A non-fault overpayment may be deducted from any future benefit payments. Under Pennsylvania Unemployment UC law if a Claimant receives benefits to which they are ultimately determined to be ineligible for they are found to have received an overpayment.

If you receive notice of a fraud overpayment you should appeal immediately.

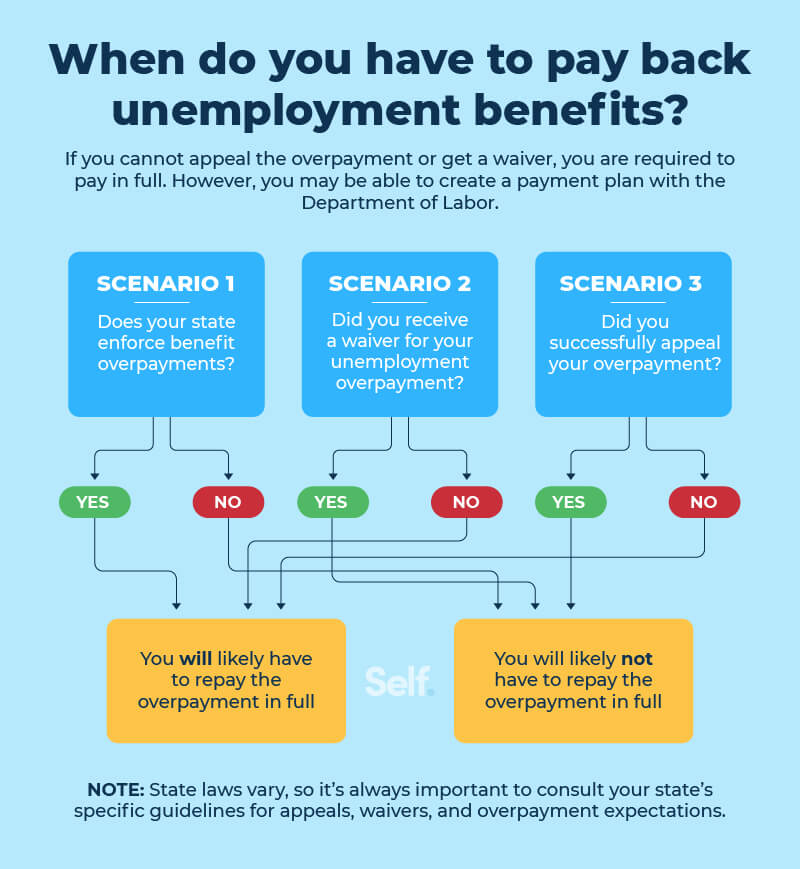

Pa unemployment overpayment. However if you have a non-fraud overpayment for a federal unemployment benefit like Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC or Federal Pandemic Unemployment Compensation FPUC you can apply for waiver of the overpayment. You are not required to pay back the overpayment. Dedicated Unemployment Overpayment Appeal Lawyers The Pennsylvania Unemployment Department has been sending employers various unsolicited notices requesting that they report former employees to places such as.

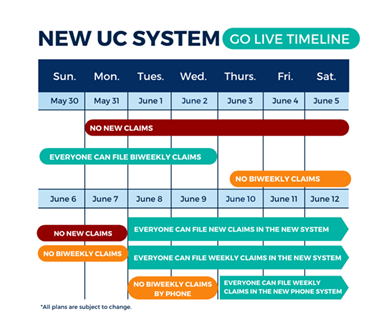

Pennsylvanias Department of Labor Industry handles all the states unemployment claims. Under Pennsylvania unemployment compensation law more and more claimants are receiving notices of overpayment. TOP allows the Department of Labor Industry to intercept a claimants federal income tax refund and apply the amount toward the overpayment balance.

Also keep in mind the state didnt pay all that money the feds did. If this is the first you are learning of the overpayment you should appeal. The overpaid amount will be deducted from future benefit payments during the Benefit Year when the overpayment occurred and the three-year period immediately following that Benefit Year.

You can request an overpayment waiver using our online form. Pellegrinos are among the close to 200000 non-fraud overpayments the state estimates were in the PUA program and more than 63000 in the regular Unemployment Compensation program. If there is an overpayment in your unemployment check the agency will mail you a Notice of Overpayment to notify you of the error.

