For Internal Revenue Service Center. To enter your 1099-G for Unemployment.

I Am Filling Out The Information For My 1099 G Form Is Payer Name My Name Is The Address My Current Address Or The Address When I Collected Unemployment

Claimants have until Jan.

Michigan unemployment 1099 g 2021. On March 11 2021 The American Rescue Plan Act included a provision to exclude 10200 of unemployment compensation from taxable income if the taxpayers modified AGI was 150000 or less. So 80 for both fed and state. Your statement will be available to view or download by mid-January.

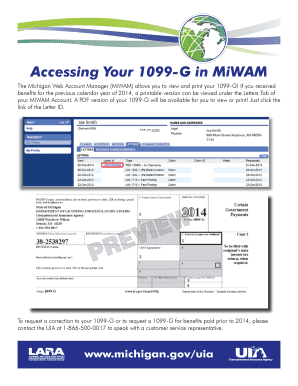

File with Form 1096. Click on the 1099-G link. You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section.

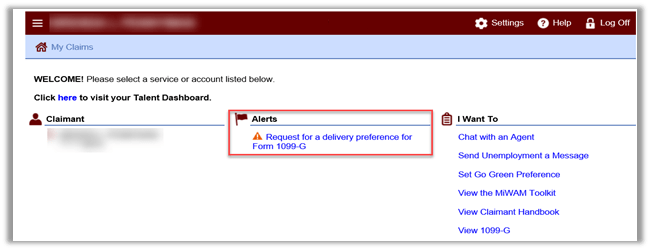

Go to Personal Income. For Privacy Act and Paperwork Reduction Act Notice see the. Go to the I Want To heading in MiWAM.

Self-posts and questions will be referred to this thread. Heres how to access it online. This year they have decided that anyone receiving a 1099-G aka unemployment cant use the free version and now has to pay 39 dollars per tax return.

Feel free to submit new and updated information as posts in rMichigan. The tax statements called 1099-G or Statement for Recipients of Unemployment Compensation Payments report how much each person received in unemployment benefits last year. I had taxes taken out.

You can follow the steps below to request your form. This may be different from the week of unemployment for which the benefits were paid. You can choose to receive your 1099-G through MiWAM or US.

Your statement will be available to view or download by mid-January. If you received unemployment benefits in 2021 you will receive Form 1099-G Certain Government Payments as proof of income. Click on the 1099-G link.

State of Michigan federal identification number used on the Substitute Form 1099-G. Department of the Treasury - Internal Revenue Service. UIA officials say any unemployment compensation must be reported on tax returns.

CBS Detroit Michiganders who received unemployment benefits this year have until Jan. I received a 1099-G for unemployment in Michigan. Each individual statement will be available to view or download by mid-January.

If you received unemployment benefits in 2020 you will receive Form 1099-G Certain Government Payments. If you received jobless benefits in 2021 you will receive Form 1099-G Certain Government Payments as proof of income. Claimants have until Jan.

Michigan recipients receiving unemployment benefits can choose the online option to receive tax form 1099-G CBS Detroit December 30 2021 Author top 0 CBS Detroit Michigan residents who have received unemployment benefits this year have until Jan. The statements are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld the past year. Find the Unemployment section Government benefits on Form 1099-G.

Minimum Wage Voting Audit Ballot Drives Advance In Michigan. December 29 2021 at 1035 pm. By January 31 2021 the Division will deliver the 1099-G for Calendar.

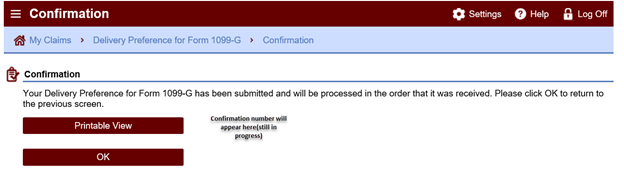

If you received benefits in 2021 you will receive Form 1099-G Certain Government. 2 2022 to request an electronic version of their 1099-G through the Michigan Web Account Manager MiWAM. If you do not select electronic you will automatically receive a paper copy by mail.

