Ohio unemployment weekly claims are necessary to receive your benefits. A base period in Ohio consists of the past 4 quarters of three months each not including the current one.

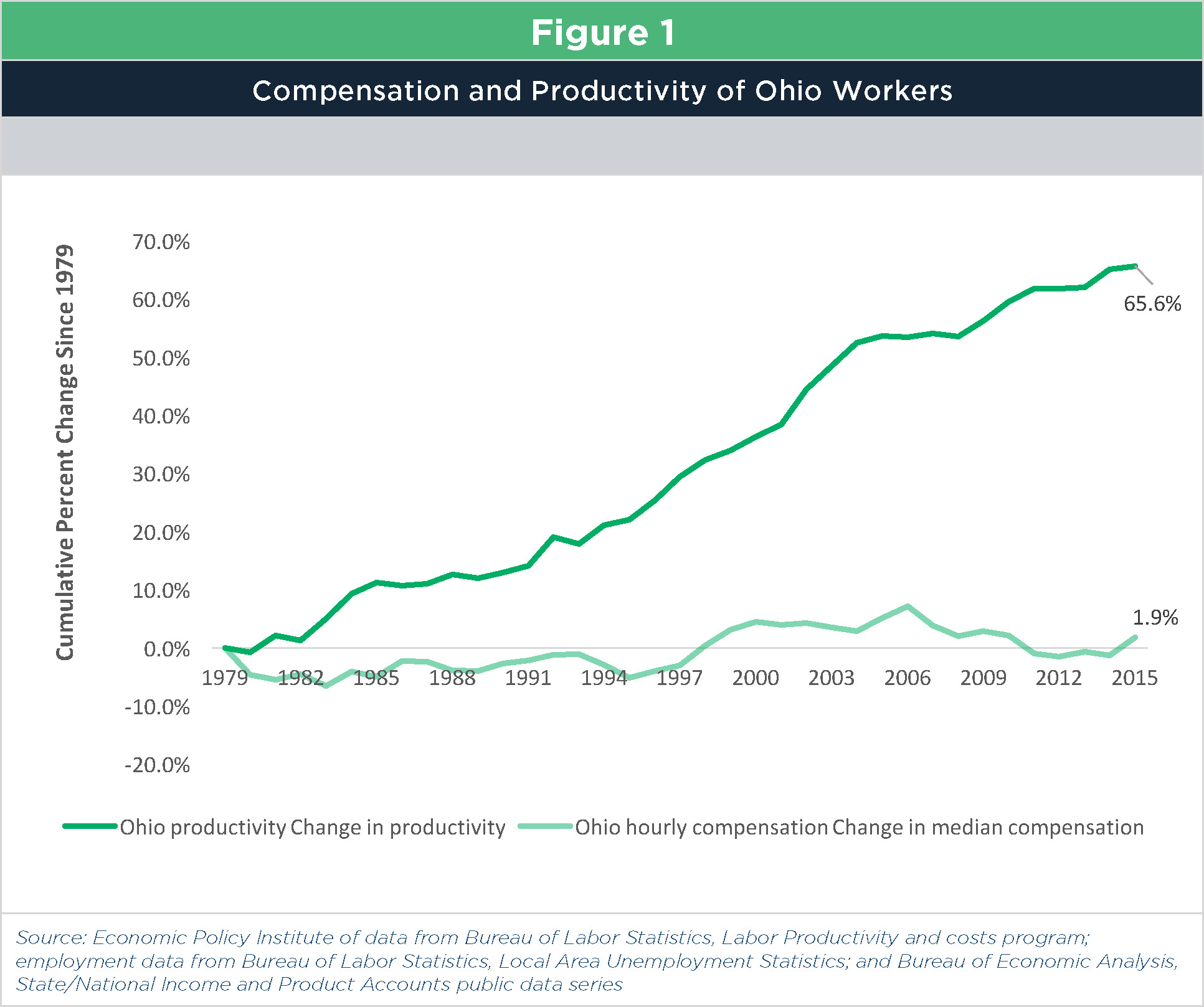

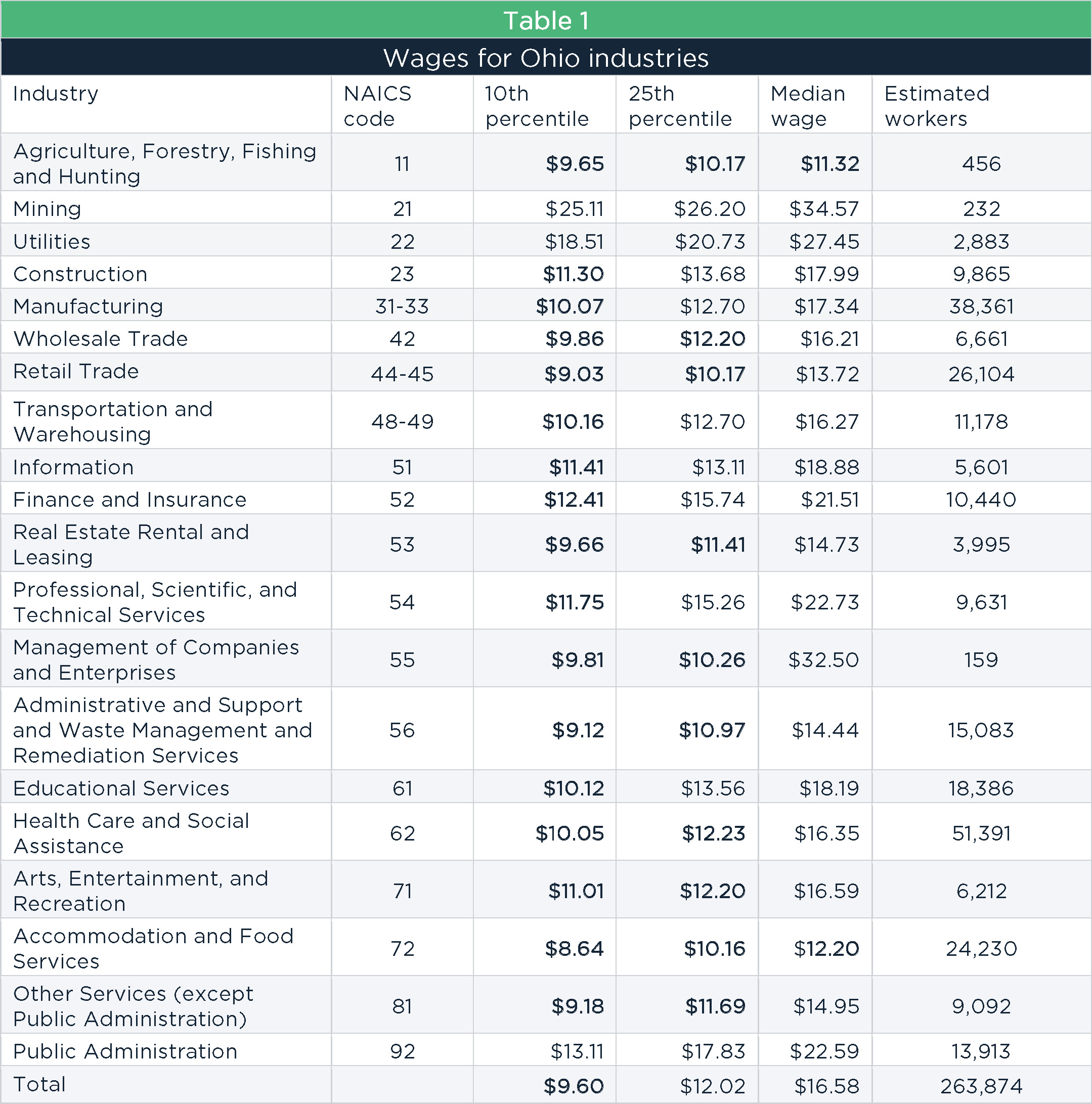

Minimum Wage Hike Would Boost Ohio Workers

Estimated Weekly Benefit Amount WBA The calculator returns your estimated WBA based on your average weekly wage during the base period.

Ohio unemployment minimum earnings. You may receive a higher figure if you have dependents. Mike DeWine in June. The minimum benefits amount in Ohio is 115 and the maximum benefits amount in Ohio is 413 for a claimant who has zero dependents.

You have worked and earned a minimum amount of wages in work covered by unemployment tax during the past 18 months. Your average weekly wage must be at least 269 before taxes and other deductions in order to qualify for benefits. Earnings - Example Based on a weekly benefit amount of 20000 Gross earnings for the week 9523 Minus earnings exemption 20 of 20000.

