Federal Unemployment Tax Act FUTA taxes funds the unemployment insurance and job service program available in each state. Insufficient earnings or length of employment.

Artist Management Contract Template Lovely 6 Artist Management Contract Template Spqp Contract Template Artist Management Elementary School Newsletter Template

What I am getting at is that some weeks you may earn more than your weekly benefit which is why they give you 0 dollars.

Unemployment 0 due to deductions. So people receiving unemployment compensation will end up in that category since their counted income will be capped at 133 of the poverty level. If you still have a claim balance then you are still good. Tax Treatment of Unemployment Compensation.

We have no money coming in and we are getting desperate. OESC also publishes Unemployment Insurance. If your modified AGI is 150000 or more you cant exclude any unemployment compensation.

Many people receive between 200 and 400 a week. While an unemployment claim stating that you are eligible for 0 shouldnt deter you from applying there are some factors you should consider before filing a claim. BEACON 20 is a multi-year project dating back to 2015 that integrates all benefits appeals tax and reemployment functions of the unemployment insurance system.

The IRS will begin accepting tax returns on Jan. The Logan Utah-Idaho metropolitan area had the lowest unemployment rate in October of any metro area in the country at 11 according. Reasons why unemployment is so high right now.

The FUTA tax is 6 0060 on the first 7000 of income for each employee. The following circumstances may disqualify you from collecting unemployment benefits. The total amount of income you receive including your unemployment benefits and your filing status will.

If you lost your job in 2020 and youre faced with preparing your tax return for that year its important to know which of your unemployment benefits are considered taxable income. Unemployment benefits are included along with your other income such as wages salaries and bank interest For tax year 2020 the first 10200 of unemployment income were tax free for taxpayers with an AGI of less than 150000. Generally to receive unemployment benefits you need to meet guidelines related to your length of employment earnings classification as an employee and the circumstances of losing your job.

Businesses all over the nation are experiencing a shortage of workers. Weekly benefit amount ranges from 5 and 900 per week depending on your state income history and any additional income you have currently. Use the Unemployment Compensation Exclusion Worksheet to figure your modified AGI and the amount to exclude.

Unemployment compensation is taxable. Lost job because of Covid-19. Though FUTA tax is a payroll tax it is different from the FICA taxes in the sense that only the employer contributes toward the FUTA taxes.

What does it mean when unemployment states deductions in excess of weekly benefit and how do I correct the situation. The 15200 excluded from income is all of the 5000 unemployment compensation paid to your spouse plus 10200 of the 20000 paid to you. The American Rescue Plan Act ARPA passed in March 2021 includes a provision that makes 10200 of unemployment compensation earned in 2020 tax-free for taxpayers with modified.

In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse. In 2021 there was a change to the way unemployment benefits taxes are paid. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax.

Lost job because of Covid-19. Note that there are some states that. Exceptions to this rule are.

In addition to state UI tax employers have other responsibilities not covered in this article such as federal UI tax state. As part of the American Rescue Plan the first 10200 of unemployment benefits received in 2020 was free of federal taxes. The cause for this is due to the pandemic were living in.

Most states pay unemployment benefits for a maximum of 26 weeks. Most states have their own State Unemployment Insurance Tax Act SUTA or SUI. In order to have qualified for the.

This amount is deducted from the amount of employee federal unemployment taxes you owe. For your 2021 tax return the standard deduction is now 12550 for single filers an increase of 150 and 25100 for married couples filing. However the American Rescue Plan Act of 2021 allows an exclusion of unemployment compensation of up to 10200 for individuals for taxable year 2020.

Heres what to know about filing taxes unemployment claims and child tax credit payments. Consequently the effective rate works out to 06 0006. The official rate of 48 is less than a quarter of the true unemployment rate and is so far from reality its almost comical.

Including those forced to retire early those forced into PT work when they wanted fulltime work those unemployed for more than 26 weeks. The funds provide compensation for workers who lose their jobs. You must pay federal unemployment tax based on employee wages or salaries.

The LISEP 228 unemployment number captures all types of unemployment. BEACON 20 is replacing a legacy mainframe IT system that is several decades old. If your claim balance is 0 then you need to probably file a new claim.

Check your claim balance. The FUTA rate is 60 and employers can take a credit of up to 54 of taxable income if they pay state unemployment taxes. An Employers Guide to Unemployment Insurance Compensation Employer UI Taxes Benefit Wage Charges New Hire Reporting and more which you can download from the OESC website.

The enhanced premium subsidies in the American Rescue Plan result in 0 benchmark plan premiums for buyers with income up to 150 of the federal poverty level. Unemployment compensation is considered taxable income by the IRS and most states thus you are required to report all unemployment income as reported on Form 1099-G on your income tax returnYou should be mailed a Form 1099-G before January 31 2022 for Tax Year 2021 stating exactly how much in taxable unemployment benefits you received. Most employers receive a maximum credit of up to 54 0054 against this FUTA tax for allowable state unemployment tax.

