If employee has 10000 in Medicare Employee wage base the amount collected should be 145 based on 145 rate. The standard FUTA tax rate is 60 on the first 7000 of taxable wages per employee which means that the maximum tax that you as an employer have to pay per employee for the 2022 tax year is.

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

HB 6136 would amend the law so that during declared states of emergency where businesses are forced to close the automatic increase in the taxable wage base would not apply.

Michigan unemployment taxable wage base 2022. Small business owners found themselves changing and adapting to every new thing that was thrown at them and. You would think by now they would update the limit. Never combine the UI rate and AFT rate when entering the UI rate in your software.

The AFT for all other employers is 018. Legislation passed in 2021 SB 89Act 91 requires that the taxable wage base remains at 7700 for 2022. Taxable Limit Bases.

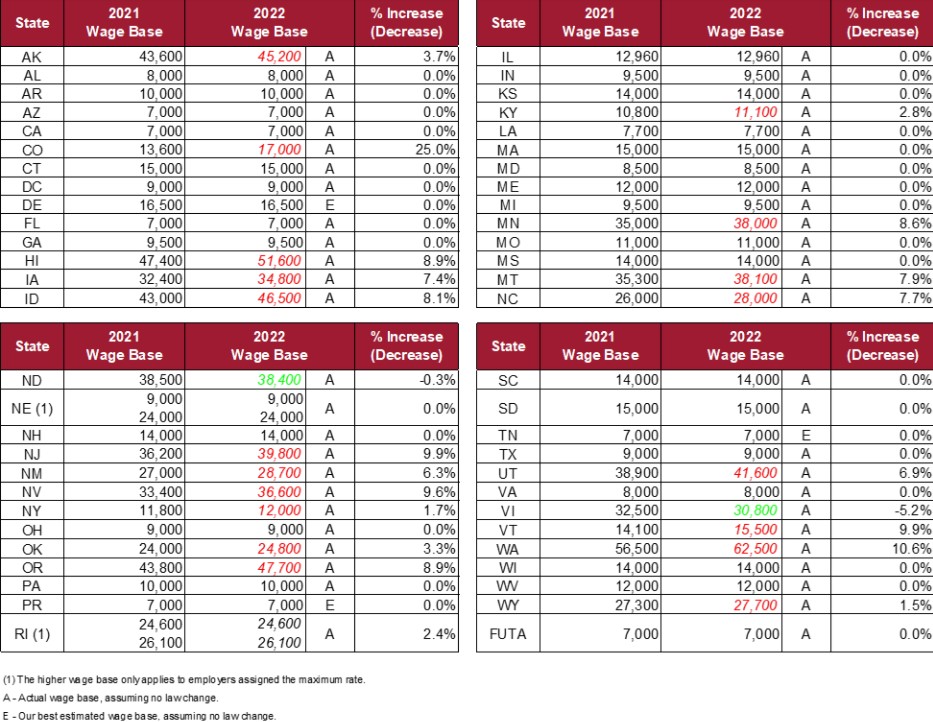

The 2022 taxable wage base will continue to be 15000 in 2022. Quickbooks is still showing 2520000. State Unemployment Taxable Wage Base.

1 2022 the unemployment-taxable wage base is to be 12960 the department said in a notice pertaining to. Rate 145 Additional Medicare tax 09 on wages in excess of 200000 Federal Unemployment Tax FUTA wage base 7000. 2022 RESERVE RATIO TABLE Your rate.

The maximum wages subject to New York unemployment tax will increase from 11800 to 12000 in 2022. From the report determine if you want to decrease or increase the wage base tax amount and income subject to tax and by what amount. 7000 x 6 420.

Rate 62 Medicare wage base unlimited. The Illinois unemployment-taxable wage base is not to change for 2022 the state Department of Employment Security said Nov. Michigans two-tiered unemployment-taxable wage base system is not in effect for 2021 a spokeswoman for the state Department of Labor and Economic Opportunity said Feb.

