You didnt specify what type of refund so you may want to look at IRS news release IR-2021-159 IRS continues unemployment compensation. Mondays update is the first official news release about the effort since late July.

Felder Demands Tax Relief Again Ny State Senate

In that batch of corrections the average special refund was 1189.

Unemployment ny irs refund. They dont need to file an amended. Most taxpayers will receive their unemployment refunds automatically via direct deposit or paper check. The IRS will automatically send refunds for qualified taxpayers who received unemployment benefits in 2020.

The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. 1 the IRS announced it had sent about 430000 tax refunds to taxpayers who overpaid taxes on their unemployment in 2020. To date the IRS says it has now distributed 117 million of these refunds to the tune of 144 billion.

Enter your Social Security number. We believe that we will be able to automatically issue refunds associated with the 10200 Mr. The IRS has been reviewing Forms 1040 and 1040SR to identify those who are due an adjustment on their refund because of overpayment of taxes on unemployment compensation.

Enter the amount of the New York State refund you requested. The IRS has stated that roughly ten million Americans likely overpaid on their unemployment taxes in 2020 and qualify for the refunds that could amount to. Check your refund status online 247.

How to avoid this 30 percent reduction. Its tough to say how long it will take to receive your refund but the IRS claims it can take up to four months which depends on a few factors. Questions about unemployment benefits have been a constant during the.

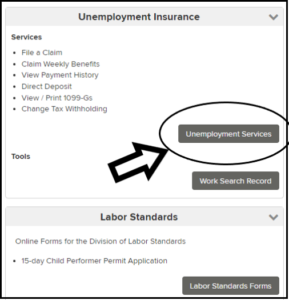

See Refund amount requested to learn how to locate this amount. The IRS efforts to correct. The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds.

The IRS will start refunding money to people in May who filed tax returns before the new tax break on unemployment benefits included in the American Rescue Plan went into effect Under the legislation Americans who got unemployment benefits in 2020 are exempt from paying federal income tax on up to 10200 in benefits. The IRS says it has identified more than 16 million taxpayers who may be. On March 17 they changed the tax laws and made the first 10200 of unemployment tax free so what the IRS did is theyre adjusting and people are starting to receive their refunds said.

The average refund for overpayment is about 1200. Paper checks will be sent starting Friday. Select the tax year for the refund status you want to check.

Social Security Benefit 2022. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. The payments will start going out in May the agency said.

That number increases to 20400 for. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. Para español llámenos al 518-457.

The Internal Revenue Service IRS has started issuing tax refunds to those who received unemployment benefits in 2020 with around 15. The IRS sent out refunds for the wrong amount to some taxpayers who collected unemployment benefits in 2020. Check your unemployment refund status by entering the following information to verify your identity.

Choose the form you filed from the drop-down menu. According to The Century Foundation about. The IRS said last week it sent more than 28 million payments.

The newest round of refunds has already gone out as direct deposits. The resolution of these issues could take 90 to 120 days depending on how quickly and accurately you respond and the ability of IRS staff trained and working under social distancing requirements to complete the processing of. Why is the IRS sending refunds.

The IRS said that those. Last week the IRS announced it began sending out refunds to eligible taxpayers who have paid taxes on 2020 unemployment benefits. AP photo Rich Exner.

IRS to begin issuing refunds this week on 10200 unemployment benefits Millions of Americans are due money if they received unemployment benefits last year and filed their 2020 taxes before the. In some states such as New York these benefits have been rising since October 2021 from a maximum of 680 dollars to 835 dollars. IRS will begin issuing refunds on 2020 unemployment insurance taxes.

WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. IRS issues another 430000 refunds for adjustments related to unemployment compensation. IRS Start Sending Refund 10200 Tax Break This Week.

Unemployment And Withholding Taxes Homeunemployed Com

Unemployment Insurance Rate Information Department Of Labor

Will New York Tax Unemployment Payments We Still Don T Know Syracuse Com

New Unemployment System Will Give Those Who Once Worked Full Time Now Working Part Time The Difference In Pay Fingerlakes1 Com

Don T Tax The Jobless New York Must Return Cash To Those Who Received Pandemic Enhanced Unemployment Aid New York Daily News

1099 Unemployment Nyc 2011 2022 Fill Out Tax Template Online Us Legal Forms

Glitch On Nys Unemployment Site Fixed For Users Trying To Certify Claims

Tax Consulting Services Instagram Tax Consulting Tax Flyer Template

Millennials Are Being Left Behind And It Poses A Huge Risk To The Us Economy Consumer Debt Millennials Debt

Unemployment And Withholding Taxes Homeunemployed Com

Senators Call For State Department Of Labor To Forgive Unemployment Overpayments Ny State Senate

1099 G Tax Form Department Of Labor

No comments:

Post a Comment