Lose your job through no. If a disability has caused you to be unable to work or unable to work in the capacity you were once able to you may be eligible for New York disability benefits.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22253262/unnamed.jpg)

Change For Part Time Workers Receiving Unemployment Benefits The City

My wife is a sole proprietor a clinical social worker psychotherapist in the community.

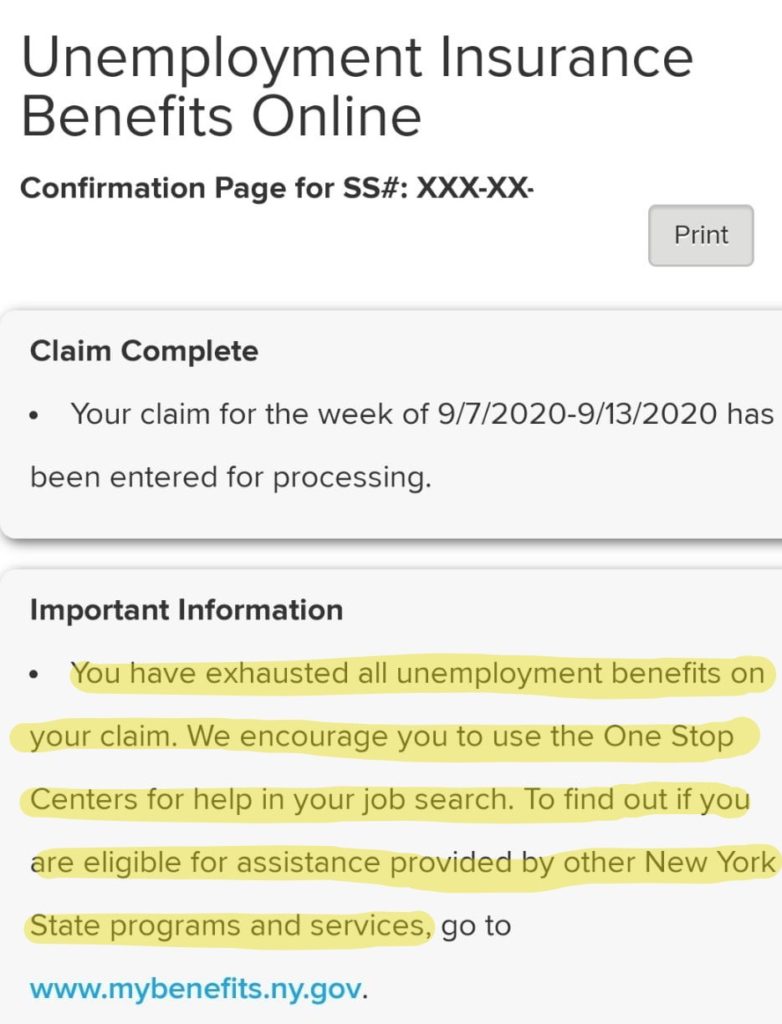

Nys unemployment eligibility. Actively seeking work each week you are collecting benefits. In order to start your unemployment NY unemployment requirements include the following. OVERVIEW OF UNEMPLOYMENT INSURANCE IN NYS DURING COVID-19 ELIGIBILITY REQUIREMENTS OVERVIEW.

First you must have earned a minimum amount during the base period. Typically you can claim the income if. You are totally unemployed.

By law the unemployment insurance program provides benefits to people who. In New York two types of base periods exist. You must be available to work.

Who qualifies to collect unemployment insurance. Your past earnings must meet certain minimum thresholds. You earned enough money in the last year and a half.

You may contact these offices to get answers to questions about unemployment eligibility filing an New York unemployment claim for eligibility and checking on the status of a previously completed unemployment claim. In New York State employers pay for benefits not workers. Once you have filed a claim for benefits you must also claim weekly benefits for each week you are unemployed and meet the eligibility requirements.

Who qualifies for unemployment benefits in New York. If youre unemployed in New York assistance is available. To qualify for Unemployment Insurance benefits you must have worked and earned enough wages in covered employment.

Instead benefits will be reduced in. You can find specific information regarding income qualifications on the New York state website. You may be eligible for Unemployment Insurance UI if you.

You must make a reasonable effort to find suitable full-time work. In New York State employers pay contributions that fund Unemployment Insurance. To be eligible to receive unemployment benefits in New York you must meet the following requirements.

