Rates include basic tax rates ranging from. New York state income tax rates are 4 45 525 59 597 633 685 965 103 and 109.

For 2020 total unemployment tax rates for experienced employers range from 06 to 79.

Nys unemployment tax rate. A preliminary look at the 2020 state unemployment taxable wage bases. Employers contribute to the state unemployment program by paying SUTA tax every quarter depending on the SUTA tax rate and the Wage Base. For 2020 total unemployment tax rates for experienced employers range from 06 to 79.

The current gross FUTA tax rate is 60 of taxable wages to be paid by the employer only. New York State Unemployment Insurance SUI New York Wage Base. Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and.

12 on its website. All contributory employers continue to pay an additional 0075 Re-employment Services Fund surcharge. The 2021 New York state unemployment insurance SUI tax rates range from 2025 to 9826 up from 0525 to 7825 for 2020.

13 to 91 for 2019. For 2020 the new employer normal contribution rate is 25. Wage Reporting and Unemployment Insurance Report NYS 45.

Pin on NYCEntry The federal unemployment tax act futa tax is imposed at a flat rate on the first 7000 paid to each employee. Wage bases shown in bold changed from the prior year. Publication NYS-50 Employers Guide to Unemployment Insurance Wage Reporting and Withholding Tax.

New Yorks unemployment tax rates are unchanged for 2020 the state Labor Department said Feb. Unemployment tax rates are unchanged from 2019. This article highlights some of the common.

You will pay 1050 in SUI. Withholding publications and guidance. Rates include basic tax rates ranging from.

Certain churches and non-profits are exempt from this payment. 18 - 19 Subsidiary tax rates. Less than 0 The Unemployment Insurance contribution rate is the normal rate PLUS the subsidiary rate.

5 of 7000 350. The unemployment-taxable wage base is 11600. Withholding forms and instructions.

