However the American Rescue Plan Act of 2021 allows an exclusion of unemployment compensation of up to 10200 for individuals for taxable year 2020. Heres what to know about paying taxes on unemployment benefits in tax year 2021 the return youll file in 2022.

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits

Each employers UI tax rate is unique tied to unemployment benefits paid to former employees.

Unemployment benefits taxes 2022. The Democrats American Rescue Plan waived federal taxes on up to 10200 of unemployment benefits per person for 2020. This means that when it comes time to pay taxes in April 2022 if you received unemployment benefits this year youre back on the hook for their taxes. Boosted unemployment benefits.

Unemployment compensation is considered taxable income by the IRS and most states thus you are required to report all unemployment income as reported on Form 1099-G on your income tax returnYou should be mailed a Form 1099-G before January 31 2022 for Tax Year 2021 stating exactly how much in taxable unemployment benefits you received. Be prepared to pay taxes on unemployment benefits in 2022. Unemployment Income Rules for Tax Year 2021 When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

But for 2021 there is. This means that when it comes time to pay taxes in April 2022 if you received unemployment benefits this year youre back on the hook for their taxes. As part of the American Rescue Plan the first 10200 of unemployment benefits received in 2020 was free of federal taxes.

AUTOMATIC child tax credit payments worth up to 2000 are still there for millions of struggling Americans a top Democratic senator says. Will there be a tax break for the unemployed in 2022. It makes sense to withhold tax upfront to avoid surprises.

The Internal Revenue Service have announced that the nations tax season will start on Monday January 24 2022 when the tax agency will begin accepting and processing 2021 tax year returns. Unfortunately another tax break for unemployed people is unlikely to come to fruition in 2022. The US Sun.

In 2021 there was a change to the way unemployment benefits taxes are paid. Direct deposit and tax services available. In 2020 only part of unemployment benefits were taxed.

If you collected any unemployment benefits in 2021 that were meant for 2020 meaning any late accrued payments you will need to include this on your 2021 tax return during the 2022 filing season. Port Hueneme to issue 1000 checks to grocery pharmacy workers. 3 changes to know about before filing your taxes.

If you received unemployment benefits in 2021 you will owe income taxes on that amount. If you collected unemployment benefits last year youll likely pay taxes this. Unemployment compensation is taxable.

