Unemployment The State of New York. Mail your request to Unemployment Insurance Division NYS Department of Labor PO.

New York Unemployment Benefits Eligibility Claims

Your Rights.

Nys unemployment nj. If you are living andor willing to look for work in the state of New York you may also file your claim by calling the Telephone Claims Center at 1-888-209-8124 during regular business hours. If You Already Filed a Claim. For most year-round jobs part-time status is defined as less than 35 hours per.

Are unemployement benifits i am a electrican employed in ny taxable in nys. NEW YORK WWTI Although many states are experiencing a drop in unemployment rates New York is having a harder time bouncing back from the effect the pandemic has had on employment. The newest round of refunds has.

You must continue to certify every week you are. New Jerseys unemployment rate is 73 and it received 62 billion in federal funding from the American Rescue Plan. Full pay would be available to these employees if this bill is passed as written.

Pregnancy and Health Issues While Unemployed. Once you have filed a claim for benefits you must also claim weekly benefits for each week you are unemployed and meet the eligibility requirements. Seasonal employment in New Jersey is defined as work that is performed or 36 weeks or fewer per calendar year and is based on seasonal need or local draw.

Report the same amount on your. Unfortunately like the situation in New York the New Jersey. The refunds are for people who collected unemployment last year and filed their 2020 returns before mid-March.

I am a resident of nj and file a nys203 nys non resident return. Disaster Unemployment Assistance. In addition to their weekly benefits claimants received a weekly Federal Pandemic Unemployment Compensation FPUC benefit.

Beginning October 20 2021 through November 18 2021 DUA is available to New Yorkers in the following New York Counties Bronx Dutchess Kings Nassau Queens Richmond Rockland Suffolk and Westchester who 1 lost employment as a direct result of Hurricane Ida and 2 live or work in an impacted county. So even if you live in New York if you work in New Jersey you should apply in New Jersey. Unemployment compensation is not subject to New Jersey gross income tax and should not be included on the New Jersey gross income tax return.

That means that unemployment eligibility requirements are identical for out-of-state claimants and for New York residents. In general you should apply for unemployment in the same state in which you work. Can I collect unemployment in NY and NJ.

But without an extension all three key federal programs will end. Nys withholding are withheld on my 1099. June 6 2019 117 PM.

This is also called certifying for benefits You can start certifying as soon as you receive a notification from the DOL. New York State offers unemployment insurance benefits to qualified workers who have worked in the state during the prior 18 months and who meet certain criteria. According to the personal-finance website WalletHub the US.

The total amount of unemployment benefits you received is taxable to New York State under New York State tax law. My Unemployment Insurance Claim Status Please enter your Social Security Number Date of Birth Email First Name and Last Name to gain access to the system to. Report it anonymously by contacting the New York State Department of Labor Liability and Determination Fraud Unit by any of these methods.

About 250000 New Jerseyans are currently receiving Pandemic Unemployment Assistance PUA according to the Department of Labor. View the Current Schedule for Claiming Weekly Benefits. Seasonal employees may face different rules for overtime and unemployment than regular year-round workers.

January 2017 Unemployment in New York is handled by the New York State Department of LaborFiling for unemployment is fairly simple and the DOL recommends filing online for the quickest response. If they do it does not matter whether they reside in New York. Otherwise you should contact the Out of State Residents Office.

However Unemployment compensation is taxed by New York State. 600 per week for benefit weeks ending 452020 to 7262020 and 300 per week for benefit weeks ending 132021 to 952021. Bonding and Caregiving While Unemployed.

While you may be eligible to exclude a portion of your unemployment benefits on your federal tax return there is no exclusion in New York State. Likewise temporary disability including family leave. That means someone living out of state can claim UI benefits in New York.

No - If you are a resident of NY but receive NJ unemployment income this unemployment is not taxable in NJ. Visit New York State Department of Labors website at wwwdolnygov Call 1-866-435-1499 24 hours a day or 518-485-2144 between 800 AM and 400 PM Fax information to 518-457-0024. Be sure to write your Social Security number on your request.

Box 1195 Albany NY 12201. Unemployment rate currently sits at 54 a vast improvement from the nearly historic high of.

