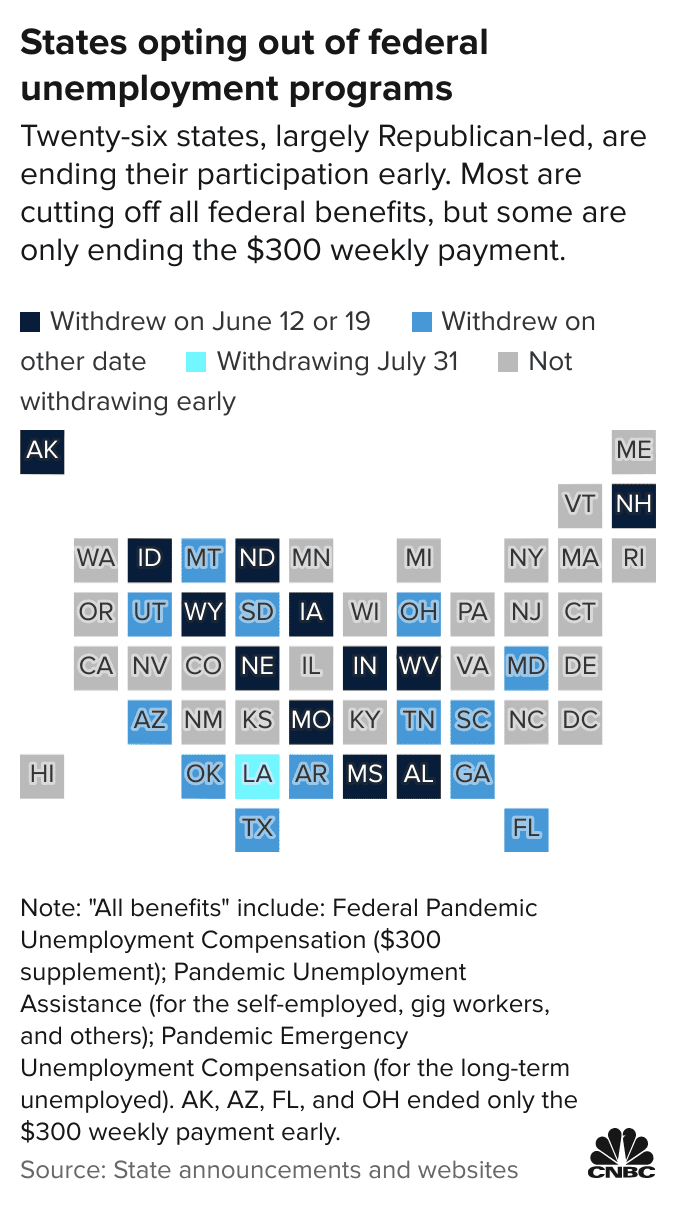

52 rows Extends unemployment benefits after state unemployment benefits. Initial claims for unemployment benefits averaged about 199000 a week in December. Using April 2021 as a base the total number of employed people rose by 116 in the states that cut unemployment benefits by the end of.

Use this calculator to estimate the weekly unemployment benefits you could qualify for. Georgia had the lowest Black unemployment rate among the states with available data in 2021Q3 at 41 while Maryland had the lowest Blackwhite unemployment ratio at 13. __ The maximum unemployment benefit you can get in West Virginia is 724 a week through June 19 2021.

Their findings are detailed in the following table. Across the country employment rates appear to be the highest in the West and Northeastern regions. Governments Have Paid 836 Billion in Unemployment Benefits.

The weekly supplemental payment of 600 on top of any state-provided unemployment benefits expired on July 31 2020. The majority of US. State and Federally Funded Unemployment Benefit Payments by State through Sept.

According to the 247 Wall Street methodology Vermont is the best state benefits and employment wise to be unemployed. How much unemployment benefits can I get in West Virginia. Will I have to pay taxes on my Unemployment Benefits.

Thats a fourfold decrease from levels in January 2021 and lower than pre-pandemic levels in December 2019. Over the first three months of 2021 the states in these regions with the highest unemployment averaged a rate of around 84. Montana has the longest unemployment compensation for 28 weeks more than six months.

Cutoff Of Jobless Benefits Is Found To Get Few Back To Work The New York Times

Unemployment Insurance Data Employment Training Administration Eta U S Department Of Labor

Will There Be Any Federal Unemployment Benefit Extensions In 2022 For Expired Pua Peuc And Extra 300 Fpuc Programs News And Updates On Missing And Retroactive Back Payments Aving To Invest

Cutoff Of Jobless Benefits Is Found To Get Few Back To Work The New York Times

Wow Payment Approved 4 300 Bonus Cash Payments Biden Harris Signed Bonus Stimulus 2021 Youtube In 2021 Bonus Cash Campers For Sale Debit

Ga Dept Of Labor On Twitter Payment Date Work Search Unemployment

First Ui Claims Of 2021 Are Still Higher Than The Worst Of The Great Recession Economic Policy Institute

300 Weekly Fpuc Unemployment Stimulus State Payment Tracker And Pua Peuc Extensions Updates And Latest News Benefit Program Best Tax Software Tax Return

An Early End To Federal Unemployment Pay Is Not Getting People To Work

An Early End To Federal Unemployment Pay Is Not Getting People To Work

Over Half Of States Ending Federal Unemployment Benefits Early Committee For A Responsible Federal Budget

Unemployment Benefits Comparison By State Fileunemployment Org

See If You Are Eligible For Lower Cost Coverage In 2021 Insurance Benefits Health Plan Health Care

Cutoff Of Jobless Benefits Is Found To Get Few Back To Work The New York Times

No comments:

Post a Comment