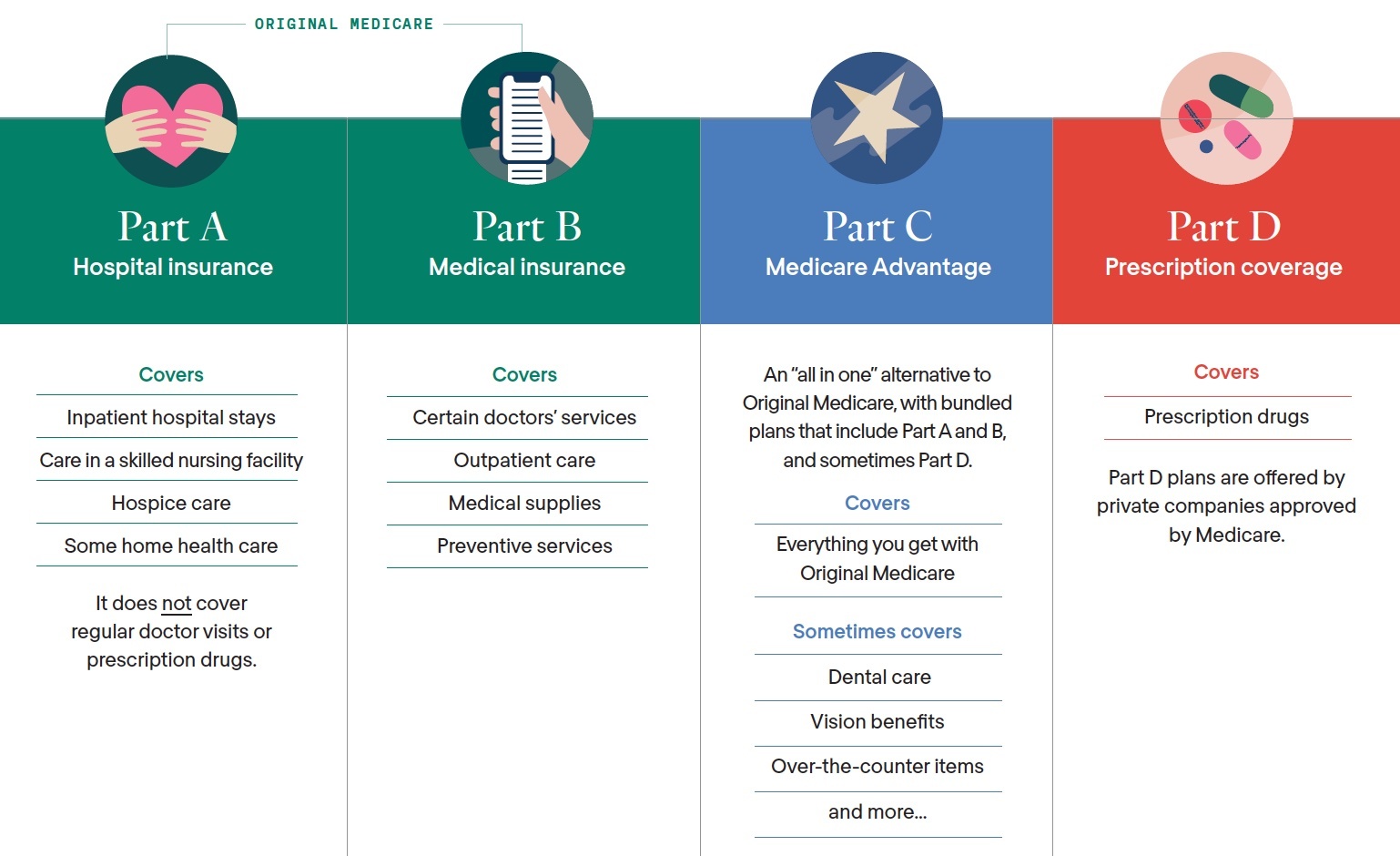

Even though the ARP lifted the 400 FPL income limit for 2021 and 2022 consumers with higher incomes may still not receive a tax credit if the premiums available to them are low enough to be below 85 of their household income. Taxes 2022 Unemployment Benefits The internal revenue service irs has started issuing tax refunds to those who received unemployment benefits in 2020 with around 15. Expanded unemployment benefits ended on Labor Day in 2021 but if you received any unemployment benefits this year you might be in for a shock when you file your taxesUnlike the stimulus checks.

Automatic 2000 child tax credit is still there for millions in 2022 heres the status on a January 300 check. The IRS says it plans to issue another batch of special unemployment benefit exclusion tax refunds before the end of the yearbut some taxpayers will have to wait until 2022. At this time last year.

The American Rescue Act passed a law in March of 2021 that exempted the first 10200 from being taxed in unemployment benefits. Many people needed refunds after that because they had already paid their taxes. Absent SB 8 and the Commissions action most Texas employers would have seen significant increases in their tax obligation for 2022.

While the ARPA allows 10200 of unemployment compensation received in 2020 to be tax-free unemployment benefits received in 2021 remain taxable on the return youll file in 2022 unless some future relief measure is enacted. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Fl Unemployment Benefits Reduced For 2022 Florida News Miamitimesonline Com

Unemployment Compensation Are Unemployment Benefits Taxable Marca

Tax Refunds On 10 200 Of Unemployment Benefits Start In May Irs

How To Claim Unemployment Benefits H R Block

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Unemployment Tax Break 2022 A New Unemployment Income Tax Exclusion Coming Marca

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Stimulus Check Live Updates Unemployment Benefits New California Stimulus Cola 2022 Marca

Will You Owe Taxes On Your Unemployment Checks In 2022 Cnet

No comments:

Post a Comment