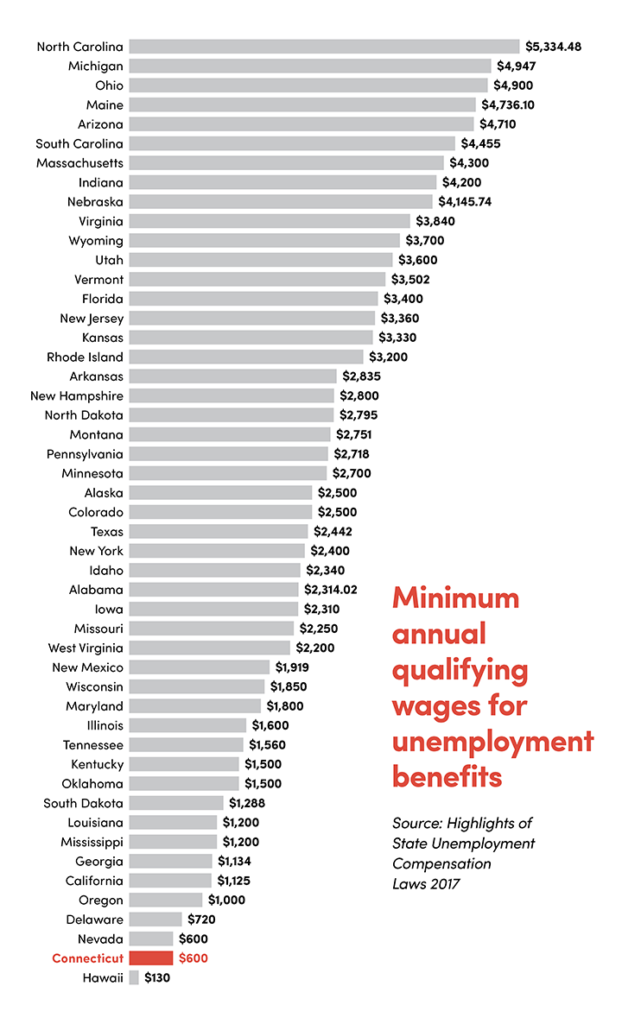

Must remain reimbursing or contributory minimum of 2 years. The minimum earnings amount changes each year and only applies to the year in which you are applying not your Base Period qualifying wages. Maines is the same Many states require far less in earnings.

The state uses this information to determine you are searching for work and failing to file them will end your benefits. State of Ohio unemployment benefits are capped at weekly payouts of 424 and are determined based on how much you earned with your last employer. Unemployment Insurance Tax 6 Public Entities REIMBURSING Reimburses the state for benefits paid on a dollar for dollar basis Reimbursement of benefits paid are made monthly CONTRIBUTORY Pays contributions unemployment taxes on the first 9500 earned by each employee taxable wages Contributions are paid quarterly total taxable wages annual tax rate.

The maximum amount you can receive per week is. Can I work part time. This year that amounts to 280 a week or an absolute minimum of 5600 in earnings.

In order to start your unemployment OH unemployment requirements include the following. You must have earned at least 237 per week during the base period. It ruled the governor overstepped by turning down the assistance.

Whats the minimum wage to get unemployment in Ohio. The 5600 figure for Ohio is an absolute minimum based on working 20 weeks. Your previous job must have earned take-home pay adequate to cover your living expense.

The minimum benefits amount in Ohio is 115 and the maximum. In order to collect Unemployment Benefits in Ohio your 2016 application must show at least an average weekly gross wage of 243 during your established Base Period. You must have worked a minimum of 20 weeks during the previous base period to be considered unemployed.

You are totally unemployed. Ohio is one of the states that allow a dependency allowance for any dependent spouses or minor children you are supporting. While collecting unemployment you can work part-time.

The Lost Wages Assistance program was a federal-state unemployment benefit that provided 300 to 400 in weekly compensation to eligible claimants. Must have an average weekly wage of at least 23000 during the base period before taxes and deductions. This regular unemployment compensation is generally available for up to 26 weeks.

Ohio unemployment insurance benefits are available if you meet these criteria. Ohio Unemployment Insurance BENEFITS CHART - 2022 If your application for unemployment benefits is allowed your actual weekly benefit amount will be determined after you certify your application. The Ohio 10th District Court of Appeals today reversed a trial court decision and ruled that state law calls for Ohio to continue paying the 300-a-week Federal Pandemic Unemployment Compensation FPUC benefits cut off by Gov.

Under the American Rescue Plan Act unemployment has been extended and expanded. 443 no dependents 537 1 or 2 dependents 598 3 dependents or more Like most states Ohio limits the period you can receive unemployment benefits to a maximum of 26 weeks. The minimum weekly benefit from Ohio unemployment is 115.

