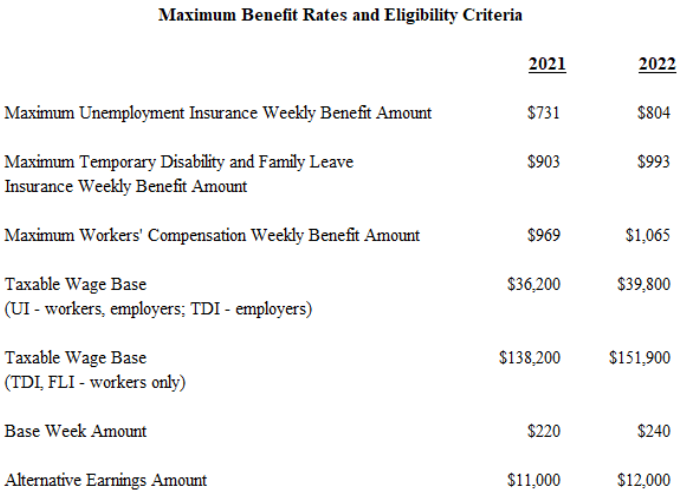

New Jerseys wage bases for the unemployment insurance temporary disability insurance and family leave insurance programs are to increase in 2021 the state Department of Labor and Workforce Development said Aug. 2021 Maximum Unemployment Insurance weekly benefits rate.

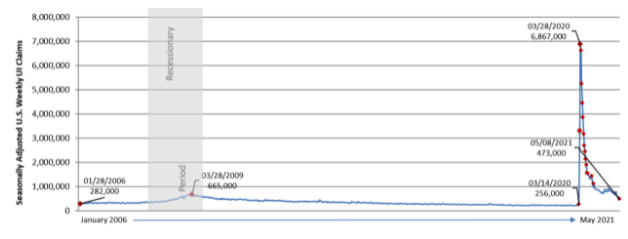

How Severely Will Covid 19 Impact Sui Tax Rates Workforce Wise Blog

Employers for 2021 the wage base increases to 36200 for nt unemployme insurance disability insurance and workforce development.

Nj unemployment withholding rate 2021. Federal Unemployment Tax Act FUTA. On March 25 2021. This was the case for NJ for FY2020.

52 rows New Jersey 28 including the Workforce Development and. 6876 X 8 55008. Do not subtract the biweekly Federal Thrift Savings Plan contribution.

The new employer rate remains at 28 for FY 2022. NJ Withholding Tax based on Marital Status number of allowances claimed on State of NJ W4. The unemployment-taxable wage base is to be 36200 for employers and for employees up from 35300 in 2020 the department.

Ohio 9000 9000 Oklahoma. The tax rate is 6 but states can apply an unemployment tax credit of up to 54 when they have no federal loans outstanding meaning employers might only pay 06. The employee withholding UC tax rate for 2021 will remain at 06 0006.

For employers for 2021 the wage base increases to 36200 for unemployment insurance disability insurance and workforce development. FUA is funded by federal unemployment tax rates on the first 7000 employers pay to each employee. Employee withholding is not limited to the 10000 taxable wage base.

634 Disability Insurance Tax NJ. Employees unemployment and workforce develop-ment wage base increase to 36200 maximum withholding 15385. Document provides guidance on 2021 withholding rates for Unemployment Insurance.

Supplemental Workforce Administrative Fund NJ SWAF. 764 x 9 to account for 10 withholding 6876 weekly payment after withholding. New Jersey Temporary Disability TDI Family Leave Insurance FLI Taxes.

As of January 1 the maximum. A n exclusive NJBIA members-only benefit the Fast Facts document provides guidance on 2021 withholding rates for Unemployment Insurance New Jersey. If you received Unemployment Insurance Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC or Extended Benefits EB you may have chosen to withhold 10 of your benefits for tax purposes.

New Jersey Unemployment Tax. New Jersey new employer rate includes. IMPORTANT INFORMATION FOR TAX YEAR 2021.

