Everyone except workers that remain attached to an employers payroll have to. Besides meeting the main qualifications for unemployment in Ohio you must also meet the following set of requirements.

/cloudfront-us-east-1.images.arcpublishing.com/gray/5BNGIVBY5BFQDHIDXVARCYZGKM.png)

Pandemic Unemployment Assistance Now Available For Ohioans

A qualifying work week is one in which you earned 215 and above before taxes or deductions.

Ohio unemployment qualifications 2020. If you claimed traditional unemployment PEUC or EB benefits within the last 12 months simply go to unemploymentohiogov click on Get Started Now and answer the questions. COLUMBUS Ohio On Friday Ohio will roll out new federal unemployment programs aimed at helping furloughed workers and individuals who have been let go due to the COVID-19 pandemic. Ohio law allows that 20 of your weekly benefit amount be exempted from any earnings you may receive before a deduction is made.

Unemployment benefits will be available for eligible individuals who are requested by a medical professional local health authority or employer to be isolated or quarantined as a consequence of COVID-19. Benefit amounts are approximately 60-70 percent of wages and range from 50-1300 a week depending on your income. Ohio Unemployment Insurance BENEFITS CHART - 2022 If your application for unemployment benefits is allowed your actual weekly benefit amount will be determined after you certify your application.

If you lose your job in March 2020 and receive unemployment benefits you qualify for 20 weeks of payments. You are either totally or. You must be unemployed through no fault of your own.

This includes those whose earnings in their previous wages averaged less than 280 per week. When prompted log in using your Social Security number and existing PIN. File a claim for each week you collect unemployment.

Actively look for work on a. An executive order issued by Governor DeWine expands flexibility for Ohioans to receive unemployment benefits during Ohios emergency declaration period. Apr 13 2020 What are the requirements to qualify for unemployment benefits in Ohio.

What are the requirements to file for unemployment benefits. Soon after approval you can begin collecting unemployment payments. In order to qualify for unemployment in Ohio you must have lost your job through no fault of your own.

In addition unemployment benefit insurance qualifications have been relaxed as follows. You must be totally or partially unemployed. Individuals not eligible for traditional unemployment benefits may be eligible for PUA.

Who Qualifies for Unemployment in Ohio. If you havent filed your taxes yet. Ohio Executive Order 2020-01D was adopted March 9 2020 and is available here.

On March 18 2020 President Trump signed into law the Families First Coronavirus Response Act FFCRA which provided additional flexibility for state unemployment insurance agencies and additional administrative funding to respond to the COVID-19 pandemic. 3302020 1 CARES Act Unemployment Insurance Explainer Prepared by Ways and Means Republicans as of March 30 2020 The CARES Act - Congress economic stimulus bill - provides much-needed temporary support for American workers impacted by COVID-19. If youre denied based on Ohio unemployment qualifications you may file an appeal.

To calculate the earnings deduction. Governor DeWine signed an executive order 2020-03D on March 16 2020 that makes several changes to Ohios unemployment law. It dedicates 250 billion to give workers more access to Unemployment help during this public.

Its also possible that you entered past earnings without documentation. If you are not a resident of Ohio but worked in Ohio at your last job you still have Ohio unemployment eligibility. Due to the pandemic Ohioans who earned less than 150000 do no have to pay state or federal income tax on the first 10200 in unemployment income they received in 2020.

Governor DeWine issued Executive Order 2020-01D declaring a state of emergency in Ohio to protect the well-being of Ohioans from COVID-19. Heres how to get these tax benefits. Unemployed workers will include individuals requested by a medical professional local health authority or employer to be isolated or quarantined as a consequence of COVID-19 even if not actually diagnosed with COV.

The Coronavirus Aid Relief and Economic Security CARES Act was signed. You should be partially or totally unemployed while applying for unemployment benefits. Must be physically able to work and available for work.

On the standard federal 1040 form you will list the full amount of unemployment benefits you. In 2020 you must have worked at least 20 weeks in covered employment and earned at least 269 in the base period four out of the last five completed calendar quarters. If you receive 15 weeks of benefits and find a new job youll have five remaining weeks of benefits to access.

If the weekly benefit amount is 40000 and weekly earnings are 20000. Total earnings in week 20000. If you do not remember your PIN call 1-866-962-4064 to reset it.

State of Ohio unemployment benefits are capped at weekly payouts of 424 and are determined based on how much you earned with your last employer. Ohioans in the traditional unemployment program have had since June as a result of Governor DeWines Executive Order 2020-24D. You must be actively looking for a suitable new job.

You will receive written notification of your entitlement and this notification is usually provided within a few days of your filing. An example of how this is computed appears below. Unemployment benefits provide short-term benefit payments to workers that are eligible who have a complete or partial loss of wages due to a non-work-related illness injury or pregnancy.

Register with the Employment Security Commission. You should have worked 20 qualifying work weeks. When you apply for Ohio unemployment benefits the Ohio Department of Jobs and Family Services reviews your information for the states eligibility requirements.

Whenever overpayments are issued Ohio law requires up to 50 of future benefits to be applied to the overpayment balance. Be mentally and physically able to work. To have Ohio unemployment eligibility you must meet the following criteria.

If so your weekly payment will default to the minimum 189 with an overpayment noted for weeks claimed. The Ohio Governors executive order.

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Ohio Unemployment Eligibility Fileunemployment Org

Ohio It S Friday Now And Still Not Paid Anyone Else R Unemployment

Ohio Finishing Updates To Unemployment System That Will Allow 95 000 More To Claim Benefits

Ohio Residents Can Again Seek Pandemic Unemployment Assistance Wtol Com

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Ohio Unemployment Ui Initial Allowed Jobs Ecityworks

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Apply For Ohio Unemployment Benefits Credit Karma

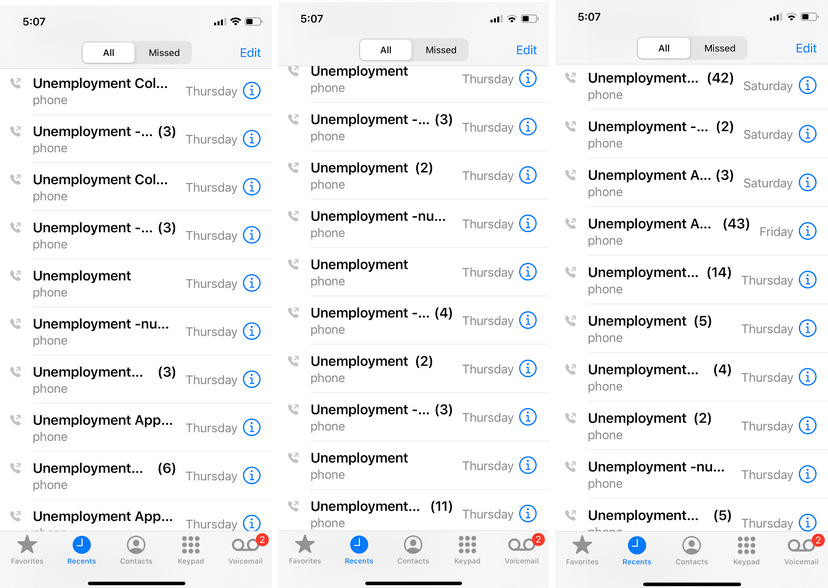

It Literally Consumes Everything I Do Ohioans Desperate To Reach Unemployment Hotline As Calls Dropped Claims Languish Eye On Ohio

How To Apply For Unemployment Benefits Online In Ohio Youtube

No comments:

Post a Comment