This tax form provides the total amount of money you were paid in benefits from the Office of Unemployment. What Is The Irs Form 1099.

Tax form arriving soon for PA residents who claimed unemployment in 2021.

Pa unemployment tax form. Upload Edit Sign PDF Documents Online. Learn More About UCMS. 2020 Individual Income Tax Information for Unemployment Insurance Recipients.

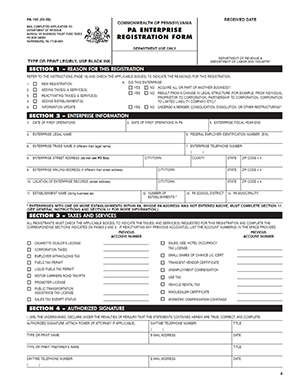

A single form the Pennsylvania Enterprise Registration Form or PA-100 is used to register for most of. To request a copy of your 1099-G by mail or fax. Fast Easy Secure.

Department of Labor Industry LI Secretary Jennifer Berrier on Friday reminded Pennsylvanians who claimed unemployment benefits in 2021 to monitor their mailboxes and unemployment system notifications for the 1099 form they will need to properly file their 2021. The 10 percent deduction is based on your net amount payable ie the amount of benefits payable before deductions for earnings benefit reduction child support and bankruptcy intercept and. Opens In A New Window.

Employers and third-party administrators can file PA UC quarterly tax reports make payments and maintain important account information. Once the form is open click on the desired entry field and a blinking cursor appears. You may choose to have federal income tax withheld from your benefit payments at the rate of 10 percent of your weekly benefit rate plus the allowance for dependents if any.

31 there is a chance your copy was lost in transit. To report unemployment compensation fraud complete the online fraud form located at wwwucpagov or call the toll-free Pennsylvania UC Fraud Hotline at 800-692-7496. Claimants of all unemployment programs offered during 2021 will receive a 1099 tax form detailing their benefit payments.

Federal income tax withheld from unemployment benefits if any. Edit PDF Files on the Go. Total taxable unemployment compensation includes the new federal.

01142022 Harrisburg PA Department of Labor Industry LI Secretary Jennifer Berrier today reminded Pennsylvanians who claimed unemployment benefits in 2021 to monitor their mailboxes and unemployment system notifications for the 1099 form they will need to. For claimants who want a hard copy physical 1099 tax forms will be mailed no later than January 31 2022. Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you including. If you havent received your 1099-G copy in the mail by Jan. Electronic Payment Requirement Waiver Request for Pennsylvania This form must be submitted if you are currently unable to comply with the electronic payment requirement and are requesting a temporary waiver allowing you to submit your Unemployment Compensation tax payment via check or money order.

Claimants of all unemployment programs offered during 2020 receive a 1099 tax form detailing their benefit payments. Claimants who have requested the 1099 tax form to be mailed should receive it no later than Jan. 1099-G Tax Form Information you need for income tax filing T he Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be mailed by January 31 st of each year for Pennsylvanians who received unemployment benefits.

Get Information About Starting a Business in PA. Recipients who did not File for Unemployment Should Contact Fraud Office Harrisburg PA Department of Labor Industry LI Acting Secretary Jennifer Berrier today reminded individuals who claimed unemployment benefits during 2020 to watch their mailboxes and unemployment system notifications for the 1099 form that is required to file their 2020. Register to Do Business in PA.

Edit PDF Files on the Go. Fast Easy Secure. Your local office will be able to send a replacement copy in the mail then you will be able to file a complete and accurate tax return.

Register for a UC Tax Account Number. Report the Acquisition of a Business. This form will soon be viewable on the online system where claimants file their weekly claims.

File and Pay Quarterly Wage and Tax Information. Appeal a UC Contribution Rate. The Pennsylvania Department of Labor and Industry is reminding taxpayers that the following 1099G forms are being mailed to claimants of the below programs.

Open the PDF form in Acrobat Reader. Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments. Ad Save Time Editing Documents.

Claimants of all unemployment programs offered during 2021 will receive a 1099 tax form detailing their benefit payments. If you wish to save the blank form to your hard drive and open it at a later time you should use the Save a Copy button within the Adobe application instead of the Save button on your Internet browser. Tax Form Arriving Soon for Pennsylvanians Who Claimed Unemployment Benefits in 2021.

This form will be available online and viewable in the same system where claimants file their weekly claims. Change My Company Address. For claimants who want a hard copy physical 1099 tax forms will be mailed no later than January 31 2022.

Ad Save Time Editing Documents. How Do I Get My Unemployment Tax Form. Although unemployment compensation is not taxable for Pennsylvania personal income tax purposes this form will be an important part of preparing your tax returns.

This form will be available online and viewable in the same system where claimants file their weekly claims. Tax Forms and Information. The claimants of all of the unemployment programs offered in 2021 will receive a 1099 tax form which includes the details of their benefit payments.

How does an employer register for a UC tax account. Apply for a Clearance. As taxable income these payments must be reported on your state and federal tax return.

Upload Edit Sign PDF Documents Online.

1099 G Tax Form Why It S Important

1099 Form Fileunemployment Org

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

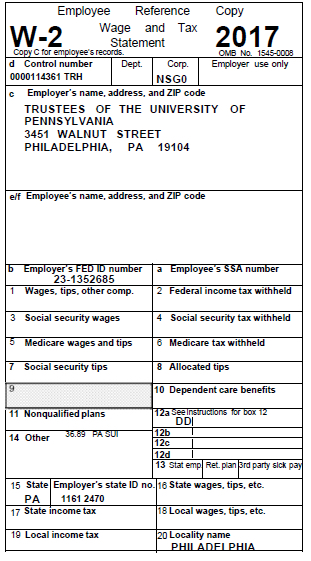

Tax Forms For 2017 University Of Pennsylvania Almanac

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Tax Form Arriving Soon For Unemployment Program Claimants Lower Bucks Times

Pa 100 Filing Service Harbor Compliance

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

No comments:

Post a Comment