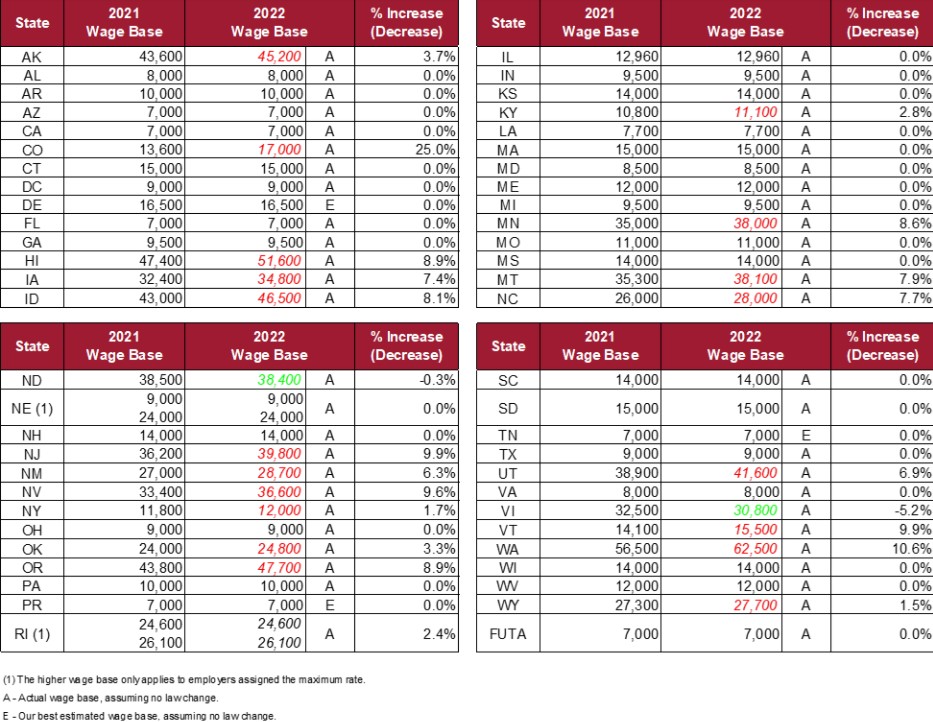

This history is known as an employers unemployment insurance experience. The list of state wage bases is from 2019 to 2022.

Unemployment And Payroll Indicators Detroit Regional Chamber

The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA wage base of 7000 per employee although most states wage bases exceed the required amount.

Michigan unemployment wage base 2022. In 2020 the Trust Fund balance fell below 25B therefore the 2021 taxable wage base is 9500. To access from the APA home page select Compliance and then State Unemployment Wage Bases under Overview The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA taxable wage base of 7000 per employee and most states have wage bases. 2022 Wage Base Limit 2021 Wage Base Limit 2020 Wage Base Limit State Agency Website and Phone Number.

It was 7000 in 2020. Michigan UIA website State ends EB and PUA UI benefits. Beginning in the fifth year of liability the tax rate is made up.

2022 STATE WAGE BASES Updated 092921 2021 STATE WAGE BASES 2020 STATE WAGE BASES 2019 STATE WAGE BASES. The Michigan Wage Hour Division announced Thursday that the base minimum wage for the state will increase to 987 per hour in 2022. As of today 11821 NCs Unemployment tax wage base has not been corrected.

A current listing of enacted leave laws can also be found by clicking here. Taxable Wage Bases 2019 2022 State unemployment insurance taxes are based on a percentage of the taxable wages an employer pays. These changes include minimum wage changes updated state unemployment wage bases and new paid sick leave laws.

Iowa unemployment tax wage base 34800. How to Apply for UI 877600-2722. If we prepare your payroll taxes please bring this notice to us.

The state has one wage base for 2021 it will be 9500 for all employers. Among changes that come with the new year is an increase in hourly pay for Michiganders set for Jan. If the balance is lower the wage base increases.