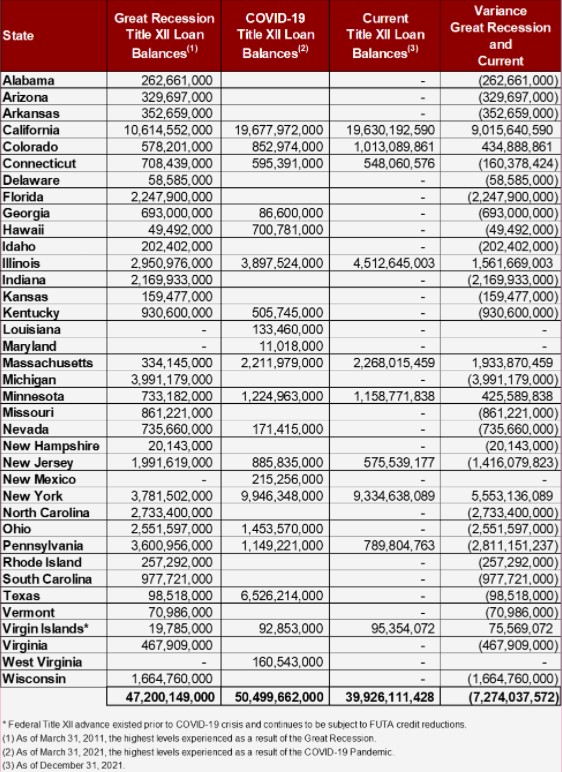

2022 Wage Base Limit 2021 Wage Base Limit 2020 Wage Base Limit State Agency Website and Phone Number. The taxable wage base is expected to continue to increase by 300 each calendar year until it reaches 12000. 5 Small Business Trends to Expect in 2022.

To access from the APA home page select Compliance and then State Unemployment Wage Bases under Overview The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA taxable wage base of 7000 per employee and most states have wage bases. The pandemic has definitely made its mark upon the world especially in the business world. The new employer tax rate will remain at 30.

10000 x 145 145. I am showing that the taxable wage base is 2600000 for 2021 not 2700000. Under current law this will trigger the increase of the taxable wage base to 9500 for 2021 and thus increase taxes on employers.

There will be changes to the minimum wage in many states in 2022. The taxable wage base will continue to increase as follows. The MES Act provides for a reduced taxable wage base if the UIA Trust Fund balance reaches or exceeds 25 B for two consecutive quarters.

The state has one wage base for 2021 it will be 9500 for all employers. What is the current taxable wage base. Locally the New Jersey minimum wage will increase from 1110 to 1190 for under five employees and for six or more employees it will increase to 1300.

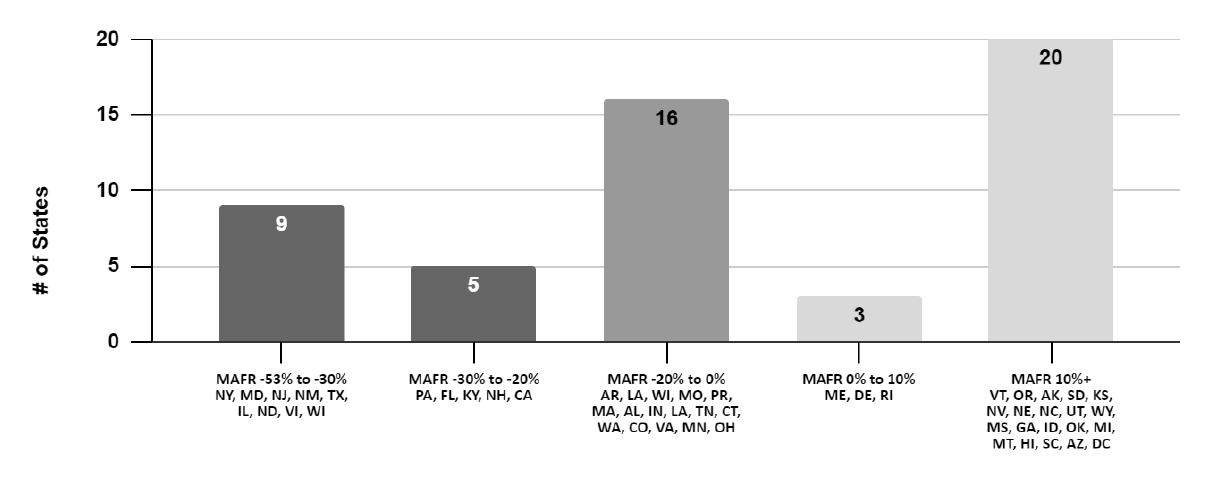

Taxable Wage Bases 2019 2022 State unemployment insurance taxes are based on a percentage of the taxable wages an employer pays. The taxable wage base is 9500. The reduced wage base for non-delinquent employers is not valid as the Michigan Unemployment Trust Fund has fallen below the required threshold.

