Both the forms NJ-927 and WR-30 must be submitted for the quarters ending March 31 June 30 September 30 and December 31 of each. For those residents who lost their jobs then many struggled with filing for unemployment benefits.

Base Period Calculator Determine Your Base Period For Ui Benefits

If your claim is.

Nj unemployment quarters. First Quarter End date. Alternate Base Year 2 consists of the three most recently completed calendar quarters preceding the date of claim and weeks and wages in the filing quarter up to your last day of work. January 30 of the following year.

This affects which quarterly earnings are considered as your base period see below when calculating your weekly benefit amount. You can also get help filing an unemployment benefits claim at a One-Stop Career Center in your area. Your maximum benefit amount depends on how much money you earned in your base period.

People must have earned at least 165 per week and have worked at least 20 hours each week during the base period in order to qualify. The maximum anyone can receive regardless of how many weeks they worked during the base year or how much they earned is 26 times the maximum weekly benefit rate. Forms NJ-927 and NJ-927-W must be filed on or before the 30th day of the month following the end of the quarter.

This was the case for NJ for FY2020. To find a New Jersey unemployment office location visit our helpful guide. Second Quarter End date.

New Jersey Unemployment Office Locations The New Jersey One-Stop Career Centers is the place to start while you are seeking a job. This alternate base year will contain less than 52 weeks. FUA is funded by federal unemployment tax rates on the first 7000 employers pay to each employee.

New Jersey has recovered more than three-quarters of the jobs lost since the spring of 2020 when the pandemic crushed the labor market. All employers are required to file the Employers Quarterly Report Form NJ-927 or NJ-927-W for each quarter regardless of the amount of tax due. Each calendar quarter all employers other than domestic employers subject to the provisions of the Unemployment Compensation Law are required to file the Employers Quarterly Report Form NJ-927 and Employer Report of Wages Paid.

Each calendar quarter all employers other than domestic employers subject to the provisions of the Unemployment Compensation Law are required to file the Employers Quarterly Report Form NJ-927 and Employer Report of Wages Paid. Enter the date that you filed your claim or will file your claim for unemployment. If you are approved for unemployment benefits in New Jersey the.

The state gained almost 76000 jobs last month and has now recovered 548500 jobs about three-quarters of those lost in March and April 2020 as a result of COVID-19. Located throughout New Jersey One-Stop Career Centers offer services free of charge to aid you to develop the skills needed to succeed in todays work environment. Each calendar quarter all employers other than domestic employers subject to the provisions of the Unemployment Compensation Law are required to file the Employers Quarterly Report Form NJ-927 and Employer Report of Wages Paid Both the forms NJ-927 and WR-30 must be submitted for the quarters ending March 31 June 30.

The tax rate is 6 but states can apply an unemployment tax credit of up to 54 when they have no federal loans outstanding meaning employers might only pay 06. Both the forms NJ-927 and WR-30 must be submitted quarterly. Employment gains in November came from eight of nine major private sectors including more than 3300 in the leisure and hospitality industry.

NJ will participate in pilot program to improve federal unemployment system. July 30 Third Quarter End date. June 30 Due date.