Your unemployment is not due to any fault of your own. You must continue to certify every week you are. Possible calendar quarters are January through March April through June July through September and October through December.

Eligibility Requirements for New York Unemployment Benefits In New York there are two basic eligibility requirements for receiving unemployment benefits. Find out about New York unemployment benefits eligibility requirements a list of local unemployment offices throughout the state how to apply for unemployment online or in person and information about other financial assistance programs for those who have become unemployed. Otherwise you should contact the Out of State Residents Office.

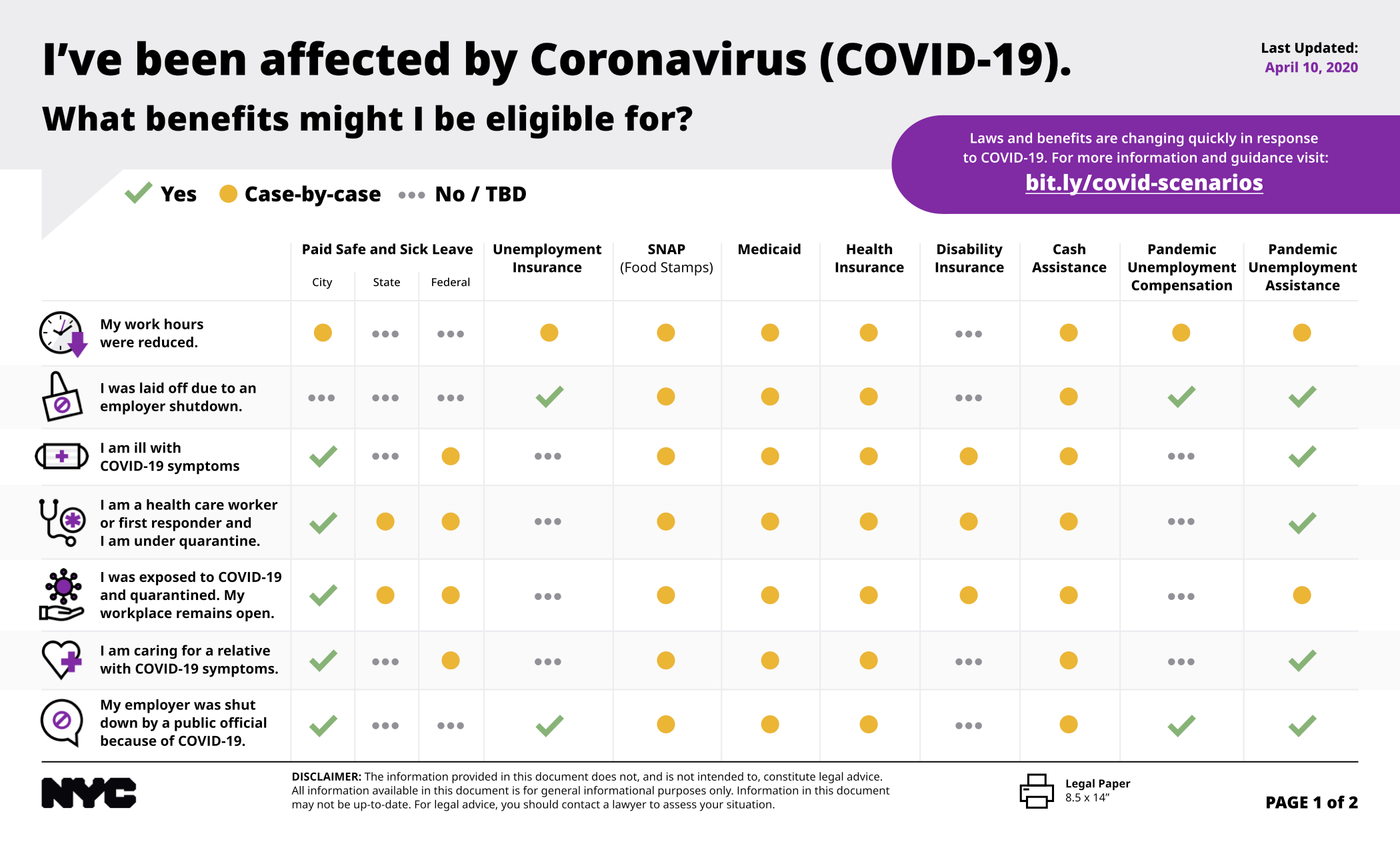

OVERVIEW OF UNEMPLOYMENT INSURANCE IN NYS DURING COVID-19 ELIGIBILITY REQUIREMENTS OVERVIEW. Pandemic Unemployment Assistance PUA. Those who qualify can receive a weekly benefit payment for a maximum of 26 full weeks during a one-year period.

