Unemployment compensation is generally included in adjusted gross AGI income under the IRC. Contributing employers covered under the Michigan Employment Security MES Act are required to pay unemployment insurance taxes on their employees wages.

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

Yes the extra 300 unemployment benefit will be considered taxable income in April 2021 when you file your taxes.

Is michigan unemployment taxable. This week HB 6136 Hall was introduced to prevent an automatic increase in unemployment taxes for Michigan job providers. Is unemployment income earned in Michigan not taxed by Michigan for a non-resident. In Michigan state UI tax is just one of several taxes that employers must pay.

Under the Michigan Income Tax Act taxable income means adjusted gross income under the Internal Revenue Code IRC subject to certain statutory adjustments. If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings. Unemployment compensation is excluded from gross is unemployment taxable in michigan for 2020 of less than 150000 up to 10200.

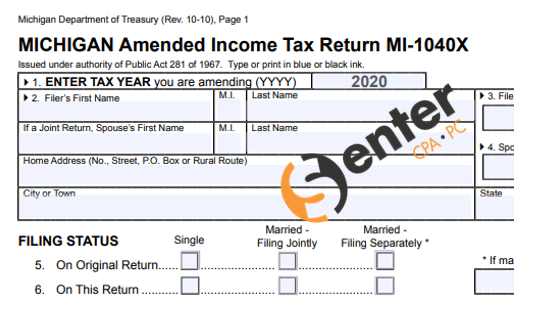

Michigan Confirms Unemployment Compensation is Taxable for Tax Year 2020 The State of Michigan has issued a decision on the treatment of unemployment compensation for the 2020 tax year. Do I have to pay Taxes on Stimulus Payments The 1200 stimulus payments that people received from the federal government under the. Form UIA 1771Tax Rate Determination for Calendar Year 2021.

You have the option to have taxes withheld. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. Michigan law currently prescribes that an automatic increase in the taxable wage base-part of the formula that determines how much unemployment taxes an employer must pay- will occur if the Unemployment Compensation Fund falls below 25 billion.

Therefore the federal exclusion of certain unemployment compensation will result in a lower federal AGI which will flow-through to the Michigan return resulting in a lower taxable income For taxpayers that have not yet filed at the state or federal level they can do so the IRS has worksheets in place right now to accommodate the filing. Michigan law currently prescribes that an automatic increase in the taxable wage base-part of the formula that determines how much unemployment taxes an employer must pay- will occur if the. Are unemployment benefits taxable.

Up to 10200 of unemployment benefits will tax exempt in. Up to 10200 of unemployment benefits will tax exempt in. Conformity with the federal law eg 150000 up to 10200 of benefits.

What is a taxable wage base. Unemployment compensation is taxable. The taxable wage base is the amount of an employees wages that is taxed by the Unemployment Insurance Agency each calendar year and is payable by the employer.

Michigan 2021 SUI taxable wage base to increase. You will receive a 1099-G. The UI tax funds unemployment compensation programs for eligible employees.

Governor vetoes provision that would have bolstered the UI trust fund balance. Take a look at Are UI Benefits Taxable. Assume that your company receives a good assessment and your SUTA tax rate for 2019 is 27.

September 3 2020. Unemployment compensation is taxable. But a new break for 2020 returns is being allowed.

Recently introduced HB 6136 would if enacted provide that the Michigan state unemployment insurance SUI taxable wage base would remain at 9000 for calendar year 2021 rather than increase to 9500 due to a decrease in the states UI. Legislation HB 6136 that would have held the 2021 state unemployment insurance SUI taxable wage base at 9000 failed to pass before the end of the 20192020 legislative session. If your small business has employees working in Michigan youll need to pay Michigan unemployment insurance UI tax.

Therefore unemployment compensation is also. Therefore unemployment compensation is also. Unemployment compensation is generally included in adjusted gross AGI income under the IRC.

Michigan pending legislation would hold the SUI taxable wage base at 9000 for calendar year 2021. As of publication the state unemployment tax rate ranges between 06 and 103 percent. Michigan UIA website 2021 SUI wage base increases.

Michigan Confirms Unemployment Compensation is Taxable for. The Michigan 2021 state unemployment insurance SUI tax rates continue to range from 006 to 103. Workers do not pay Michigan unemployment taxes and employers are not.

New employers except for certain employers in the construction industry pay at 27. Using the formula below you would be required to pay 1458 into your states unemployment fund. Many dont know it but unemployment benefits including those extended by the pandemic are taxable.

Typically all unemployment compensation is reported as taxable income. Under the Michigan Income Tax Act taxable income means adjusted gross income under the Internal Revenue Code IRC subject to certain statutory adjustments.

Send A Message Through Upper Peninsula Michigan Works Facebook

This Quarterly Tax Reference Guide Is For Any Business That Has Employee S And Cont Bookkeeping Business Small Business Bookkeeping Small Business Organization

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

Treasury Grants Tax Penalty And Interest Relief To Michigan Individuals Receiving Unemployment Benefits Doeren Mayhew Cpas

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Labor And Economic Opportunity December 2021

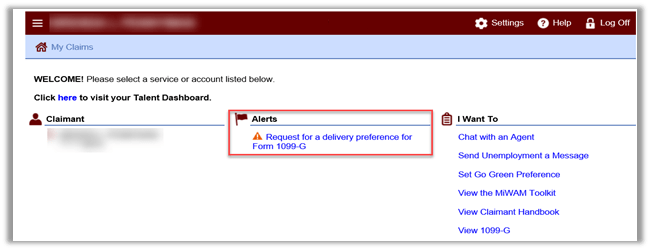

Labor And Economic Opportunity How To Request Your 1099 G

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Labor And Economic Opportunity How To Request Your 1099 G

Miwam Michigan Web Account Manager Account Login Claimants Guide

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Michigan Families Need Unemployment Benefits And A Functional System

No comments:

Post a Comment