New Jersey defends its handling of unemployment matters. The withholding tax rates for 2021 reflect graduated rates from 15 to 118.

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

What is the maximum unemployment benefit for New Jersey.

Nj unemployment maximum. The maximum anyone can receive regardless of how many weeks they worked during the base year or how much they earned is 26 times the maximum weekly benefit rate. For PUAPEUC recipients the balance represents the maximum that was available for weeks of unemployment before 9421. The maximum New Jersey unemployment amount in 2020 is 713.

In your base period you must have 20 weeks where you earned gross wages totaling at least 10000. I have no idea if New Jersey even allows this and if your wife was doing this but most people do have the state withhold 10 for tax withholding purposes. The effective rate per hour for 2021 is 1200 effective 01012021.

Regarding the timeline she found a new job and started working at the beginning of. 6876 X 8 55008. A base week is defined as one where you earned at least 200.

The unemployment rate did tick down from 72 to 71 but the gap to the national rate widened even more to a yawning 23 percentage points observed Dr. Your base period will be. Note the table below contains the the maximum regular.

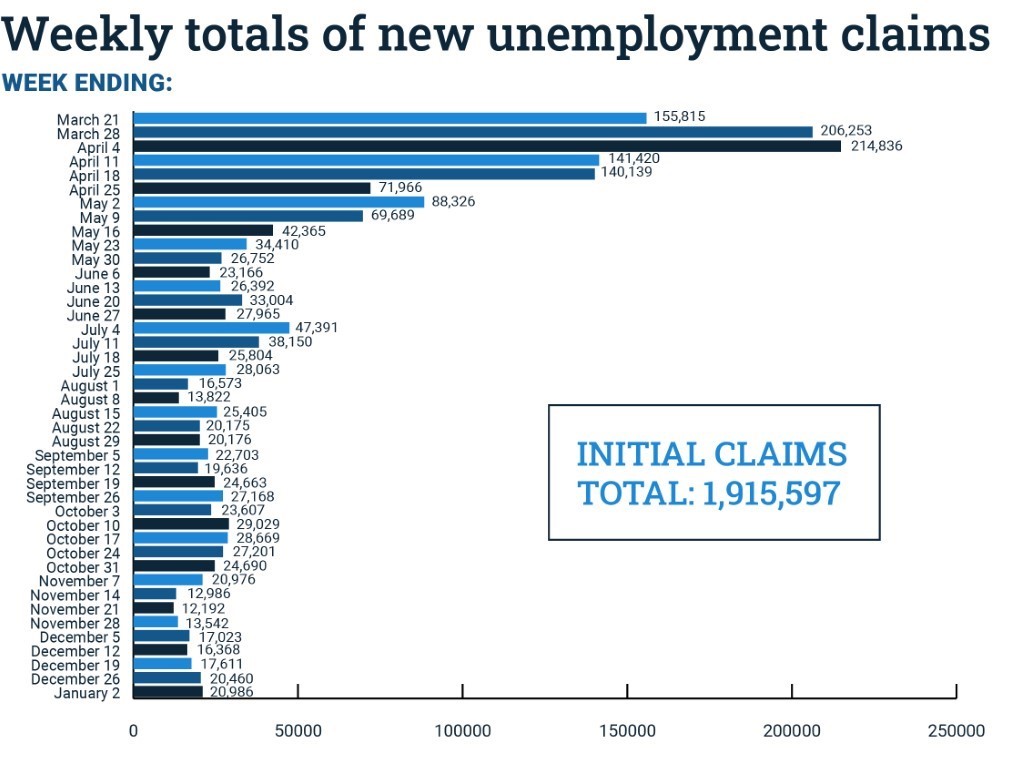

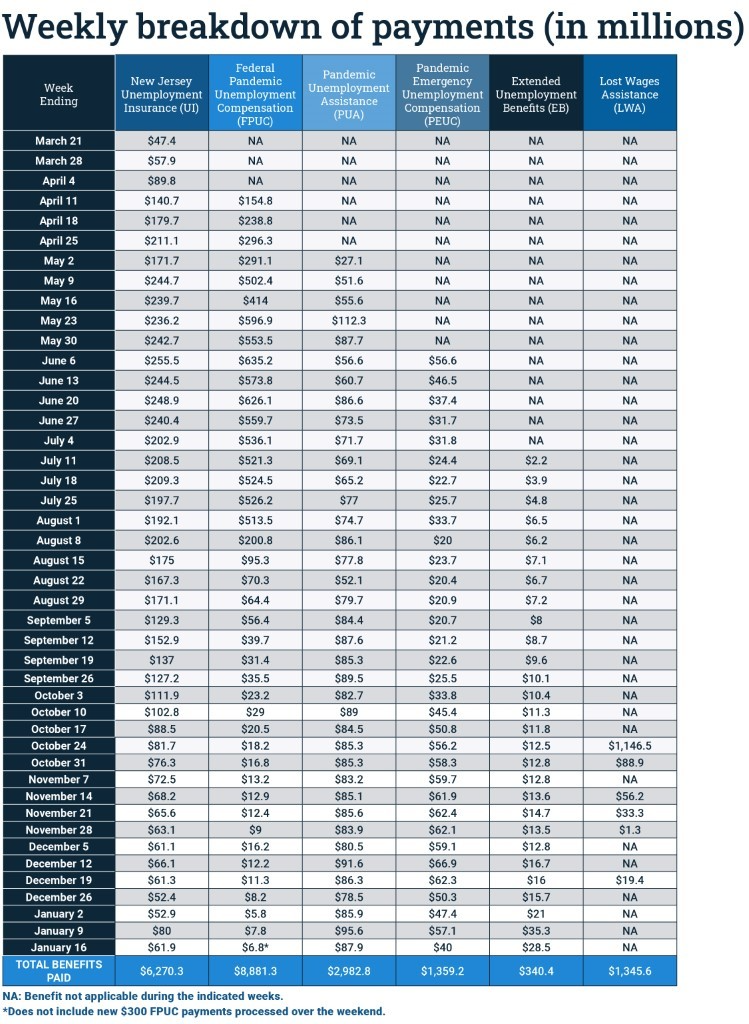

Amount and Duration of Unemployment Benefits in New Jersey. New Jersey weekly unemployment benefits are 60 of the average weekly earnings up to a maximum of 600 per week. In roughly 22 months the Labor Department has paid 36 billion to about 15 million claimants said spokeswoman Angela Delli-Santi.

New Jerseys unemployment rate 71 is now Americas 3rd highest. New Jerseys unemployment rate is now the second highest in the nation at 7 compared to the national rate of 46 according to federal data released Friday. If you are eligible to receive unemployment your weekly benefit rate WBR will be 60 of your average weekly earnings during the base period up to a maximum of 713.

