Administration Code Section 1217-810 provides information regarding unemployment benefits. You will still be able to receive benefits for eligible weeks prior to September 4 2021.

Harvey Cedars Long Beach Island Long Beach Island Beach Favorite Vacation

However any employee who does not receive pay for the contractual vacation period or any part thereof may receive unemployment benefits if otherwise eligible.

Nj unemployment vacation pay. Unemployment regulations vary by state but many allow vacation pay to affect your unemployment benefits. It states that the receipt of your vacation pay in a lump sum will not prevent you from filing for unemployment said Claudia Mott a certified financial planner with Epona Financial Solutions in Basking Ridge. In New Jersey unemployed workers can file for unemployment benefits for up to 26 weeks.

Federal benefits created during the benefit expired September 4 2021. Payments made to employees for vacation sick or other paid leave during the quarter are to be reported as part of wages paid during that quarter. Unemployment benefits will not be paid until after the severance pay runs out.

Administration Code Section 1217-810 provides information regarding unemployment benefits. Unemployment benefits provide 60 of average wages with a maximum of 731week in 2021 for 26 weeks plus an additional 300week from January 2 2021 through September 4 2021. Does vacation pay affect unemployment benefits in NJ.

Read our FAQs on paid leave job protection and caregiving. In New Jersey employers are not required to provide employees with vacation benefits either paid or unpaid. Continuation pay is considered wages and is taxable under Administrative Code 1216-42.

The state allows claimants to receive unemployment benefits while they are simultaneously receiving severance pay. Administration Code Section 1217-810 provides information regarding unemployment benefits. Therefore yes you can claim benefits.

However if the employer has a policy allowing employees to accrue or earn vacation time then the employee may be entitled to payment. The money to pay these benefits comes from a payroll tax paid by employers and workers. When an employee quits is laid off or is fired some states require employers to pay out all accrued unused vacation time.

Although severance pay does not reduce an applicants unemployment benefits other types of compensation paid when employment ends can reduce. C The receipt of a lump sum payment at termination representing unused accrued vacation leave is not a bar to the receipt of unemployment benefits. It depends upon the circumstances.

The burden of proof is on you the employee to prove that you quit for good cause. It is subject to state unemployment temporary disability workforce development and family leave insurance contributions. Check with the unemployment office for your state to get the definitive answer for your location.

Unemployment Compensation is an insurance benefit paid to workers who meet all the requirements of the New Jersey Unemployment Compensation Law. It states that the receipt of your vacation pay in a lump sum will not prevent you from. If your employer requires you to work while you have COVID-19 and you quit you might be eligible for unemployment benefits if you are found to have good cause for quitting.

As of April 24 more than 622000 people were collecting unemployment in New Jersey which means they are receiving both their regular unemployment payment plus the additional 600 Pandemic Unemployment Assistance PUA payment as part. However when you can collect will depend on how you are. STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT Payment in Lieu of Notice When your employer continues to pay you after you stop working You cannot file until the last payment is received but the payments do not reduce your benefits Severance or Bonus Pay Vacation or Sick days Holidays.

As of April 24 more than 622000 people were collecting unemployment in New Jersey which means they are receiving both their regular unemployment payment plus the additional 600 Pandemic Unemployment Assistance PUA payment as part of the Coronavirus Aid Relief and Economic Security CARES Act. Unemployment Compensation and Severance Pay in New Jersey In New Jersey someone who receives severance pay or a severance package from a former employer may also apply for unemployment benefits. It states that the receipt of your vacation pay in a lump sum will not prevent you from filing for unemployment said Claudia Mott a certified financial planner with Epona Financial Solutions in Basking Ridge.

New Jersey law doesnt impose this requirement in all situations. A layoff lasting longer than eight weeks would require the person to certify that they are able and available for work. The Laws and Regulations which govern the payment of Unemployment Benefits are complex and your claim must go.

However if you previously scheduled vacation time for the week in which you are claiming benefits you must report those days to unemployment. The state of New Jersey does not consider severance pay to be income when calculating whether or not a person should be able to receive unemployment benefits said. Receiving a payout for unused accrued vacation days is not considered vacation pay in the eyes of the NJ Department of Labor.

Regardless of your state regulations your state labor office wants to know when you receive vacation pay which you must report as a condition of your benefits. Of Labor FAQsIf an employer chooses to provide these benefits it is only required to comply with its established policy or employment contract. As long as severance is paid in a lump sum is intended to recognize past years of service or does not otherwise extend a persons employment it should not affect eligibility for NJ unemployment.

Continuation pay is considered wages earned when calculating temporary disability benefits for claimants. If you received holidayvacationsick pay from your employer during this week report that information here. When you receive payment for any unused vacation or flexible leave benefits upon leaving your job it may impact your unemployment benefits.

As long as the severance is paid in a lump sum is intended to recognize past years of service or otherwise doesnt extend the persons employment with the company. If you dont you could receive overpayment penalties including fines or jail. State regulations regarding how vacation pay will impact unemployment benefits vary.

