All UI claims are in effect for up to one year. In 2012 State regulations set the maximum benefit amount provided to claimants at 12 of the claimants previous wage earnings.

Youth Unemployment Essay Economics Summary Writing Essay Love Essay

Amount and Duration of Unemployment Compensation Benefits.

Pa unemployment maximum. Unemployment Benefits and COVID-19. Your highest quarterly earnings cannot exceed 63 of your total wages. Your weekly benefit amount will be about 50 of your average weekly wages subject to a weekly maximum of 572 or 580 with dependents.

Additionally the amount of emergency relief for weeks of unemployment beginning after March 31 2021 increased from 50 of the compensation paid to 75. Pennsylvania Department of Labor and Industry data confirmed that the commonwealths December 2021 unemployment rate is 17 percentage points below its December 2020 level and three-tenths of a percentage point below its November 2021 level. The maximum weekly benefit for individuals is now 572 a week or about 14 per hour.

The national rate was 39 in. Unemployment insurance is taxable income and must be reported on your IRS federal income tax return. Policies and benefits vary by state.

States offer unemployment benefits for up to 26 weeks. With at least 16 credit weeks. Currently in PA the maximum amount that you can receive in unemployment benefits ranged between 520 and 528.

For example if you earned 1688 to 1712 in your highest-paid quarter you will receive 70 a. How much unemployment benefit can I get in Pennsylvania. Benefits range from 235 a week to 823.

Of 235 per week while Massachusetts has. Benefits are available for up to 26 weeks. A credit week is the one in which claimant earned at least 50.

The Pennsylvania Department of Labor Industry announced today in a press release that Pas unemployment rate fell by three-tenths of a percentage point in Dec. How much unemployment benefit can I get in Rhode Island. The state calculates their unemployment assistance benefit amount to be about 50 percent of their average weekly earnings.

Answer 1 of 3. Pennsylvanias unemployment rate dropped three-tenths of a percentage point to 54 from Novembers rate according to the state Department of Labor and Industry. The applicable period for emergency unemployment relief for governmental entities and nonprofit organizations is extended to weeks of unemployment ending on or before September 6 2021.

The maximum WBR is 572 for highest quarterly earnings of 14538 if you are single. As a result of the COVID-19 pandemic a historic surge of people are seeking unemployment compensation. Amount and Duration of Unemployment Benefits in Pennsylvania.

This is the amount you can receive in a week though in most cases this sum will not be provided. However many factors can affect the final benefit amount and the charts on the website provide only an estimation. Pennsylvanias unemployment rate dropped to 54 percent in December according to the states Department of Labor Industrys preliminary employment situation report.

Nationally the unemployment rate decreased by 28 percentage points over the month to 39. Your local state unemployment agency will send you form 1099-G to file with your tax return see due dates. The Pennsylvania Department of Labor and Industry offers a website that can help you calculate your potential unemployment benefits.

In state of Pennsylvania a worker with no less than 18 credit weeks is qualified for 26 weeks. This relatively large amount of cash will only ever be provided by the local and federal government is special circumstances whereby its practically. Maximum weeks of benefits differ from 26 to 30 weeks most frequently 26 weeks.

Pennsylvanians who have lost work can receive up to 572 per week in benefits for a maximum of 26 weeks. If you have a dependent spouse andor children your maximum WBR is 580. A person who previously earned 900 weekly in salary would typically receive 450 per week in State benefits.

The maximum unemployment benefit available to individuals in Pennsylvania was 872 a week or about 22 per hour through September 6 2021. This is dependent on the amount of money made by a Pennsylvania worker prior to unemployment. Maximum Benefits Allowed MBA 300.

The majority of US. Weve made progress in meeting this unprecedented demand for unemployment benefits in Pennsylvania but. The duration is normally measured as a number of weeks of total unemployment.

During the same. This form is sent in late. 56 rows Highest Quarterly Wage.

Mississippi has the lowest maximum unemployment benefits in the US. This includes the federally funded enhanced extended benefits PUA PEUC and 300 FPUC provided in 2020 and 2021. The Pennsylvania Department of Labor Industry LI released a report Friday saying that Pennsylvanias unemployment rate fell three-tenths of a percentage point to 54 percent in December.