Who is eligible for NYS unemployment. In New York State employers pay contributions that fund Unemployment Insurance. To be eligible for this benefit program you must a resident of New York and meet all of the following.

Depending on your vocation and industry you may qualify for unemployment if you have had your hours reduced. File a claim online to receive temporary income while you search for a job. You have worked and earned a minimum amount of wages in work covered by unemployment tax during the past 18 months.

My question pertains to eligibility for NYS Unemployment Insurance and Pandemic Unemployment Insurance Eligibility Question. Temporary income for eligible workers who lose their jobs through no fault of their own 2. Regular Unemployment Insurance UI.

For individuals who are not otherwise eligible for UI benefits. You must meet a number of requirements to be approved for unemployment benefits in New York. To substantiate your claim you should keep a record of your work search dates contacts and other pertinent efforts to validate your claim.

New York Disability Application. Get Unemployment Assistance. Under the new rules you can work up to 7 days per week without losing full unemployment benefits for that week if you work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment.

Worked in New York during the past 12 months this period may be longer in some cases and. The first four of the five completed calendar quarters before you filed for benefits. This is also called certifying for benefits You can start certifying as soon as you receive a notification from the DOL.

Are actively seeking work and keep a. To qualify for Unemployment Insurance benefits you must have worked and earned enough wages in covered employment. You must file an Unemployment Insurance claim to find out if you are eligible and learn your actual benefit.

The three eligibility requirements to collect unemployment benefits in New York are. Regular Unemployment Insurance UI. Have enough employment to establish a claim.

In normal times according to the Department of Labor youre eligible for UI benefits if you. Eligibility Requirements for New York Unemployment Benefits. We have compiled the address phone number and fax number of every NYS unemployment office.

To determine eligibility use the information presented in the Determining Disability Eligibility section. New York s standard base period is defined as four calendar quarters. Unemployment Insurance is temporary income for eligible workers who become unemployed through no fault of their own.

Many people may be eligible and we are told you have to apply and be denied regular UI first before you can apply for Pandemic Unemployment. What You Need to Know. No deductions are taken from workers paychecks.

Lost your job through no fault of your own for example you got laid off worked within the last 18 months and are you ready willing and able to work immediately. New York qualifications for unemployment coverage are based on the amount of income a former employee has earned during the base period which represents one year of work and wages prior to filing an unemployment claim. You must be unemployed through no fault of your own as defined by New York law.

Under New York law an employee is eligible for unemployment coverage only if they earn a certain minimum amount of money during a standard base period. With this change your benefits will not be reduced for each day you engage in part-time work. If you are living andor willing to look for work in the state of New York you may also file your claim by calling the Telephone Claims Center at 1-888-209-8124 during regular business hours.

Earned a minimum amount of wages determined by New York guidelines and. She gets a 1099 each year.

May 5 2020 Urgent Solution To Unemployment Benefits Delay Are You Still Waiting To Be Called By Dol Follow This Walkthrough Ny State Senate

New York Unemployment Benefits Eligibility Claims

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

May 5 2020 Urgent Solution To Unemployment Benefits Delay Are You Still Waiting To Be Called By Dol Follow This Walkthrough Ny State Senate

New York Resident Gets Letter Offering Her Unemployment Benefits In Kentucky Wstm

New Yorkers Seeking Unemployment Benefits Still Desperate To Reach Help Here Are Tips Syracuse Com

Nys Department Of Labor Nyslabor Twitter

May 5 2020 Urgent Solution To Unemployment Benefits Delay Are You Still Waiting To Be Called By Dol Follow This Walkthrough Ny State Senate

How Does Unemployment Work In New York Employment Lawyers

Can I Collect Nys Unemployment Benefits Workers Compensation Syracuse Ny Workers Compensation Lawyers Mcv Law

Certify For Weekly Unemployment Insurance Benefits Department Of Labor

No comments:

Post a Comment