How to get my 1099 g from unemployment ohio. 13 states that will make taxpayers pay state taxes on the full amount of their unemployment compensation are Colorado Georgia Hawaii Idaho Kentucky Massachusetts Minnesota Mississippi North Carolina New York Rhode Island South.

Where you can schedule a.

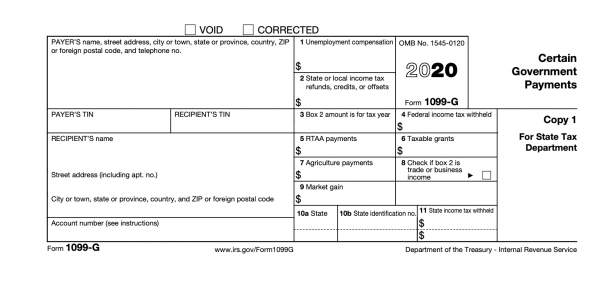

1099-g ohio unemployment. I usually keep every single piece of paper that is mailed to me regarding taxes which is why Im surprised that I cannot find my 1099-G form Ohio. They have until Jan. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returnsUnemployment benefits are taxable pursuant to federal and Ohio law.

With your TurboTax open enter Form 1099-G in the search box. Individuals have to report unemployment. It includes benefits paid by a state or the District of Columbia from the Federal Unemployment Trust Fund and railroad unemployment compensation benefits of 10 or more.

All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. Last week the agency said 1099-G tax forms will be sent to 17 million people in Ohio who have received unemployment benefits since March. There will be a number of Ohioans who receive a 1099-G tax form in the mail stating that they received unemployment benefits in 2020 when in fact they did not.

Employee must file Form 1099-G. Httpsunemploymenthelpohiogov click on the REPORT IDENTITY THEFT button and complete the form. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st.

Ohio Targets Fraud as 1099-G Tax Form Distribution Begins. You must also file Form 1099-G for each person from whom you have withheld any federal income tax report in box 4 under the backup withholding rules regardless of the amount of the payment. To enter Form 1099G in TurboTax Deluxe follow the steps.

Combine the box 1 amounts from all Forms 1099-G and report the total as income on the unemployment compensation line of your tax return. Legitimate unemployment claimants who received benefits in 2021 need 1099-G forms so they can report this income when filing their annual taxes. You can view and print your 1099-G from your correspondence inbox.

This will help save taxpayer dollars and allow you to do a small part in saving. I got unemployment because of Covid for 4 months and I need to report this but I dont know how to provide 1099 G info since I dont have it. Federal 1099-G tax forms for unemployment benefits paid in 2015 are now available online.

In addition this form will be sent by US. I received a 1099-G from Ohio for Unemployment Compensation. UNEMPLOYMENT COMPENSATION--Generally includes any amount received under an unemployment compensation law of the United States or of a stare.

Last month ODJFS issued 17 million 1099-G tax forms to individuals in whose names unemployment benefits were paid in 2020. You can elect to be removed from the next years mailing by signing up for email notification. Shows the total unemployment compensation paid to you this year.

Individuals in this situation must call the PUA Call Center at 1-833-604-0774 for assistance. The 1099-G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment Assistance payments during the calendar year January 1 to December 31. Except as explained below this is your taxable amount.

Those benefits need to be reported as taxable income. If you have received an Ohio 1099-G but you did not file for unemployment in 2020 you should visit unemploymentohiogov click on the Report Identity Theft button and complete the reporting form Once you have completed the form to Report Identity Theft ODJFS will issue a Corrected 1099-G showing the amount was not received. If you dont receive it in the first week of feb.

That option is not listed under types and keeps flagging my box 4 amount due to me choosing federal withholding. Your 1099 G tax info at their web site wwwunemploymentohiogov but when I go to the web site I cant find my 1099G Tax Info. Issuing 17 million 1099-G tax forms throughout the month of January pursuant to federal law that requires reporting of unemployment benefits.

If you get one but did not apply for unemployment that is a. For example if you collected unemployment in 2018 the 1099-G should have been mailed by January 31 2019. Call your processing center and request your copies.

ODJFS issued approximately 17 million 1099-G forms in 2021 and 200000 forms in 2020-30- The Ohio Department of Job and Family Services manages vital programs that strengthen Ohio families. I received a 1099-G from the Ohio Department of Job and Family Services ODJFS. Every year we send a 1099-G to people who received unemployment benefits.

While on your states website copy the contact information so you can contact the office directly if necessary. The Department of Job and Family Services is expected to send 1099-G forms to all 17 million that it has record of receiving unemployment benefits. Mail to the most current address on your claim.

The state said it will be issuing a record 17 million 1099-G forms to Ohioans for unemployment payments received last year. 1099Gs are available to view and print online through our Individual Online Services. 31 to send it to you.

You Can Reset Your Pin Online Or By Calling The Pin Reset Hotline At 866 962. Certain amounts that are not reportable on Form 1099-G such as compensation for services prizes and certain. February 6 2020 156 PM.

New PUA applications will continue to be accepted through Wednesday October 6 2021 but only for weeks of unemployment prior to September 4. Miami Valley vaccines. COLUMBUS Ohio As the Ohio Department of Job and Family Services begins issuing 1099-G tax forms to individuals who received unemployment benefits the previous year Director Matt Damschroder says the department is taking additional steps to ensure 1099s go only to legitimate claimants amid.

Many of those individuals were never paid unemployment benefits and did. All states 13 States Wont Let You Claim Bidens 10200 Unemployment Tax Break These 13 states need to correct this. How to get my 1099 g from unemployment ohio.

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

Surprise Tax Forms Reveal Extend Of Unemployment Fraud Omaha Daily Record

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

Pdf Telecharger 1099 G Ohio Gratuit Pdf Pdfprof Com

No comments:

Post a Comment