You qualify for unemployment benefits if all of the following are true. Each year is divided into four quarters which are.

Base Period For Filing Unemployment Benefits Fileunemployment Org

The four calendar quarters in a year are.

Michigan unemployment base period. The Base Period looks at a workers wages in past calendar quarters There are 4 calendar quarters in a year. Actual base period is defined this way - Of the five completed calendar quarters before your claim your base period is the first four of those quarters. January 1 March 31.

Weeks are calculated by multiplying total wages earned during your base period by 40 and then dividing by your WBA. Sunday and ends at 1200 midnight the following Saturday. If a claim is filed anytime between January to March 2020 the base period will be 12 months from October 1 2018 through September 30 2019.

Like every state Michigan looks at your recent work history and earnings during a one-year base period to determine your eligibility for unemployment. How do you calculate unemployment benefits in Michigan. In Michigan as in most states the base period is the earliest four of the five complete calendar quarters before you filed your benefits claim.

If you file your claim in July 2020 the four quarters in your standard base period are. Your base period is the period of time that you worked prior to losing your job in which you establish the amount of money that you will receive in unemployment. First quarter is January through March Second quarter is April through June Third quarter is July through September Fourth quarter is October through December.

The base period is usually the first four of the last five quarters. It is calculated to include the oldest four of the most recent five calendar quarters completed before the person filed the unemployment claim. 1- You must have wages in at least two quarters of your qualifying period base period.

Your standard base period is the first four of the last five completed calendar quarters before you filed your unemployment claim. 2012 State of Michigan Unemployment Insurance Agency Each base period employers proportionate share of total wages paid to the unemployed worker in the base period is as follows. The UIA uses calendar quarters.

Employer A Employer B cated to 29545 rounded to 2955 Employer C cated to 34090 rounded to 3409 Employer D to 11363 rounded to 1136 These percentages. For the applicants MI unemployment benefits claim UIA specifically looks at the wages paid in the first four of the last five completed quarters. 1st quarter January March.

To determine if the applicant has enough wages the Unemployment Insurance Agency UIA looks at the applicants base period which is a period of four calendar quarters. Amount and Duration of Unemployment Benefits in Michigan. You earned wages in two of the quarters.

In most cases the base period will be the first four of the last five completed calendar quarters prior to the week you file your new claim for benefits. Unem ploy ment benefits. The standard base period includes the first four of the la st five completed calendar quarters prior to when you filed your claim.

A quarter is one three month period of the year. There are four calendar quarters in a year. If the resulting figure is less than 14 weeks you cannot receive any benefits.

The maximum number of weeks for which you can receive your WBA varies between 14-20 weeks depending on your total wages earned during your base period. The standard base period includes wages from four of five completed calendar years earlier before you filed for a claim. The standard base period includes the first four of the last five completed calendar quarters prior to when you filed your claim.

And October December. To keep track of your benefit amount- Multiply 0041 with the amount you received as payment in the high quarter of your base period- Sum up to 6 for each dependent for five dependents- Add up both the amounts and you get your unemployment benefit. If you are eligible to receive unemployment your weekly benefit in Michigan will be 41 of what you earned during the highest paid quarter of the base period.

3- The total of your base period earnings must equal or exceed one and one-half times your highest quarter earnings. April 1 June 30. If a claimants wages dont qualify for the standard base period their wags are calculated based on an alternate base period.

The most you can receive per week is currently 362. The base period in Michigan is a 12-month period four calendar quarters in the claimants recent work history. The four calendar quarters in a year are.

To qualify for Michigan Unemployment Insurance The Unemployment Insurance Agency UIA will check your standard base period. The amount ranges between 81 to 362. In Michigan as in most states you must have earned a minimum amount in wages from employers who are covered by the states unemployment laws most are during a 12-month stretch called the base period in order to qualify for benefits.

And October December. How to find Standard Base Period. The total income for those quarters must be at least 5500.

You can also receive an allowance of 6 per week per dependent up to 30. Michigan Unemployment Base Period. If you cannot qualify based on your standard base period the bureau will check y our earnings in the alternate base period which is the four most recently completed calendar quarters.

What is the Alternative or Alternate Base Period. Michigan Web Account Manager MiWAM The Michigan Web Account Manager is the Unemployment Insurance Agency UIA or Uis portal for filing and managing their UI account. Those first four quarters are known as your base period Your weekly unemployment insurance benefits payment amount will be calculated by multiplying the total wages you made in the highest earning quarter of your base period by 41 then adding 6 per qualified dependent.