If you have one or more dependents the dependency classification chart will be able to help you. In Ohio traditional unemployment compensation is available to workers who meet minimum employment and earnings requirements and are unemployed through no fault of their own. The average weekly wage is determined by dividing your total wages earned during the base period from any employer who pays unemployment contributions by the total number of weeks.

MEUC benefits were available to eligible traditional unemployment claimants who also earned at least 5000 in self-employment wages during the year prior to when they first applied for unemployment benefits. Do You Meet the Minimum Earnings Requirement. Only Arizona North Carolina and Washington state have a higher minimum amount than Ohio.

The state does pay partial benefits and working part-time and filing allows you to extend your unemployment claims period. Depending on your vocation and industry you may qualify for unemployment if you have had your hours reduced. The Federal government through the Disaster Relief Fund provided 300 per claimant per week and states were asked to provide the remaining 100.

To meet the Ohio unemployment requirements your total earnings during the base period must be at least ½ times higher than the wages earned during the highest-paying quarter. You must be unemployed through no fault of your own. Due to economic conditions and unemployment claims filed the Ohio Unemployment Trust Fund is below the minimum safe level as of the computation date of the 2022 rates The minimum safe level is in essence the balance required in the Trust Fund to fund a moderate recession.

Check the dependency chart below to know your weekly benefits. If you file your application during 2022 you must have an average weekly wage of at least 298 before taxes or other deductions. You will receive written notification of your entitlement and this notification is usually provided within a few days of your filing.

Workers must have earned wages in at least 2 of 4 calendar quarters and wages earned during the base period must be above the minimum amount. Unemploymentohiogov by mail or. However you must work less than four days a week earning less than 405 to receive unemployment benefits.

