To learn more about how your benefits are. Unemployment is considered to be a key measure of the health of the economy.

Impact Of Covid 19 On Employment Income Advanced Estimates Statistics Explained

51 rows Weve identified 11 states where the typical salary for an Unemployment job is above.

Unemployment yearly income. If you receive unemployment benefits during a tax year you will receive a 1099-G form. It must contain first and last name income amount and tax year. Data retrieved on June 15 2021.

Learn more about how to estimate your expected income if youre. And similar to HealthCaregov proof of income can be. Unemployment benefits are taxable.

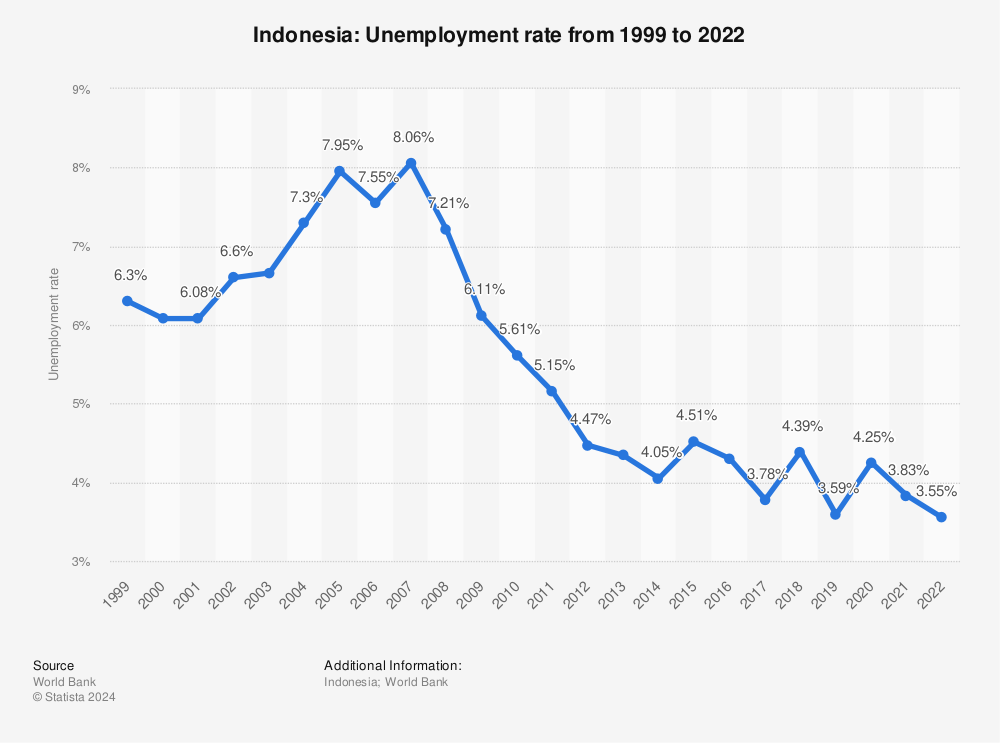

Unemployment total of total labor force modeled ILO estimate International Labour Organization ILOSTAT database. 1995 2000 2005 2010 2015 2020 40 45 50 55 60 65 70 World. If you receive unemployment benefits it counts as income.

