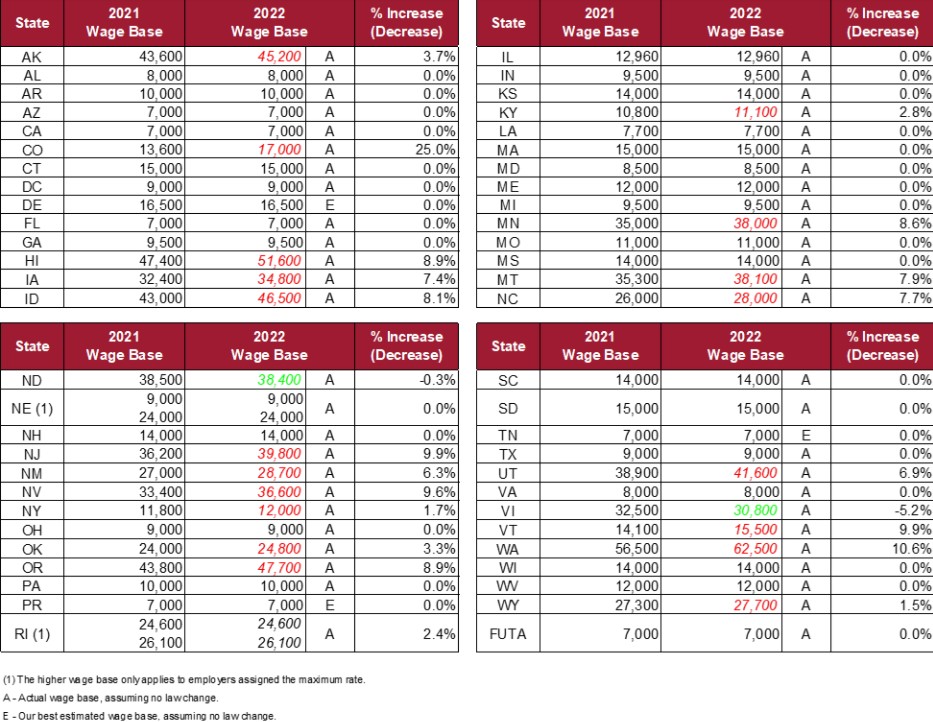

050 employee share 15 59. 2022 STATE WAGE BASES Updated 012022 2021 STATE WAGE BASES 2020 STATE WAGE BASES 2019 STATE WAGE BASES.

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

T he Internal Revenue Service IRS has started issuing tax refunds to those who received unemployment benefits in 2020.

Pa unemployment tax rate 2022. Pennsylvania Department of Labor and Industry data confirmed that the commonwealths December 2021 unemployment rate is 17 percentage points below its December 2020 level and three-tenths of a percentage point below its November 2021 level. However pursuant to PA 21-5 the following changes have been made for 2022. The standard FUTA tax rate is 60 on the first 7000 of taxable wages per employee which means that the maximum tax that you as an employer have to pay per employee for the 2022 tax year is.

The new employer rate remains at 36890 for non-construction employers and 102238 for construction employers. Httpswwwucpagovemployers-uc-services-uc-taxuc-tax-ratesPagesYearly-Tax-Highlightsaspx Tax rates will range from 12905 to 99333 to begin. Employers who receive their 2022 UC Contribution Rate Notice with this mailing date will have the following important tax deadlines.

The Pennsylvania Department of Labor Industry LI released a report Friday saying that Pennsylvanias unemployment rate fell three-tenths of a percentage point to 54 percent in December. These rates include a 540 surcharge and 050 additional contribution tax. Pennsylvania Unemployment Tax.

Pennsylvania Unemployment Tax The employee rate for 2022 remains at 006. Effective July 1 2021 tax rates are 38398 for. The PA Unemployment Contribution UC rate notices are usually mailed on or before December 31st.

Earned income tax codes in the system are programmed with the non-resident rate and the employees residence rate is entered on the employee tax profile along with the resident PSD code. January 30 2022 is the last day to file a timely voluntary contribution to lower the 2022 contribution rate. Once an employee makes 7000 in gross wages for the year thats it.

Pennsylvania Department of Labor Industry Office of Unemployment Compensation website. Go to the Pennsylvania website and search the work address and the employees home. Local services tax codes LST are occupational only.

COVID-19 caused high rates of unemployment across the country and depleted many state unemployment insurance funds. The maximum tax will increase from. The Total Contribution Rate is the sum of the Basic Contribution Rate the Increase for UC delinquency if applicable the Surcharge Adjustment and the Additional Contributions.

Pennsylvania Announcement Relating to 2022 Unemployment Tax Rates Unemployment tax rates for experienced employers will continue to range from 12905 to 99333 in the 2022 tax year. A new unemployment income tax exclusion coming. SUI New Employer Tax Rate Employer Tax Rate Range 2021 Alabama.