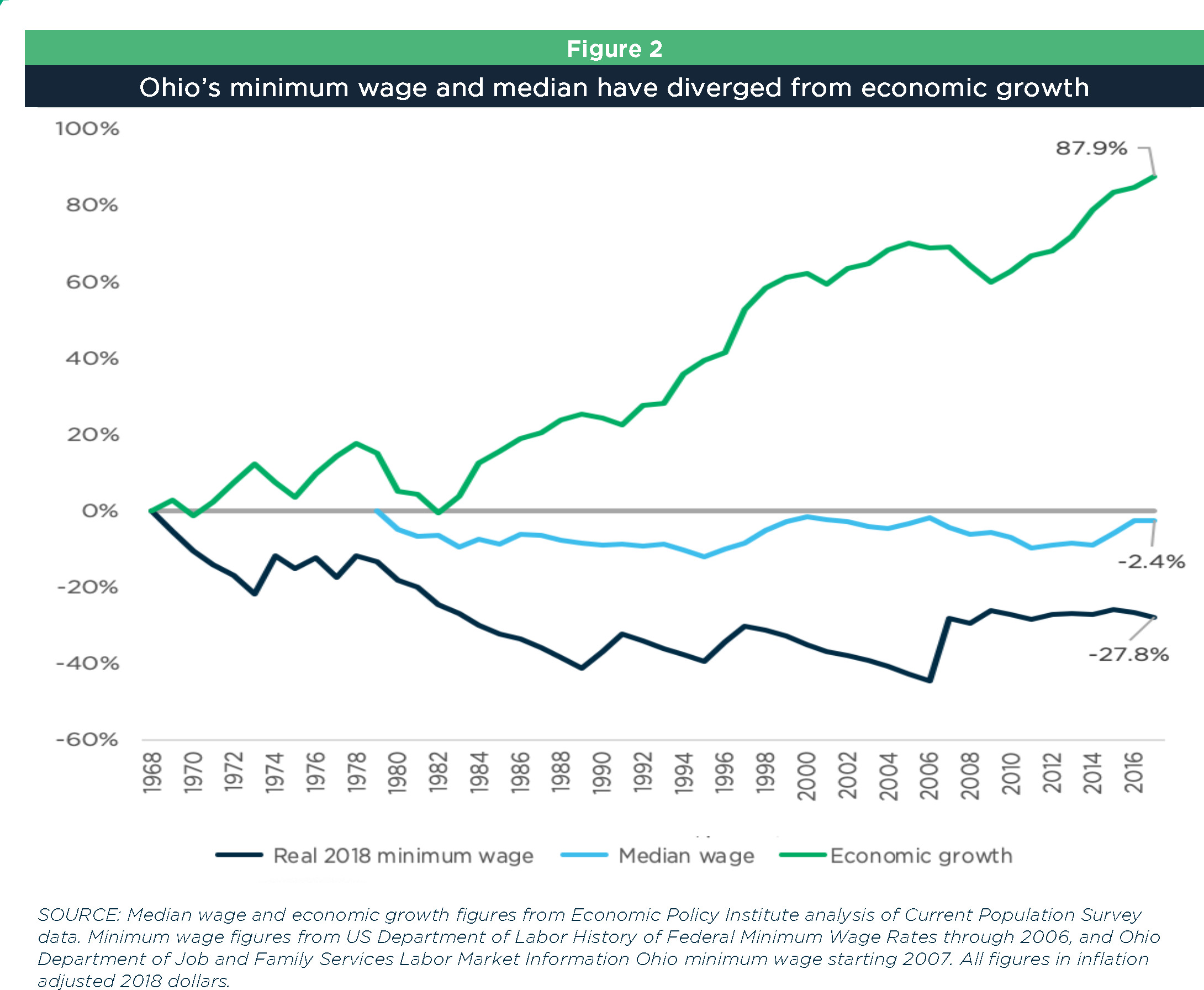

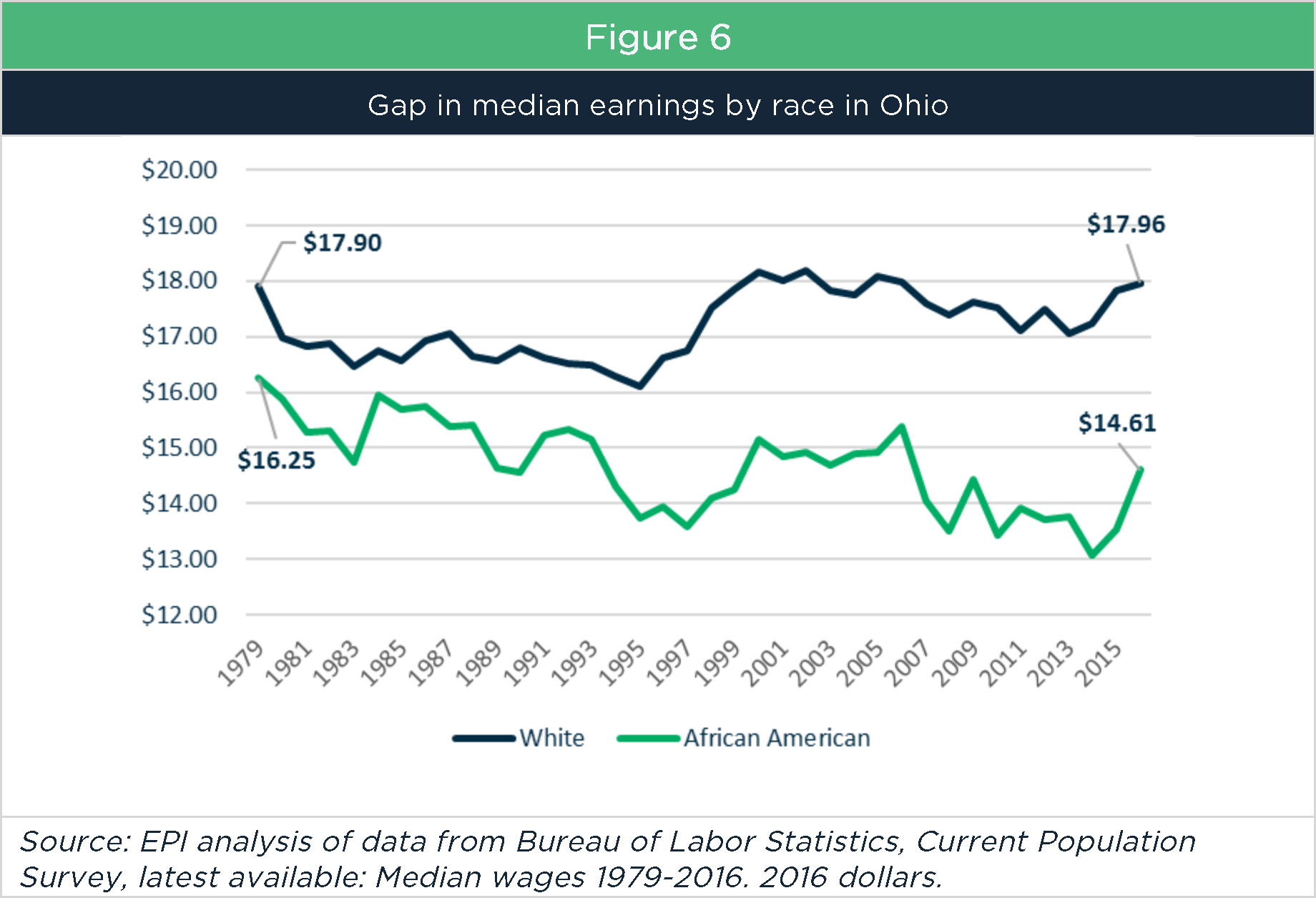

15 Minimum Wage Would Improve Incomes Increase Equity

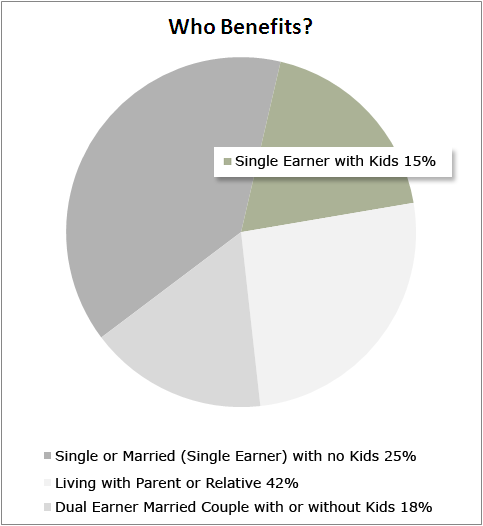

Raise The Wage Act Would Help 1 8 Million Ohioans Policy Matters Ohio July 18 2019

Minimum Wage Teen Unemployment Employment Policies Institute

State Minimum Wage Rate For Ohio 2022 Data 2023 Forecast 1968 2021 Historical

Minimum Wage Hike Would Boost Ohio Workers

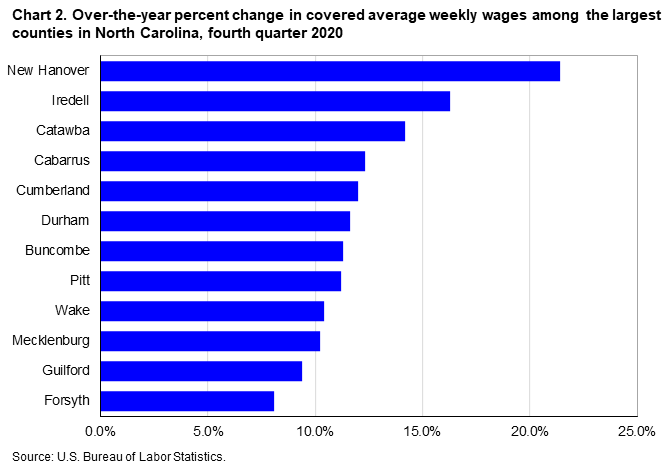

Minimum Wage Workers In North Carolina 2013 Southeast Information Office U S Bureau Of Labor Statistics