Even if the overpayment is not your fault you will be required to repay the amount of benefits that you received unless you apply for and receive a waiver of the obligation to repay. Those missing 5-10 days to recover from covid will not be able to get any type of financial help and if they do not have PTO may be losing savings to deal with isolating. If you were overpaid benefits and you repaid the amount it is still included in the Total Payment If the repayment was made in the same year as the overpayment make the necessary adjustment and notation on your tax form 1040 or 1040A.

In order for there to be a fault overpayment there also must be a finding that the person who was overpaid had a particular state of mind. In April 2020 the unemployment rate surged to 147 with 231 million workers losing their jobs. However the deductions may not exceed one-third of the weekly benefit rate.

You can email appeals to UCAPPEALSPAGOV. 1 While it has since come down to 6 in March 2021 thats still 25 higher than February 2020. A non-fault overpayment occurs when you receive UC benefits you are not entitled to receive through no fault of your own.

Unemployment Department Aggressively Pursuing Claimants For OVERPAYMENT OF UNEMPLOYMENT BENEFITS MKO. A Spotlight PA investigation found the Department of Labor and Industry from 2006 to 2016 did not use interest rates set annually by the state Revenue Department which ranged between 3 and 8. Has started issuing repayments for unemployment interest overcharges but just 30 of those eligible have applied for a refund.

Just the limited old state unemployment benefits which can be as few as 12 weeks. You should state that you are appealing any overpayments associated with your social security number and that you never received notice of the overpayments. There is no interest on the overpayment.

The notice will explain the reason you are getting the overpayment notice how much you owe penalties if applicable information on how to appeal and instructions on repaying the amount you have been overpaid. If you qualified for other programs thats what they should have gave you. If the total overpayment is 99 or less it will be deducted in full.

Check and see about waivers for this type of thing. There is no forgiveness or waiver of a Pennsylvania non-fault overpayment. This letter advises you of your responsibility to pay back the overpayment.

We have seen a steady rise in the number of people who get such worrisome notices wondering if they will be fined put in jail or lose their home. Your state unemployment office will notify you typically by mail if you have been overpaid. Your online receipt canceled check or money order may be used as proof for adjustments claimed.

Overpayments are generally categorized as either fault or non-fault overpayments. You can email a copy of a completed waiver form to uchelppagov. Other courts in Pennsylvania have added that fault includes conduct that is designed to intentionally mislead the Department of Labor and Industry and the Unemployment Compensation office.

Each year interest accrues on money people owe to the department because for various reasons the state overpaid their unemployment benefits. The government can take ⅓ one-third of your future unemployment benefits for up to 4 years until the amount is repaid. The burden of.

An overpayment or improper payment occurs if you are paid unemployment benefit payments and DUA later determines that you were not eligible to receive them. If the overpayment is not your fault you shouldnt have to pay any of it back. Unemployment Overpayment Lawyer - Pennsylvania Unemployment Attorneys.

There may also be a waiver sent to you in your UC or PUA portal. You must include your name your SSN and your mailing address. The state should not be able to recover that federal money.

Any overpayment of UC or extended unemployment benefits EB due to fraud or unreported earnings is eligible for submission to the Treasury Offset Program TOP. We also recommend uploading a copy of the waiver to your portal in the general uploads section. A non-fault recoupable overpayment is an overpayment that occurred through no fault of your own.

They Want It All Back Pennsylvanians Who Had Collected Unemployment Surprised And Upset By Overpayment Notices Witf

Overpayment Notices Spotlight More Confusion Challenges With Md Unemployment Benefits Wbff

Pa Department Of Labor Industry On Twitter If Your Unemployment Compensation Uc Claim Reaches Its Benefit Year End Bye Date Today You May Need To Reapply To Continue Receiving Benefits We Will

Pa Dept Of Labor And Industry Admits To Over Charging Interest On Unemployment Payments Cbs Pittsburgh

Missouri Bill Aims To Forgive Unemployment Overpayments

Illinois Unemployment Pua Overpayments May Be Forgiven Ides To Issue Waivers Abc7 Chicago

Do You Have To Pay Back Unemployment Benefits Self Credit Builder

Do You Have To Pay Back Unemployment Benefits Self Credit Builder

En Masse Featured Artists Jay Delutis To Check Out The Artists Profile Visit Www Rawartists Or For More Eve Raw Artists Winter Collection Autumn Summer

Report To Legislators Concerns Remain About Pa S Unemployment System Wlvr Fm

Reminder Unemployment Compensation Claimants Should File By 9 Pm Wednesday Before System Is Offline

No comments:

Post a Comment