13 rows Additional Medicare add on if pay is over 200000 single 250000 married 0009. My wife disclosed that information during the unemployment interview that occurred on March 12th. As we reported the fiscal year 2022 July 1 2021 to June 30 2022 SUI tax rates increased to range from 05 to 58 on Rate Schedule C up from a range of 04 to 54 on Rate Schedule B for FY 2021 July 1 2020 to June 30 2021.

Employee SUI withholding rate is 0425 on wages up to 36200. Withholding Formula New Jersey Effective 2021 Subtract the nontaxable biweekly non-Federal 401k contribution from the gross biweekly wages to obtain the adjusted gross biweekly wages. New Jersey Income Tax Income tax must be withheld according to the tables which you should have received from the State of New Jersey.

For calendar year 2021 the maximum unemployment insurance temporary disability insurance and workers compensation benefit rates the alternative earnings and base week amounts and the taxable wage base are listed below. The new law increases the Gross Income Tax rate for income between 1 million and 5 million and provides a new withholding rate for the remainder of 2020. New Jersey employers face several changes affecting tax withholding rates and taxable wage bases in the year ahead and NJBIA breaks them all down in a recently released Fast Fact employers guide.

It applies to the total wages paid in 2021. You must withhold New Jersey tax from compensation paid to nonresident employees working in New Jersey. State unemployment tax assessment SUTA is b.

Jerseys Fiscal Year 2021 budget. Effective January 1 2020 the tax rate on that income bracket increases from 897 to 1075 regardless of filing status. The employee Unemployment Insurance tax rate remains at 03825 003825 of taxable payroll.

Use these to estimate the amount of withholding that will occur if you choose to use the wage chart. New Jersey Temporary Disability TDI. 2021 Maximum Workers Compensation weekly benefit rate.

Weekly benefits have also been adjusted in 2021 for Workers Compensation Unemployment. New Jersey 36200. And FICA and Medicare.

The wage base is computed separately for employers and employees. 13847 Workforce Development Partnership Fund. The contribution rate for state and local government entities that choose to make contributions rather than reimburse the trust fund for Unemployment Insurance benefits paid to their former employees remains at 06 percent of taxable wages for calendar year 2022.

New Jersey Unemployment Tax. Unemployment Insurance Tax NJ Unempl EE. Employees unemployment and workforce development wage base increase to 36200 maximum.

The wage base is computed parately se for employers For and employees. New Jersey and Pennsylvania Reciprocal Agreement New Jersey and Pennsylvania have a. If a nonresident employee works inside and outside New Jersey only the compensation paid for work performed in New Jersey is subject to New Jersey withholding.

03825 Unemployment Compensation Fund and 00425 Workforce Development Fund for 2021. For 2021 employees are subject to a 00425 000425 Workforce DevelopmentSupplemental Workforce Funds tax rate the same as 2020. Regarding the timeline she found a new job and started working at the beginning of March.

As of January 1 2021 the minimum wage in New Jersey rose to 12hour for most employees. EY Tax Alert 2021-1582 8-30-2021 The fiscal year 2022 tax rates continue.