The benefits are retroactive which means that you could potentially qualify for financial support insofar that you became unemployed as a direct result of the coronavirus pandemic on or after January 27.

Slope Intercept Form Examples Eliminate Your Fears And Doubts About Slope Intercept Form Exa Slope Intercept Form Slope Intercept Point Slope Form

Printable Budget Worksheets Printable Budgeting Worksheets Printable Budget Worksheet Budget Printables

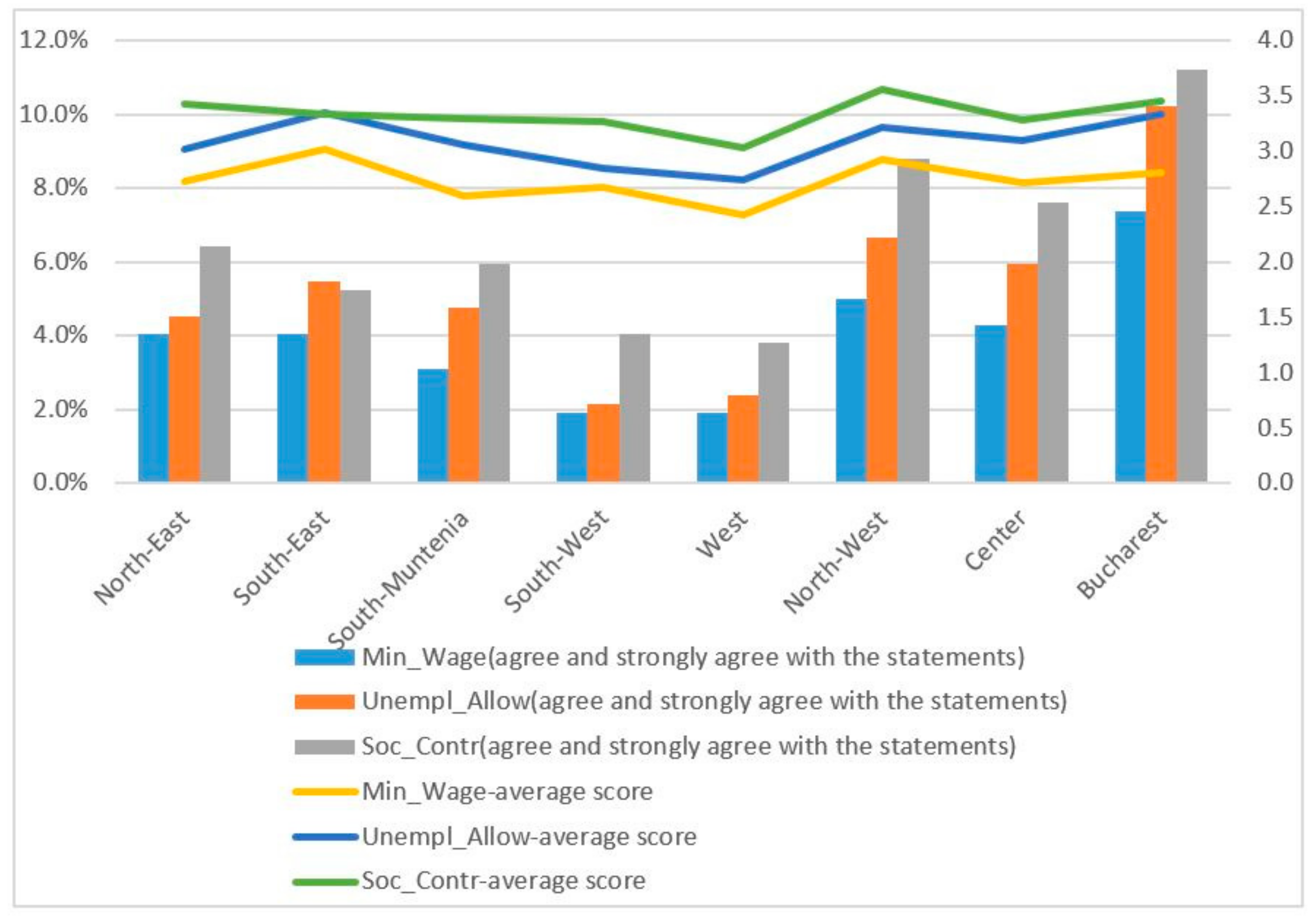

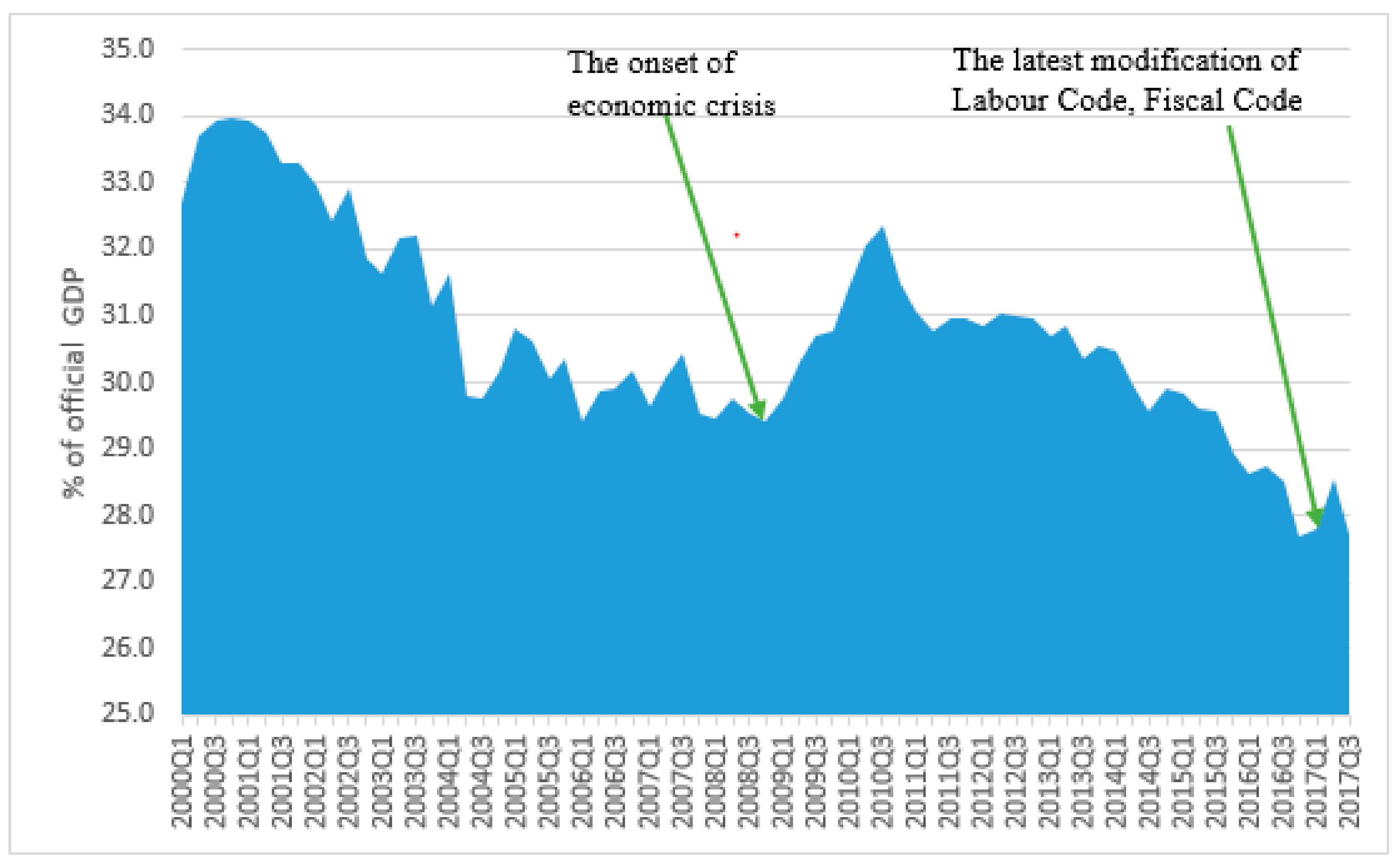

Sustainability Free Full Text Researching The Main Causes Of The Romanian Shadow Economy At The Micro And Macro Levels Implications For Sustainable Development Html

5 Common Tax Time Frustrations How To Avoid Them Successebook Tax Time Finance Household Finances

Wage Envelope 1940s Zine Design Graphic Design Typography Packaging Design

The Weekly Leading Index Wli Of The Economic Cycle Research Institute Ecri Is At 130 6 Unchanged From Last Week The Wli Annua Recess Index Moving Average

Sustainability Free Full Text Researching The Main Causes Of The Romanian Shadow Economy At The Micro And Macro Levels Implications For Sustainable Development Html

Sustainability Free Full Text Researching The Main Causes Of The Romanian Shadow Economy At The Micro And Macro Levels Implications For Sustainable Development Html

News Release State Personal Income 2014 Economic Analysis States Region

Beautiful Tire Shop Business Card Check More At Https Limorentalphiladelphia Com Tire Shop Business Card

Payroll Payroll Report Template Payroll Template

Sustainability Free Full Text Researching The Main Causes Of The Romanian Shadow Economy At The Micro And Macro Levels Implications For Sustainable Development Html

No comments:

Post a Comment