Finally if you would like to suggest articles or topics for this newsletter or would like to nominate your company to participate in Michigan Employer Advisor Focus Group please send a message to UIA-EmployerAdvisorMichigangov. The new law stops any further increase in the unemployment taxable wage base in 2022. The unemployment-taxable wage base is 9500 for all employers.

The version I am looking at right now is 2019 Pro but I have seen the wrong base amount on all versions. Michigans minimum wage rate will increase to 987 from the current 965 as. In recent years this construction rate has ranged from 68 to 81.

Michigans UI law requires that the SUI taxable wage base increase to 9500 for any calendar year that the states UI trust fund balance was less than 25 billion on the previous June 30EY tax alert 2021-0465 3-1-2021. The wage base fluctuates with the balance in the states unemployment trust fund. The maximum amount the wage base can be is 12000.

The reduced wage base for non-delinquent employers is not valid as the Michigan Unemployment Trust Fund has fallen below the required threshold. It shows an employers prior Actual Reserve benefits charged and contributions paid basis of the CBC and ABC components since the last annual determination and the employers new Actual Reserve. The UIA 2022 taxable wage base for employers will be 9500.

Michigans two-tiered unemployment-taxable wage base system is not in effect for 2021 a spokeswoman for the state Department of Labor and Economic Opportunity said Feb. The New 2022 Tax Withholding Table can be found here. The taxable wage base is 9500.

Michigan pending legislation would hold the SUI taxable wage base at 9000 for calendar year 2021. You should have received a notice of your 2022 rate in early December. It should be 27000.

Recently introduced HB 6136 would if enacted provide that the Michigan state unemployment insurance SUI taxable wage base would remain at 9000 for calendar year 2021 rather than increase to 9500 due to a decrease in the states UI trust fund. The 2021 taxable wage base for employers in the highest SUI tax rate group is 26100. The MES Act provides for a reduced taxable wage base if the UIA Trust Fund balance reaches or exceeds 25 B for two consecutive quarters.

Notification of State Unemployment Tax Rate Early each year the UI issues its Tax Rate Determination for Calendar Year 20__ Form UIA 1771. For each year thereafter computed as 16 of the states average annual wage. Consequently the employer SUI taxable wage base will increase to 9500 for 2021 unless the state legislature reintroduces and enacts similar legislation during the 20212022 legislative session.

For 2021 the wage base was 10000. Federal Unemployment Tax FUTA wage base 7000. The increase to the 2021 SUI taxable wage base up from 9000 in 2020 was confirmed by the Michigan Unemployment Insurance Agency UIA.

It is still showing 25200. Unemployment Taxable Wage Base. A number of states and the District of Columbia have payroll-related changes that will take effect in the new year.

The rates in the third and fourth years of liability are partly based on the employers own history of benefit charges and taxable payroll. Unemployment tax rates generally are unchanged from 2020. Unemployment Insurance Agency What is the current taxable wage base.

The taxable wage base will continue to increase as follows. Michigans labor force participation rate a measure of people working or actively looking for work dropped to 574 in April 2020 down. All payroll updates have been done.

Federal and State Payroll Updates - 2022.

