Twc will be receiving benefit eligibility requirements you unemployment texas benefits eligibility requirements that would end of unemployment benefits if you were moving with. Unemployment benefits are taxable income reportable to the Internal Revenue Service IRS under federal law.

Last employers business name and address.

Unemployment benefits requirements in texas. In Texas employees who are fired for work-related misconduct may not qualify for unemployment benefits. Unemployment benefits are available if you meet eligibility requirements set by the Texas Unemployment Compensation Act TUCA. Texas Unemployment Eligibility Requirements.

New eligibility requirement to get unemployment benefits in Texas Texas Workforce Commission reinstates work search proof. In order to qualify for unemployment benefits you must be ready willing available and able to work. Past wages date of last job termination and ongoing availability for work and search.

Essential Worker parents and guardians are in challenge of past care. To meet Texas unemployment benefits eligibility you must meet three requirements. Review the work requirements for initial and continued eligibility.

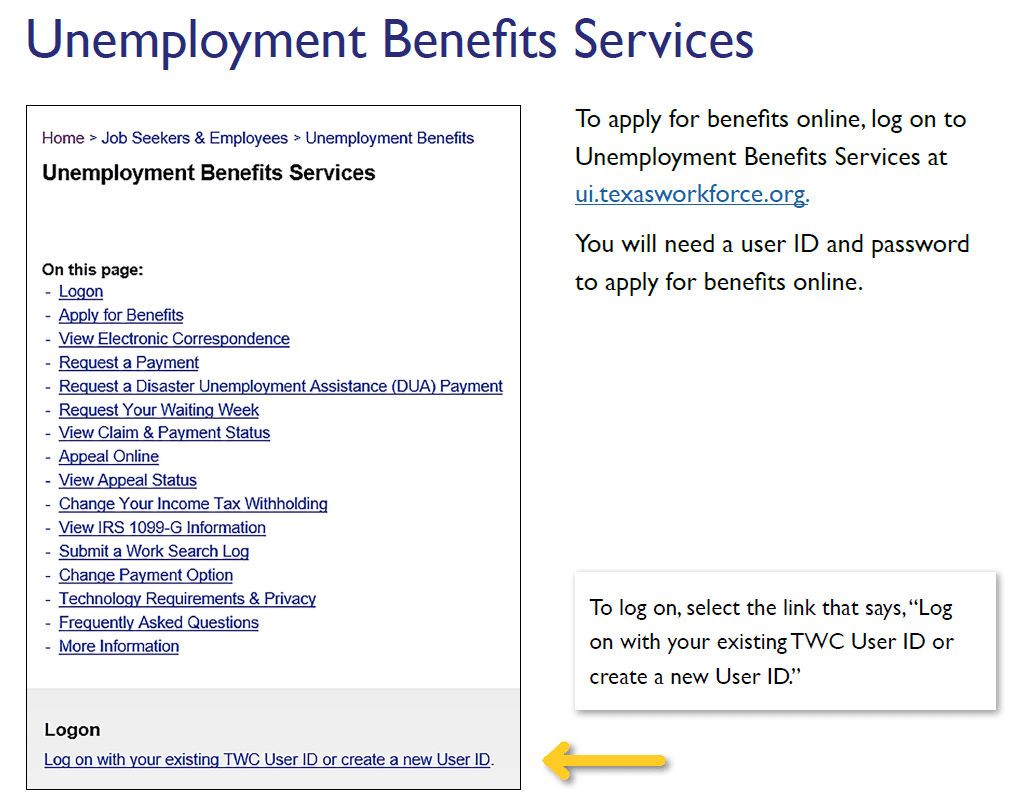

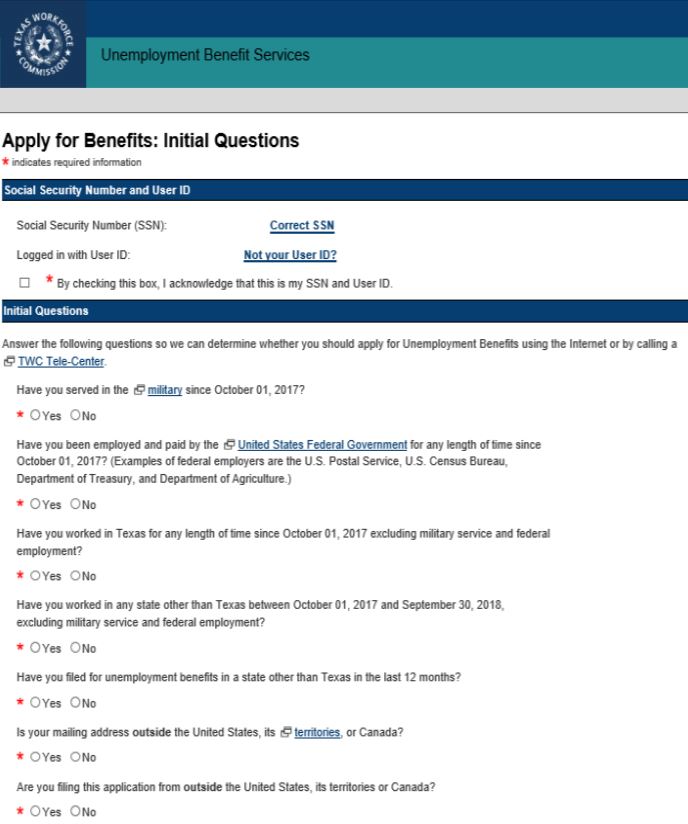

Those seeking to apply for Unemployment Benefits will need to submit an application. I am out of work for the foreseeable future due to Covid 19. In the state of Texas unemployment benefits payments are authorized under the Texas Unemployment Compensation Act which is Title Four Subtitle A of the Texas Labor Code which governs Texas unemployment benefits.

