609 633-7813 Division of Unemployment Insurance. The 118 tax rate applies to individuals with taxable income over 1000000.

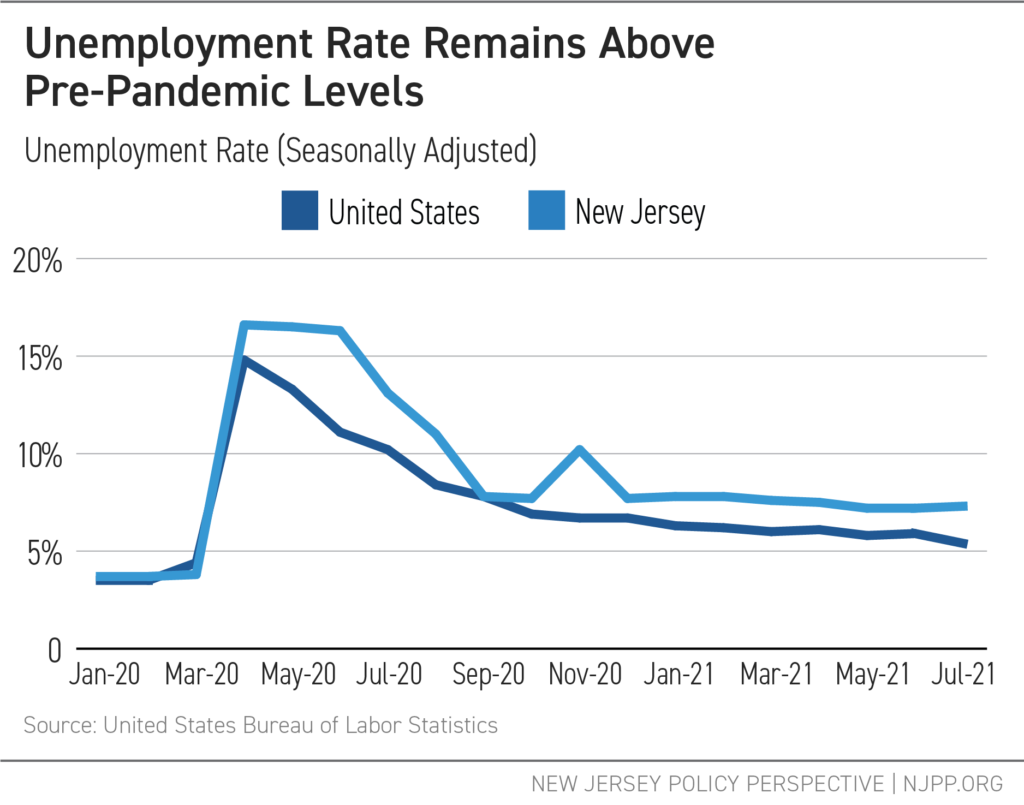

New Jersey Unemployment Rate 2020 Statista

You cannot be paid more than your weekly benefit rate.

Nj unemployment insurance rate. The contribution rate for state and local government entities that choose to make contributions rather than reimburse the trust fund for Unemployment Insurance benefits paid to their former employees remains at 06 percent of taxable wages for calendar year 2022. New Jersey new employer rate includes. 240 up from 220 Fiscal year 2022 SUI tax rates increased.

These rates include the 01 Workforce Development Fund rate and the 00175 Supplemental Workforce Fund rate. 8 Notable periods of unemployment insurance fraud in New Jersey. In addition an employee who was forced to resign also may be eligible for unemployment benefits if he resigned for good cause relating to his job.

Trenton New Jersey 08625-0912 609 633-6400 Option 3 Division of Revenue Department of Treasury Electronic Wage Reporting Ph. As of January 1 2021 the minimum wage in New Jersey rose to 12hour for most employees. For PUAPEUC recipients the balance represents the maximum that was available for weeks of unemployment before 9421.

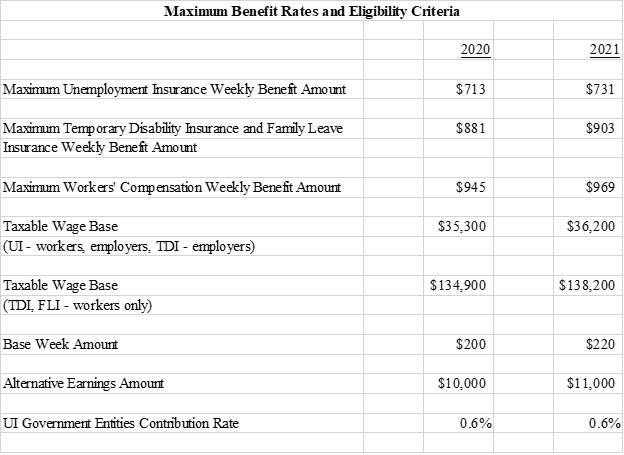

E-GovServicestreasnjgov Division of Employer Accounts Experience Rating PO Box 913 Trenton New Jersey 08625-0913 609 633-6400 Option 2 FAX. FREE Paycheck and Tax Calculators. The maximum weekly benefit for state plan Temporary Disability and Family Leave Insurance claims increases to 903 from 881 while the maximum weekly benefit for Workers Compensation rises to 969 from 945.