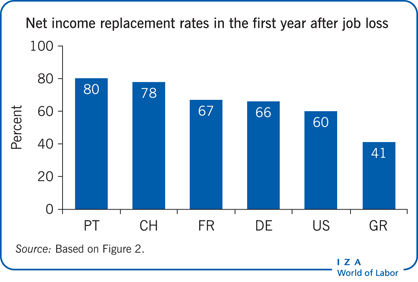

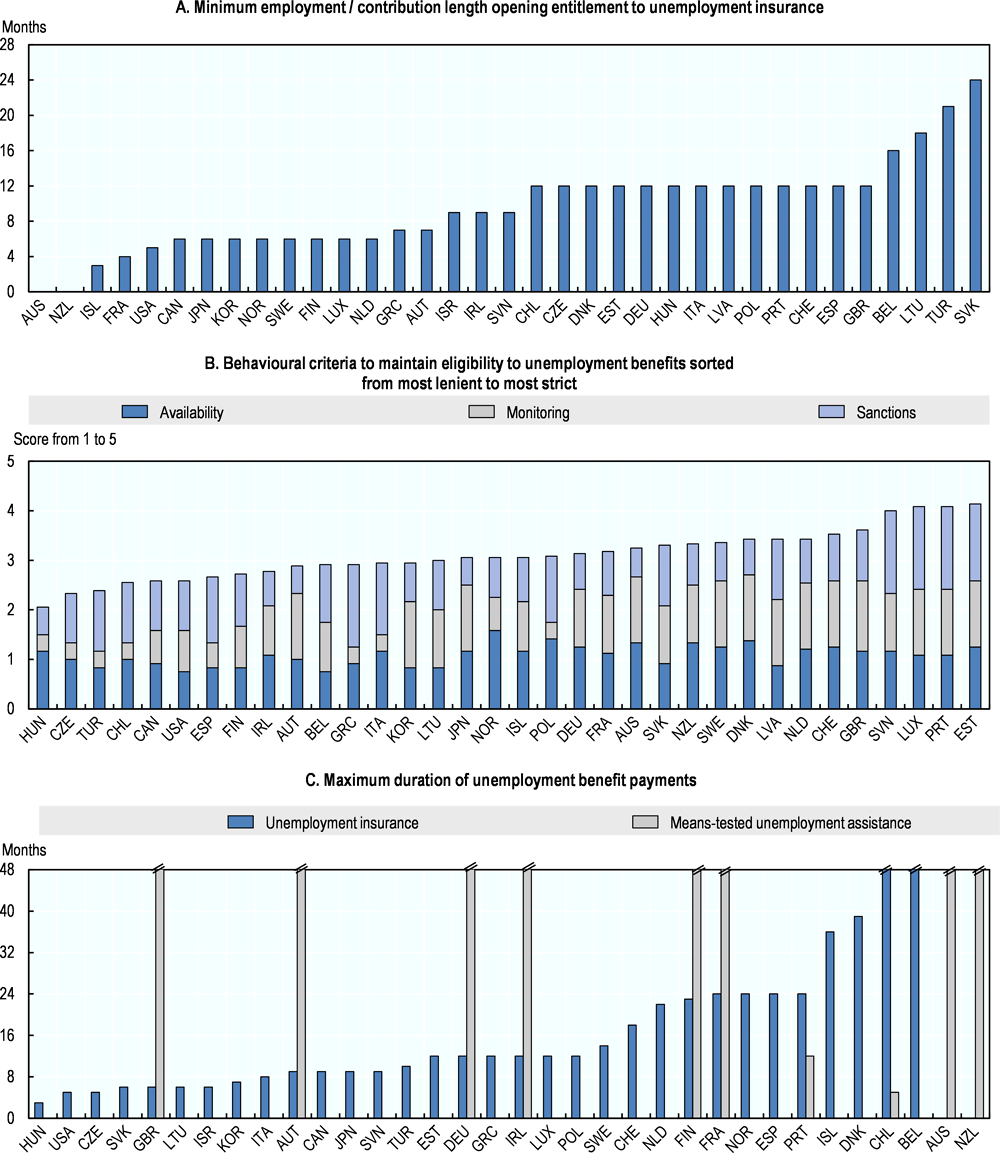

This is the equivalent of 890week or 3858month. Calculations refer to a single person without children whose previous in-work earnings were 67 of the average wage. However if you return any of the money you receive you can reduce your tax liability.

The term unemployment refers to a situation when a person who is actively searching for employment is unable to find work. Yes add the 600 per week when estimating annual income. No do not include this amount in current yearly income.

Someone who receives unemployment benefits from early April through July 31 will receive about 10000 from this. New Exclusion of up to 10200 of Unemployment Compensation. Unemployment Insurance and Calculating Projected Annual Income.

Organisations like the OECD report statistics for all of its member states. Get help estimating income and expenses with HealthCaregovs income calculator. Of course if you find a new job you will no longer be eligible for unemployment.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. Report the gross amount of the weekly UI before any deductions. For an individual that means income from 12490 to 49960 in 2020 according to the Kaiser Family Foundation.

Does Unemployment Count as Income. Just in case you need a simple salary calculator that works out to be approximately 2226 an hour. Unemployment income may be averaged over the last two years and year to date but the lender must verify income from a current job in the same field.

For a family of four that would translate into income of. If you earn other income while receiving unemployment that may reduce the amount of benefits available to you. 1040 federal or state tax return.