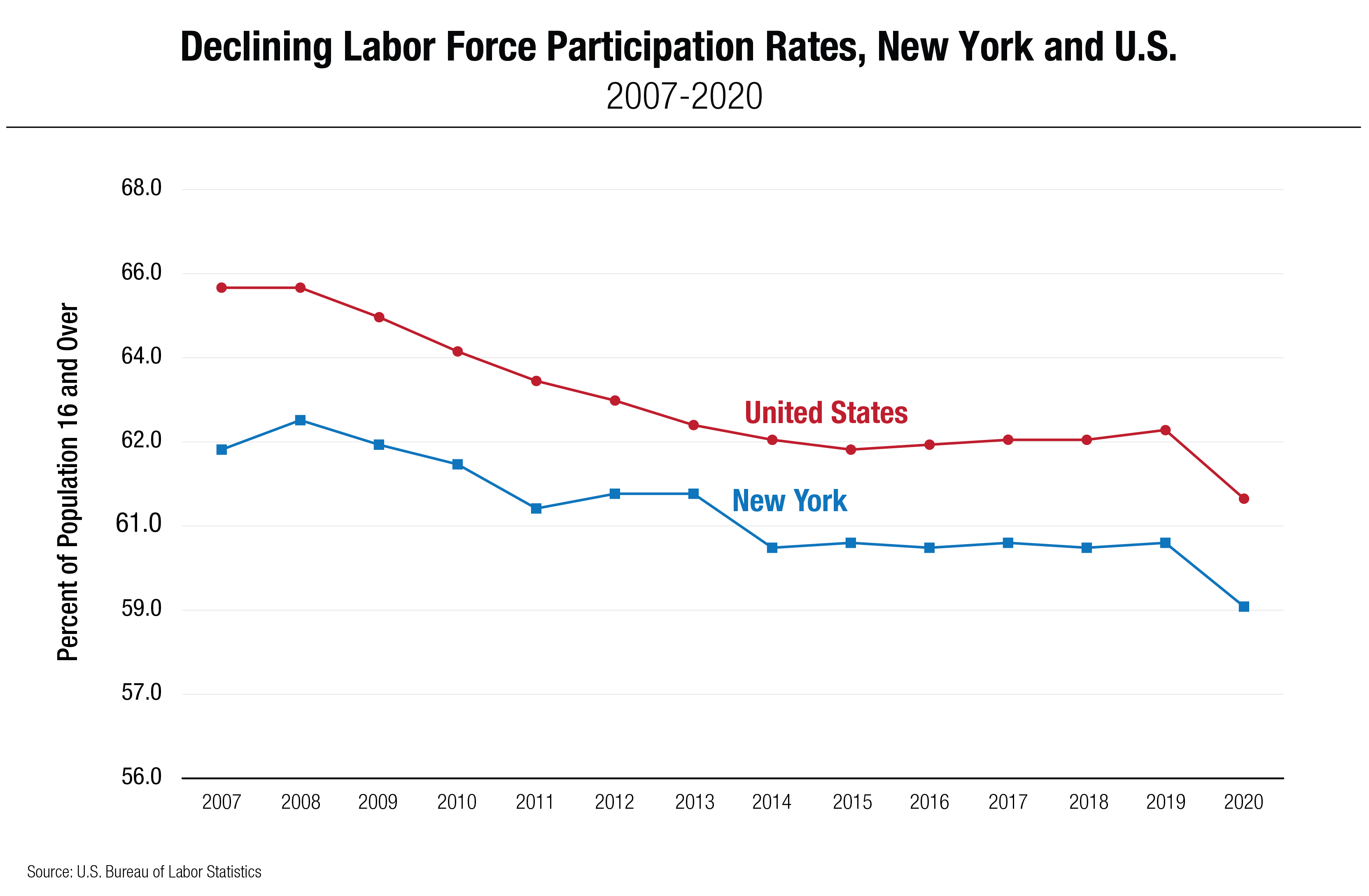

State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. Find your rate on the Notice of Unemployment Tax Rate mailed by the Department of Labor each March. New York which has the second highest unemployment rate in the country is one of just 11 states that is fully taxing unemployment benefits according to HR Block.

Pay the metropolitan commuter transportation mobility tax MCTMT Resources. And Withholding Tax Revised December 2021 NYS-50 1221 This booklet contains information on. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees.

Here is how to do your calculation. The new brackets and rates would be effective for the 2021 tax year. An employers New York State Unemployment Insurance contribution rate is divided into two parts - the normal and the subsidiary contribution.

Withholding tax rate changes. Controlling unemployment insurance costs. Filing Unemployment Insurance New York State in Nepali.

For 2022 the new employer normal contribution rate is 34. New York state income tax brackets and income tax rates depend on taxable income and filing. 3525 plus corresponding subsidiary fund percent.

New Yorks maximum marginal income tax rate is the 1st highest in the United States ranking directly. Your free and reliable 2019 New York payroll and historical tax resource. New York Unemployment Insurance.

New Yorks unemployment tax rates are unchanged for 2020 the state Labor Department said Feb. Like the Federal Income Tax New Yorks income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. However an allowed credit effectively reduces the tax rate to a net of 06 for wages paid up to the wage limit of 7000 for the majority of states.

New York new employer rate. President Joe Biden announced in March that the federal government would not tax the first 10200 of unemployment benefits for taxpayers earning less than 150000 in 2020. Federal Unemployment Tax.

If youre a new employer youll pay a flat rate of 3125. Employer contribution rates range from 0525 to 7825 with a wage base of 11800. New York State Unemployment Insurance Rate.

Nys unemployment insurance rate. The amount of money in the UI. Pay unemployment insurance contributions.

For example the wage base limit in California is 7000. 52 rows Generally states have a range of unemployment tax rates for. Unemployment insurance is a crucial safety net providing a temporary cash cushion.

