FUTA requires that each states taxable wage base must at least equal the FUTA taxable wage base of 7000 per employee and most states have wage bases that exceed the. If you have to call the telephone claims center regarding your claim call 888-209-8124 during the hours of operation.

Nigeria Unemployment Rate Rises To Second Highest On Global List Bloomberg

FUTA Tax Rates and Taxable Wage Base Limit for 2021.

Nys unemployment 2021 limit. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. The study also discovered the following about New Yorks unemployment recovery. The MCTD includes New York City the counties of New York Manhattan Bronx Kings Brooklyn Queens Richmond Staten.

New Yorks unemployment rate between July and August fell from 76 to 74 and the economy added 28000 jobs in the private sector the state Department of Labor announced on Thursday. The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year. 9637 Change in Unemployment July 2021 vs July 2019 708641 unemployed people in July 2021 vs 360869 in July 2019.

After 2026 the wage base is permanently adjusted on January 1 of each year to 16 of the state average annual wage rounded up to the nearest 100. Calendar quarter if they are required to withhold New York State income tax from wages paid to employees and their payroll expense for all covered employees is more than 312500 for that calendar quarter. Year 2025 - 12800.

11 May 2021 0126 EDT. 9689 Change in Unemployment July 2021 vs January 2020 708641 unemployed people in July 2021 vs 359918 in January. Pay from a public employer earned January 1 2021 through June 24 2021 will not count toward a retirees annual earnings limit.

States that have decreased their wage bases are highlighted in blue. After that the maximum weekly benefit is 504. The state average annual wage is established no later than May 31 of each year.

That earnings limit suspension was in place from January 1 2021 through June 24 2021. 56 rows The higher the trust fund balance the lower the taxable wage base. If you live in a state that doesnt use a standard new employer rate you must wait for your state to assign you your starting rate.

New York is in the top 20 for the maximum amount of unemployment benefits paid out with up to 99 weeks of benefits are available under covid-19 relief. In case the employer starts a new business the states provide a standard new employer SUTA rate. The 150000 limit included benefits plus any other sources of income.

As a result employer tax payments grew between 26 and 160 in 2021. Unemployment insurance is taxable income and must be reported on your IRS federal income tax return. The FUTA tax rate protection for 2021 is 6 as per the IRS standards.

Your local state unemployment agency will send you form 1099-G to file with your tax return see due dates. The following are the 2021 state unemployment insurance SUI wage base limits. Following the Federal Unemployment Tax Act FUTA scheme state unemployment contributions taxes are determined by applying a certain percentage to the taxable wages paid by the employer.

On January 14 2021 New York State Department of Labor Commissioner Roberta Reardon ordered that employers UI accounts will not be charged for unemployment insurance UI benefits paid during much of the COVID-19 pandemic. The higher the trust fund balance the lower the taxable wage base. 2019 legislation HB 198 froze the taxable wage base at 16500 for 2020 under the bill language from July 1 2019 to October 29 2020 so that the Division of Unemployment Insurance and the Unemployment Compensation Advisory Council could determine whether the formula used to.

The wage base limit is the maximum threshold for which the SUTA taxes can be withheld. PUBLISHED 1232 PM EDT Sep. This form is sent in late.

New executive orders again suspended the limit from September 27 2021 through January 25 2022. States that have increased their wage bases are highlighted in brown. State Wage Base Alabama 8000 Alaska 43600.

Restrictions on public gatherings and businesses largely ended in June providing a snapshot for how businesses and job seekers are potentially reacting to the changes. This rate will again change as the business grows depending on the number of unemployment claims made to the state by workers who lose their jobs. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

