As taxable income these payments must be reported on your federal tax return but they are exempt from California state income tax. If you have received unemployment income at any point during the year you will be required to complete and return IRS Form 1099-G.

Accessing Form 1099 For 2020 Unemployment Recipients

The 1099-G tax form includes the amount of benefits paid to you for any the following programs.

Unemployment 1099 form. This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. If you are self-employed or a 1099 employee and have lost contracts or income recently you might be wondering if you can file for unemployment benefits. Any time you have a source of income that is not from a full-time employer you should receive a 1099 form to file for unemployment and your taxes.

UI Customer 1099 Form. If you have received unemployment insurance payments last year you will need to report the total amount as found on your 1099-G on your federal taxes. Finish filling out Schedule 1.

Use your 1099-G Form to File your Taxes Your unemployment payments are reported as income to the IRS. Federal income tax withheld from unemployment benefits if any. However you dont have to claim your 1099 form until you receive the full payment you agreed to.

This form can be found at michigangovuia. A - Complete Form UIA 1920 Request to Correct Form 1099-G and submit it to UIA. The Department of Unemployment Assistance DUA will mail you a copy of your 1099-G by Jan.

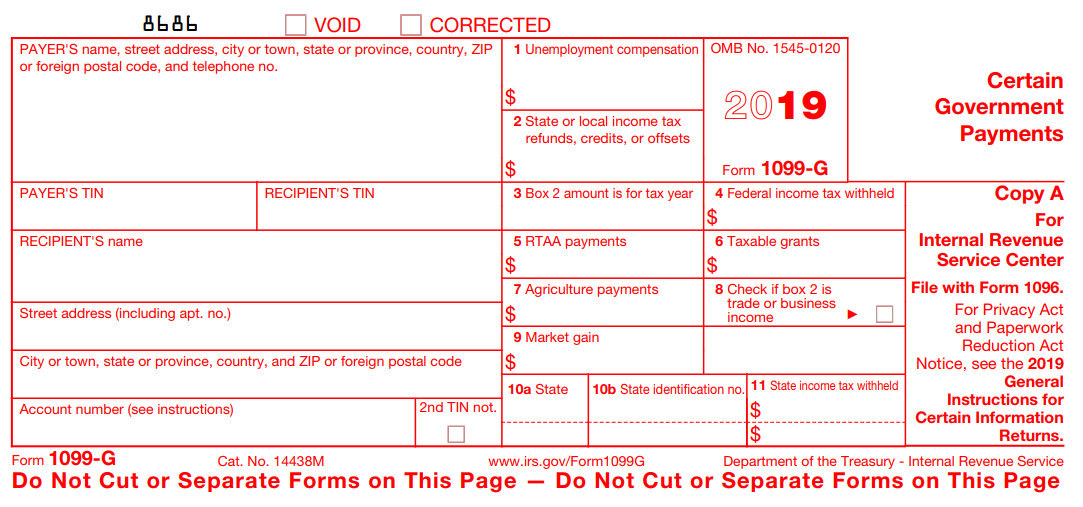

This includes Form 1099-NEC income. Form 1099-G Certain Government Payments is mailed in January to anyone who received an unemployment benefits payment during the previous calendar year. Click on Forms for Workers.

ODJFS issued approximately 17 million 1099-G forms in. Keep reading to learn more. A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you including.

Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. Unemployment benefits including Pandemic Unemployment Assistance PUA Federal Pandemic Unemployment Compensation FPUC Pandemic Emergency. Form 1099-G is a type of 1099 form thats used to report certain government payments most commonly unemployment benefits and state or local tax refunds.

Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments. The earnings must be submitted to your unemployment office when you file your claims. Postal Service will forward the Form 1099-G if a current forwarding order is on file.

Go to wwwirsgovidtheftunemployment for more information. Shows the total unemployment compensation UC paid to you in the calendar year reported. You simply enter your unemployment compensation on line 7 of Schedule 1 and you find that number on Box 1 of your 1099-G form that you received in the mail.

If you filed a 1099 because you were primarily self-employed you probably wont be eligible for unemployment. If your Form 1099-G is mailed to an address other than your current address the US. Insurance contracts etc are reported to recipients on Form 1099-R.

If you received PUA you will receive PUA 1099-G If you received regular UC including PEUC EB TRA you will receive UC 1099-G. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly. Mail completed forms to.

How to Get 1099G Online - Department of Labor. If your annuity starting date is after 1997 you must use the simplified method to figure your taxable amount if your payer didnt show the taxable amount in box. Can you get unemployment if you get paid through a 1099.

31 of the year after you collected benefits. If you own a business or work as an independent contractor such. In most states companies pay a tax to cover unemployment insurance so that separated employees can benefit from it.

Legitimate unemployment claimants who received benefits in 2021 need 1099-G forms so they can report this income when filing their annual taxes. Most commonly freelancers and independent contractors use 1099 forms to record their yearly income. Box 169 Grand Rapids MI 49501-0169.

Unemployment Insurance Agency 1099-G PO. If you received unemployment compensation during the year you should receive Form 1099-G from the Office of Unemployment Compensation. All individuals who received unemployment insurance UI benefits last year will receive the 1099-G tax form.

If you have received unemployment income at any point during the year you will be required to complete and return IRS Form 1099-G. If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns. Unemployment Insurance UI Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Extended Benefits EB Federal Pandemic Unemployment Compensation FPUC and Lost Wages Assistance LWA.

Most people who receive this type of income will receive this form in the mail. 1099-G income tax statements for 2021 will be available online mid-January 2022. For detailed instructions on how to use this page please click the Instructions button.

Reporting Form 1099 Income to Your Unemployment Office If youre collecting unemployment insurance benefits you must report any source of income you receive. If you get a Form 1099-G you need to use it when you prepare your tax return. Report the incorrect amount shown in box 1 of Forms 1099-G on your tax return.

However the COVID-19 pandemic has changed that and certain relief bills now allow for such workers to file claims. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly. The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year.

This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. Combine the box 1 amounts from all Forms 1099-G and report the total as income on the UC line of your tax return. Qualified plans and section 403b plans.

If you received unemployment your tax statement is called form 1099-G not form W-2. You will need this information when you file your tax return. Claimants who fail to do so can face serious consequences.

If you have received Unemployment Insurance benefits and would like to download and print a 1099 G form for income tax filing purposes enter the information requested below to view your form.

1099 G 2020 Public Documents 1099 Pro Wiki

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

Irs Courseware Link Learn Taxes

Tax Form Now Arriving Tied To Fake Unemployment Claims

How To Get A 1099 G Form From Unemployment In New York State Online Or A Hard Copy By Mail Youtube

Why Did I Receive A 1099g Tax Form Idaho Work

The Irs 1099 G Form What It Is And Who Receives

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

1099 G 2019 Public Documents 1099 Pro Wiki

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

1099 G Tax Form Why It S Important

1099 Form Unemployment Benefits

1099 G Tax Information Ri Department Of Labor Training

No comments:

Post a Comment