You are typically ineligible for unemployment benefits if you lost your job due to an inability to work scheduling conflictsunavailability or misconduct on the job. The season ends in October and I will be out of work for 4-5 months.

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

I am about to start a job as a w2 sales rep.

Unemployment ny w2. State e-file available for 1995. How do I get my w2 for unemployment. E-file fees do not apply to NY state returns.

Importing data into W2 Mate is very easy. - Year 2011 W2 and W3 forms ezPaycheck 2011. New York Unemployment Benefits.

Tank you for this allison. Version 319 - released on Dec 12 2011. State e-file available for 1995.

The Mixed Earner Unemployment Compensation program which provides 100 extra per week to non PUA recipients who have had mixed income W2 and 1099 will be available from April 26. North Carolina Unemployment Benefits. State unemployment divisions issue an IRS Form 1099-G to each individual who receives unemployment benefits during the year.

Cat returns to owner after. The PSL 511 is Paid Sick Leave at 511day You will enter that in the W2 Box 14 area in TurboTax as Paid Sick leave 99232 and select the category for Sick leave wages 511day. Expands eligibility for individuals who are typically ineligible for Unemployment benefits for example independent contractors and self-employed.

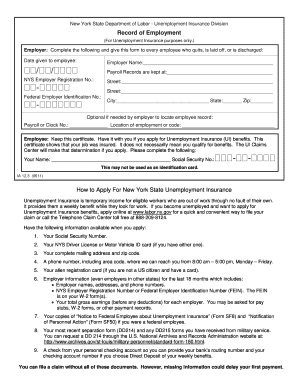

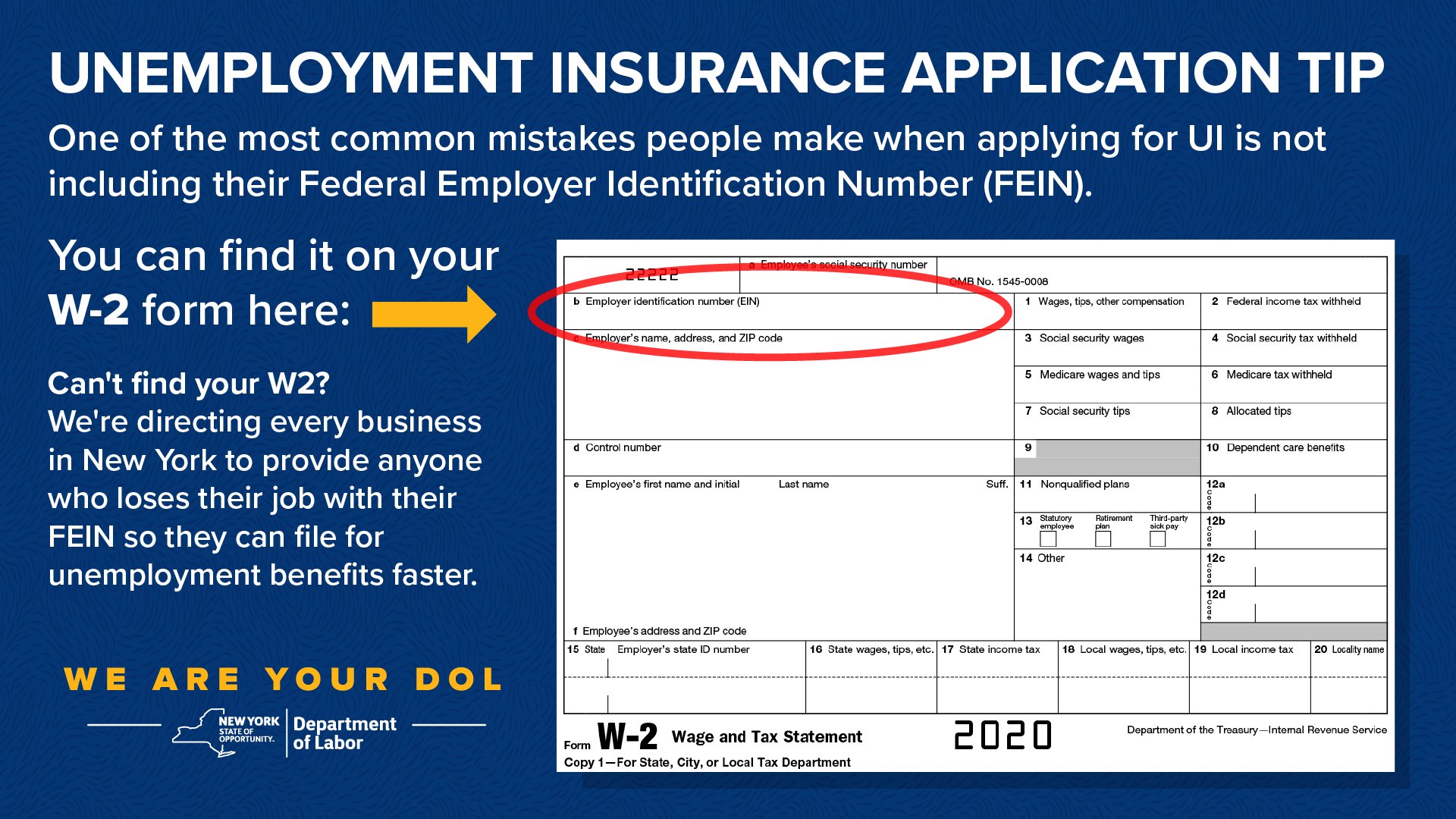

E-file fees do not apply to NY state returns. If you do not need to print tax. This number is always the same as your companys FEIN.