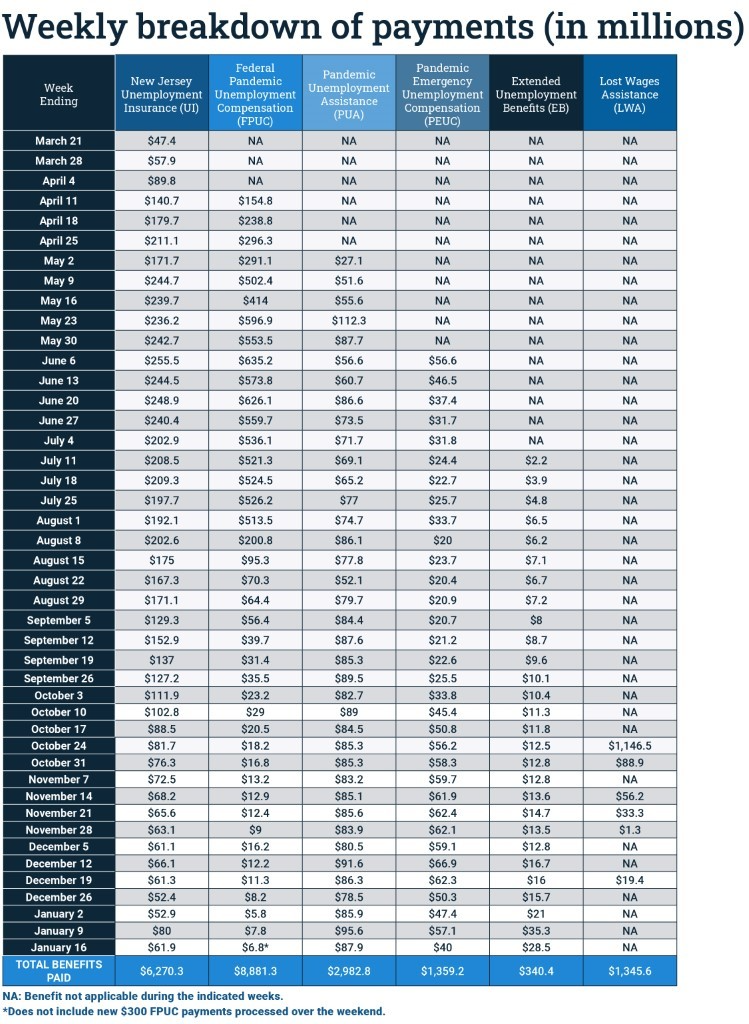

As a result the correlational relationship between the number of unemployed New Jersey workers and personal income in the state has been nearly no nexistent since the second quarter of 2020. GIT Amounts Withheld For Quarter Enter the total Gross Income Tax withheld. Trenton Over the course of the last year the State of New Jersey has been inundated with unemployment insurance UI claims due to the financial impact of the COVID-19 pandemicFor many individuals understanding the different types of unemployment compensation can be a difficult process with each program having.

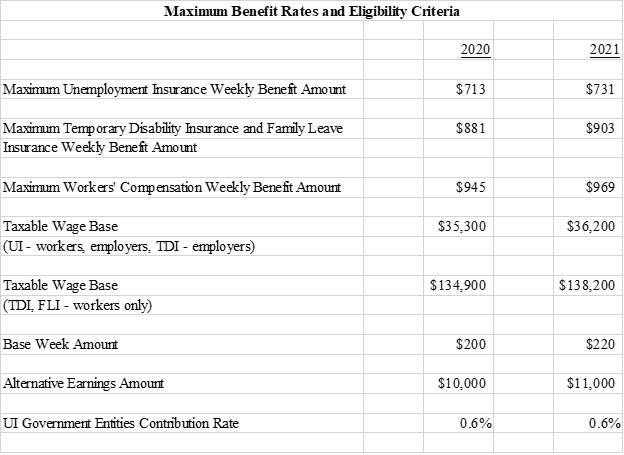

Right now the maximum total benefit amount any one claimant can receive during their annual claim period is 19006 731 x 26. December 31 Due date. Instead spikes in personal income throughout the pandemic tend to appear in quarters when many Americans were receiving federal stimulus payments.

Employers that are filing Form NJ-927-WX should enter the amount withheld for each weekperiod in this quarter. Unemployment Insurance Explained. September 30 Due date.

Employers that are filing Form NJ-927X should enter the amount withheld for each month in the quarter. Additional information such as most recent quarterly earnings proof of wages earned in the form of pay stubs and verification of earned wages may be asked for in case of the Alternate Base Period. March 31 Due date.

The QCEW covers more than 95 percent of New Jersey jobs available at the state county and municipal level by detailed industry. If the withholding amount is zero enter 0. The Quarterly Census of Employment and Wages QCEW is a quarterly count of employment establishments and wages reported by employers covered under the New Jersey Unemployment Compensation law.

Fourth Quarter End date. New Jersey will usually consider your claim effective as of Sunday of the same week that you file. A resident of New Jersey who works in Pennsylvania is not eligible for New Jersey family leave because they have no wages in New Jersey for covered employment If you lived in New Jersey while commuting to work in Pennsylvania you must file your unemployment claim directly with Pennsylvania by calling their.

New Jersey looks at the earliest four quarters in the past five in order to determine whether or not the workers earned enough to qualify. Alternative Base-year 1 consists of the four most recently completed calendar quarters preceding the date of a claim and Alternative Base-year 2 consists of the three most recently completed calendar quarters preceding the date of the claim and weeks in the filing quarter up to the date of the claim. You can also file a claim by calling the states Reemployment Call Centers through the New Jersey unemployment phone numbers listed below.

1 for the first failure for one quarter in any eight consecutive quarters 500 for each employee 2 for the second failure for any quarter in any eight consecutive quarters 1000 for each employee 3 for the third and any subsequent failure for one quarter in any eight consecutive quarters 2500 for each employee. Your base period is defined as the first four quarters out of the past five quarters before you file your initial New Jersey unemployment weekly claim. The Alternative Base Period for unemployment benefits is the last four completed calendar quarters preceding the starting date of the claim.

