New York recognizes an alternate base period for those who cant meet the earnings requirements below in the regular base period. Most eligibility requirements for unemployment in New York are met in the base period.

The Ultimate Guide For Unemployment Benefits In Ny Freedomcare

The alternatebase period is the last four completedcalendar quarters prior to the calendar quarter in which the claim is effective.

Nys unemployment alternate base period. Period we use your Alternate Base Period to calculate your benefit payment. This alternate period is almost always the four most recent calendar quarters before filing your claim. Complete the steps below using black or blue ink.

The more money that you made in your base period the larger the amount that you will recieve every week for unemployment. Even filers who qualify using the regular base period can ask. This is only available to applicants that receive workers compensation and.

My question involves unemployment benefits for the state of. Forms can be downloaded here and must be sent to the New York Department of Labor PO. If you qualify under the Basic base period but you think using the Alternate base period would result in a higher benefit rate you may apply within 10 days from the date of the initial monetary notice to have your rate recalculated using the Alternate base period.

Basic base period is the first four of the last five completedcalendar quarters prior to the calendar quarter in which the claim is effective. Request the alternate base period within 10 days of the date of the monetary benefits determination sent to you by the DOL. The Alternate Base Period is the last four completed calendar quarters before the quarter in which you file for benefits.

Extended Base Period A longer timeframe for considering income for unemployment. If you have enough wages in your Basic Base Period we do not automatically check to see if. For those who are unable to meet the earnings requirements below in the regular base period New York recognizes an alternate base period.

In order to receive unemployment benefits in New York you must have been employed for paid work for at least 2 calendar quarters during your Base Period a Base Period is one year or 4 calendar quarters. The Department of Labor must receive your completed form within 10 days from the Date Mailed on the Monetary Determination. The form can be returned by fax to 518-457-9378 or by.

They must have worked and been paid wages for work in at least two calendar quarters in the base. If you have earned enough wages in your Basic Base Period. You have only 10 days from the date of your Monetary Determination to file a Request for Alternate Base Period form.

There is a deadline for us to consider you for the Alternate Base Period. Once wages are used they cannot be included in a future claim. The alternate base period encompasses the last four completed calendar quarters before claimants file for unemployment.

Requirements during one of your base periods basic first 4 of the previous 5 quarter years or alternate last 4 of the previous 5 quarter years. Additional information such as most recent quarterly earnings proof of wages earned in the form of pay stubs and verification of earned wages may be asked for in case of the Alternate Base Period. Now if I want to use my alternate base period the most recent quarter instead of the high quarter do I still have to meet the threshold of the other quarters being 15X that of.

The alternate base period is the last four completed quarters before the person files for unemployment. Fill out the Request for Alternate Base Period form. If high quarter is 4000 benefit rate is 126 of the average of the two highest quarters.

If you qualify using the Alternate base period that base period will be used to establish your claim. For example if you file a claim in December the alternate base period is January through December of the previous year. You must have worked and been paid wages in jobs covered by Unemployment Insurance in at least two calendar quarters You must have been paid at least 2600 in one calendar quarter.

This alternate period considers more recent employment. I understand that if you file in the 1st quarter of 2014 your Base Period begins the last quarter of 2012 and ends the third quarter of 2013. Include any documentation that could be considered proof of employment and wages such as pay.

1999 Fourth Quarter October December 1999 Completed Lag Quarter January March 2000 Filing Quarter April June 2000 Worked Began October 13 1999 Filed June 23 2000. While you can determine ahead of time how much New York unemployment compensation you receive you will be formally notified before your benefits begin. New Yorks Basic Base Period is the first four of the last five completed calendar quarters prior to the beginning date of the UI claim.

Your base period is the period of time that you worked prior to losing your job in which you establish the amount of money that you will receive in unemployment. NY Hello I understand that to qualify for unemployment your base quarter earnings must be 15X that of your high quarter earnings. Alternate Base Period The four financial quarters directly before you submit forms to apply for unemployment in NY.

I Rules for using alternate quarter NYS unemployment - benefits rate legislation insurance jobless extension jobs employers employees hiring resumes occupations government laws unions. The Alternative Base Period for unemployment benefits is the last four completed calendar quarters preceding the starting date of the claim. By choosing the alternate base period which includes the most recently completed quarter you may bring your benefit rate up.

For purposes of this section the remuneration in the high calendar quarter of the base period used in determining a valid original claim shall not exceed an amount equal to twenty-two times the maximum benefit rate as set forth in subdivision five of section five hundred ninety of this article for all individuals. My hours were reduced am I eligible for regular UI. The alternate base period is the persons last four completed quarters before filing for unemployment.

This alternate period takes more recent employment into account. Traditional Base Period Alternative Base Period First Quarter January - March 1999 Second Quarter April June 1999 Third Quarter July Sept. Earnings in only 2 or 3 base period or alternative base period quarters the benefit rate will be calculated as follows.