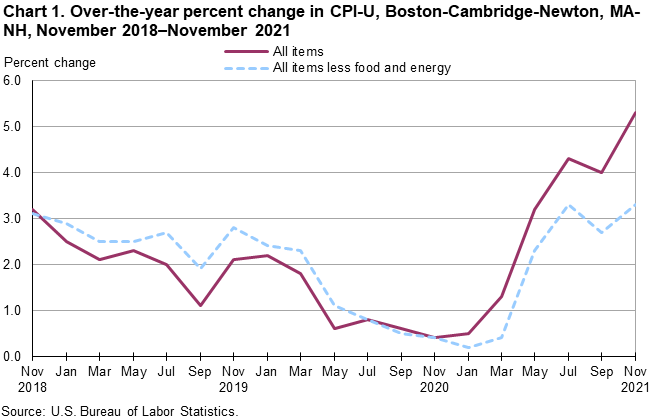

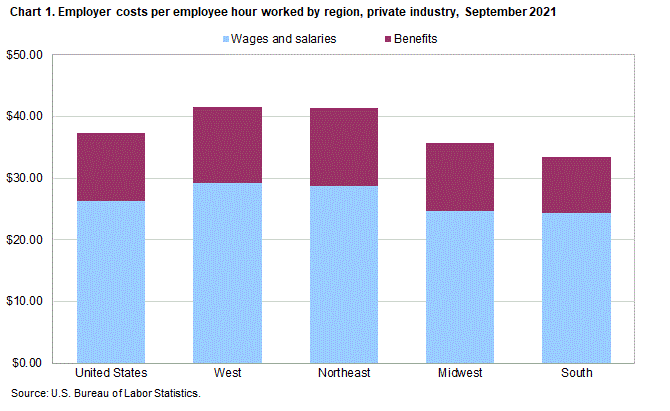

Consumer Price Index Boston Cambridge Newton November 2021 New England Information Office U S Bureau Of Labor Statistics

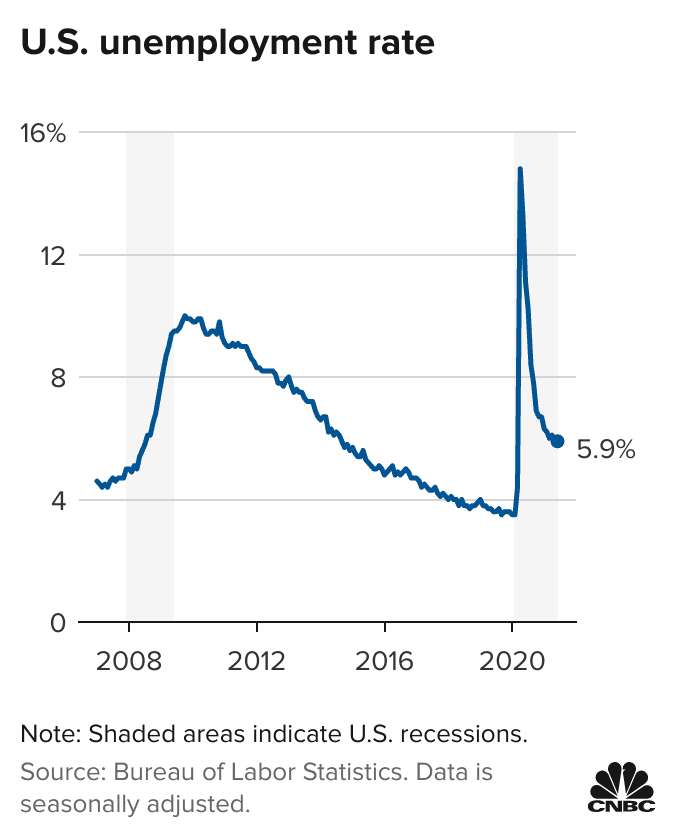

Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

Zip Code 19342 Profile Map And Demographics Updated March 2020 Coding Demographics Map

