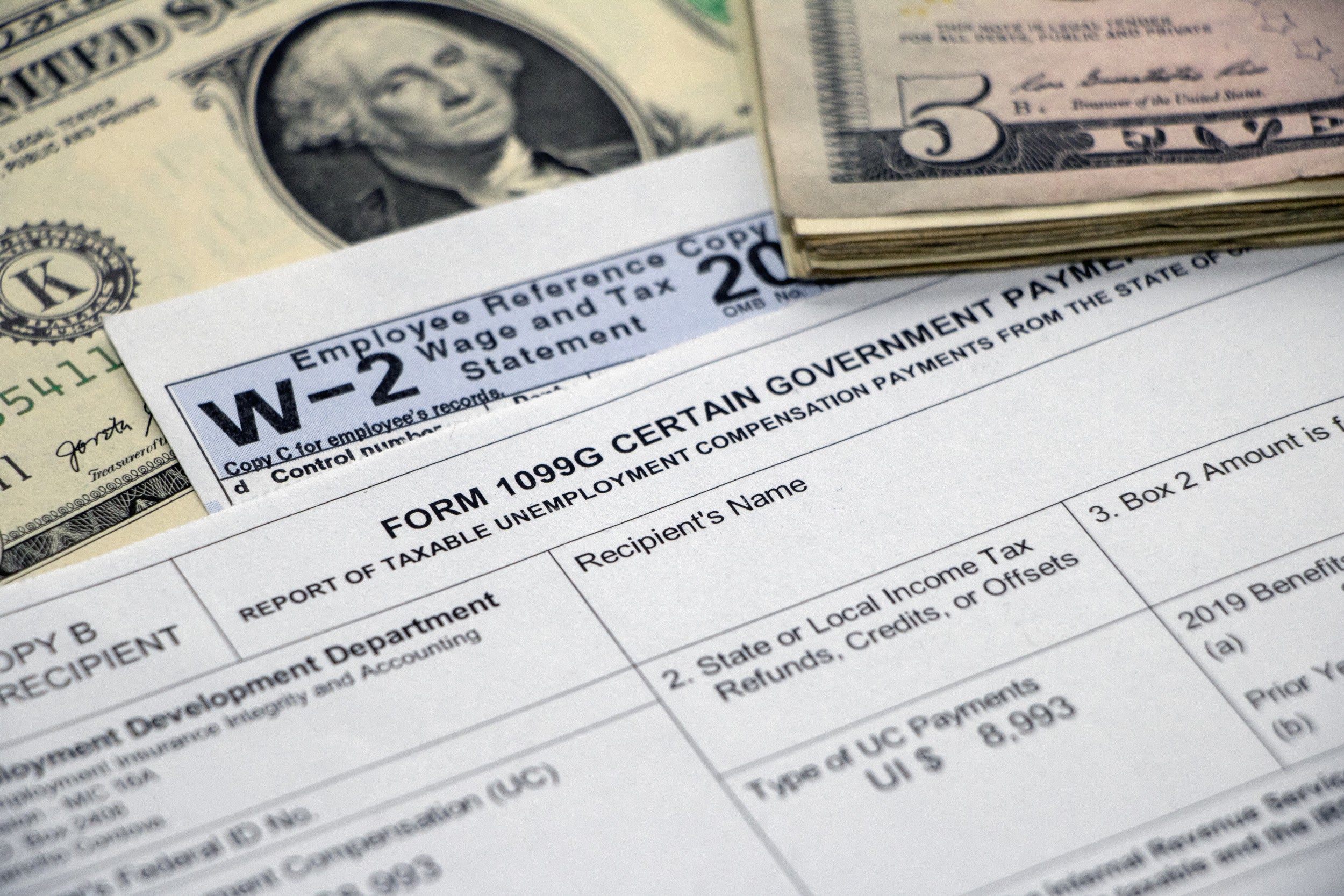

The American Rescue Plan a 19 trillion Covid relief bill waived federal tax on up to 10200 of jobless benefits per person. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income.

Unemployment And Withholding Taxes Homeunemployed Com

While married couples filing jointly could exclude up to 20400 of unemployment benefits from their earnings.

