After 1099-G forms for 2021 are available online select Get your 1099-G from My UI Home in the online claimant portal to access your 1099-G tax forms. Due to the extremely high volume of unemployment claims filed the IRS is.

1099 Pay Stub Template Excel New 9 Free 1099 Pay Stub Template Pay Stubs Template Money Template Contract Template

If you received PUA you will receive PUA 1099-G.

Unemployment 1099 online. To receive your 1099-G online. If this amount if greater than 10 you must report this income to the IRS. ILogin is required to view your 1099-G form online.

Visit the Florida Department of Economic Opportunitys Tax Information webpage to view options for requesting tax documents. Pacific time except on state holidays. Once logged in to the New Mexico Workforce Connection Online System you can log in to the UI Tax Claims System by clicking on Unemployment Insurance umbrella icon.

Many states now offer online access to 1099-G forms which is a big help when its time to file but you never received the form. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. If you received unemployment benefits as well as the additional 600 per.

11 days ago Oct 06 2021 Click the Unemployment Services button on the My Online Services page. 2 Under Account Alerts click Please select a delivery preference for your 1099 Form. Filing taxes is much easier when you have all the forms you need in front of you.

The EDD updates UI Online with the most current tax information for the previous tax year no later than January 31. If you received any unemployment benefits in 2021 you will need the 1099-G tax form to complete your federal and state tax returns. WwwirsgovUC Unemployment benefits are taxable Unemployment benefits must be reported on your federal tax return.

Log in to your UI Online account. How to requestRequest your unemployment benefits 1099-G. States unemployment office and visit.

Your email address will be displayed. Shows the total unemployment compensation UC paid to you in the calendar year reported. Go to wwwirsgovidtheftunemployment for more information.

Postal Service will forward the Form 1099-G if a current forwarding order is on file. Through the 1099G page you can view and print tax information on unadjusted benefits Form 1099G for up to five years and can also request paper forms. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124.

If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. The 1099-G form for calendar year 2021 will be available in your online account at labornygovsignin to download and print by mid-January 2022.

You can access your Form 1099G information in your UI Online SM account. We also send this information to the IRS. 3 Under Delivery Preference for Form 1099-G click Electronic.

A record number of Americans are applying for unemployment compensation due to the COVID-19 Outbreak. Enter the amount from Box 1 on Line 19 Unemployment Compensation of your 1040 form. After logging in to the UI Tax Claims System you can view your 1099-G by clicking on View Correspondence on the menu on the left-hand side of the screen.

Click on the down arrow to select the right year. Click the Unemployment Services button on the My Online Services page. The 1099-G tax form is commonly used to report unemployment compensation.

The 1099-G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment Assistance payments during the calendar year January 1 to December 31. You can view 1099-G forms for the past 6. Your local unemployment office may be able to supply these numbers by phone if you cant access the form online.

Click on View and request 1099-G on the left navigation bar. Report the incorrect amount shown in box 1 of Forms 1099-G on your tax return. 1 Log into MiWAM.

To access this form please follow these instructions. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124. Log-in today to view and print your 1099.

ESD sends 1099-G forms for two main types of benefits. Payment history in UI Online or by calling 1-866-333-4606 If you dont agree with the amount on your Form 1099G call 1-866-401-2849 and provide your current address and phone number To learn how to get detailed unemployment payment information in UI Online refer to UI Online. If you do not have an online account with NYSDOL you may call.

Access Tax InformationForm 1099G Using UI Online YouTube. How to Get 1099G Online - Department of Labor. If you received unemployment benefits during 2021 youll use this form to file your taxes.

How to Get Your 1099-G online. If you received unemployment compensation during the year you should receive Form 1099-G from the Office of Unemployment Compensation. You will receive an email acknowledging your delivery preference.

Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. Unemployment and family leave. Can I Get My 1099 From Unemployment Online.

If you received regular UC including PEUC EB TRA you will receive UC 1099-G. We will mail you a paper Form 1099G if you do not choose electronic delivery by December 27. Your 1099-G form will be available in late January 2022.

Combine the box 1 amounts from all Forms 1099-G and report the total as income on the UC line of your tax return. IRS Form 1099-G is now available online for anyone that received benefits in 2021. The deadline to choose the online option is January 2 2022.

Form 1099-G Certain Government Payments is mailed in January to anyone who received an unemployment benefits payment during the previous calendar year. Unemployment compensation must be reported on tax returns if you received jobless benefits in 2021 using the 1099-G Certain Government. Instructions for the form can be found on the IRS website.