For example if you file your claim in December of 2019 the base period. The first four of the last five completed calendar quarters in which an individual files a claim. The more money that you made in your base period the larger the amount that you will recieve every week for unemployment.

The UIA in Michigan calculates your total and weekly unemployment benefits using your base-period wages. 2- The base period is the first four quarters 12 months of the last five completed quarters from the date your claim is filed. A calendar week that starts at 1201 am.

July 1 September 30. October 1 December 31.

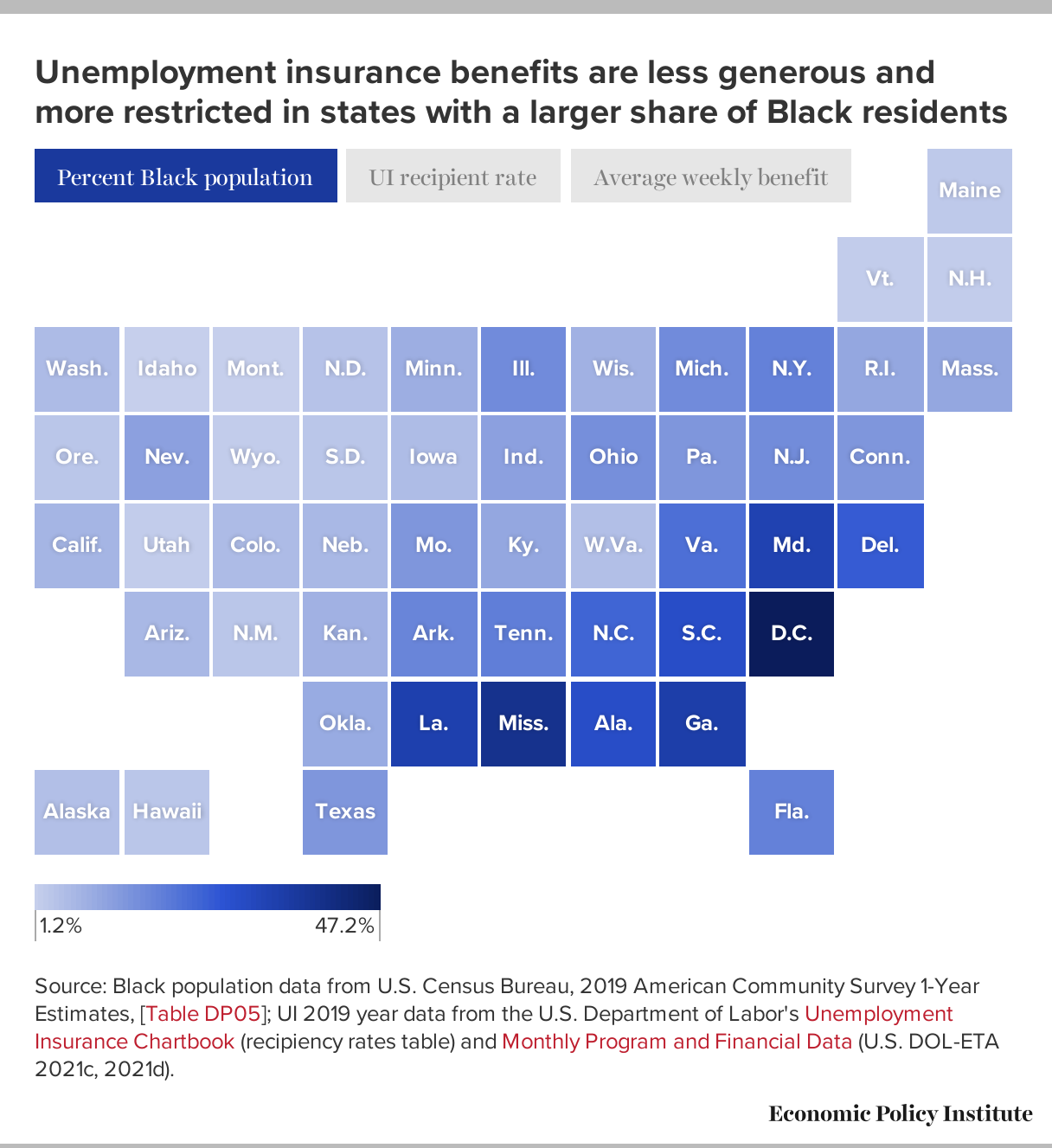

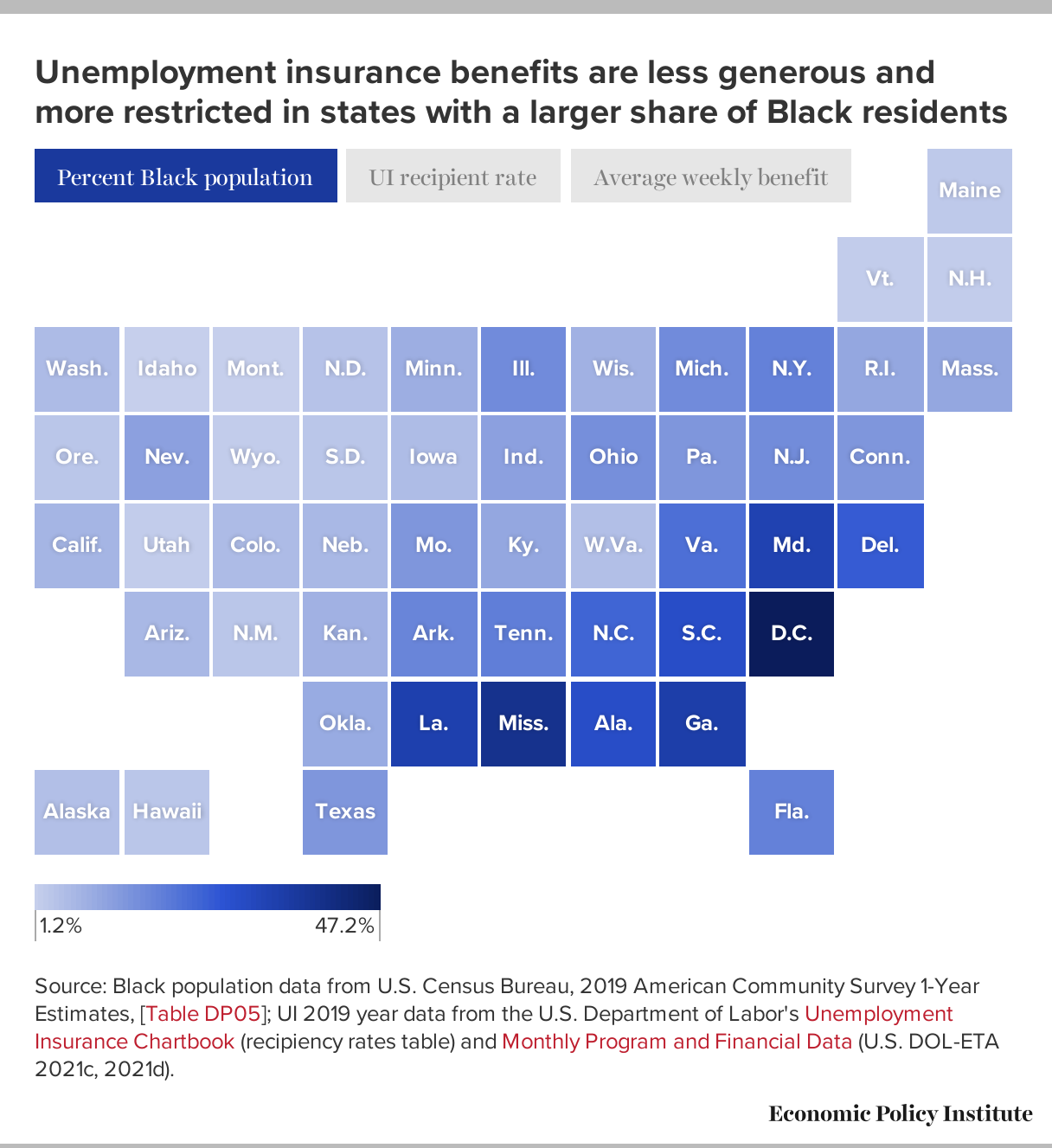

Section 3 Eligibility Update Ui Eligibility To Match The Modern Workforce And Guarantee Benefits To Everyone Looking For Work But Still Jobless Through No Fault Of Their Own Economic Policy Institute

Esdwagov Calculate Your Benefit

How Unemployment Benefits Are Calculated By State Bench Accounting

Michigan Unemployment Know Your Rights Aboutunemployment Org

Unemployment Benefits Michigan Eligibility Claims

Base Period For Filing Unemployment Benefits Fileunemployment Org

How To Apply For Unemployment In Michigan

Free Michigan Michigan Unemployment Benefits Labor Law Poster 2022

Unemployment Benefits Comparison By State Fileunemployment Org

Base Period Calculator Determine Your Base Period For Ui Benefits

Unemployment Benefits Michigan Eligibility Claims

No comments:

Post a Comment