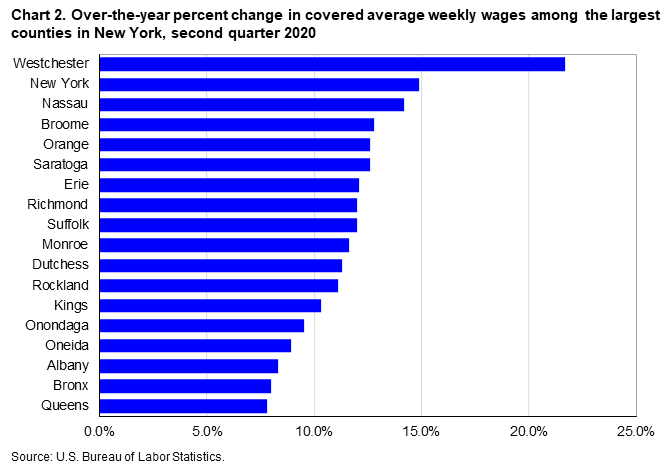

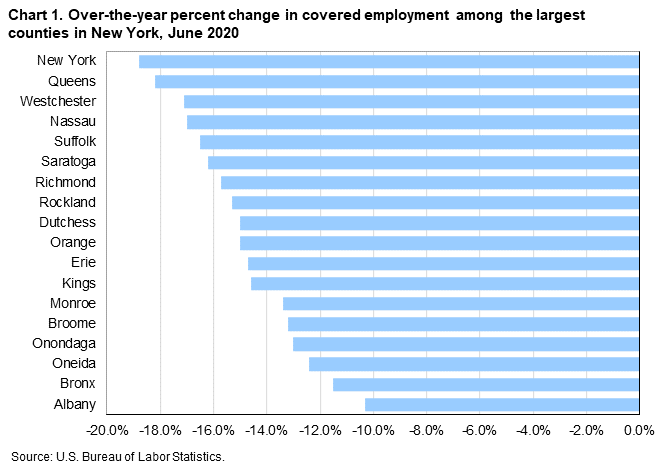

County Employment And Wages In New York Second Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

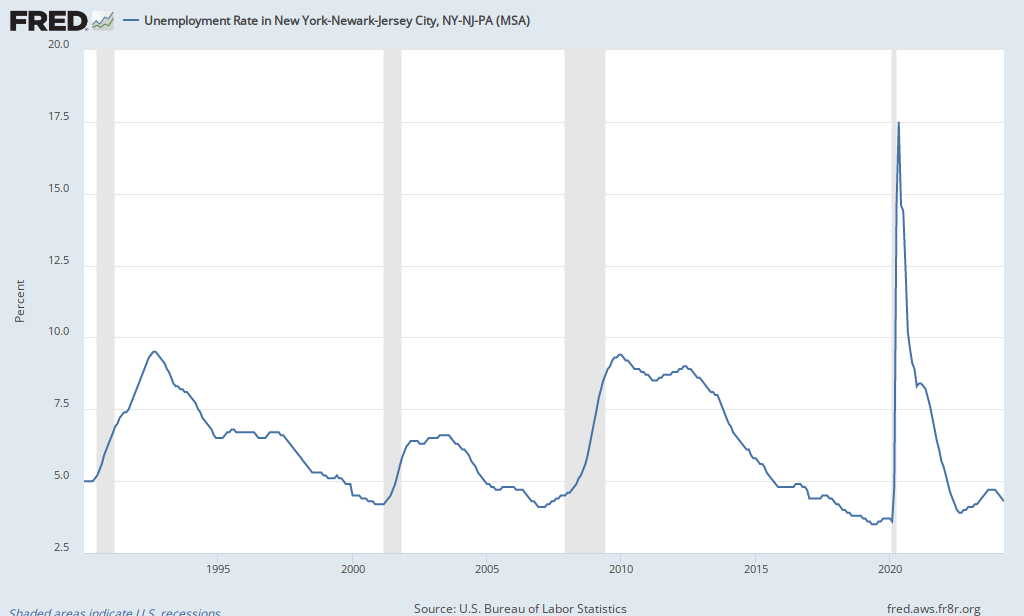

Unemployment Rate In New York Newark Jersey City Ny Nj Pa Msa Newy636urn Fred St Louis Fed

County Employment And Wages In New Jersey Fourth Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Unemployment Benefits Comparison By State Fileunemployment Org

![]()

New York Unemployment Tips Hotel Trades Council En

New Jersey Unemployment Tips Hotel Trades Council En

New Jersey Ends Covid Unemployment Benefits The New York Times

County Employment And Wages In New York Second Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

Nys Department Of Labor Nyslabor Twitter

New Jersey New York New Jersey Information Office U S Bureau Of Labor Statistics

Nj Unemployment 75 000 Residents To Start Receiving Thousands In Owed Benefits This Weekend Abc7 New York

Unemployment Rate In New York Newark Jersey City Ny Nj Pa Msa Newy636urn Fred St Louis Fed

No comments:

Post a Comment