New Jersey new employer rate. Unemployment compensation benefits are administered by the New Jersey Department of Labor and Workforce Developments Division of Unemployment Insurance the state government agency that helps New Jersey job seekers and workers. The wage base is computed separately for employers and employees.

993 up from 903 Alternative earnings test amount for UI and TDI. This notice informs employers of their unemployment and disability contribution rates for a fiscal year. To qualify for Unemployment Insurance benefits you must meet all of the eligibility requirements of the New Jersey Unemployment Compensation Law.

File a Claim in New Jersey. The Partial Benefit Rate is 20 higher than your weekly benefit rate. New Jersey Unemployment insurance UI is a government program that provides financial assistance to United States residents who are unemployed but seeking workThe Bureau of Labor Statistics BLS defines unemployment as people who are currently unemployed available to work and have been actively seeking work for at least 4 weeks.

713 up from 696 Maximum Temporary Disability Insurance TDI weekly benefit rate effective January 1 2020 to June 30 2020. New Jersey State Unemployment Insurance SUI New Jersey Wage Base. The following link will let you start the online process to file a claim for benefits.

Maximum Workers Compensation WC weekly benefit rate. The figures used to compute your tax rate will be shown on the form. New Jersey State.

The unemployment insurance improper payment rate in New Jersey was 1198 from July 1 2017 through June 30 2020 according to the US. 667 up from 650. As of 2019 the rate notice will no longer be mailed to you.

For example if your weekly benefit rate is 200 your Partial Benefit Rate is 240 20 higher than 200. Report your gross earnings and all hours worked for the week in which they were earned not when they are paid. 52 rows 27 including AC rate of 04 New Jersey.

Since July 1 1986 New Jerseys unemployment tax tables have included six columns of rates labeled columns A B C D E and E10. The Weekly Benefit Rate is capped at a maximum amount based on the state minimum. Each year at the end of July you may view and print your rate notice using Employer Access.

12000 up from 11000 Base week amount. 2019 Base week amount. 2019 Maximum Temporary Disability Insurance weekly benefit rate.

Republican lawmakers want Murphy to use federal American Rescue. 804 up from 731 Maximum TDI weekly benefit rate. 11 to 28 for 2021.

2019 Maximum Unemployment Insurance weekly benefits rate. New Jersey SUI Rates range from. The new employer rate continues to be 28 for fiscal year 2021.

The maximum weekly benefit amount for unemployment insurance claims filed in 2020 is 713. If you earn 50 during a week you would receive 190 in unemployment benefits 240 - 50 190. The cares act enacted three types of assistance.

As of January 1 the maximum weekly benefit amount for Unemployment Insurance beneficiaries increases to 731 from 713. Unemployment Insurance UI is a program that gives financial support to people who lose their jobs through no fault of their own. New Jersey Department of Labor Workforce.

2019 Alternative earnings test amount for UI and TDI. 2019 Taxable Wage Base under UI TDI and FLI. Apply for Unemployment Insurance in New Jersey Online using this service.

Unemployed job seekers may. For employers for 2021 the wage base increases to 36200 for unemployment insurance disability insurance and workforce development. 945 up from 921 Maximum Unemployment Insurance UI weekly benefits rate.

Maximum unemployment insurance UI weekly benefits rate. Monetary review A telephone interview to gather information about your. 03825 Unemployment Compensation Fund and 00425 Workforce Development Fund for 2021.

New Jersey Unemployment Tax. New Jersey businesses could pay roughly 885 million in additional unemployment insurance UI taxes over three years including a 252 million increase starting in October. 04 to 54 for 2021.

Unemployment insurance benefits now reach a maximum of over 65000 per week and last for 26 weeks. If you earn 50 gross during a week you would receive 190 in unemployment insurance benefits 240 50 190. Column A rates the lowest rates are applicable when the fund is highest 350 of taxable wages or greater.

What is the Maximum Weekly Base Rate for UI benefits in New Jersey. Those who meet the requirements may receive benefits for up to 26 weeks during a one-year.