Nys unemployment 10200. The exclusion affects many areas of the return including earned income credit allowable IRA deductions etc. An act to amend the tax law in relation to excluding from state income tax unemployment. Amd 612 Tax L.

New Exclusion of up to 10200 of Unemployment Compensation If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. Excludes from state income tax up to 10200 of unemployment compensation benefits earned by a resident of the state. NYS Budget Director says unemployed New Yorkers still have to pay state taxes on the first 10200 in unemployment benefits collected.

The remaining states partially or. Is the exclusion for unemployment benefits of 10200 also excluded on the state returns in particular New York State. New York taxpayers can still exclude the first 10200 in unemployment payments they received in 2020 from their federal taxes but they.

WENY 474 Old Ithaca Rd. If your modified AGI is 150000 or more you cant exclude any unemployment compensation. Does this exclusion also apply to New York State.

However State Budget Director Robert Mujica announced the state. Its outrageous that the governor and Democratic Legislative Majorities are giving 21 billion in so-called unemployment assistance to those in New York state illegally and working illegally but not one cent to match the 10200 tax break for jobless New York citizens that the federal government has given Senator Jim Tedisco said. OMara calls for income tax break for unemployed New Yorkers.

If you exclude unemployment compensation on your 2020 federal return as allowed under the American Rescue Plan Act of 2021 you must add back the excluded unemployment compensation on your 2020 New York State return. FELDER TITLE OF BILL. 4221 - As a result of a recent state law change taxpayers with household income not more than 200 of the federal poverty level may deduct up to 10200 of unemployment benefits from their taxable income on their 2020 and 2021 tax returns for each eligible individual.

The impact is worse in. S5125 - Sponsor Memo. New York News.

Unemployment Benefit 10200 not exempt in NYSSo I was told by my CPA that unemployment benefit of up to 10200 will not be exempt in NY state although federal level said itll be exempt. New York Question I know the IRS is working with online tax dos to automatically implement forms for the 10200 tax exemption To confirm has there been any updates. Seeks immediate approval of legislation excluding 10200 in unemployment benefits as well an overhaul of the states unemployment system.

People whose adjusted gross income was less than 150000 can exclude up to 10200 of unemployment benefits from taxes in 2020. ALBANY NY NEWS10 Not every state taxes unemployment but now that the federal government says the first 10200 of benefits will be tax-free New York is one of the few. The 19 trillion coronavirus relief bill passed by Democrats in March created an exemption for 10200 in jobless payments from federal income tax for households earning up to 150000.

State NOT following the feds and waiving that. Without an exemption someone who received 10200 in unemployment compensation as part of their taxable income would be forced to pay an incremental 653 in state taxes. It gives a federal tax break on up to.

Horseheads NY 14845-7212 All Rights Reserved. The federal American Rescue Plan Act of 2021 includes a provision that allows individuals to exclude up to 10200 of unemployment compensation from federal tax. Is this only a federal adjustment or does it affect each state.

President Joe Biden signed the American Rescue Plan a 19 trillion Covid relief bill a month into tax season. Unlike IRS NY will still tax first 10200 of unemployment benefits. Use the Unemployment Compensation Exclusion Worksheet to figure your modified AGI and the amount to exclude.

New York will continue to apply state income tax to 2020 unemployment benefits in. For more information on this site please read our Privacy Policy Terms of Service and Ad Choices. The 15200 excluded from income is all of the 5000 unemployment compensation paid to your spouse plus 10200 of the 20000 paid to you.

Update Tedisco Move Nys Tax Deadline To May 17th Ny State Senate

Felder Demands Tax Relief Again Ny State Senate

New York State Income Allocation

New York State New York Resident Income Shows Fe

Unlike Irs Ny Will Still Tax First 10 200 Of Unemployment Benefits R Nyc

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Turbotax 2020 Deducting Federal 10 200 Unemploymen

Re State Unemployment Ny And Exclusion

Don T Tax The Jobless New York Must Return Cash To Those Who Received Pandemic Enhanced Unemployment Aid New York Daily News

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Re State Unemployment Ny And Exclusion

Solved Will Nys Waive Taxes On Unemployment Income

Your State May Not Offer Biden S Unemployment Tax Break Here S What You Need To Know

New York State New York Resident Income Shows Fe

No comments:

Post a Comment