Kinda ridiculous that they havent. In 2020 the standard unemployment-taxable wage base was 9000 and a modified taxable wage base of 9500 applied for. The minimum and maximum unemployment tax rates for experienced employers will continue to be 19 and 68 respectively.

Accounts reserve ratio wa s compared to the range of ratios below to determine the UI rate for 2022. The list of state wage bases is from 2019 to 2022. The unemployment-taxable wage base is 9500 for all employers.

The 2021 taxable wage base for employers in the highest SUI tax rate group is 26100. Unemployment tax rates generally are unchanged from 2020. For each year thereafter computed as 16 of the states average annual wage.

The Administrative Fund Tax AFT rate for Eligible class 1 and 2 employers is 013. Michigans Department of Labor and Economic Opportunity recently announced that all employers covered under the Michigan Employment Security MES Act will be assessed an unemployment tax on a wage base of 9500 for 2021. How to Apply for UI 877600-2722.

But I am also having the same issue. Legislation passed in 2021 SB 89Act 91 requires that the taxable wage base remains at 7700 for 2022. Rate 06 Iowa unemployment tax wage base 34800 You should have received a notice of your 2022 rate in early.

In 2020 legislation SB 55Act 40 provided that the SUI taxable wage base remained at 7700 for 2021. In 2020 legislation SB 55Act 40 provided that the SUI taxable wage base remained at 7700 for 2021. 2022 STATE WAGE BASES Updated 092921 2021 STATE WAGE BASES 2020 STATE WAGE BASES 2019 STATE WAGE BASES.

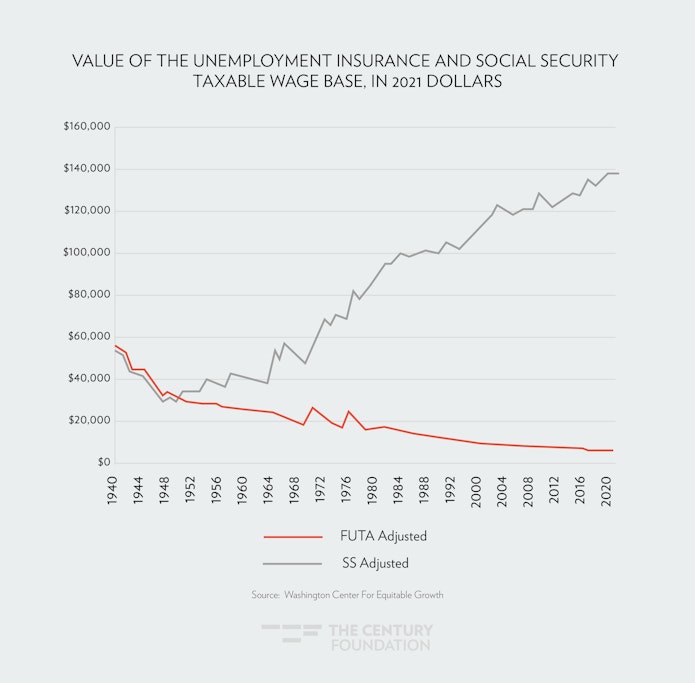

The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA wage base of 7000 per employee although most states wage bases exceed the required amount. In 2020 the Trust Fund balance fell below 25B therefore the 2021 taxable wage base is 9500.

Labor And Economic Opportunity December 2021

Michigan Taxable Wage Base Increases To 9 500

Increasing The Taxable Wage Base Unlocks The Door To Lasting Unemployment Insurance Reform

Amazon Com 2022 Michigan State And Federal Labor Laws Poster Osha Workplace Compliant 24 X 36 All In One Required Posting Laminated Office Products

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Increasing The Taxable Wage Base Unlocks The Door To Lasting Unemployment Insurance Reform

Labor And Economic Opportunity December 2021

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

2022 Federal Payroll Tax Rates Abacus Payroll

State Unemployment Insurance Taxable Wage Bases For 2022

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

No comments:

Post a Comment