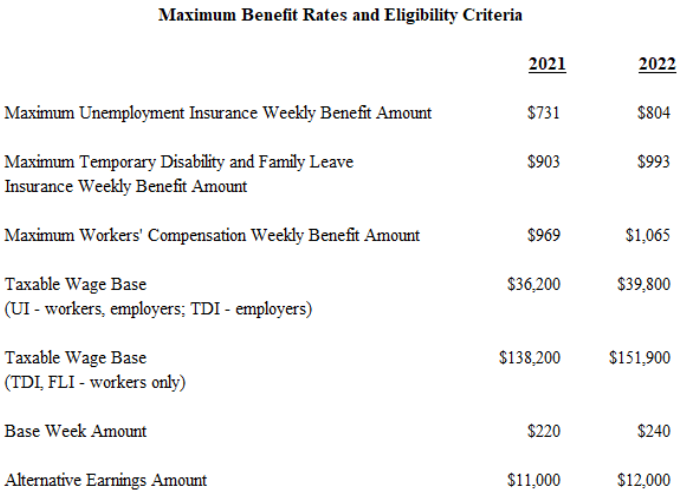

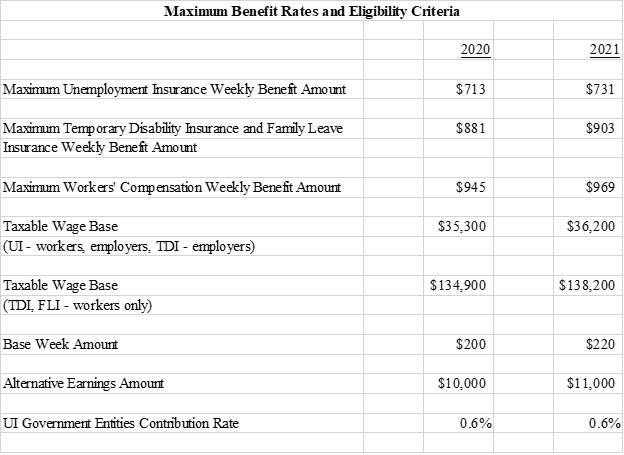

As of January 1 the maximum weekly benefit amount for Unemployment Insurance beneficiaries increase s to 7 31 from 713. Auxiliary aids and services are available upon request to assist individuals with disabilities. In 2018 the maximum weekly benefit amount is 68100.

In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731 the New Jersey Department of Labor Workforce Development NJDOL said. In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731. The maximum weekly benefit for state plan Temporary Disability and Family Leave Insurance claims increase s to 903 from 881 while the maximum weekly benefit for Workers Compensation rises to 9 69 from 9 45.

Click to read more on New Jerseys minimum wage increase. File a Claim in New Jersey. Yet thanks to an unprecedented influx of government assistance during the pandemic total personal income in the state is up 34 since the end of 2019 according to an analysis released by the Pew Charitable Trusts in November.

Bureau of Labor and Statistics New Jersey has an unemployment rate of 7 the third-highest in America behind only California and Nevada. According to the US. A claimant can collect a maximum of 26 weeks of benefits on a regular unemployment claim.

The maximum weekly amount is recalculated annually and is equal to 56 23 percent of the statewide average weekly wage. The New Jersey Department of Labor and Workforce Development is an equal employment opportunity employer and provides equal opportunity programs. The contribution rate for state and local government entities that choose to make contributions rather than reimburse the trust fund for Unemployment Insurance benefits paid to their former employees remains at 06 percent of taxable wages for calendar year 2022.

If your claim begins between these dates. 764 x 9 to account for 10 withholding 6876 weekly payment after withholding. Claimants who exhaust extended benefits will have received up to 88 weeks of unemployment a maximum of 26 weeks of regular state.

January 1 through March 31. Unemployment compensation benefits are administered by the New Jersey Department of Labor and Workforce Developments Division of Unemployment Insurance the state government agency that helps New Jersey job seekers and workers. Although the state relied on archaic systems and complex outdated benefit requirements the technology performed remarkably well she said.

December 9 2021. Charles Steindel former Chief Economist of the State of New Jersey in a Friday analysis for the Garden State. New Jersey Minimum Wage.

The following link will let you start the online process to file a claim for benefits. And while 81 of jobs have been recovered nationwide the Garden State lags at 71. Effective March 16 2020 all in-person unemployment insurance services at One-Stop Career Centers are temporarily suspendedCustomers needing to file for unemployment insurance are urged to apply online at MyUnemploymentnjgovIf you are unable to access the internet please call.

On Monday Murphy admitted that his draconian business lockdown contributed to the state leading in unemployment that was expected. The Unemployment compensation UC program is designed to provide benefits to most individuals out of work or in between jobs through no fault of their own. TRENTON Approximately 80000 New Jersey workers receiving extended unemployment Insurance UI are due to exhaust these state benefits in coming weeks as they reach the 13-week maximum.

This number is then multiplied by the number of weeks that you worked during the base period up to a maximum of 26. Right now the maximum total benefit amount any one claimant can receive during their annual claim period is 19006 731 x 26. New Jersey provides a maximum weekly benefit of 713 for up to 26 weeks.

