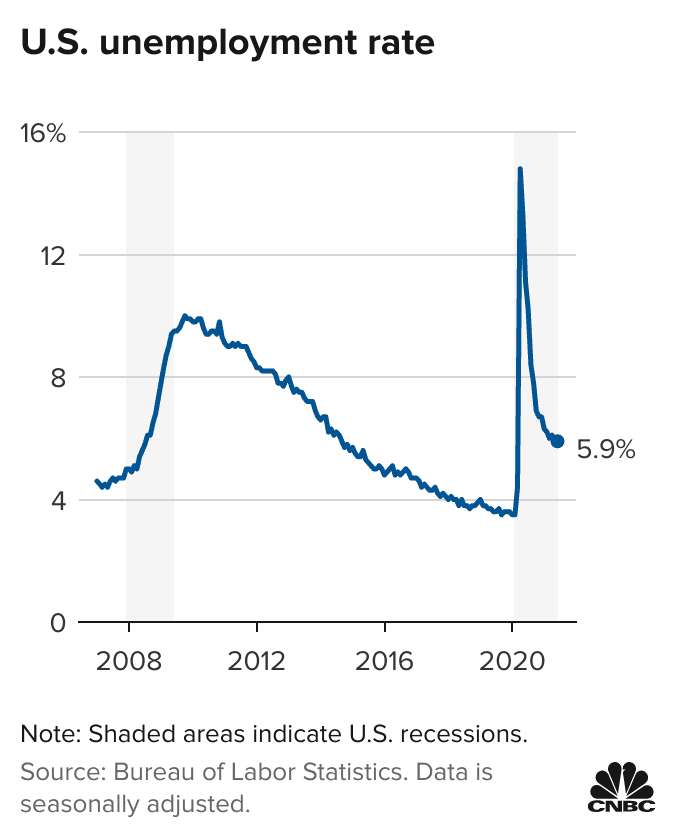

The jobless crisis was far worse in 2020 than its been this year so lawmakers may opt to limit that benefit to 2020 only. Unemployment Tax Break.

A Furniture Manufacturing Company Merges With O Cosmetic Producing Company This Type Of Merger Is Described As A H In 2021 Income Tax Return Tax Services Income Tax

Tax season is fast approaching and recipients of unemployment benefits in 2021 dont appear to be getting a tax break like they did in 2020.

Unemployment 2021 tax break. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax. Even though unemployment figures have surged in 2021 Congress is unlikely to sanction another unemployment income tax break as the cost of this would be tough to cover. The tax exemption for 10200 in unemployment benefits currently only applies to unemployment income you collected in 2020 even though the bill also extended weekly 300 federal unemployment benefits payments through September.

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. They may not get a tax break this year.

People who collected unemployment benefits in 2021 dont appear to be getting a tax break like they did for 2020. On March 11 2021 the American Rescue Plan legislation was. In 2020 the United States saw record numbers of Americans go jobless due to the COVID-19 Pandemic.

Heres what to know. Unemployment Income Rules for Tax Year 2021. Tax season is fast approaching and recipients of unemployment benefits in 2021 dont appear to be getting a tax break like they did in.

The American Rescue Plan waived federal tax on up to 10200 of unemployment benefits people collected in 2020. So you really need to plan ahead. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

If you are married each spouse receiving unemployment. The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. What are the unemployment tax refunds.

The American Rescue Plan Act passed in March of 2021 waived federal taxes on up to. Unemployment benefits were tax-free in 2020. Millions of Americans lost their jobs during the pandemic and the damage was especially devastating in the spring of 2020.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. What was the tax break in 2020.

Irs Sending Out 4 Million More Tax Refunds To Those Who Overpaid On Unemployment. A total of 542000 refunds are involved. Tax season is fast approaching and recipients of unemployment benefits in 2021 dont appear to be getting a tax break like they did for 2020.

No a tax break on 2021 unemployment benefits isnt available. The American Rescue Plan Act passed in March of 2021 waived federal taxes on up to 10200 of benefits per person for 2020 but not for 2021. Friday January 14th 2022 630.

Unemployment benefits generally count as taxable income. The American Rescue Plan Act included a tax exemption on unemployment benefits for up to 10200 an individual received in 2020. You should consider any unemployment benefits you receive in 2021 as fully taxable.

The tax break is for those who earned less than 150000 inadjusted gross incomeand for unemployment insurance received during 2020. The 10200 tax break is. Though unemployment benefits are being taxed for 2021 parts of them were not taxed for 2020.

Income Taxes on Unemployment Benefits for the tax year 2021 as of to date will not have the same tax break than in 2020. Will the 10200 exemption on unemployment benefits apply to 2021 income taxes actually its Congress that decides on the taxability of UC for federal purposes. People who collected unemployment benefits in 2021 dont appear to be getting a tax break like they did for 2020.

Dont expect that in 2021. Millions of Americans received unemployment benefits in 2020. Meanwhile so far theres no indication that unemployment benefits received in 2021 will qualify for a tax break.

Surprise 581 checks paid out to 524000 Americans in time for New Years Eve. There has been no mention of it doing anything for 2021. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000.

Unemployment Tax Break 2022 A New Unemployment Income Tax Exclusion Coming Marca

Pin On Semiotics February 2021

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Don T Count On Another Tax Break On Unemployment Benefits

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Investing For Beginners In 2021 Investing Bitcoin Business Value Investing

Will You Owe Taxes On Your Unemployment Checks In 2022 Cnet

Pin By Aaecn On Desktop Wallpapers Content Marketing Ebook Marketing Marketing

Unemployment Compensation Are Unemployment Benefits Taxable Marca

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Bitcoin Rises Above 50 000 As It Shakes Off Worries Elsewhere In 2021 Bitcoin Shake It Off Economic Indicator

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

No comments:

Post a Comment