The Federal Unemployment Tax Act FUTA is a federal law that requires businesses to pay annually or quarterly to fund unemployment benefits for employees who lose their jobs. I havent filed the form yet. If you withhold 700 or more during a calendar quarter you must remit the tax with Form NYS-1 Return of Tax Withheld within 3 or 5 business days after the.

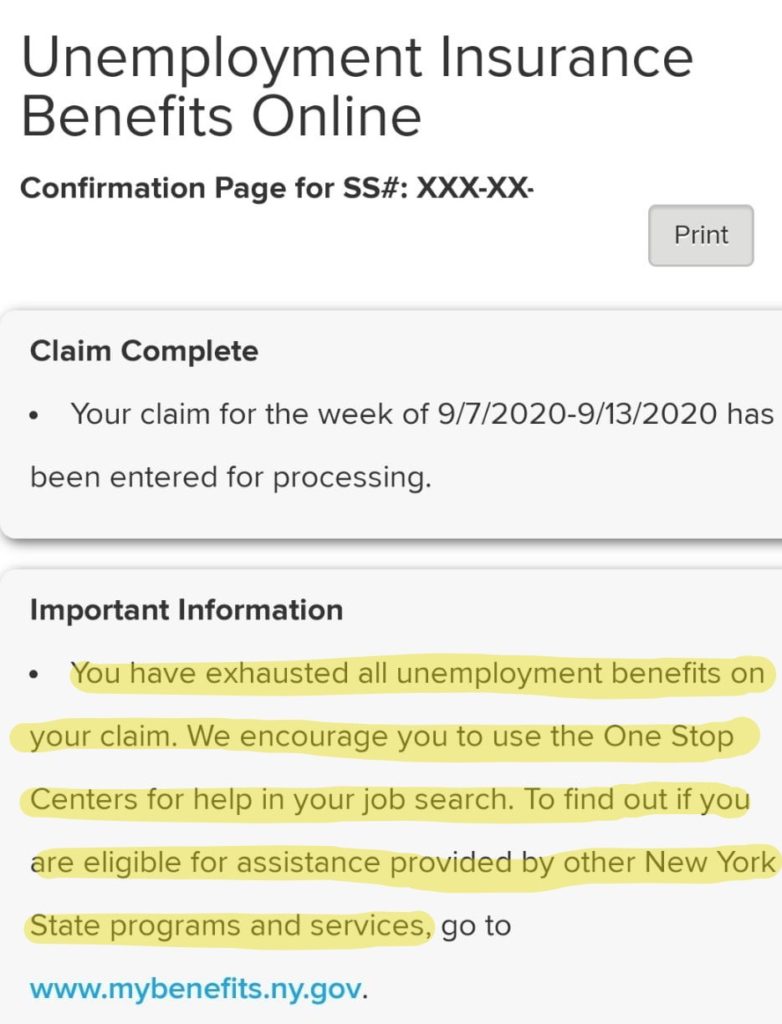

If you have any questions call the agency at 517 636-6925. Learn More W2 Mate Option 3 Import W21099 Forms Data With this option you can import data for unlimited number of W2 and 1099 forms. Got a W2 before getting unemployed could get up to 59 weeks of benefits based on traditional unemployment.

Turbo tax has that info. State e-file not available in NH. If youve run payroll in Michigan previously youll find your 10 digit.

Personal state programs are 3995 each state e-file available for 1995. State e-file not available in NH. Pandemic Unemployment Assistance.

The amounts in box 1 and box 3 of your W-2 will be different if you had a pre-tax. The amount in box 1 and box 3 is different on my W2 but the amounts are the same on my husbands. I just need the info from a 1099.

Personal state programs are 3995 each state e-file available for 1995. I was furloughed today from my production and imports job and still trying to get my bearingsFinding out if i can work for half my rate bc this wil still be slightly. Also how do I report short-term disability on my w2.

I want to view the info. Applicants who received 2500 or more in wages on a W2 from any employer where taxes were withheld since 2019 are likely eligible to receive these benefits. So based on the above a New Yorker who was working a regular job Ie.

User who needs to print W2 and W3 forms in December. For W-2s employers have to pay employment taxes unemployment tax medicare taxes social security tax workers compensation insurance and other withholding taxes. Reporting to Employees IRS Form W-2 The W-2 must show the portion of disability benefits excluded from the employees gross income.

Nys Unemployment 1099 Fill Online Printable Fillable Blank Pdffiller

Ia 12 3 Record Of Employment Fill Out And Sign Printable Pdf Template Signnow

Why Am I Getting Only 182 A Week Homeunemployed Com

New York State Unemployment Form 1099 G Jobs Ecityworks

My Income Was Earned In Ny However I Was A Part Ti

How Do I Find My Employer S Ein Or Tax Id

Nys Department Of Labor On Twitter If You Have Submitted An Application For Unemployment Without Your Fein A Representative Will Call You To Finish Your Claim If You Have Not Yet Filed

Nys Department Of Labor On Twitter While Fpuc Benefits Have Expired Ui And Pua Benefits Have Been Extended For New Yorkers When Your Effective Days Reaches 0 During Your Benefit Year You

No comments:

Post a Comment