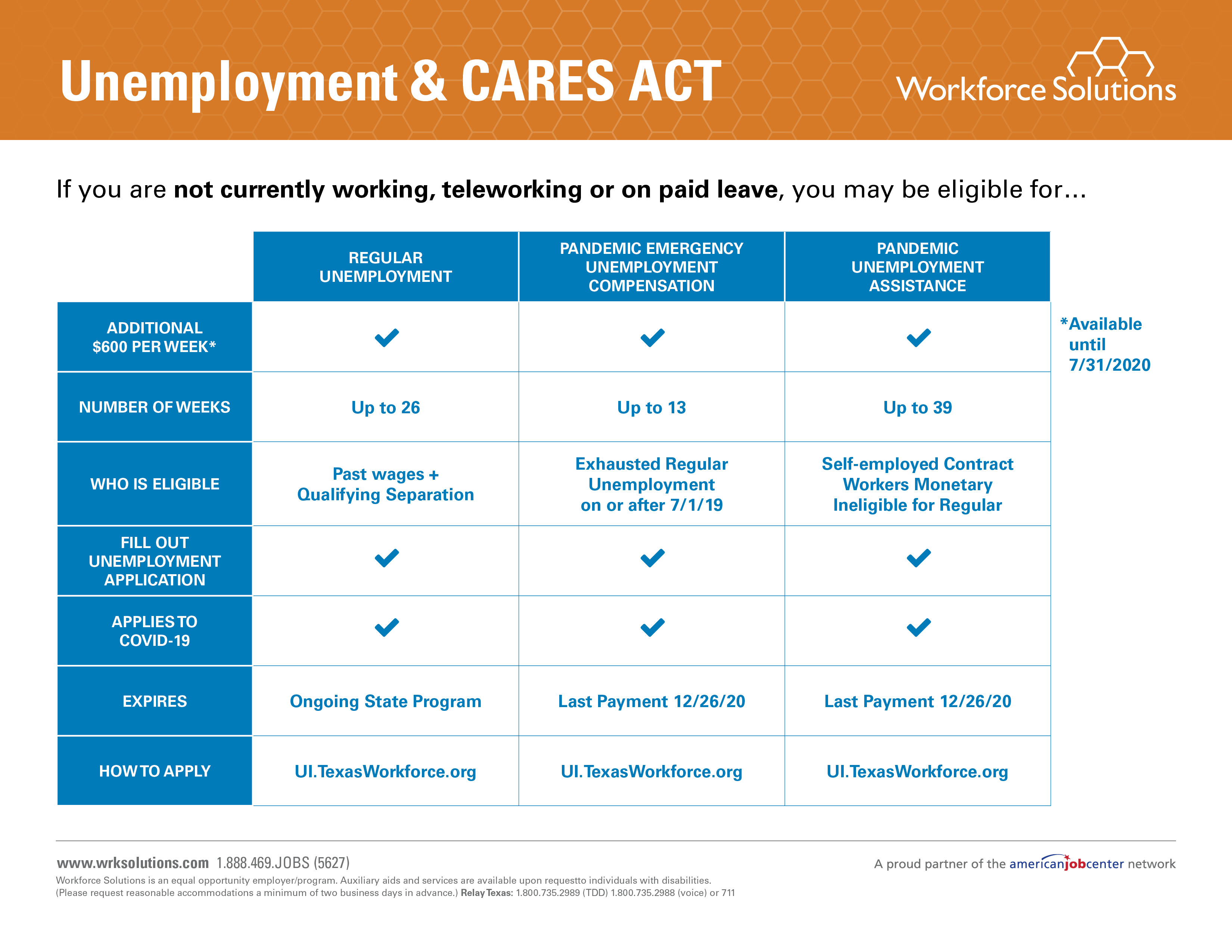

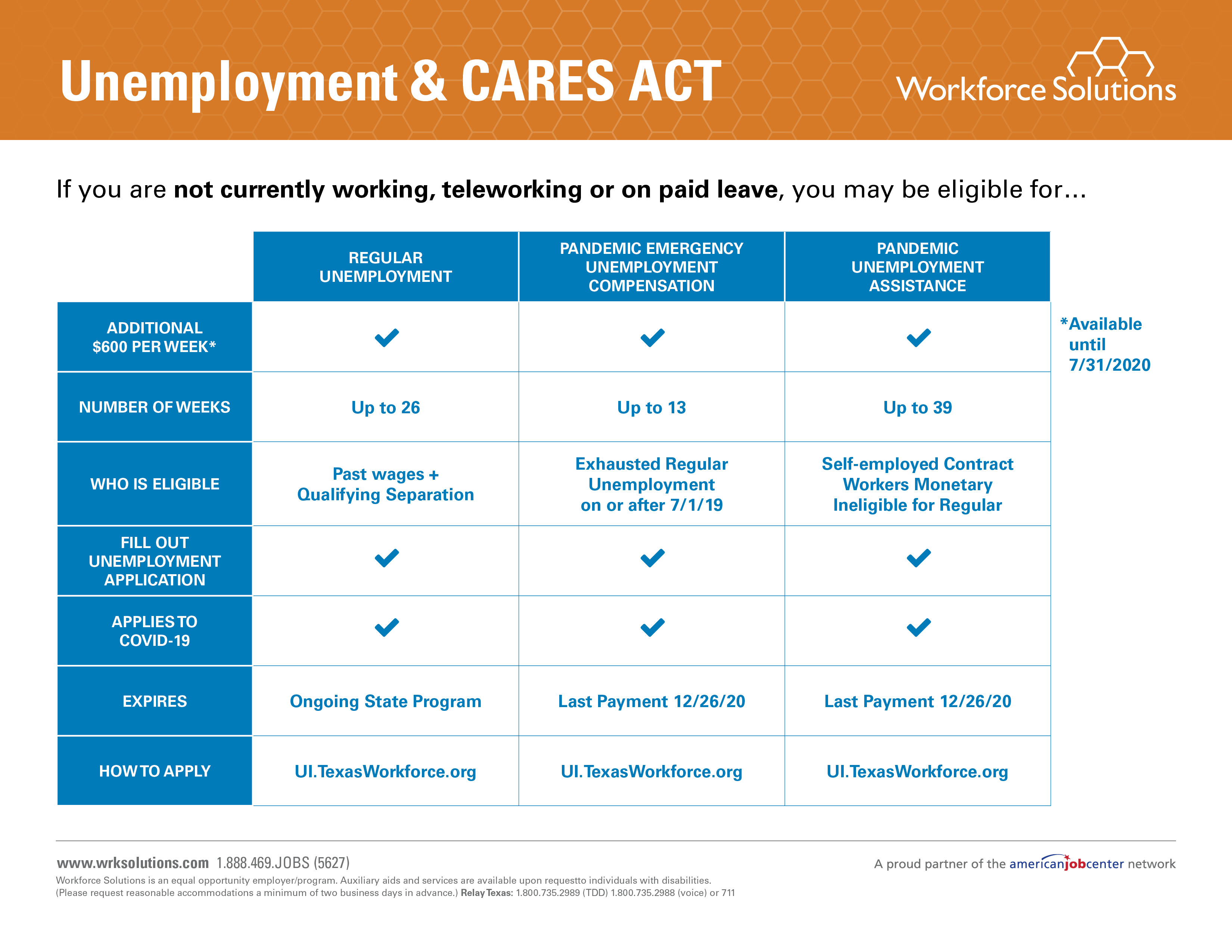

Job separations Ongoing eligibility requirements. If you qualify for unemployment benefits in Texas you can receive an initial 26 weeks of benefits. Extended unemployment benefits for workers who have used all state benefits as well as a temporary.

You need to be a US. You must have worked in Texas during the past 12 to 18 months. In order to submit an Texas unemployment payment request involves the person having to submit their previous employers business.

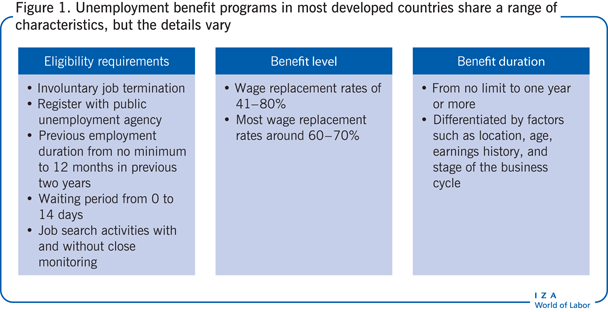

In order to receive benefits a worker -- who is experiencing unemployment through no fault of his own -- must meet qualifications and requirements in three areas. In Texas as in every other state employees who are temporarily out of work through no fault of their own may qualify to collect unemployment benefitsThe eligibility rules prior earnings requirements benefit amounts and other details vary from state to state however. Additionally an additional 26 weeks of benefits may be available if the state triggers what is called an Extended Benefits Period as occurred during the COVID-19 pandemic.