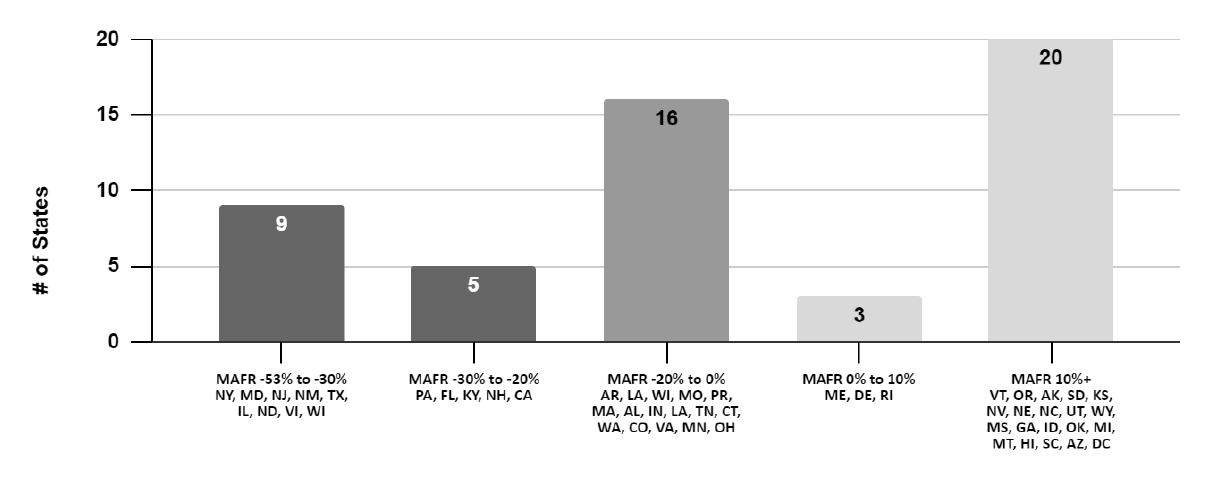

Unemployment Tax Break 2022. Wages subject to unemployment contributions for employers remains at 10000. 2022 State 2021 2022 increase or decrease 2022 employee contribution rates Alabama 8000 8000 Alaska 43600 45200 367 Employee SUI withholding rate is.

030 142 including solvency surtax California. Wages subject to unemploy-ment contributions for employees are unlimited. 7000 x 6 420.

The FUTA tax liability will remain at 06 for 2022. Nationally the unemployment rate decreased by 28 percentage points over the month to 39. The employee rate for 2022 remains at 006.

The calendar year 2021 employer state unemployment insurance SUI experience tax rates continue to range from 12905 to 99333. The FUTA tax rate is currently 60 on the first 7000 in wages paid per employee each year. Absent of PA 21-5 unemployment tax rates for 2022 would be calculated using taxable payroll and benefit charges for the three-year period beginning July 1 2018 through June 30 2021.

FREE Paycheck and Tax Calculators. The unemployment base for the employee will increase from 36200 to 39800 while the rate will remain the same at 425. 15 62 emergency.

Employee contribution rate includes the Workforce DevelopmentSupplemental Workforce Funds surcharge. The Pennsylvania Department of Labor Office of Unemployment Compensation announced last week that factors used to calculate employer tax rates for 2022 would remain the same as what they were for 2021. City of Philadelphia Wage Tax.

A PRELIMINARY LOOK AT THE 2022 STATE UNEMPLOYMENT TAXABLE WAGE BASES A PRELIMINARY LOOK AT THE 2022 SUI TAXABLE WAGE BASES SUI taxable wage bases 2021 v. Now these funds need to be replenished so a number of states are increasing taxes. 2022 FUTA Tax Rate.

A higher wage base limits b higher percentages again known as the tax rates that are. Wages subject to unemployment contributions for employees are unlimited. The FCR and FUTA rates that will be charged for 2022 are listed below.

Pennsylvania Unemployment Compensation Taxes vary with every employer. Pennsylvania Income Tax The withholding rate for 2022 remains at 307. 065 68 including employment security assessment of 006 Alaska.

A voluntary contribution may be submitted at any time but to affect a contribution rate it must be received within 30 days from. The Interest Factor for 2022 is 000. However employers in general receive a 54 FUTA tax credit reduction when they file their FORM 940 Employers Annual FUTA Tax Return resulting in a net FUTA tax rate of 06.

Wages subject to unemploy-ment contributions for employers re-mains at 10000. How SUI is changing in 2022. For budgeting purposes you should assume a 06 FUTA rate on the first 7000 in wages for all states with an additional percentage to be charged to cover the FUTA Credit Reduction FCR.

For 2022 the employer base for unemployment and disability increases from 36200 to 39800. The employer rate for these taxes is determined by the State and sent in a notice in July. These increases can come in the form of.

Standard rate 257 207 employer share. For each year thereafter computed as 16 of the states average annual wage. Employee contributions UC withholding is 006 percent 60 cents per 1000 gross wages.

Pennsylvania Unemployment Compensation Taxes. Find the PSD Codes and Tax Rates. The taxable wage base will continue to increase as follows.

Will You Owe Taxes On Your Unemployment Checks In 2022 Cnet

Sui Tax Rates Will Increase For Employers In 2022 Gusto

Happy New Year Happy New Happy New Year Happy

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

State Unemployment Insurance Taxable Wage Bases For 2022

2022 Tax Inflation Adjustments Released By Irs

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Numerous States Announce 2022 Unemployment Tax Increases 501 C Services

Unemployment Benefits Extension 2022 Will Your State Send You Checks In 2022 Marca

Ten Changes To Watch In Open Enrollment 2022 Kff

No comments:

Post a Comment