To calculate your WBA divide your base period quarter with the highest wages by 25 and round to the nearest dollar. Partial Unemployment Benefit Calculator If you work part time your benefits are reduced in increments based on your total hours of work for the week.

New York Unemployment Benefit Changes Stokes Wagner Jdsupra

How to calculate unemployment benefits in New York.

Unemployment quarters ny. In order to receive unemployment benefits in New York you must have been employed for paid work for at least 2 calendar quarters during your Base Period a Base Period is one year or 4 calendar quarters. If a claim is filed anytime between January to March 2020 the base period will be 12 months from October 1 2018 through September 30 2019. Youth Unemployment Rate 820.

How to find Standard Base Period. GDP is the annual rate and inflation is for December of that year and is the year-over-year rate. 13 rows File your Quarterly Combined Withholding Wage Reporting and.

It comprises the first four of the last five completed calendar quarters preceding a UI claims starting date. In order to be eligible for partial unemployment benefits your hours must have been reduced to less than your normal work hours through no fault of your own you must work 30 or fewer hours in a week and you must. NYs minimum wage.

Disaster Unemployment Assistance. The New York unemployment EDD application states that former employees must have earned wages for working in at least two quarters of the base period. In order to receive unemployment benefits in New York you must have been employed for paid work for at least 2 calendar quarters during your Base Period.

Former employees must have worked and been paid wages in at least two calendar quarters by companies who have unemployment insurance. Beginning October 20 2021 through November 18 2021 DUA is available to New Yorkers in the following New York Counties Bronx Dutchess Kings Nassau Queens Richmond Rockland Suffolk and Westchester who 1 lost employment as a direct result of Hurricane Ida and 2 live or work in an impacted county. The maximum weekly benefit rate is 504 for highest quarterly earnings of 13104.

To qualify for unemployment insurance in NY your total base period earnings must be at least 15 times your HQW. Maximum New York State Unemployment Benefit. Base periods are divided into calendar quarters and the quarter you were paid the highest amount of wages determines the amount of your New York unemployment weekly claims.

Eligibility Requirements for New York Unemployment Benefits. In New York there are two basic eligibility requirements for receiving unemployment benefits. Average Hourly Earnings YoY 470.

Additionally claimants must have grossed at least 1900 in one of those quarters and their total wages must be 15 times their highest quarter earnings. In 2019 the job must have paid you at least 2400 in wages during one of the calendar quarters. The first quarter runs from January 1 through March 31.

New York defines an employer as having paid at least 300 in wages during any quarter. To find out how much your actual weekly benefits will be use this calculator. The first four of the five completed calendar quarters before you filed for benefits.

Your HQW must be a minimum of at least 221 times NYs minimum wage which gets rounded to the next lowest 100 if needed. How much you may get for unemployment in NY is the total you earned in your highest quarter divided by 26 up to a maximum of 504 per week. Additionally claimants must have grossed at least 1900 in one of those quarters and their total wages must be 15 times their highest quarter earnings.

Long Term Unemployment Rate 124. NY residents total wages paid must be at least 15 times the amount paid in their highest paid quarter. How long do you have to work to collect unemployment in NY.

Past workers must have been paid at least 1900 in one calendar quarter. The minimum weekly benefit rate is 100 104 starting January 1 2020 provided you meet eligibility requirements. Former employees must have worked and been paid wages in at least two calendar quarters by companies who have unemployment insurance.

The unemployment benefit rate for a week of total unemployment is based on the employees wages of the calendar quarter with the highest wages up to a maximum weekly benefit. For example if an individuals. Each calendar quarter the law requires liable employers to report their payroll and pay unemployment insurance contributions.

Unemployment rates for the years 1929 through 1947 were calculated from a different BLS source due to current BLS data only going back to 1948. They do this on the Quarterly Combined Withholding Wage Reporting and Unemployment Insurance Return Form NYS-45 which must be filed online see below for information about electronic filing. You must have at least two calendar quarters with earnings within four consecutive calendar quarters in order to be eligible for a weekly benefit.

Past workers must have been paid at least 1900 in one calendar quarter. Your MBA is 26 times your weekly benefit amount or 27 percent of all your wages in the base period whichever is less. 26 rows The total wages paid to you in your base period must be one and one.

NY residents total wages paid must be at least 15 times the amount paid in their highest paid quarter. Quarters are specific three-month time spans within a year. While you can determine ahead of time how much New York unemployment compensation you receive you will be formally notified before your benefits begin.

The second quarter runs from April 1 through June 30. Refer to the Rates page of the Research Foundation RF Web site for the current amount. The New York unemployment EDD application states that former employees must have earned wages for working in at least two quarters of the base period.

First you must have earned a minimum amount during the base period.

