However an S corporation will be subject to the CIT to the extent that it is a financial institution or insurance. Your personal return is filed using IRS for 1040.

Llc Michigan How To Start An Llc In Michigan Truic

See the Michigan Business Tax FAQ for details.

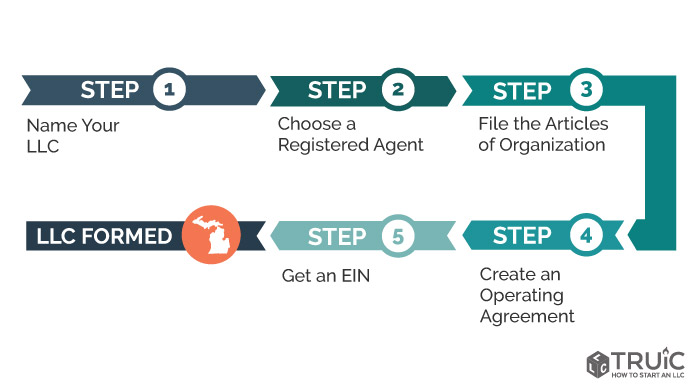

How to file s corp in michigan. Becoming a Michigan S-Corporation is a two-part process. There are five basic steps to start an LLC and elect S corp status. May be individuals certain trusts and estates and.

Determine your filing due date and fee. Submit your report and fees to the Michigan Department of Licensing and Regulatory Affairs LARA. Create an Operating Agreement.

Form 2553 electing special tax status must be filed with the IRS. Choose a Registered Agent. To start the filing process enter the CID and PIN number for the corporation.

Choose a Registered Agent. The first step to incorporating as an S Corp is to file your companys Articles of Incorporation with the state in which you are establishing your business. Filing IRS Form 966 lets the Federal Government know that the Michigan Corporation has been legally Dissolved.

Official documents must be filed with the state in order to form a Michigan corporation and state filing fees must be paid. How to File as a Michigan S Corporation. Instead the shareholders of S corporations have to report the flow-through of any income and loss on their personal tax returns and the tax is assessed at their individual income tax rate.

Instead of a social security number it has what is a called an employer tax identification number EIN. The filing fee is 15. If you do not have the CID or PIN please visit our CIDPIN Recovery Page to obtain that information.

The election is done by filing Form 2553 with the Internal Revenue Service. So when you file your. Include your corporations name and identification number on the check or money order.

The due date is May 15. Its necessary to find out if you need to file a separate S corporation election form. We will prepare IRS Form 966 for you to file.

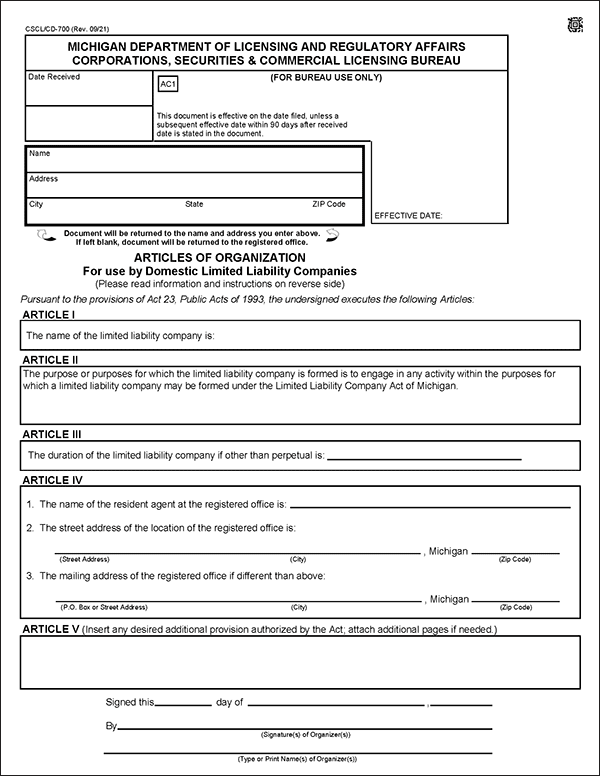

File the Articles of Organization. Submit one original amendment for filing. The Articles of Incorporation is a form that should be filed and maintained with the state of Michigan.

Create an Operating Agreement. Michigan requires corporations to file an annual report. These are the steps youll need to take in order to file your Michigan Annual Report.