New Jersey Unemployment Rate 2020 Statista

Unemployment Benefits Comparison By State Fileunemployment Org

Pin By Kipp333 On Braun First Names Unemployment New Jersey

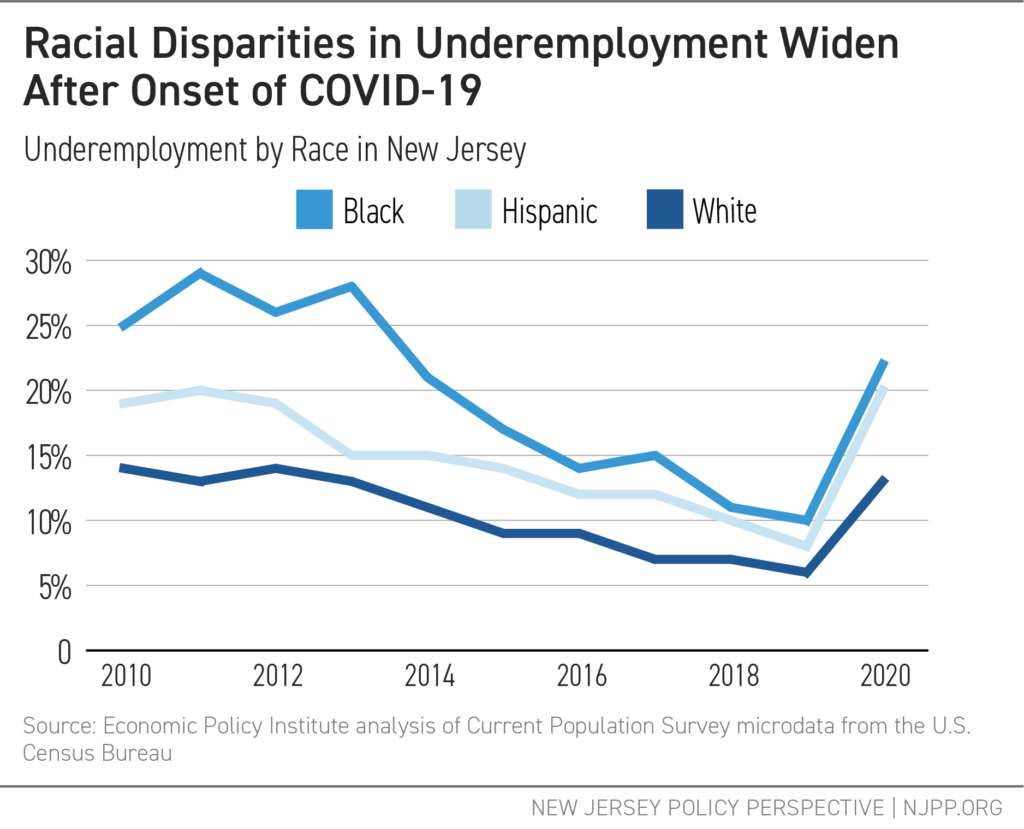

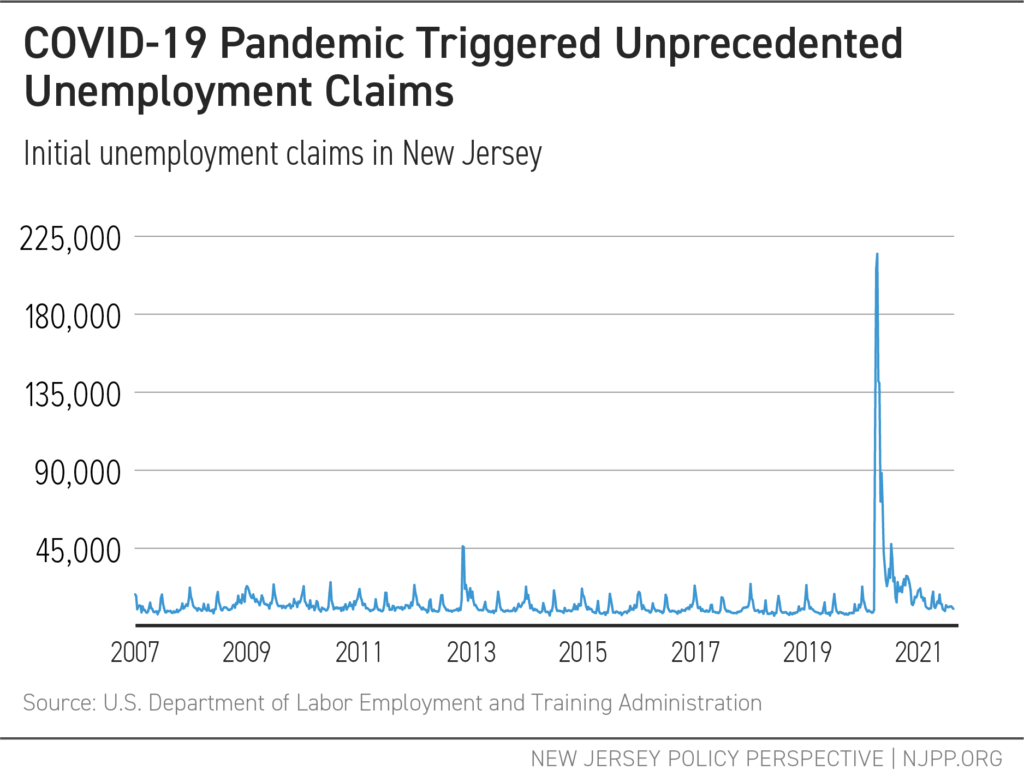

Labor Day Snapshot New Jersey S Uneven Recovery New Jersey Policy Perspective

Pin By Sumit Kumar On Careerbuilder India Staffing Agency Life Insurance Agent Health Insurance Agent

Best And Worst Cities For Repairing Bad Credit Bad Credit Bad Credit Score Credit Score

Njdol Maximum Unemployment Benefit Rates Increase On January 1st

Labor Day Snapshot New Jersey S Uneven Recovery New Jersey Policy Perspective