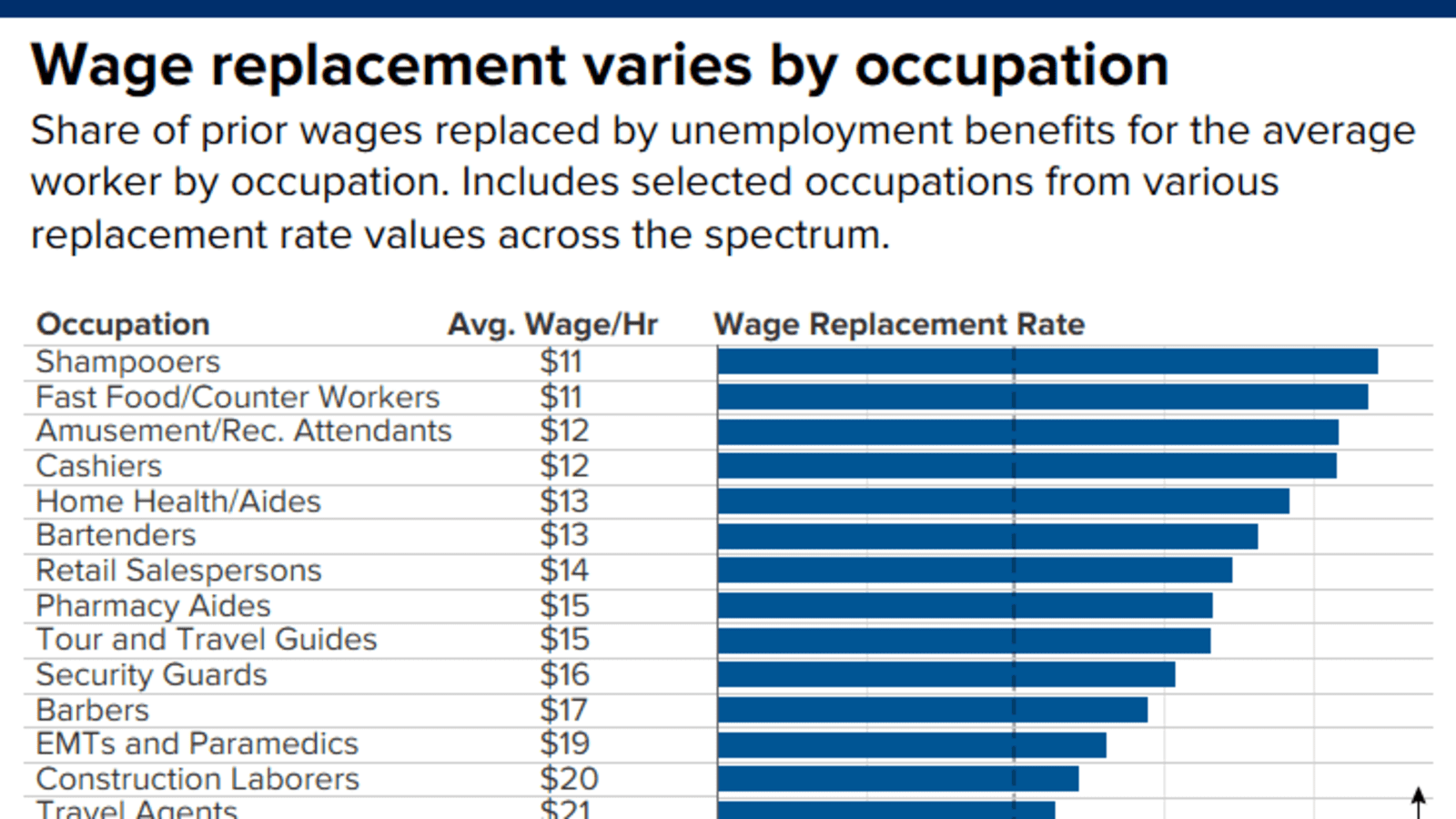

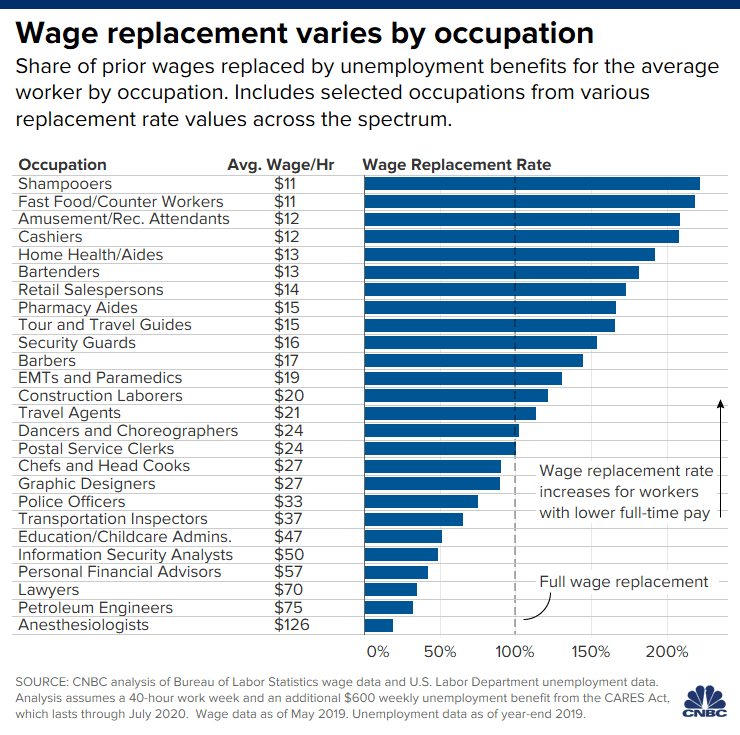

As of Dec 12 2021 the average annual pay for an Unemployment Office in the United States is 46298 a year. The Minnesota Department of Human Services has provided clarifications on how to calculate projected annual income PAI when there is unemployment insurance UI. Benefits in unemployment share of previous income.

Once you submit your application we will verify your eligibility and wage information to determine your weekly benefit amount. If you received unemployment compensation during the year you should receive Form 1099-G which is a report of income received from a government source showing the amount you were paid. 94 rows Unless otherwise stated the unemployment rate is for December of that.

Any unemployment compensation received must be included in your income and should be reported in the appropriate sections of your federal and state tax returns. You may elect to have up to 10 of your benefit amount withheld to pay federal income taxes. The unemployment rate of an individual country is usually calculated and reported on a monthly quarterly and yearly basis by the National Agency of Statistics.

The amount of Unemployment Insurance benefits you receive is dependent on a number of factors such as your past salary amount of severance you received from a former employer and additional sources of income. Unemployment income is fully taxable as ordinary income. 5 A useful purpose served by the unemployment rate in a country when available on at least an annual basis is the tracking of business cycles.