New York State Tax Department and New York State Department of Labor Unemployment Insurance Division addresses and telephone numbers are also included for. New York collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The credit and reduced rate are available by filing the Form 940 for 2021.

On the first 11800 each employee earns New York employers also pay unemployment insurance of between 0525 and 7825. The New York State Department of Labor Unemployment Insurance Division is one of the last states to mail annual tax rate notices out to employers with operations in its state. New York SUI Rates range from.

Each respective proposal includes the same three new tax rates985 percent 1085 percent and 1185 percentbut imposes such rates at differing income thresholds. Unemployment tax rates are unchanged from 2019. Most businesses also have to comply with their states State Unemployment Tax Act SUTA which coordinates with the federal tax.

It is the employers responsibility to withhold the tax and make payments. Employer rights responsibilities and filing requirements New York State unemployment insurance New York State wage reporting New York State New York City and Yonkers income tax withholding Reporting new or rehired employees. The new employer rate for 2021 increased to 4025 up from 3125 for 2020.

12 on its website. Normal unemployment insurance tax rates. Following is a preliminary list of the 2020 state unemployment insurance SUI taxable wage bases as compared to 2019 and employee SUI withholding rates if applicable.

350 x 3 1050. Learn more about your NY UI rate here. The FUTA tax rate is 6 of the first 7000 of wages though many businesses qualify for a tax credit that lowers it to 06.

The current maximum individual tax rate in New York is 882 percent. Trust Fund determines the employers normal contribution rate while the balance in the General Account determines the subsidiary contribution rate. 075 totaling 36 for 2019.

Small business owners have numerous tax obligations and if your business has employees. The unemployment-taxable wage base is 11600. SUTA the State Unemployment Tax Act is the state unemployment insurance program to benefit workers who lost their jobs.

The agencys mailing towards the end of February each year can make it difficult for employers to update their payroll service providers and ensure accurate. Use this rate to calculate line 4 on the Quarterly Combined Withholding.