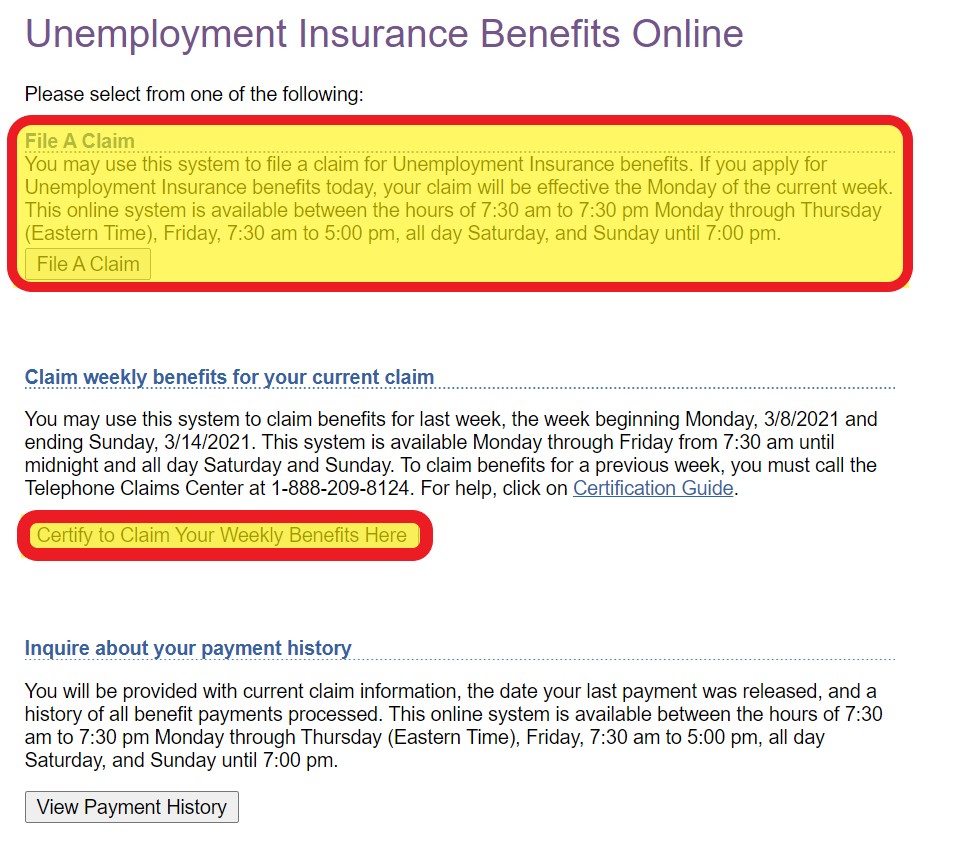

Given the current negative balance in the state unemployment trust fund 2021 UI rates for New York employers increased to a range of 21 to 99 of taxable payroll up from 2020 rates that ranged from 06 to 79. If you need interpretation services call Telephone Claims Center. Year 2026 - 13000.

The 2021 New York state unemployment insurance SUI tax rates range from 2025 to 9826 up from 0525 to 7825 for 2020. All contributory employers continue to pay an additional 0075 Re-employment Services Fund surcharge. Monday through Friday 8 am to 730 pm Saturday and Sunday 730 am to 800 pm.

For example all new employers receive a SUTA rate of 125 in Nebraska and all new construction employers receive a SUTA rate of 54 in 2021. The maximum unemployment benefit you can get in New York is 804 a week through September 6 2021. 5th worst recovery in the US.

The new employer rate for 2021 increased to 4025 up from 3125 for 2020. This includes the federally funded enhanced extended benefits PUA PEUC and 300 FPUC provided in 2020 and 2021. The first 7000 for each employee will be the taxable wage base limit for FUTA.

How much unemployment benefits can I get in North Carolina. Ask for New York State Unemployment Insurance assistance. New Yorks jobless rate has struggled to return back to its pre-pandemic level however when it stood at 37 in February 2020.

Subsequently former Governor Cuomo signed legislation that further ensured the relief to employers of UI. States who havent released their SUI wage base limits for 2021 are bolded in black. The national unemployment rate was 59 in June.