The maximum timeframe in which unemployment benefits can be paid in Pennsylvania is 72 weeks -- approximately one year and five months. How to File a Claim for Unemployment Benefits in Pennsylvania.

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

Unemployment Benefits Comparison By State Fileunemployment Org

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

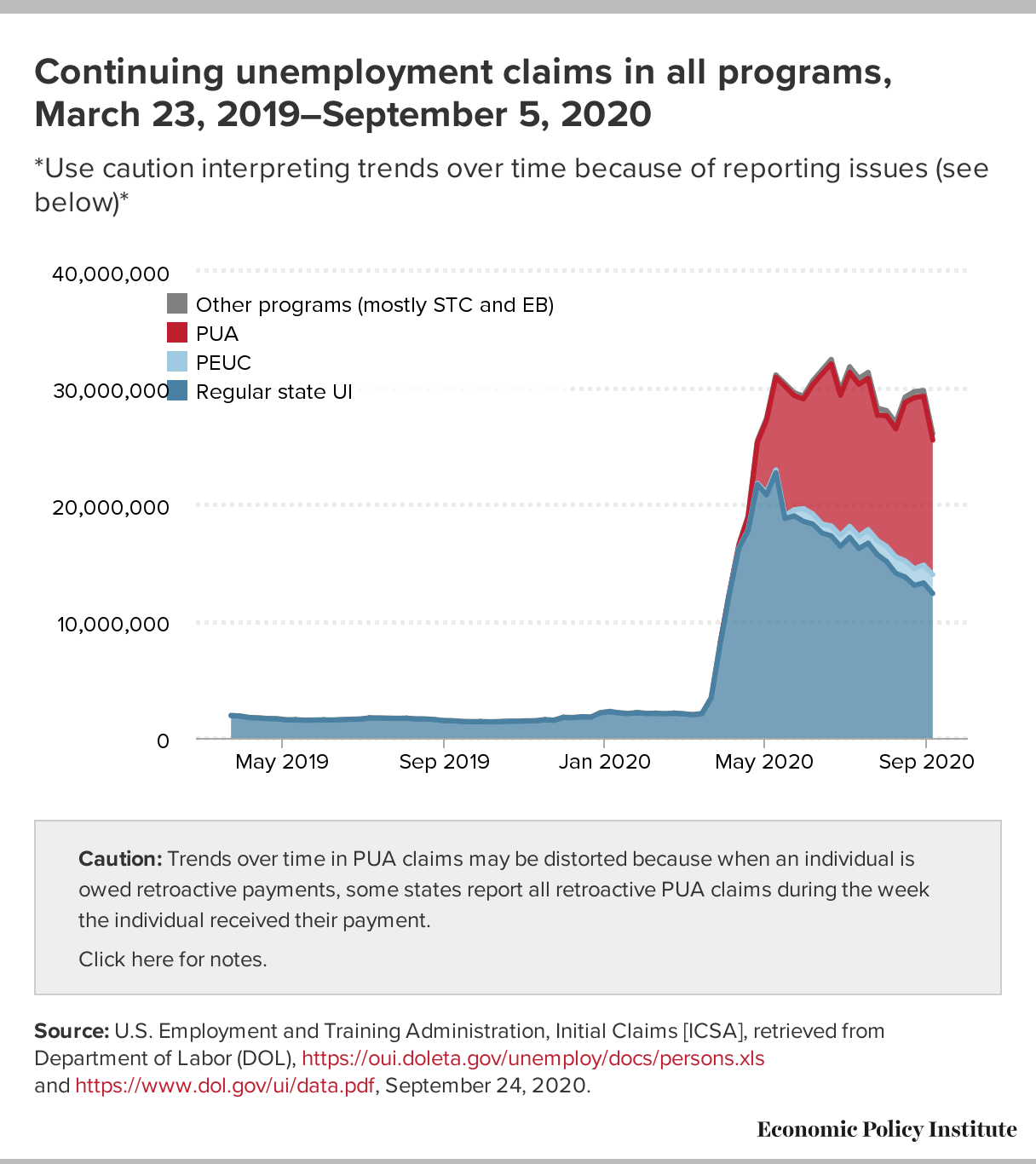

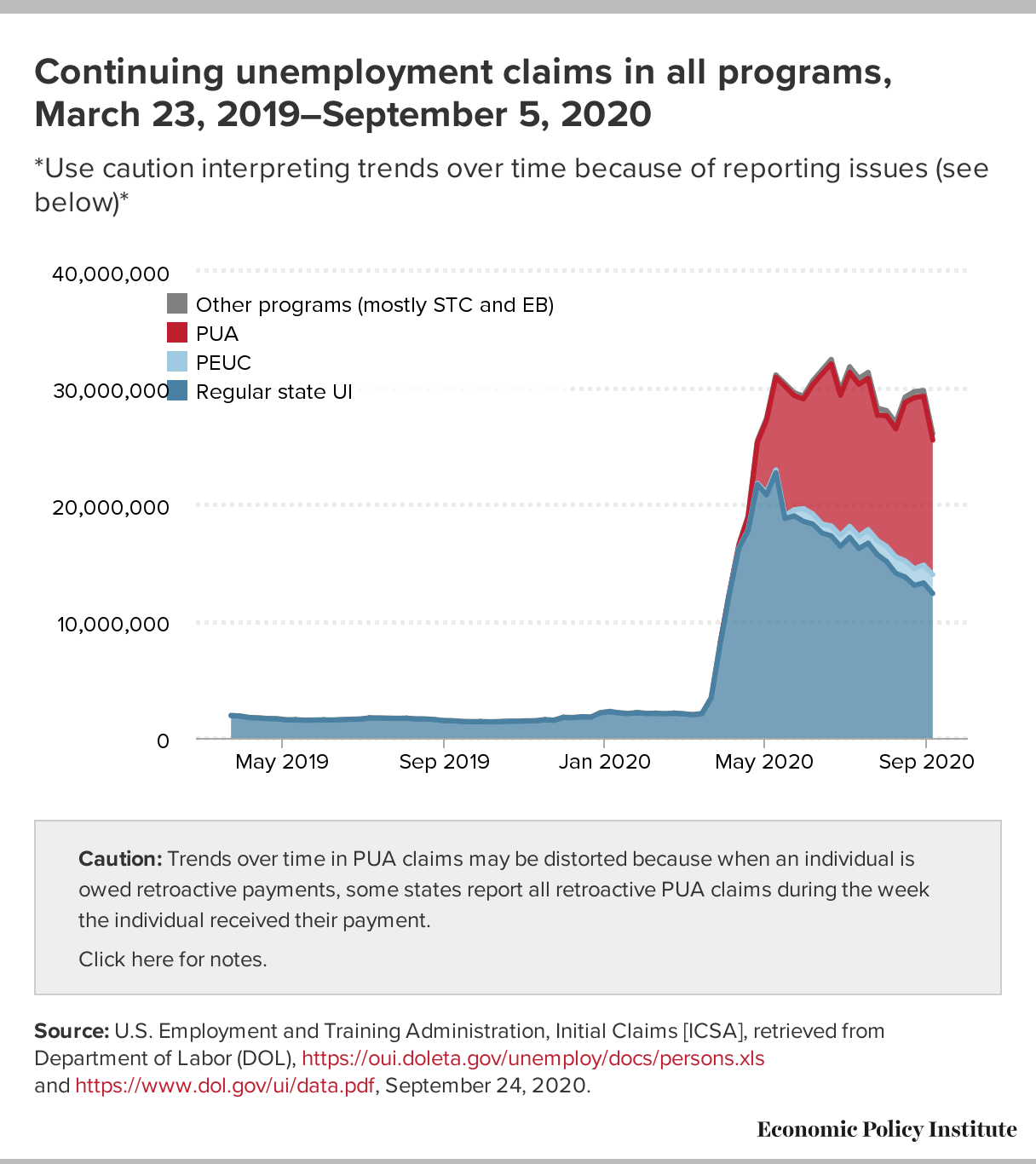

Many Workers Have Exhausted Their State S Regular Unemployment Benefits The Cares Act Provided Important Ui Benefits And Congress Must Act To Extend Them Economic Policy Institute

38 Million Have Applied For Unemployment But How Many Have Received Benefits Rand

.png)

Reminder Help Available As Federal Pandemic Unemployment Benefit Programs End Saturday

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

Pennsylvania Unemployment Rate 2020 Statista

Industrial Robot Max Industrial Robots Robot Robot Design

No comments:

Post a Comment