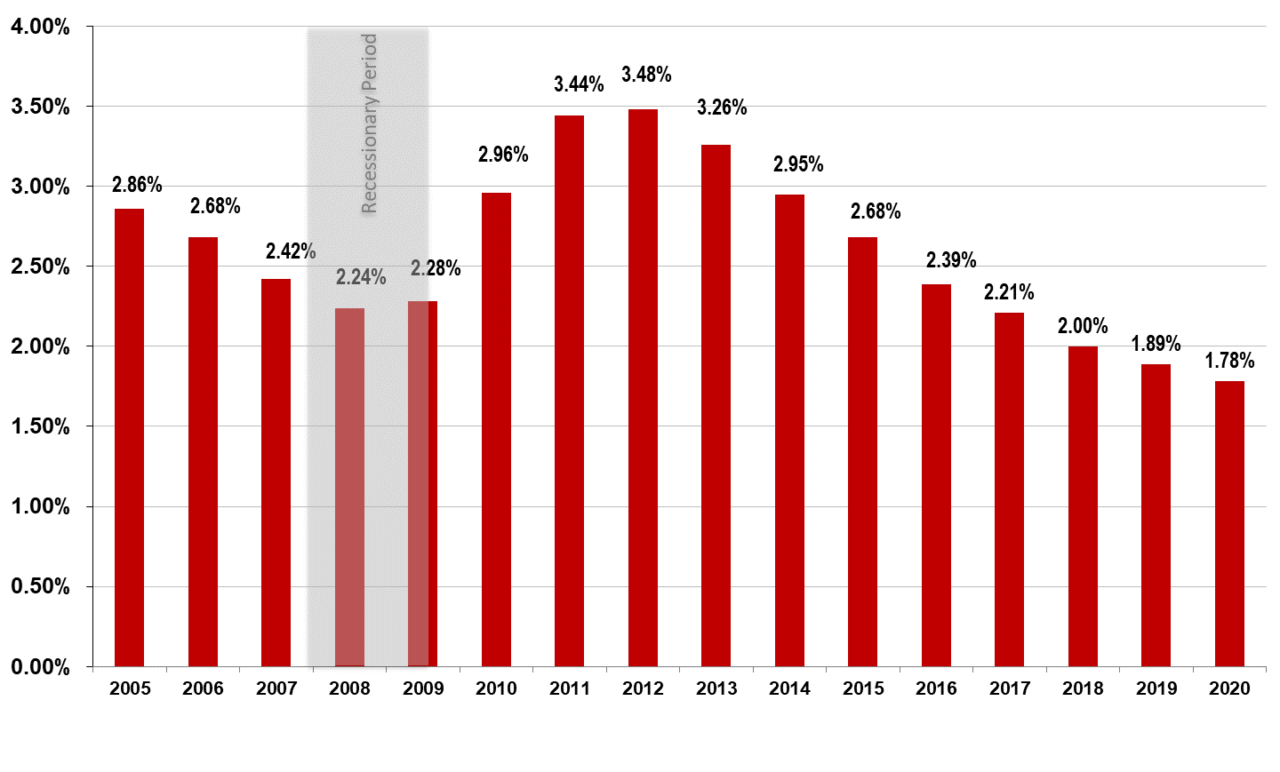

Dinapoli Unemployment Taxes On Employers Poised To Increase To Repay 9b Owed To Federal Government Office Of The New York State Comptroller