Ohio Unemployment Information Benefits Eligibility Etc Aboutunemployment Org

Percentage Of Low Wage Workers In The U S By Age 2020 Statista

Minimum Wage Hike Would Boost Ohio Workers

Unemployment Compensation Reforms Head To House

Unemployment Benefits Comparison By State Fileunemployment Org

15 Minimum Wage Would Improve Incomes Increase Equity

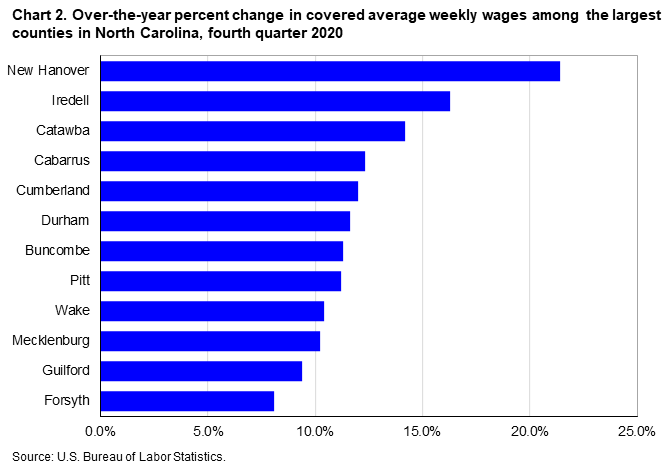

County Employment And Wages In North Carolina Fourth Quarter 2020 Southeast Information Office U S Bureau Of Labor Statistics

Program Explainer Special Minimum Benefit

No comments:

Post a Comment