How do I get my 1099G online in Ohio. This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2021 as well as any adjustments or tax withholding made to your.

Then you will be able to file a complete and accurate tax return.

How do i get my 1099 g from unemployment ohio. While on your states website copy the contact information so you can contact the office directly if necessary. How Do I Get A 1099 Tax Form From Arkansas Unemployment. Where Can I Get My 1099 G Form For Ohio Unemployment.

Httpsunemploymenthelpohiogov click on the REPORT IDENTITY THEFT button and complete the form. You can view and print your 1099-G from your correspondence inbox. IRS tax forms are used for taxpayers and tax-exempt organizations to report financial information to.

In addition this form will be sent by US. W-21099 Upload Permissions for the Ohio Business Gateway Questions regarding the W-21099 Upload Feature can be directed to the Employment Tax Division at. 1099Gs are available to view and print online through our Individual Online Services.

The Louisiana Workforce Commission LWC has begun the process of mailing out a 1099-G form to everyone who received unemployment benefits in 2020. If you want a copy of your 1099-G. Your tax preparer cannot access your 1099-G andor 1099-INT information.

Call your local unemployment office to request a copy of your 1099-G by mail or fax. Answer 1 of 2. If you dont receive it in the first week of feb.

All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. You must register for Online Services to viewprint your 1099-G andor 1099-INT. They have until Jan.

Instead you should provide the income. This will help save taxpayer dollars and allow you to do a small part in saving. Call your processing center and request your copies.

Visit the IRS website here for specific information about the IRS adjustment for tax year 2020. The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment benefits in calendar year 2021. If you havent received a 1099-G by the end of January log in to your eServices account and find it under the 1099s tab.

Can I get my 1099-G form online. How to get my 1099 g from unemployment ohio. How to get my 1099 g from unemployment ohio.

How do I get my tax form from unemployment Louisiana. This is the fastest option to get your form. Or you might need to go to your states unemployment website and use the password etc.

If you havent received your 1099-G copy in the mail by Jan. 31 to send it to you. If you get one but did not apply for unemployment that is a.

For example if you collected unemployment in 2018 the 1099-G should have been mailed by January 31 2019. If you want us to send you a paper copy of your 1099-G or email a copy to you please wait until the end of January to contact us. Some states will mail out the 1099G.

You must send us a request by email mail or fax. That you have been using to certify for weekly benefits to get your 1099G from the states site. You can receive a copy of your 1099-G Form multiple ways.

The fastest way to receive a copy of your 1099-G Form is by selecting electronic as your preferred method for correspondence. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. IncomeStatementsEWTtaxstateohus or by calling.

You can elect to be removed from the next years mailing by signing up for email notification. To access your Form 1099-G online log into your account at httpseddcagovUnemploymentUI_Onlinehtm and select 1099G at the. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns.

Your local office will be able to send a replacement copy in the mail. How To Enroll In Unemployment. Once registered log in with your username and password and click View Ohio 1099s under Online Services on the left side of the page.

Call your local unemployment office to request a copy of your 1099-G by mail or fax. Federal 1099-G tax forms for unemployment benefits paid in 2015 are now available online. Unemployment benefits are taxable pursuant to federal and Ohio law.

Pacific time except on state holidays. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received.

If you need another paper copy of your 1099-G andor 1099-INT you may request one by contacting the Department via email or by calling 1-800-282-1780 1-800-750-0750 for persons who use text telephones TTYs or adaptive telephone equipment. To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link. You Can Reset Your Pin Online Or By Calling The Pin Reset Hotline At 866 962.

If you havent received your 1099-G copy in the mail by Jan. Mail to the most current address on your claim. Receipt of both earnings and or unemployment compensation has to be reported to the IRS at the end of each tax year.

Your 1099 G tax info at their web site wwwunemploymentohiogov but when I go to the web site I cant find my 1099G Tax Info. 31 there is a chance your copy was lost in transit. It says when you call the Ohio Unemployment office that you can view and print.

Receive Form 1099G You can access your Form 1099G information in your UI OnlineSM account. How do I print my 1099-G from unemployment. The required form 1099-G must be provided by the employer or agency which is responsible for the payments in question to the recipient by 31st January of each yearA variety of agencies and employers frequently make these forms.

31 there is a chance your copy was lost in transit. What Website Do I Go To To. How do I get my 1099G from unemployment.

How To Get Your 1099 Form. You can log-in to your Reemployment Assistance account and go to My 1099-G in the main menu to view the last five years of your 1099-G Form document. Go to Services for Individuals Unemployment Services and select Form 1099-G Information from the sub-navigation options presented.

1099 Form Unemployment Benefits

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

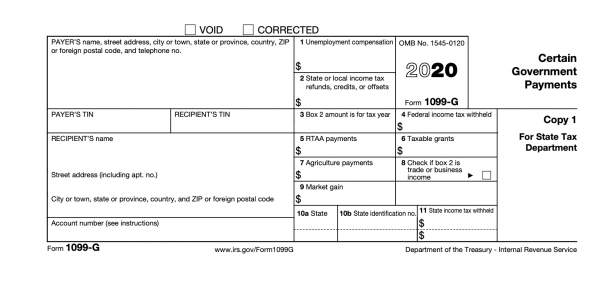

Form 1099 G Certain Government Payments Definition

What To Do If You Receive A 1099 G And Didn T Apply For Unemployment In 2020 Nbc4 Wcmh Tv

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Surprise Tax Forms Reveal Extend Of Unemployment Fraud Omaha Daily Record

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

1099 Form Unemployment Benefits

1099 Form Unemployment Benefits

No comments:

Post a Comment