Esdwagov Calculate Your Benefit

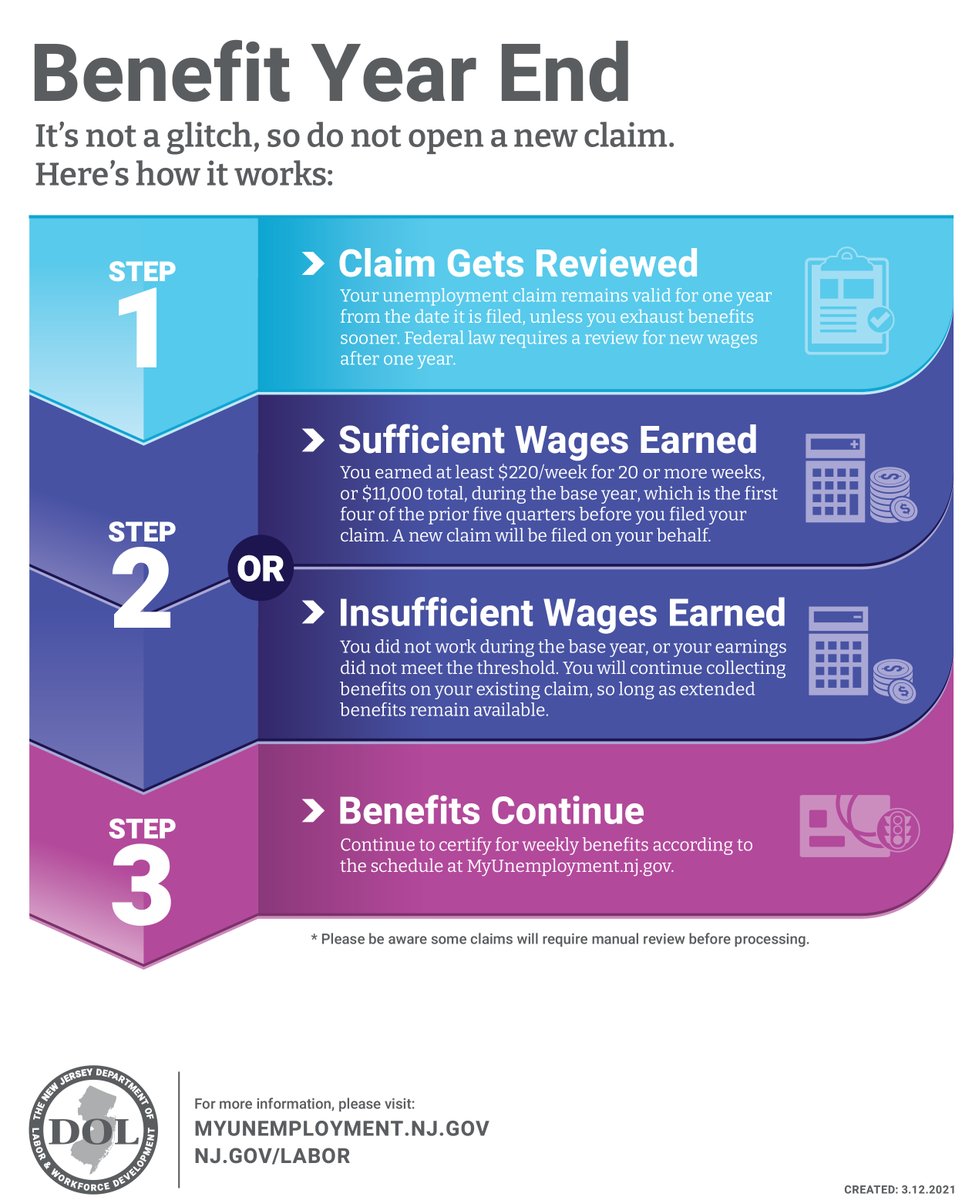

Nj Labor Department On Twitter Remember Don T Open A New Claim Claimants Reaching The Benefit Year End Do Not Have To File A New Claim For Benefits To Continue We Ve Developed New

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Base Period Calculator Determine Your Base Period For Ui Benefits

How To Get Unemployment Benefits In South Dakota Aboutunemployment Org

County Employment And Wages In New Jersey Fourth Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Njdol Maximum Unemployment Benefit Rates Increase On January 1st

Base Period For Filing Unemployment Benefits Fileunemployment Org

Njdol Jobless Residents Receive New Stimulus Payments

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Unemployment Benefits For The Jobless

Unemployment Benefits Comparison By State Fileunemployment Org

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

No comments:

Post a Comment