If you wish to use the Alternate Base Period to increase your eekly w benefit rate. Claimants who qualify under the basic base period may request that their benefits be calculated using the alternate base period if they believe it would result in a higher compensation rate. New York Unemployment Base Period.

This form is also available in the Unemployment Insurance Claimant Handbook.

Esdwagov Calculate Your Benefit

Base Period For Filing Unemployment Benefits Fileunemployment Org

Base Period For Filing Unemployment Benefits Fileunemployment Org

![]()

New York Unemployment Benefits Eligibility Claims

How To Apply For Unemployment Benefits In Texas Fileunemployment Org

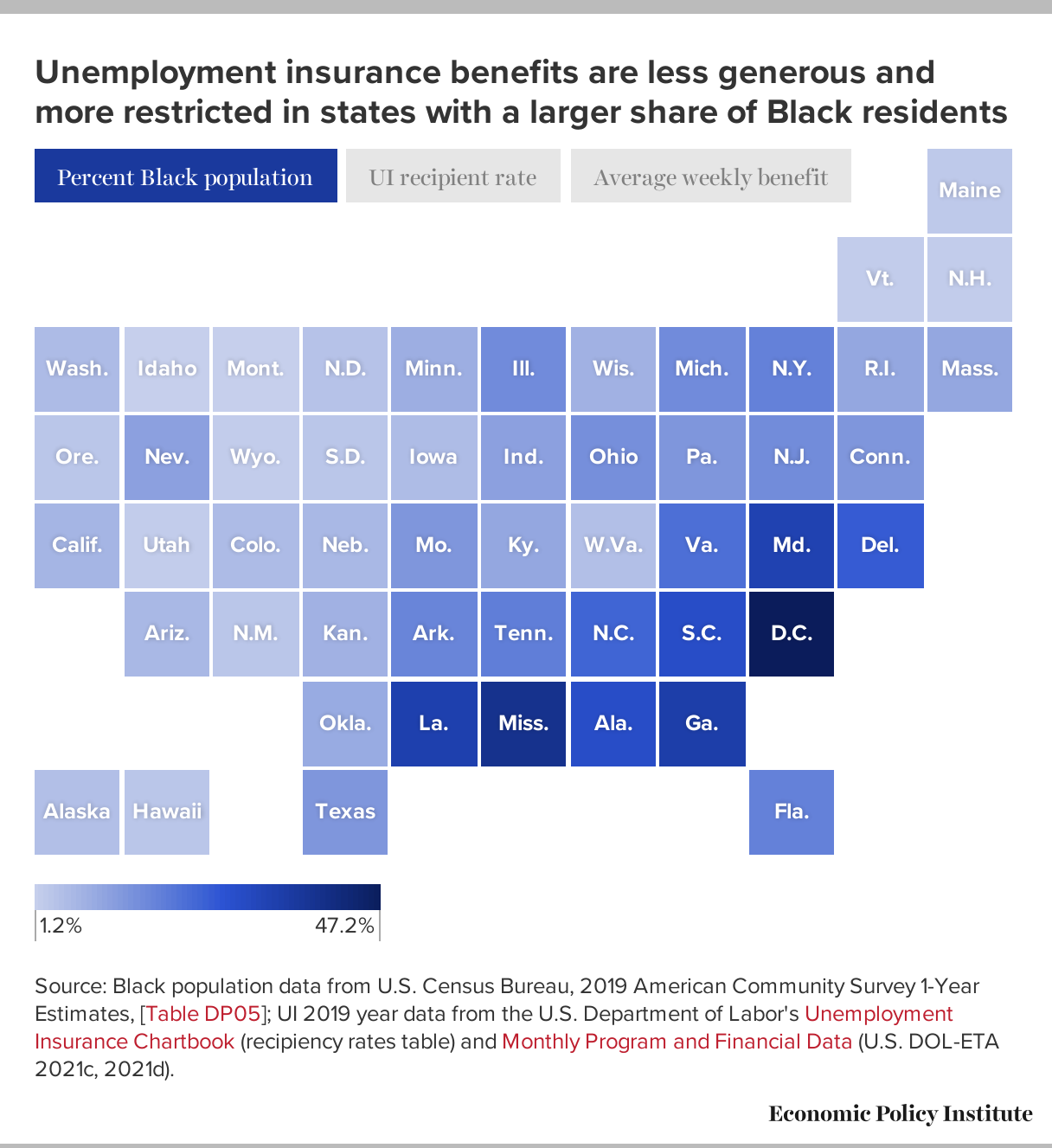

Section 3 Eligibility Update Ui Eligibility To Match The Modern Workforce And Guarantee Benefits To Everyone Looking For Work But Still Jobless Through No Fault Of Their Own Economic Policy Institute

Esdwagov Calculate Your Benefit

Base Period For Filing Unemployment Benefits Fileunemployment Org

No comments:

Post a Comment