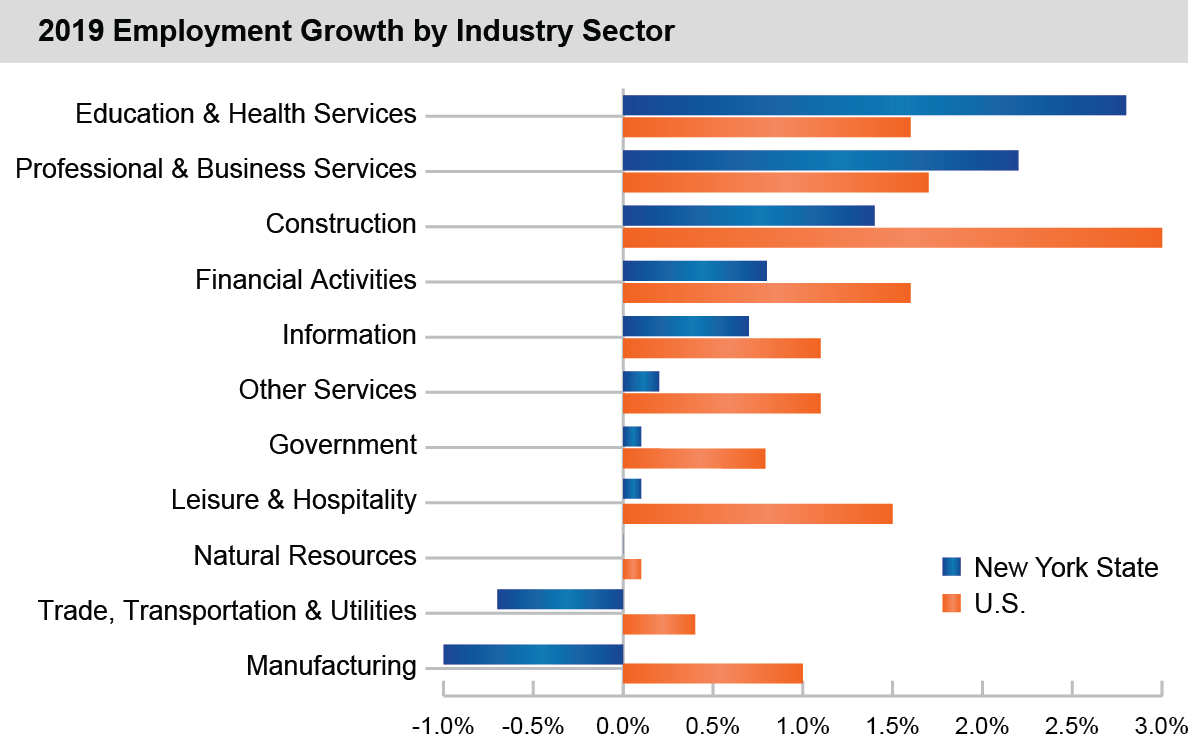

Economic And Demographic Trends Office Of The New York State Comptroller

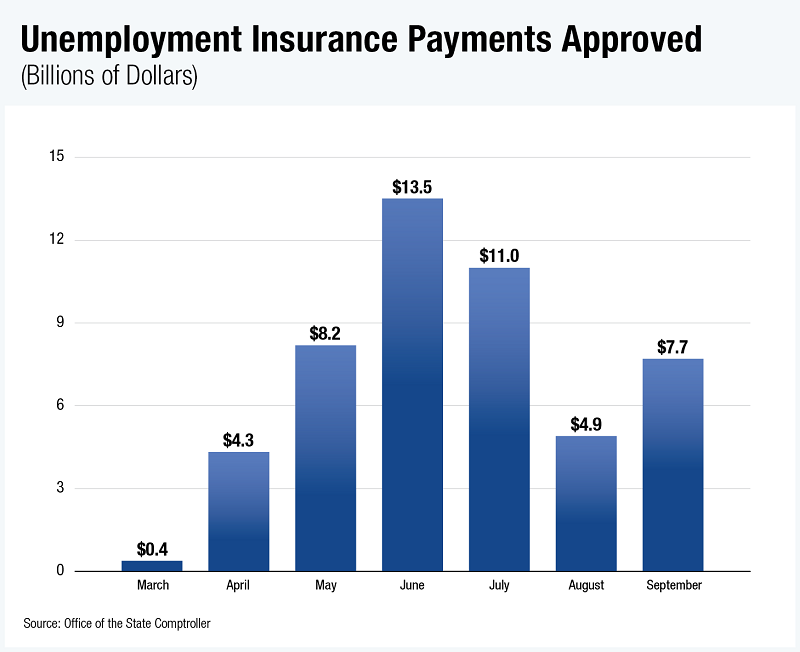

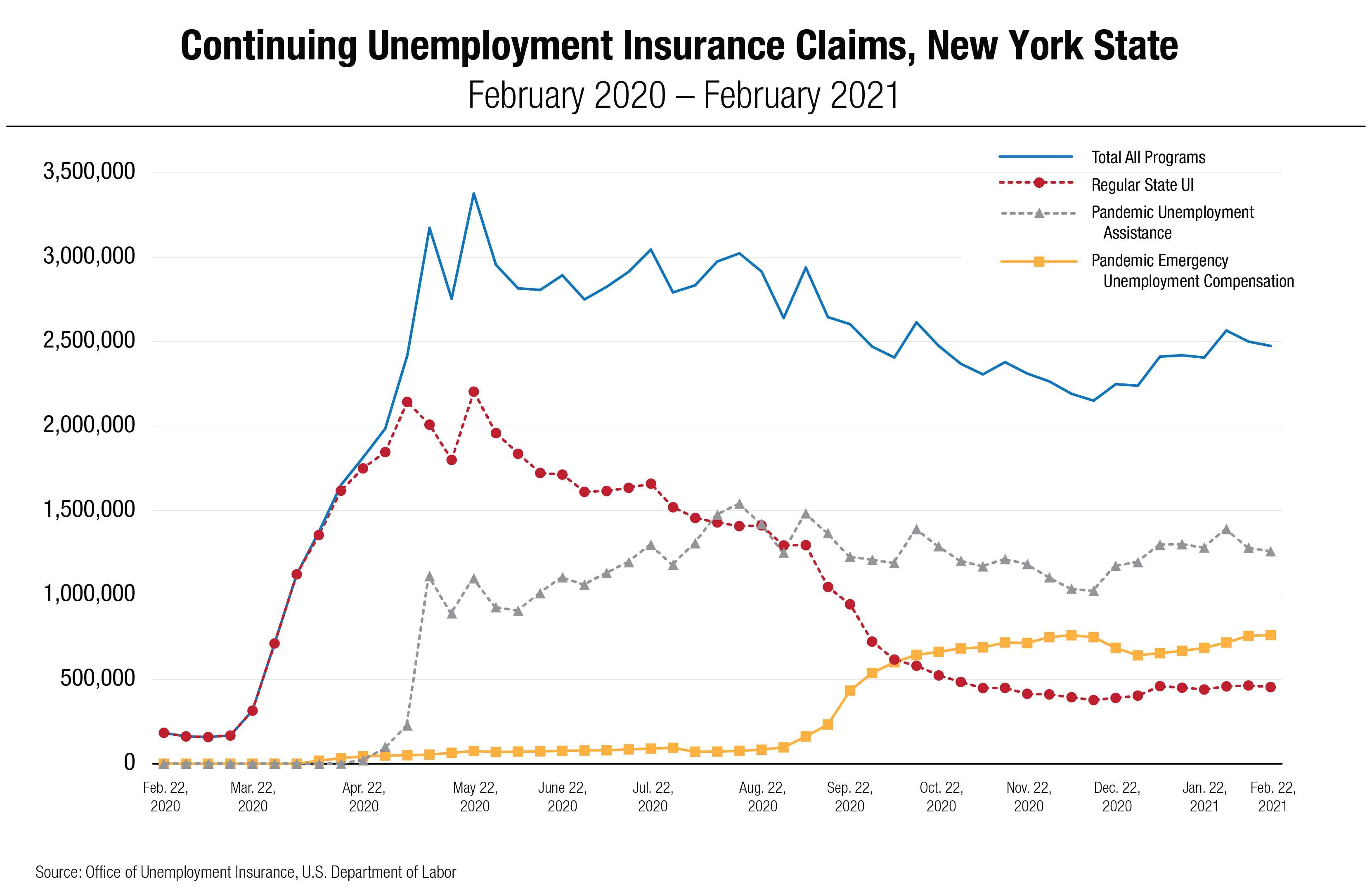

New York S Economy And Finances In The Covid 19 Era Office Of The New York State Comptroller

New York S Economy And Finances In The Covid 19 Era March 4 2021 Office Of The New York State Comptroller

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

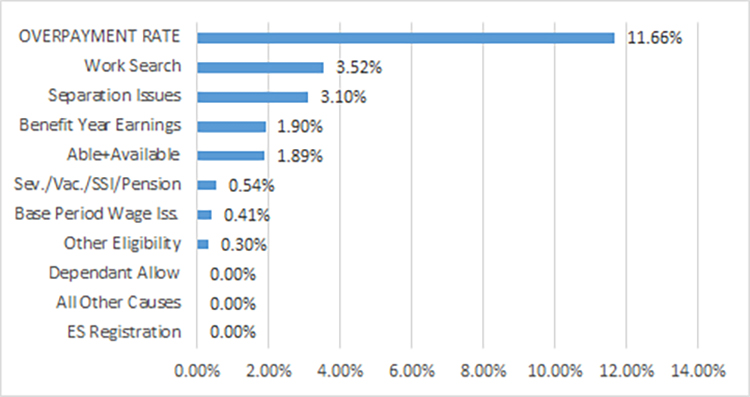

How Severely Will Covid 19 Impact Sui Tax Rates Workforce Wise Blog

Income Taxes What You Need To Know The New York Times

New York S Economy And Finances In The Covid 19 Era March 4 2021 Office Of The New York State Comptroller

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

New York U S Department Of Labor

Unemployment Insurance Rate Information Department Of Labor

Nys Department Of Labor Nyslabor Twitter

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

No comments:

Post a Comment