If you received jobless benefits in 2021 you will receive Form 1099-G Certain Government Payments as proof of income. 2 2022 to request an electronic copy of their 1099-G tax return according to the. 1099-G tax forms being sent to Michiganders who didnt file for unemployment Rod Meloni Reporter CFP Published.

1099-G tax form Michigan Unemployment Insurance Agency UIA unemployment benefits. Your statement will be available to view or download by mid-January. 2 2022 to request an electronic version of their 1099-G through the Michigan Web Account Manager MiWAM.

State unemployment divisions issue an IRS Form 1099-G to each individual who receives unemployment benefits during the year. They are just trying to capitalize on the fact that a huge portion of Americans received a. Unemployment and Paid Family Leave.

I am doing my federal taxes using a online - Answered by a verified Tax Professional. The 1099-G reflects Maryland UI benefit payment amounts that were issued within that calendar year. 2 2022 to request an electronic copy of their 1099-G tax form according to the Michigan Unemployment Insurance Agency.

Enter you information on the next screen. February 1 2021 821 PM Updated. 1099-Gs are required by law to be mailed by January 31st for the prior calendar year.

2021 General Instructions for Certain Information Returns. Health Officials Advise Surgical Masks Over Cloth To Protect Against Spread Of COVID-19. Claimants have until Jan.

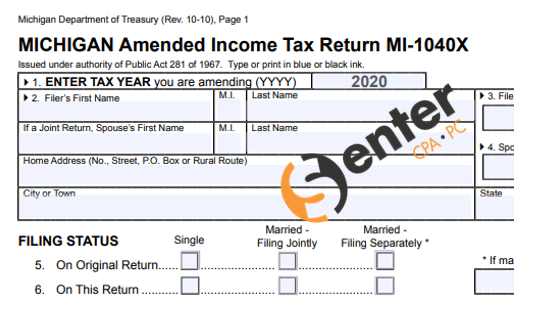

Click on the 1099-G letter for the 2021 tax year. On April 1st the State of Michigan notified taxpayers that they would be conforming to the Federal law and that those who filed a return that did not include this. You can choose to receive your 1099-G electronically through MiWAM or by US.

The Michigan Department of Labor and Economic Development will be mailing 1099 statements to anyone who received unemployment benefits in 2006 during the month of January. Click on the 1099-G. 2 2022 to request an electronic version of their 1099-G through the Michigan Web Account Manager MiWAM.

Heres how to access it online. On the form youll see the total amount of your compensation reported in Box 1. To receive your 1099-G electronically you must request your delivery preference by January 9 2021.

Please note these posts are automatically generated every week. Click on the 1099-G link. If you received jobless benefits in 2021 you will receive Form 1099-G Certain Government Payments as proof of income.

UIA officials say any unemployment. If you received jobless benefits in 2021 you will receive Form 1099-G Certain Government Payments as proof of income. Click on the 1099-G letter for the 2021 tax year.

Applicants have until January 2 2022 to request an electronic version of their 1099-G through. If you received jobless benefits in 2021 you will receive Form 1099-G Certain Government Payments as proof of income. Claimants have until January 2 2022 to request an electronic version of their 1099-G through the Michigan Web Account Manager MiWAM.

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

1099 G Michigan Fill Online Printable Fillable Blank Pdffiller

How To Apply For Michigan Uia Mixed Earners Unemployment Compensation Meuc Program Michigan Unemployment Help Career Purgatory

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

Michigan Pua And Unemployment Help And Updates Photos Facebook

1099 Form Fileunemployment Org

Michigan Pua And Unemployment Help And Updates Posts Facebook

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Labor And Economic Opportunity How To Request Your 1099 G

1099 G Form Michigan Fill Online Printable Fillable Blank Pdffiller

Form 1099 Nec For Nonemployee Compensation H R Block

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/d1vhqlrjc8h82r.cloudfront.net/02-01-2021/t_097c9f3558714f239e0634ba3af11887_name_image.jpg)

No comments:

Post a Comment