As of January 1 2021 the minimum wage in New Jersey rose to 12hour for most employees. New Jerseys programrun by our Department of Labor and Workforce Development NJLWDprovides jobless workers with 60 of their average base pay on a weekly basis. New Jersey has the third highest unemployment rate in the nation according to the Bureau of Labor Statistics October data release.

New Jersey Gross Income Tax. The 118 tax rate applies to individuals with taxable income over 1000000. Whats the maximum amount of unemployment you can get in NJ.

What is the maximum weeks for unemployment benefits in NJ. Listed in the table below are the latest maximum weekly unemployment insurance benefitcompensation amounts by state.

New Jersey Unemployment Benefits Eligibility Claims

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Nj Unemployment 75 000 Residents To Start Receiving Thousands In Owed Benefits This Weekend Abc7 New York

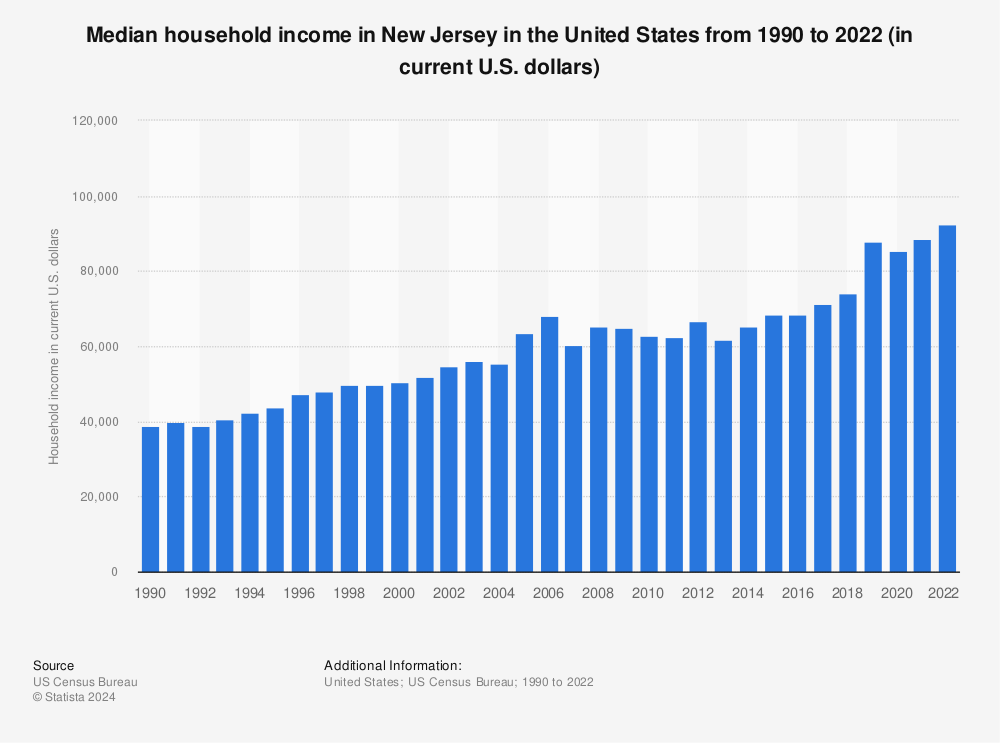

New Jersey Unemployment Rate 2020 Statista

300k Workers Move To N J S Unemployment Benefits After Federal Programs End New Jersey Monitor

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

Median Household Income In New Jersey 2020 Statista

New Jersey Ends Covid Unemployment Benefits The New York Times

Unemployment Rate In Morris County Nj Njmorr5urn Fred St Louis Fed

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Njdol Eligible Workers Set To Receive 300 Supplemental Unemployment Payments

Njdol Jobless Residents Receive New Stimulus Payments

Njdol Maximum Unemployment Benefit Rates Increase On January 1st

No comments:

Post a Comment