Earnings and therefore base weeks are credited when the leave is actually taken which may or. You cannot receive earned sick leave pay temporary disability benefits and unemployment benefits at the same time. In addition to severance pay the states Department of Labor says bonuses vacation holiday pay Social Security benefits or pension payments from prior employers will not reduce the amount of unemployment you receive Sarnecki said.

Coming Soon Online Details For Why Unemployment Benefits Delayed

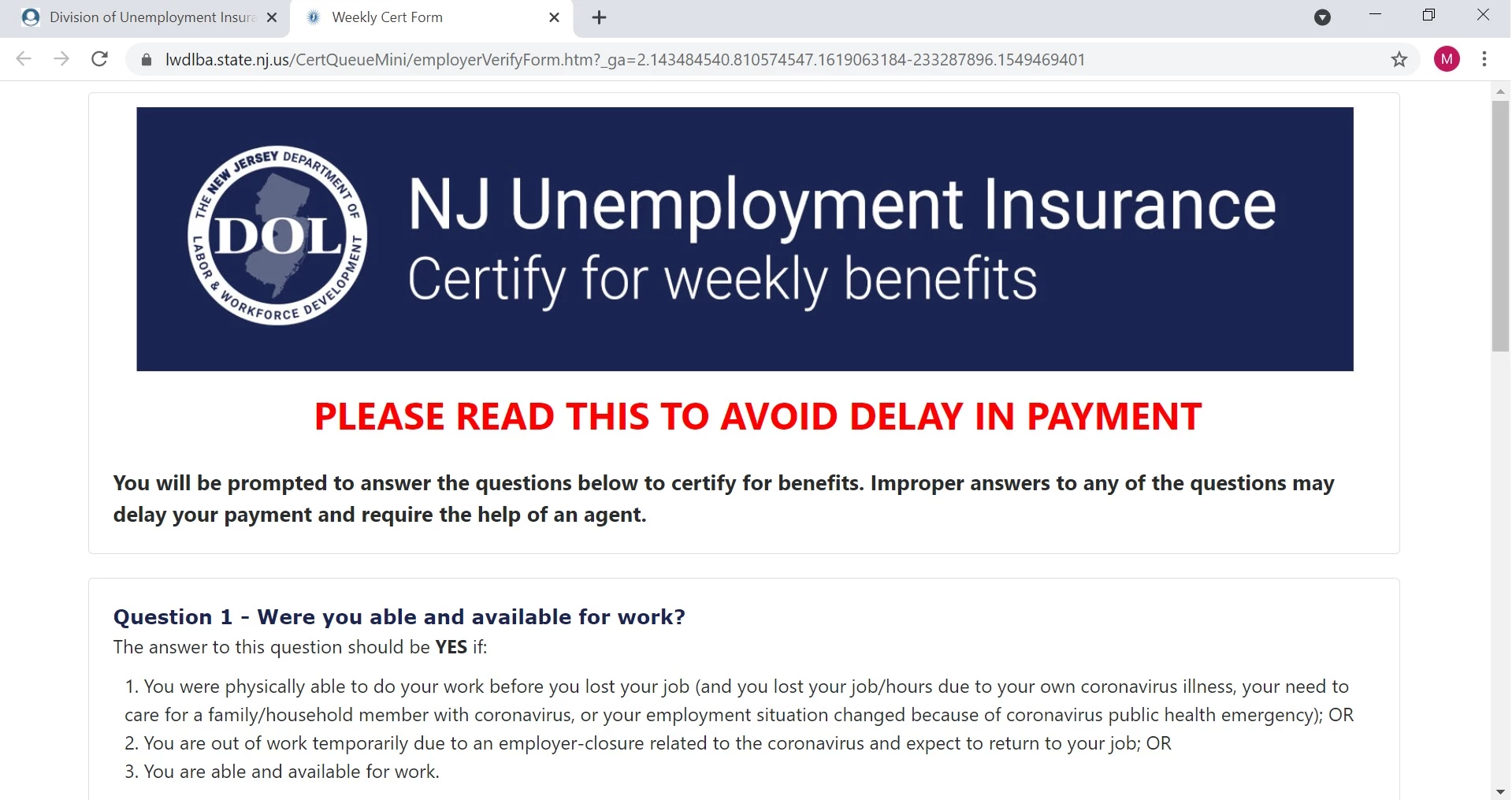

Division Of Unemployment Insurance How To Certify For Benefits Online

Jersey Camden New Jersey Vintage Postcards Travel Postcard

N J Labor Commissioner Answers Questions From Workers Filing For Unemployment Benefits Roi Nj

Business Letter Sample Request For Approval Copy Cover Letter Formal Buisness Letter Cover Letter Format Business Letter Sample Application Cover Letter

New Jersey Unemployment Benefits Eligibility Claims

Stuart Fl Riverwalk Waterfront Sunday Music River Walk

Division Of Unemployment Insurance How To Certify For Benefits Online

Division Of Unemployment Insurance How To Certify For Benefits Online

New Jersey Unemployment Tips Hotel Trades Council En

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Positive Mindset

Destinations For Fleeing New Yorkers The Big Picture Big Picture Nassau County Vacation Property

No comments:

Post a Comment