To be eligible for these benefits you must have earned a certain amount of income in your past job. Those guidelines include situations such as losing your job in a reduction-in-force action or you are let go due to a downturn in the economy or at a particular employer. TWC is temporarily waiving these requirements to ensure all Texans can have access to resources when in need.

Review these scenarios to determine how COVID-19 may affect eligibility. Citizen or a legal alien. You must meet all requirements in each of these three areas to qualify for unemployment benefits.

TWC evaluates your unemployment benefits claim based on. Can you draw unemployment if you quit your job in Texas. Using the formula below you would be required to pay 1458 into your states unemployment fund.

If you are receiving benefits you may have federal income taxes withheld from your unemployment benefit payments. In order to be eligible for Texas Unemployment Insurance UI enrollment youll need to meet the following requirements. Your past wages are one of the eligibility requirements and the basis of your potential unemployment benefit amounts.

First and last dates month day and year you worked for your last employer. Any risks to your health safety or morals. The Texas Unemployment Compensation Act dictates the rules and regulations of unemployment benefits in Texas.

You must be unemployed through no fault of your own and within the guidelines as defined by Texas law. Texas Unemployment Benefits Requirements. Enhanced and Extended Unemployment Benefits.

TWC determines if a job is suitable based on. Employers pay unemployment insurance taxes and reimbursements that support unemployment benefit payments. You must report all unemployment benefits you receive to the IRS on your federal tax return.

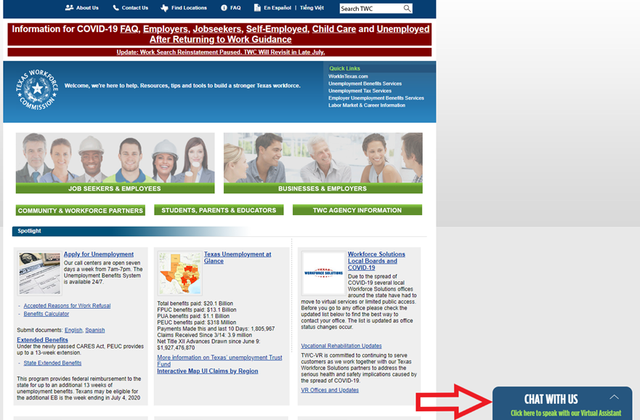

Unemployment Benefits Eligibility Requirements in Texas April 13 2020 In recent weeks the Texas Workforce Commission and other unemployment offices across the country have been flooded with new applications for unemployment benefits. Employees do not pay unemployment taxes and employers cannot deduct unemployment taxes from employees paychecks. To continue to be eligible for unemployment benefits you must apply for and be able to accept a suitable full-time job.

You must be currently unemployed and available for work. You must also be able to work available for work and looking for work each week that you request benefits. The Texas Workforce Commission has provided more information about qualifying job separation scenarios here.

The total amount of your base period wages must be at least 37 times that of your weekly benefit amount. Unemployment Eligibility Work Requirements. Assume that your company receives a good assessment and your SUTA tax rate for 2019 is 27.

Thus if you are an unemployed Texas resident you must meet the following qualifications for unemployment compensation in order to continue to receive benefits. Your experience qualifications and training. I have been approved for unemployment benefits but it says I have to apply to different jobs 3 times a week.

The Equifax logo is a registered trademark owned by Equifax in the United States and other countries. To qualify for unemployment benefits in Texas you must have worked in Texas during the past 12 to 18 months and have at least a minimum amount of wages as required by our guidelines. If youre unemployed and struggling financially you may qualify to receive TWC unemployment program benefits if youre able and willing to continue looking for work.

In order to apply you will need. The working conditions and pay for similar work in your area. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

Covid 19 Unemployment Benefits Hamilton Ryker

Iza World Of Labor Unemployment Benefits And Unemployment

Texas Unemployment Login Twc Logon Help Unemployment Portal

Unemployment Benefits For Green Card Holders Citizenpath

Texas Twc Enhanced Unemployment Benefits With The End Of Pandemic Unemployment Programs How Much You Can Get In 2022 And Claiming Back Dated Payments Aving To Invest

Texas Unemployment Login Twc Logon Help Unemployment Portal

Unemployment Benefits Information

Pin By Rhonda Rutledge On Spirituality Denial Family Law Lakewood

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

Unemployment Benefits Workforce Solutions

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

Contact For Texas Unemployment Benefits Phone Email

No comments:

Post a Comment