To proceed with the Restoration go to. What Is a Michigan S-Corporation. Be a domestic corporation.

Get an EIN and File Form 2553 to Elect S Corp Tax Status. All Dissolved Michigan Corporations must file IRS Form 966 with the US Internal Revenue Service. For complete details on state taxes for Michigan corporations visit Business Owners Toolkit or the State of Michigan.

Get an EIN and File Form 2553 to Elect S Corp Tax Status. The name and address who will serve as the point of contact to the Michigan Secretary of State for all business related matters. The form you use to file an s-corp return is IRS form 1120-S.

To qualify for S corporation status the corporation must meet the following requirements. File the Articles of Organization. Youll need to contact the Michigan income tax agency or speak with your tax advisor to find out how Michigan treats S corporations.

If you mail in the form include a check or money order payable to State of Michigan. The form can be submitted by mail or in person. To form an S corporation designate S status with IRS via Form 2553 within 2 months and 15 days of filing your articles of incorporation with Michigan.

This address must be located in Michigan. The corporate income tax is levied and imposed only on a person that is required or has elected to file federally as a C corporation or is an insurance company a financial institution or a unitary business group. Some states like Arkansas Ohio New Jersey Wisconsin and New York require additional filing at the state level.

Make this contact before attempting to make the S corporation election for your Michigan corporation. Foreign corporations must appoint a registered agent for service of process physically located in Michigan. To register file Application for Certificate of Authority to Transact Business or.

First you must register with the state as a regular corporation. Once this has been completed there will be a set of formal compliance processes that your business must. Five Basic Steps to Start an LLC and Elect S Corp Status.

S corporations are subject to the Michigan Business Tax. In Michigan all businesses are required to file for a general business license sometimes referred to as a business tax. The following are taxation requirements and ongoing fees for Michigan corporations.

As a result an S Corp is taxed at a shareholder level. A Michigan S corporation is considered by law to be an individual entity separate from its owners shareholders. Have only allowable shareholders.

How to File Your Michigan Annual Report. S corporations are responsible for tax on certain built-in gains and passive income at the entity level. A Michigan S-corporation is a standard corporation that has elected for the special S-corp tax status with the IRS.

Fill out your annual report online OR submit a paper form. To create an S-Corp in Michigan you will also need to register your business by filling out and submitting the Articles of Incorporation. There is no additional paperwork that must be filed with Michigan to obtain S status.

Next elect to have your corporation treated as an S-Corporation with the IRS. The date for filing your Corp return is March 15th The date for filing your personal return is April 15th. Get your business licenses and permits.

This filing is required within 30 days after the final Dissolution plan is approved. Draft Your Corporate Bylaws. Your Michigan Corporation becomes an S Corporation only when with the consent of all shareholders special tax treatment pass-through taxation is sought by filing Form 2553 with the IRS in accordance with Subchapter S of the Internal Revenue Code.

History Www Hubbardsupply Com Michigan Travel Flint Flint Michigan

Flag Of Michigan The Flag Of The State Of Michigan Depicts The State S Coat Of Arms On A Dark Blue Field Michigan State Flag Michigan Flag State Of Michigan

Pin By Erin On Logos Fonts Creative Resume Marketing And Advertising Central Michigan University

Smith Bridgman S First Street Store Is Shown In This Flint Journal File Photo From 1962 Flint Michigan Flint Michigan Travel

Falcon Knight Model 12 Tourer 1928 7517 Knight Models Knight Cars Usa

Candle 2 On Twitter City Paths City Planner

1932 Burnt Bluff Mi Michigan Usgs Topographic Map In 2021 Topographic Map Relief Map Map

The Newly Renovated Wells Hall At Michigan State University Now Complete With A Starbucks S Michigan State University Michigan State Spartans Michigan State

Gibson Futura Explorer Guitar 1950 S Patent Art By Guitarspatents 4 99 Bocetos Para Dibujar Guitarras Bocetos

Pin By J E Hart On Dogs In Advertising Heating And Cooling Vintage Ads Winter Comfort

Llc Michigan How To Start An Llc In Michigan Truic

Free Vector Star Set Of Star Logo Freevector Download Dxf File Free Vector Vector Free Free Vector Files Vector

The Helen Devos Children S Hospital Is The New Kid On The Block Hospital Design Children Hospital Design Hospital Interior Design

No comments:

Post a Comment