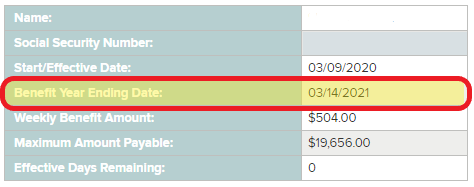

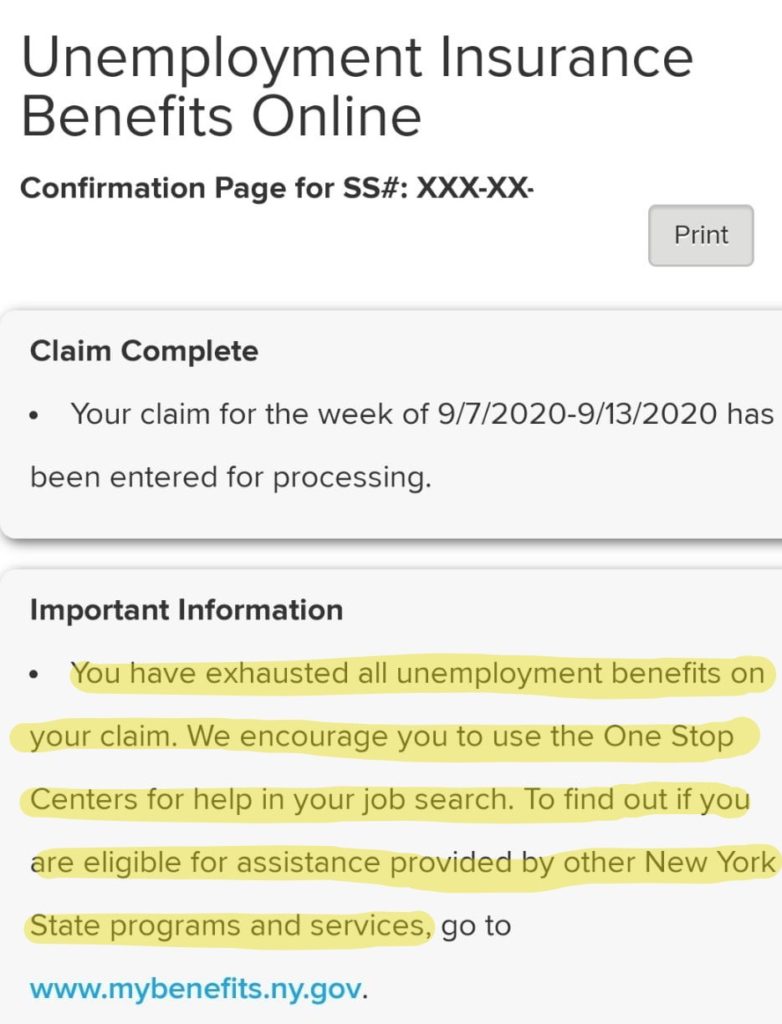

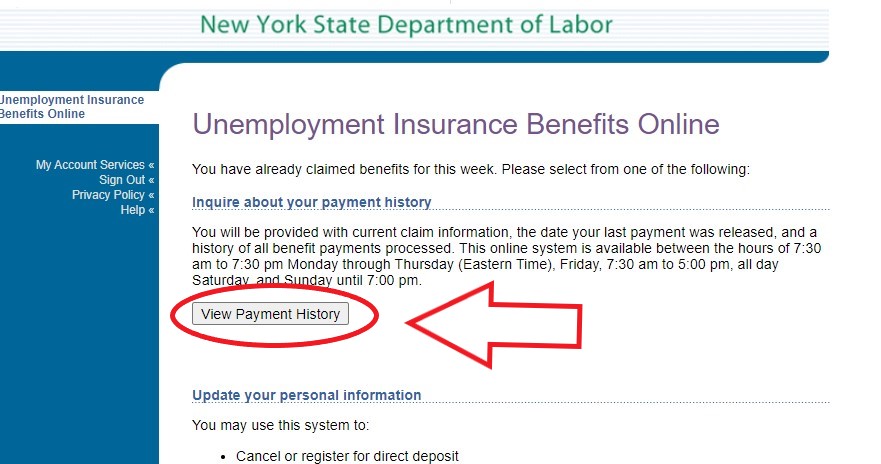

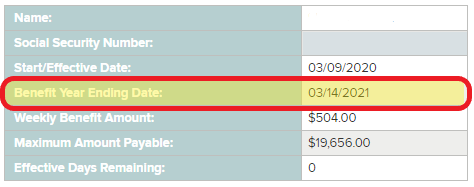

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Dinapoli Unemployment Taxes On Employers Poised To Increase To Repay 9b Owed To Federal Government Office Of The New York State Comptroller

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

How Much Unemployment Benefits Will I Get In New York As Com

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Will New York Tax Unemployment Payments We Still Don T Know Syracuse Com

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Benefit Extension Information Department Of Labor

New York Ny Dol Unemployment Insurance Compensation After End Of Pandemic Programs What You Can Get In 2022 And Claiming Retroactive Payments News And Updates Aving To Invest

Unemployment Benefits Comparison By State Fileunemployment Org

Information For Department Of Labor Employees Department Of Labor

No comments:

Post a Comment