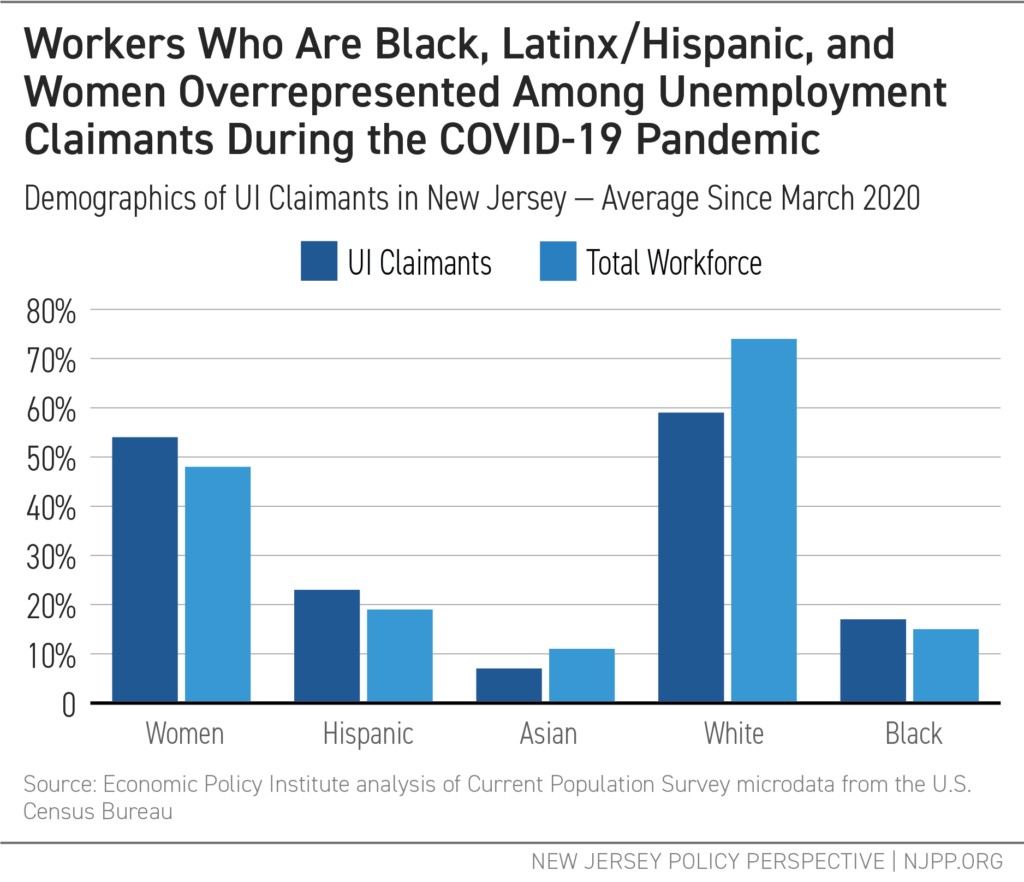

Labor Day Snapshot New Jersey S Uneven Recovery New Jersey Policy Perspective

Real Estate Postcard Templates 6x4 And 5x3 5 Marketing Template Canva Real Estate Postcards Real Estate Agent Marketing Real Estate Buying

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

Pin By Luxury Travel Network On Luxury Properties International Palm Beach Tv Commercials Streaming Tv Insurance Ads

Labor Day Snapshot New Jersey S Uneven Recovery New Jersey Policy Perspective

Pseg Login To Payment Center Pseg Com Pay Bill Check Power Outage Map Paying Bills Bills Payment

No comments:

Post a Comment