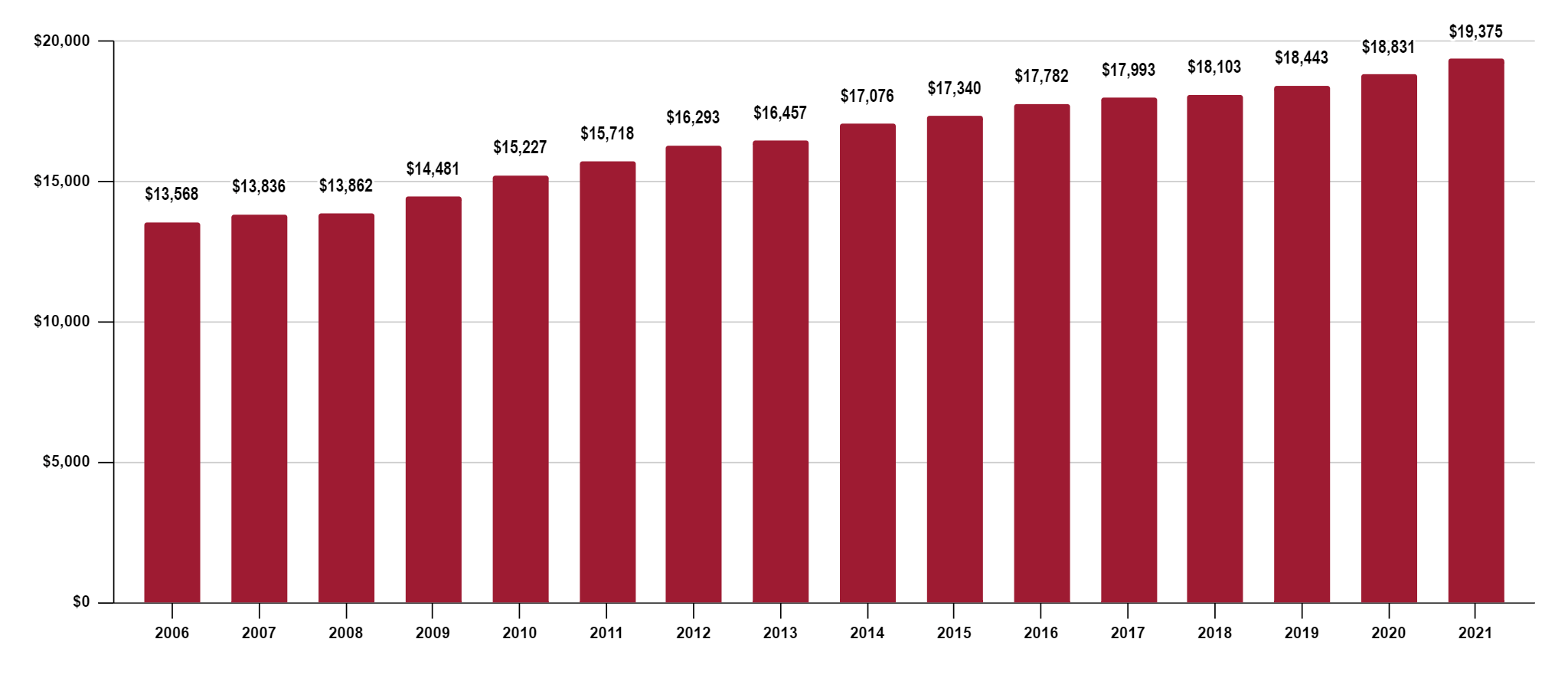

Wages Are Rising But Inflation May Have Given Workers A 2 Pay Cut

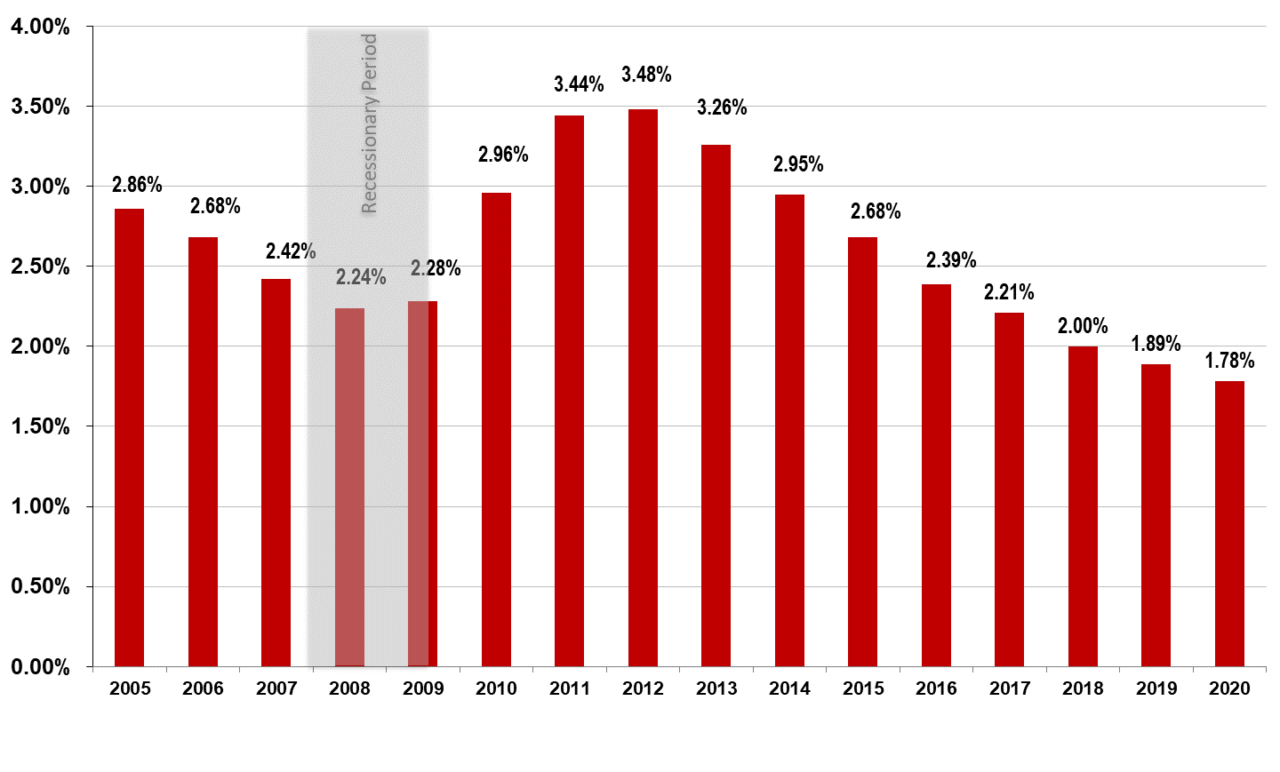

How Severely Will Covid 19 Impact Sui Tax Rates Workforce Wise Blog

How Severely Will Covid 19 Impact Sui Tax Rates Workforce Wise Blog

2022 Federal Payroll Tax Rates Abacus Payroll