One-time recovery payment 1200 per adult and 500 per qualifying child No do not include this amount in current monthly income. The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week. Since May of this year the IRS has sent out 87 million unemployment benefit refunds which surpass 10 million dollars and the agency will continue to review these tax breaks.

Federal Income Tax. Therefore borrowers currently receiving unemployment may not count the previous jobs income or unemployment income until their loan officer can verify that the borrower has a new job. This indicator measures the proportion of previous in-work household income maintained after 2 6 12 24 and 60 months of unemployment.

Income and low productivity. Recipients are sent a Form 1099-G at year-end detailing how much they received which they must report on their 1040 form.

How Inflation And Unemployment Are Related

The Downside Of Low Unemployment

Many Americans Are Getting More Money From Unemployment Than They Were From Their Jobs Fivethirtyeight

It Pays To Stay Unemployed That Might Be A Good Thing

Impact Of Covid 19 On Employment Income Advanced Estimates Statistics Explained

Unemployment Insurance Data Employment Training Administration Eta U S Department Of Labor

Unemployment Benefits Comparison By State Fileunemployment Org

Many Americans Are Getting More Money From Unemployment Than They Were From Their Jobs Fivethirtyeight

Indonesia Unemployment Rate 2020 Statista

Iza World Of Labor Unemployment Benefits And Unemployment

Indonesia Unemployment Rate 2020 Statista

It Pays To Stay Unemployed That Might Be A Good Thing

:max_bytes(150000):strip_icc()/ScreenShot2021-03-03at12.27.02PM-d723cf5aeaa64daa839afe8466d3b815.png)

How Inflation And Unemployment Are Related

No comments:

Post a Comment