How Much Unemployment Benefits Will I Get In New York As Com

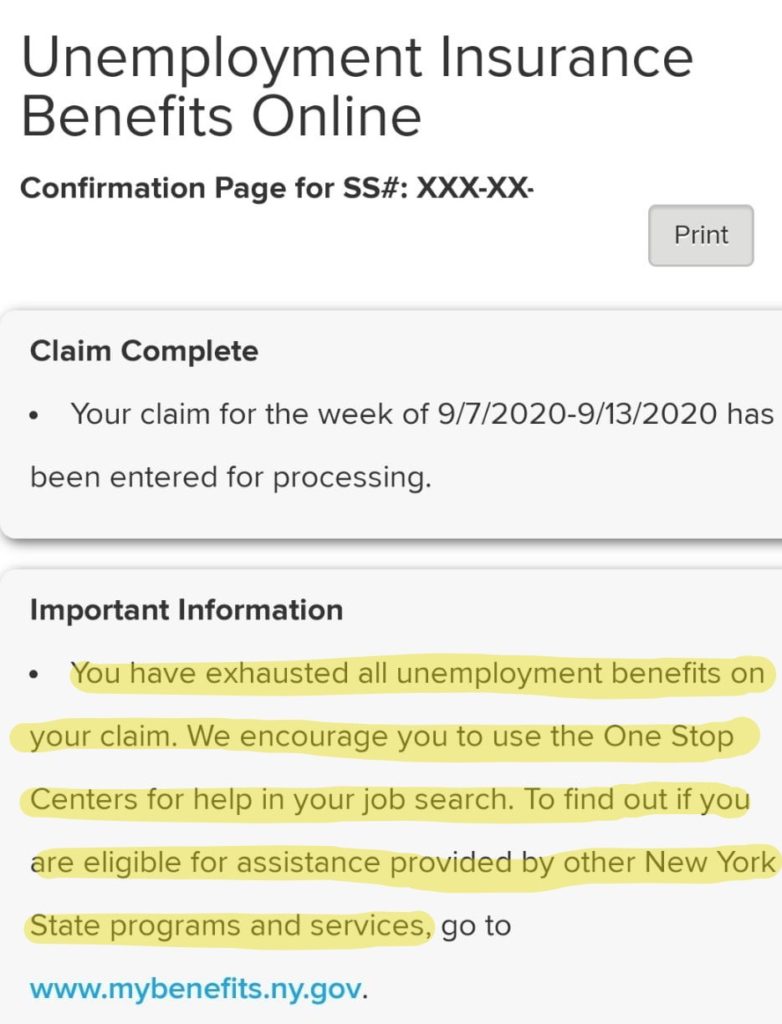

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Bye Date Arrives For Many New Yorkers Receiving Unemployment

Why Am I Getting Only 182 A Week Homeunemployed Com

All About Extended New York Unemployment Benefits

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Pin On America S Great Recession

New York State Department Of Labor Update The Extended Benefits Eb Program Is Now In Effect In Nys Thanks To The Pandemic Emergency Unemployment Compensation Peuc Eb Programs New Yorkers

How Does Unemployment Work In New York Employment Lawyers

Nys Department Of Labor On Twitter Icymi The Best Way To File A New Claim For Unemployment Insurance Ui Benefits Is Online At Https T Co T2tezsp2lf With All The Information Listed Below Click The

New York Ny Dol Unemployment Insurance Compensation After End Of Pandemic Programs What You Can Get In 2022 And Claiming Retroactive Payments News And Updates Aving To Invest

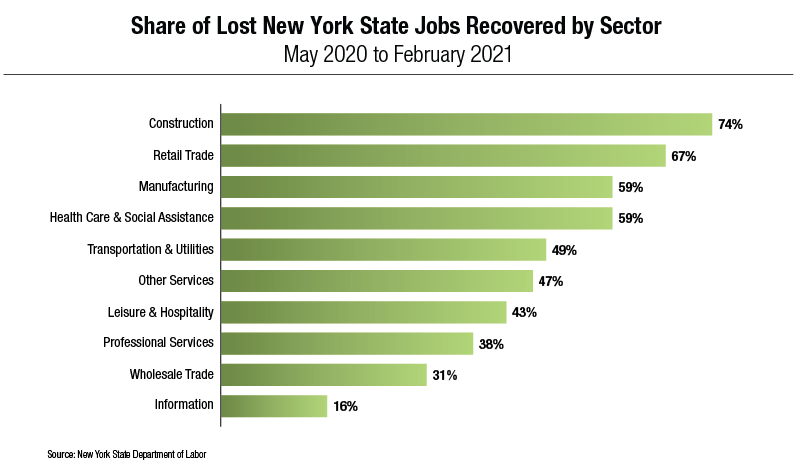

New York S Economy And Finances In The Covid 19 Era March 30 2021 Office Of The New York State Comptroller

No comments:

Post a Comment