If you received unemployment benefits in 2020 you will receive Form 1099-G Certain Government Payments. If you received Unemployment Insurance benefits the New Jersey Department of Labor and Workforce Development LWD will provide you with Income Tax Form 1099-G Certain Government Payments.

Division Of Unemployment Insurance Information You Ll Need To Apply For Unemployment Insurance Benefits

The statements called 1099-G or Certain Government Payments are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Nj unemployment 2020 tax form. PEUC also increased unemployment benefits by 600 per week until July 31 2020. If you received unemployment benefits in 2020 you will receive Form 1099-G Certain Government Payments. Ad Access Any Form You Need.

You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for unemployment income you received in 2021. Beginning with tax year 2020 you must submit Form NJ-W-3 and all W-2 W-2-G 1099s and 10941095s electronically. 2020 Alternative earnings test amount for UI and TDI.

New Jersey Department of Labor Workforce Development website Fiscal year 2022 rate notices. The Internal Revenue Service IRS requires. New Jersey normally has 26 weeks of unemployment insurance.

Family Leave Insurance benefits. Fast Easy Secure. Hi I recieved unemployment for a of months in 2020.

However the form will no longer be automatically mailed. 2020 Maximum Temporary Disability Insurance weekly benefit rate from July 1 December 31. Fast Easy Secure.

2020 Taxable Wage Base TDI FLI workers only. Benefits to all states. You will not owe state income taxes on your New Jersey unemployment income for 2020.

Anyone who exhausted their benefits after July 1 2019 is eligible to receive 13 additional week of benefits. The full amount of your benefits should appear in box 1 of the form. We do not issue Form 1099-G for pensions or unemployment or family leave insurancefamily leave during unemploymentdisability during unemployment.

Tax form is asking for 1099 G form. The new employer rate remains at 28 for FY 2022. New Hire Reporting Requirements All employers in the states of New Jersey and Pennsylvania are required to report basic information about employees who are newly hired rehired and returning to work after separation of employment or leave of.

We provide the IRS with a copy of this information. 1099-G Tax Statement Available Online Only. Hi i live in New Jersey.

Form 1099-G Certain Government Payments is a report of income paid to you by a government agency. Family Leave During Unemployment Insurance benefits. Then Gladney received a corrected tax form reflecting the actual benefits she received in tax year 2020.

Form 1099-G Income Tax Statement showing the amount of Unemployment Insurance benefits paid and amount of federal income tax withheld will be in January following the calendar year in which you received benefits. I am assuming the 3000 will be on the 2021 1099-G. Because unemployment benefits are taxable any unemployment compensation received during the year must be reported on your federal tax return.

You need to log in to your account to download a 1099-G form for your 2020 tax return if you received any of the following benefits in 2020. EY Tax Alert 2021-1582 8-30-2021 The fiscal year 2022 tax rates continue to include the 01 Workforce Development Fund rate and the 00175 Supplemental Workforce Fund rate. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

Enter the Social Security number that appears first on your New Jersey Gross Income Tax return and the tax year you wish to view. New Jersey joins California Virginia Montana Oregon and Pennsylvania as states that dont place taxes on unemployment benefits even though they have state income taxes. The CARES Act extended it to 39.

Edit PDF Files on the Go. I dont know about the remaining. Will Will the govt send me a completed 1099-G form to turn in with my taxes or do I have to fill out a form of my own.

Disability During Unemployment Insurance benefits. Complete Edit or Print Your Forms Instantly. 2020 Base week amount.

Upload Edit Sign PDF Documents Online. Edit PDF Files on the Go. Ad Save Time Editing Documents.

And If I have to do my own. Upload Edit Sign PDF Documents Online. A 1099-G from the New Jersey Division of Taxation reflects in Box 2 the State taxes you overpaid through withholdings State tax payments or credits during the tax year which was then refunded to you.

2020 Taxable Wage Base UI and WFSWF - workers and employers TDI employers. Ad Save Time Editing Documents. No New Jersey does not collect taxes on money paid out from unemployment benefits.

You dont need to include a copy of the form with your income tax return. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

Power Of Attorney Revocable And Irrevocable Mukhtar Nama Qabal E Tans Power Of Attorney Attorneys Power

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

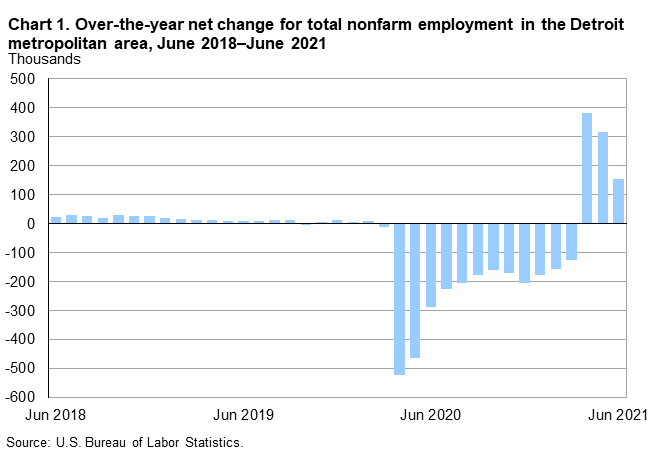

Detroit Area Employment June 2021 Midwest Information Office U S Bureau Of Labor Statistics

Zip Code 19342 Profile Map And Demographics Updated March 2020 Coding Demographics Map

Islamic Social Finance A Literature Review And Future Research Directions Emerald Insight

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Positive Mindset

1099 G Unemployment Compensation 1099g

Beware This Tax Pitfall If You Had Unemployment Income During Covid

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Positive Mindset

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Positive Mindset

No comments:

Post a Comment