31 with an expected delivery date in early February. Your 1099-G form will be available in January 2022.

I havent gotten a message yet for our 2021 1099g.

Pa unemployment 1099g 2021. Meaning if you were paid in 2021 for weeks of unemployment benefits from 2020 those will appear on your 1099-G for 2021. The officer or employee of the government unit having control of the payments received or made or the designated officer or employee must file Form 1099-G. The form will show the amount of unemployment compensation they received during 2020 in Box 1 and any federal income tax withheld in Box 4.

Form 1099-G is a federal form that the Internal Revenue Service requires be provided to taxpayers to remind them of the Pennsylvania income tax refunds or credits they received the previous year. The 1099-G will affect the filing of your federal income tax return if you itemized deductions the prior year and claimed state income tax paid as a deduction. If you receive Form 1099-G from the Rhode Island Department of Labor and Training for unemployment benefits you did not file for or receive please report it.

PA does not tax unemployment benefits so no state information is on a PA 1099G. You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for unemployment income you received in 2021. File with Form 1096.

T he Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be mailed by January 31 st of each year for Pennsylvanians who received unemployment benefits. Pennsylvania 1099G question Do I need the form to file my 2020 taxes if I was paid in 2021 Pennsylvania Question Im about to file my taxes and realized I never received a. So last year I remember getting a message on the PUA dashboard for our 1099 for our 2020 taxes.

Department of the Treasury - Internal Revenue Service. Federal Pandemic Unemployment Compensation FPUC provides 300week until September 4 2021 applying to weeks ending January 2 2021 for eligible individuals. The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment benefits in calendar year 2021.

By January 31 2021 the Division will send the 1099-G for Calendar Year 2020. If you collect or repay unemployment insurance benefits during 2021 you will receive an IRS Form 1099-G which shows the total taxable unemployment benefit amount issued to you by the state of Idaho for a calendar year. Form 1099-G is a type of 1099 form thats used to report certain government payments most commonly unemployment benefits and state or local tax refunds.

For Privacy Act and Paperwork Reduction Act Notice see the. You only need to identify the sender address EIN amount of benefits box 1 and federal income tax withheld box 4. This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2021 as well as any adjustments or tax withholding made to your.

March 08 2021 0100 PM. Enter the 1099G by going to FederalWages Income1099Misc and Other Common IncomeOther 1099G income. It is a tax form that provides information on benefits paid in 2020.

The full amount of your benefits should appear in box 1 of the form. You must be trying to fill in information in forms mode and are overthinking the situation. The IRS will receive a copy of your Form 1099-G as well so it will know how much you received.

Similarly if you were paid for 2021 weeks in 2022 those will not be on your 1099-G for 2021 they will appear on your 1099-G for 2022. This tax form provides the total amount of money you were paid in benefits from the Office of Unemployment Compensation in 2021 as well as any adjustments or tax withholding. The Pennsylvania Department of Revenue has posted information about 1099 Forms for Unemployment Compensation including UC-1099G forms.

If you chose mail as your preferred contact method your 1099-G will be postmarked by Jan. A 1099G can be for unemployment a state or local tax refund or for a government payment of some sort of grant. For Internal Revenue Service Center.

If you have moved since filing for UI benefits your 1099-G may NOT be forwarded by the United States Postal Service. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account. 31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security.

A 1099G is not issued for a stimulus payment. Taxpayers who receive unemployment compensation are encouraged to watch their mailboxes during the tax season for the 1099G tax form that is required to file your federal tax returns. 1099-Gs are only issued to the individual to whom benefits were paid.

If you received unemployment benefits in 2021 DES will issue you an IRS Form 1099-G for tax purposes. 2021 General Instructions for Certain Information Returns. 1099-Gs are not available until mid-January 2021.

ILogin is required to view your 1099-G form online. If you received any unemployment benefits in 2021 your will need the 1099-G tax form to complete your federal and state tax returns. If you have general questions about a PUA-1099G Form As a first step we recommend you review the Pennsylvania Department of Labor and Industrys PUA-1099G Frequently Asked Questions.

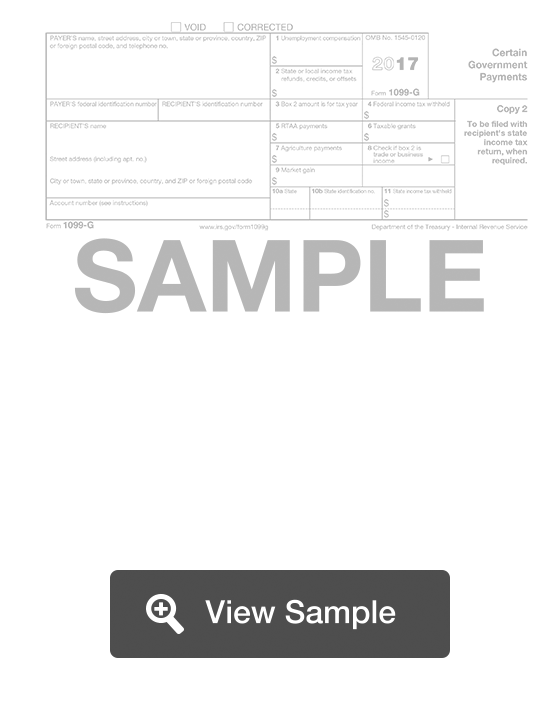

Mixed Earners Unemployment Compensation MEUC provides 100 in extra benefits to individuals with at least 5000 in net income from self-employment during the applicable tax year. If you get a Form 1099-G you need to use it when you prepare your tax return. This is what a 1099-G looks like.

In January 2021 unemployment benefit recipients should receive a Form 1099-G Certain Government Payments from the state UI agency or department paying your unemployment benefits. Although unemployment compensation is not taxable for Pennsylvania personal income tax purposes. You must also file Form 1099-G for each person from whom you have withheld any federal income tax report in box 4 under the backup withholding rules regardless of the amount of the payment.

All claimants will be able to access their 1099-G through their DES online account by Jan. Most people who receive this type of income will receive this form in the mail.

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Double Check For Missing Or Incorrect Forms W 2 1099 Before Filing Taxes Mychesco

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Pua Unemployment Claim In Pa Update Pua 1099g Form Youtube

1099 G Tax Form Why It S Important

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

No comments:

Post a Comment