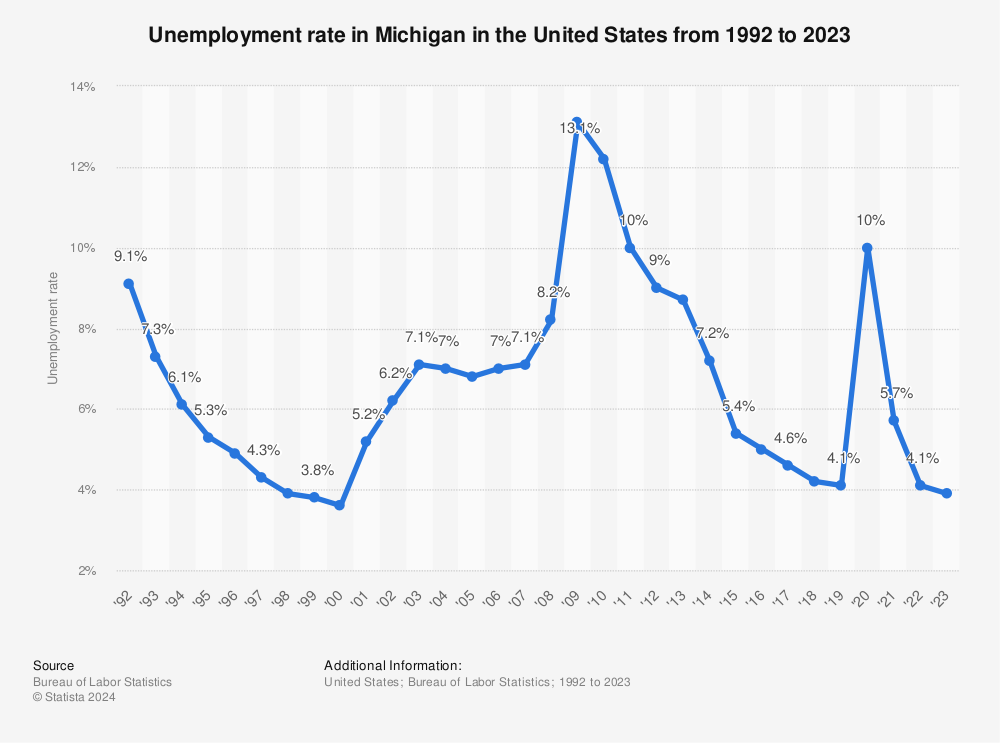

Michigan Unemployment Rate 2020 Statista

Labor And Economic Opportunity December 2021

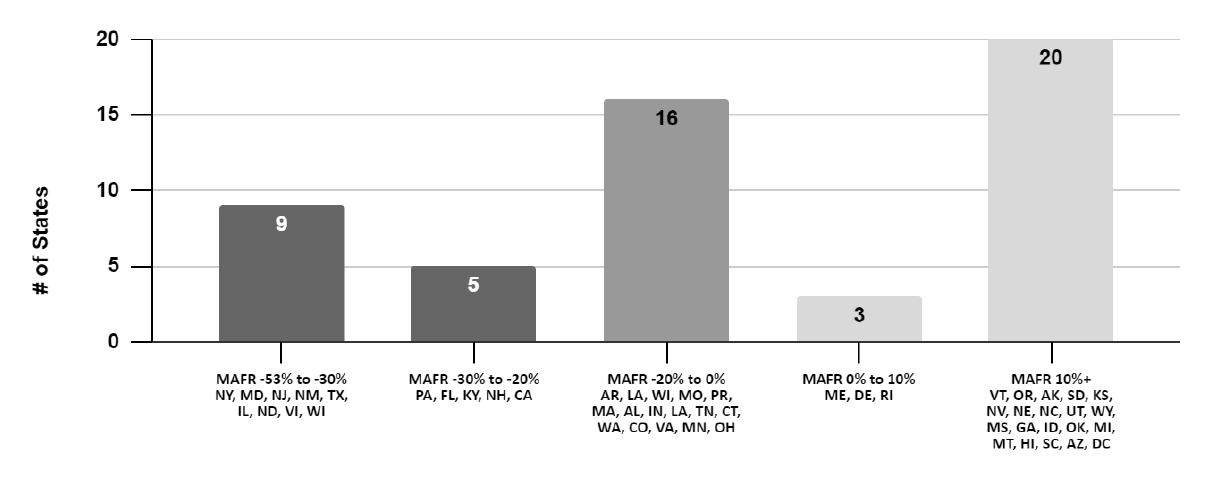

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

What You Need To Know About Michigan S New Minimum Wage Sick Pay Laws Mlive Com

Labor And Economic Opportunity December 2021

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

2022 State Minimum Wage Rates Govdocs

Labor And Economic Opportunity December 2021

Labor And Economic Opportunity December 2021

Michigan Taxable Wage Base Increases To 9 500

Coronavirus Uia Update Michigan Activates Federal Extended Benefits

No comments:

Post a Comment