The form can be viewed and printed anytime through UInteract. To access prior year forms select My UI Summary then select 1099-G Tax Information in the online claimant portal. If you see a 0 amount on your form call 1-866-401-2849 Monday through Friday from 8 am.

Every year we send a 1099-G to people who received unemployment benefits. Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year. Where can I get a 1099-G or W-2 for reemployment assistance I received.

On your 1099-G form Box 1 Unemployment Compensation shows the amount you received in unemployment wages. Click the Unemployment Services button on the My Online Services page. 4 - Review and Submit.

If your Form 1099-G is mailed to an address other than your current address the US.

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

27 Best Freelance Accountants For Hire In December 2021 Upwork Small Business Accounting Accounting Business Account

Self Employed Tax Preparation Printables Instant Download Etsy Small Business Tax Tax Preparation Business Tax

Quickstudy Finance Laminated Reference Guide Tax Prep Checklist Small Business Tax Tax Prep

60 Important Papers And Documents For A Home Filing System Checklist Estate Planning Checklist Home Filing System Emergency Binder

Small Business Accounting Checklist Pinterest

The Small Business Accounting Checklist Infographic Small Business Finance Small Business Accounting Bookkeeping Business

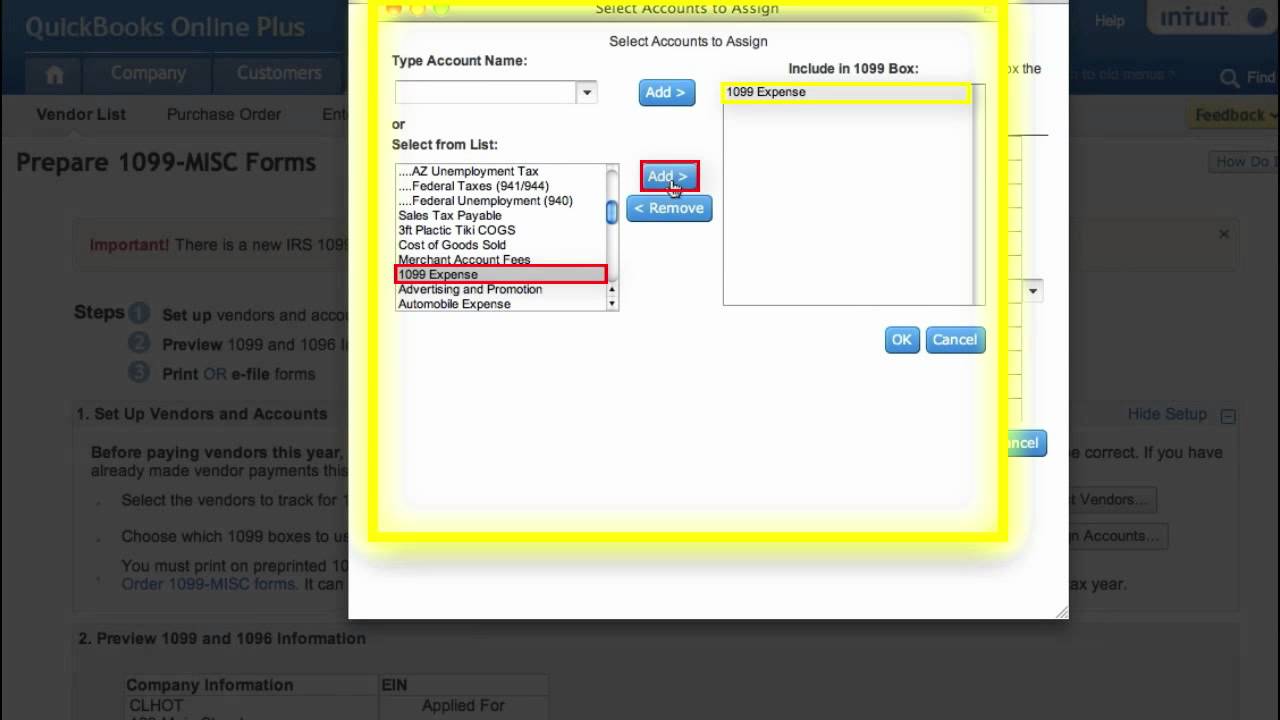

Quickbooks Online How To Prepare A 1099 Quickbooks Online Quickbooks Preparation

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

How To Manage 1099 Sales Reps Independent Contractors Independent Contractor Professional Insurance Bookkeeping Business

Last Minute Tax Guide And Infographic For Sole Proprietors Tax Guide Filing Taxes Sole Proprietor

Mba Quotes Thoughts Businessmanagementdegree Bookkeeping Business Business Tax Small Business Tax

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Deductions Tax Write Offs

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

No comments:

Post a Comment