Employer Costs For Employee Compensation For The Regions September 2021 Southwest Information Office U S Bureau Of Labor Statistics

Foreclosure Rate U S 2020 Statista

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

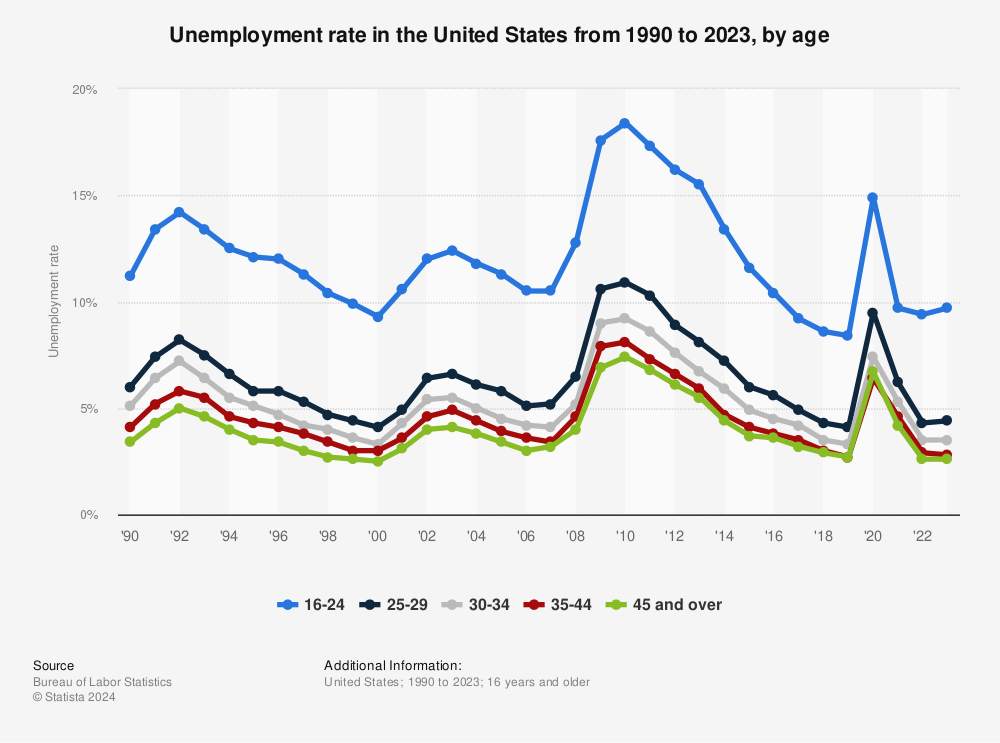

U S Unemployment Rate By Age Statista

2021 New Jersey Payroll Tax Rates Abacus Payroll

No comments:

Post a Comment